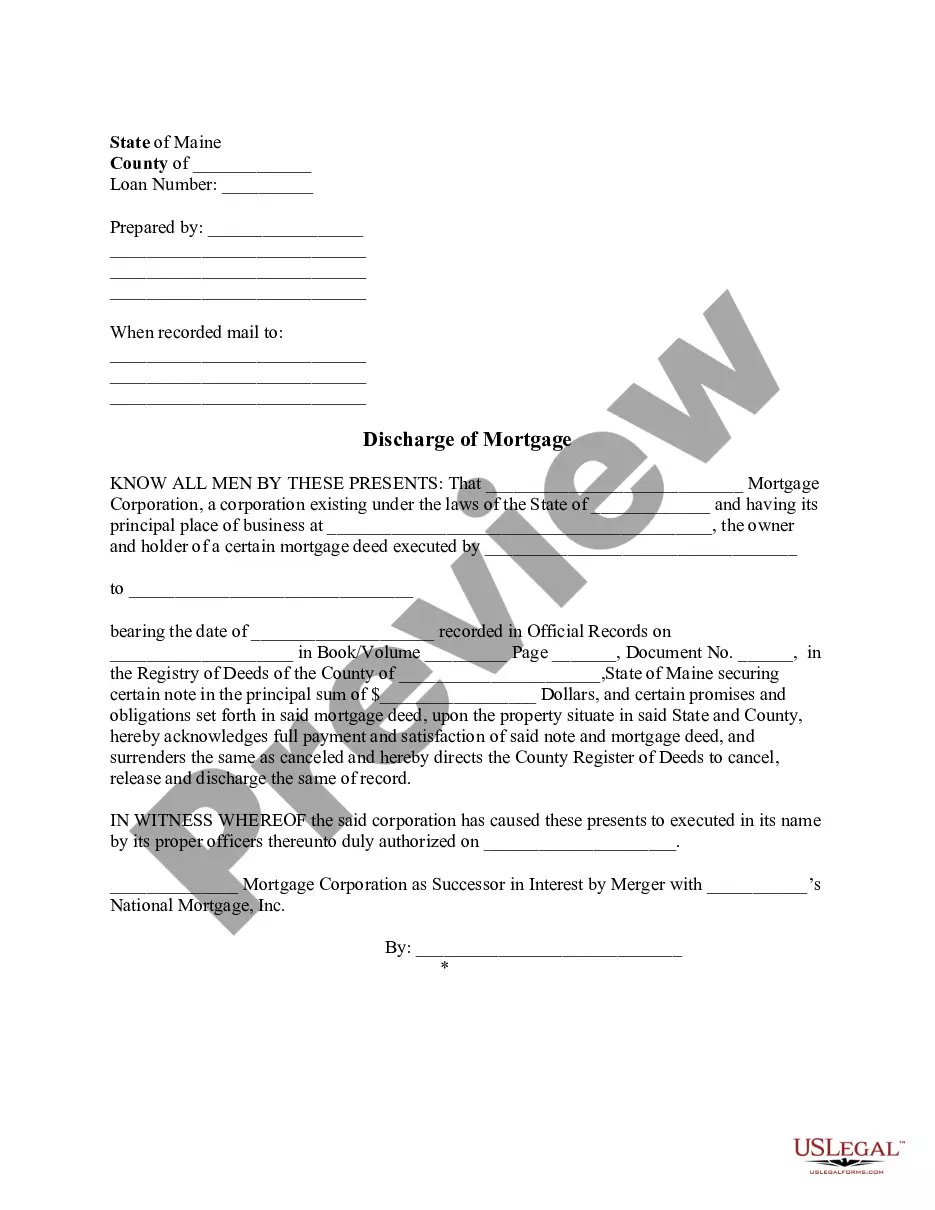

Discharge of Mortgage (2): A Discharge of Mortage is filed when the Debtor fully satifies the amount to be paid on the mortgage. The Holder of the loan files this discharge after he/she receives the money needed to pay the mortgage in full. This form is available in both Word and Rich Text formats.

Maine Discharge of Mortgage (2)

Description

How to fill out Maine Discharge Of Mortgage (2)?

You are welcome to the most significant legal files library, US Legal Forms. Right here you can find any sample including Maine Discharge of Mortgage (2) forms and save them (as many of them as you wish/need to have). Make official papers with a few hours, instead of days or weeks, without spending an arm and a leg on an legal professional. Get your state-specific example in a couple of clicks and feel assured understanding that it was drafted by our accredited lawyers.

If you’re already a subscribed customer, just log in to your account and then click Download near the Maine Discharge of Mortgage (2) you require. Due to the fact US Legal Forms is online solution, you’ll always get access to your downloaded templates, no matter what device you’re using. Find them in the My Forms tab.

If you don't come with an account yet, what are you waiting for? Check out our instructions listed below to get started:

- If this is a state-specific sample, check its validity in the state where you live.

- View the description (if readily available) to understand if it’s the correct example.

- See more content with the Preview option.

- If the document meets all your needs, just click Buy Now.

- To make your account, pick a pricing plan.

- Use a card or PayPal account to join.

- Save the file in the format you want (Word or PDF).

- Print out the file and complete it with your/your business’s info.

Once you’ve filled out the Maine Discharge of Mortgage (2), give it to your attorney for confirmation. It’s an extra step but an essential one for making certain you’re entirely covered. Join US Legal Forms now and access a mass amount of reusable examples.

Form popularity

FAQ

The process of removing a home loan from a property's title. In this case, the word 'discharge' means 'to end'. When does this happen? When a property is sold, the seller must discharge their mortgage so the buyer can take unencumbered, legal ownership over the property. If you're repaying your home loan in full.

Often, it is filed directly by the bank or a settlement attorney. However, in some cases, the discharge may be transmitted directly to the person who is paying off the mortgage upon making a final mortgage payment, and that person needs to record the discharge so that clear title can be conveyed to someone else.

Discharging a mortgage is a legal process which requires instructing a solicitor to prepare a document called a Discharge on your behalf. The property solicitor will recover the title deeds from the lender which will enable them to draw up a Discharge.

How long does it take to discharge a mortgage? Generally it takes between 14-21 business days to complete the discharge process. At one stage it took less time, around 10-14 business days, but these days more people are refinancing their home loan so there are more discharges taking place.

How long does it take to discharge a mortgage? Generally it takes between 14-21 business days to complete the discharge process. At one stage it took less time, around 10-14 business days, but these days more people are refinancing their home loan so there are more discharges taking place.

When discharging your mortgage, you are paying your current loan in full. The mortgage we have registered on the title of your property is removed, and we will no longer hold it as security.

The discharge of a mortgage means that the borrower no longer is obligated to make further payments on the loan. A discharge can be the result of the mortgage being paid in full or refinanced by the borrower. A mortgage also can be discharged if the borrower files for bankruptcy.

You will need to book in to collect your property's title deed from the lender's settlement agent's office. There is one in most major capitals. If you cannot attend in person, a solicitor or conveyancer can also assist; however, they will need to be paid for their time.

Discharging a mortgage is a legal process which requires instructing a solicitor to prepare a document called a Discharge on your behalf. The property solicitor will recover the title deeds from the lender which will enable them to draw up a Discharge. The Discharge is then sent to the lender for execution.