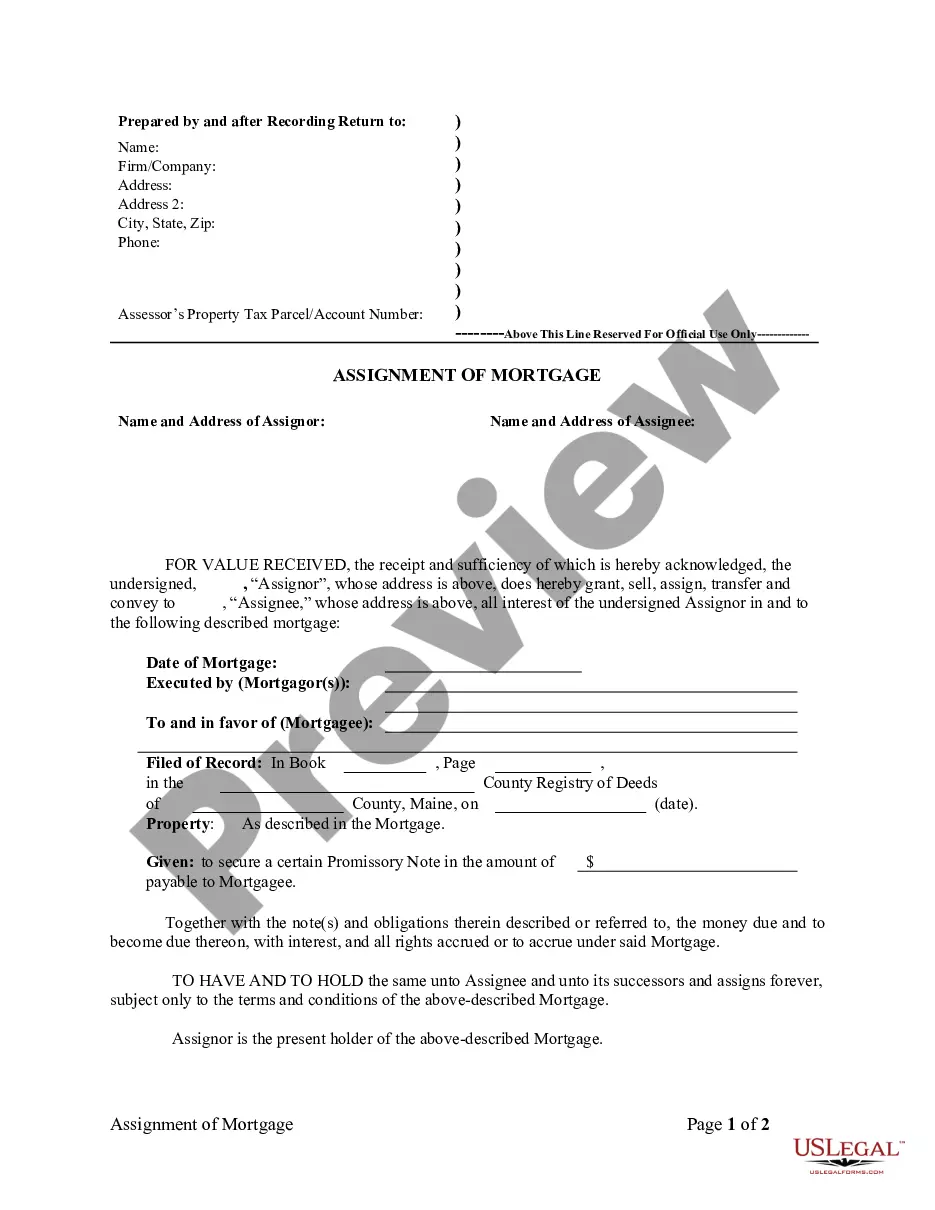

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Maine Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Maine Assignment Of Mortgage By Individual Mortgage Holder?

You are welcome to the greatest legal documents library, US Legal Forms. Right here you can find any sample including Maine Assignment of Mortgage by Individual Mortgage Holder templates and download them (as many of them as you want/need to have). Prepare official documents in just a couple of hours, rather than days or even weeks, without spending an arm and a leg on an legal professional. Get the state-specific sample in a few clicks and feel assured understanding that it was drafted by our qualified lawyers.

If you’re already a subscribed user, just log in to your account and click Download next to the Maine Assignment of Mortgage by Individual Mortgage Holder you require. Due to the fact US Legal Forms is web-based, you’ll generally have access to your saved templates, no matter the device you’re using. See them inside the My Forms tab.

If you don't have an account yet, just what are you awaiting? Check out our instructions listed below to get started:

- If this is a state-specific sample, check out its applicability in your state.

- View the description (if available) to learn if it’s the right template.

- See far more content with the Preview option.

- If the document meets all of your requirements, just click Buy Now.

- To create your account, choose a pricing plan.

- Use a card or PayPal account to join.

- Save the template in the format you require (Word or PDF).

- Print out the file and complete it with your/your business’s info.

As soon as you’ve filled out the Maine Assignment of Mortgage by Individual Mortgage Holder, send out it to your attorney for verification. It’s an extra step but a necessary one for being confident you’re fully covered. Become a member of US Legal Forms now and get access to a large number of reusable samples.

Form popularity

FAQ

You will need to sign a promissory note and a mortgage or trust deed.The document should be signed and dated by the borrower, and you will need to file or record the document at the local recorder of deeds office or other office responsible for the filing of real estate documents.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full.

In title theory states, a lender holds the actual legal title to a piece of real estate for the life of the loan while the borrower/mortgagor holds the equitable title.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

If the borrower on a recorded mortgage defaults, the lender can foreclose and either be paid in full or receive the property. However, if a mortgage or deed of trust was not recorded, the lender cannot foreclose against the property, just against the defaulting borrower personally.

Purpose A gap mortgages allows funding for a property to continue while it is going through the process of selling.Documents required for a mortgage assignment are: Instead of having you pay off your old loan with money from your new lender, your original lender assigns your loan balance to the new one.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.