This office lease provision refers to a tenant that is a partnership or if the tenant's interest in the lease shall be assigned to a partnership. Any such partnership, professional corporation and such persons will be held by this provision of the lease.

Maryland Standard Provision to Limit Changes in a Partnership Entity

Description

How to fill out Standard Provision To Limit Changes In A Partnership Entity?

Discovering the right authorized file template could be a have a problem. Naturally, there are plenty of layouts available online, but how will you discover the authorized develop you want? Take advantage of the US Legal Forms website. The support offers 1000s of layouts, including the Maryland Standard Provision to Limit Changes in a Partnership Entity, that can be used for company and personal requires. All of the varieties are checked by specialists and fulfill federal and state demands.

In case you are currently signed up, log in for your bank account and then click the Down load switch to find the Maryland Standard Provision to Limit Changes in a Partnership Entity. Make use of bank account to appear with the authorized varieties you may have purchased formerly. Go to the My Forms tab of the bank account and get another backup of the file you want.

In case you are a brand new customer of US Legal Forms, here are simple guidelines that you can follow:

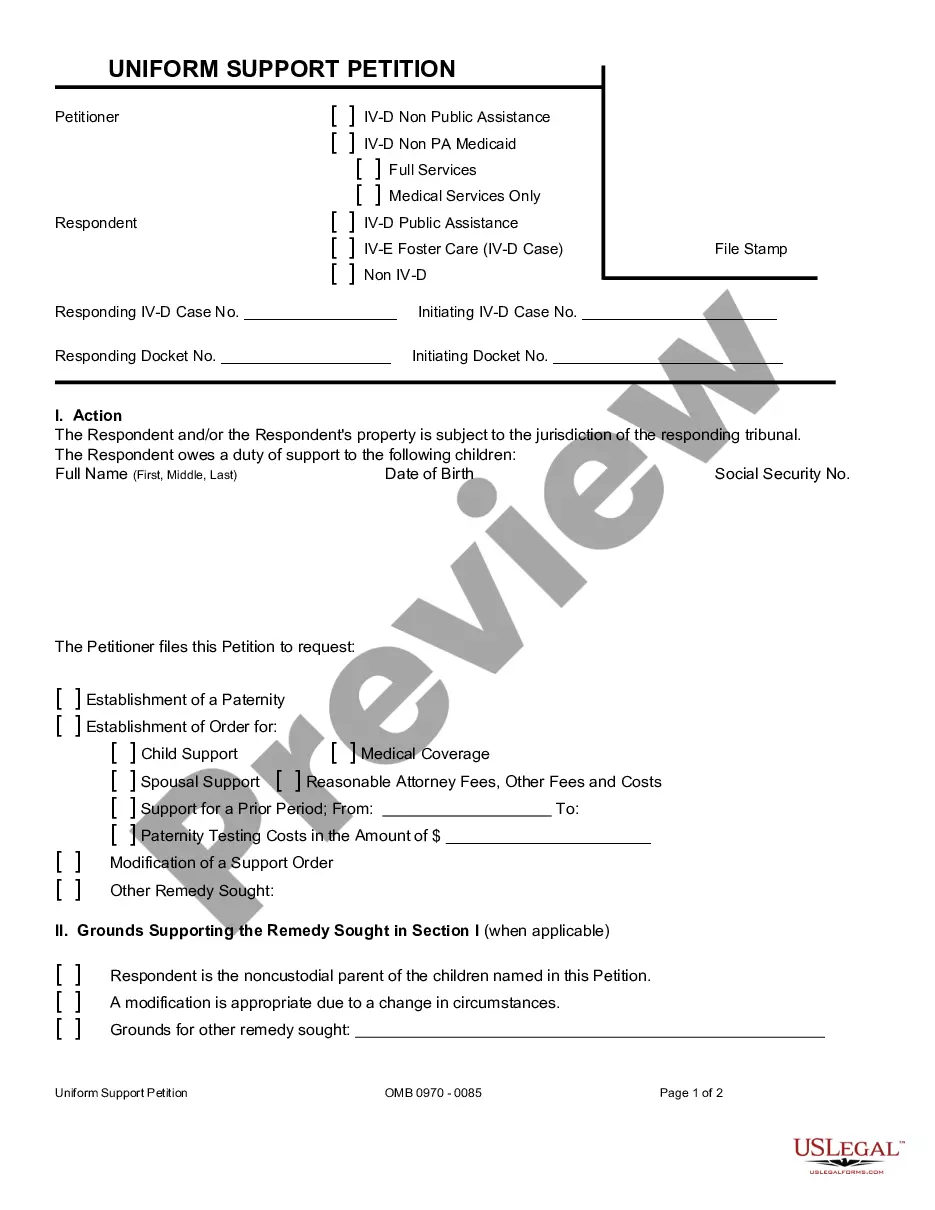

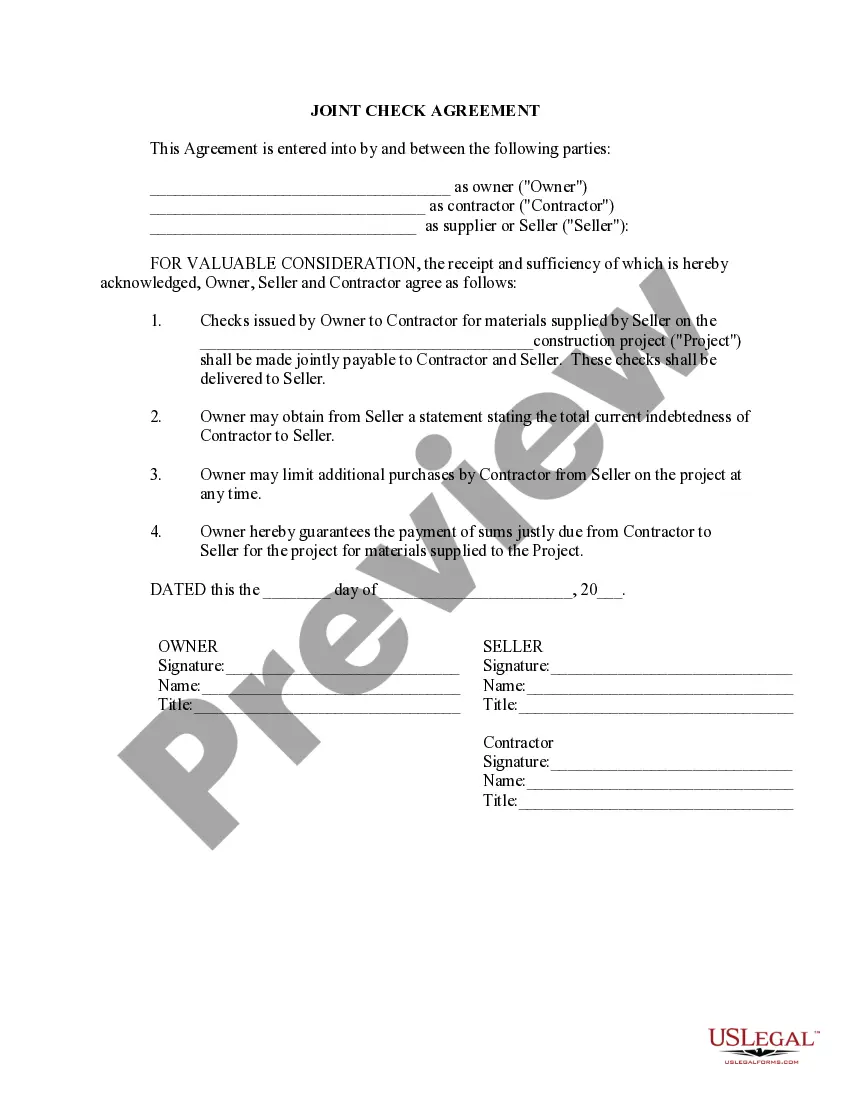

- Very first, be sure you have chosen the right develop to your city/county. You can check out the form while using Review switch and study the form information to guarantee this is basically the right one for you.

- If the develop is not going to fulfill your expectations, take advantage of the Seach discipline to obtain the proper develop.

- Once you are positive that the form is acceptable, click the Get now switch to find the develop.

- Opt for the pricing prepare you want and type in the essential info. Create your bank account and pay money for your order with your PayPal bank account or credit card.

- Choose the submit file format and download the authorized file template for your gadget.

- Full, change and produce and indication the received Maryland Standard Provision to Limit Changes in a Partnership Entity.

US Legal Forms may be the greatest collection of authorized varieties for which you can discover various file layouts. Take advantage of the service to download expertly-produced documents that follow condition demands.

Form popularity

FAQ

Actually, on line 17, you claim either the Standard Deduction or your Itemized Deductions. $4,700 would be a common amount to be entered on the line. If you are not itemizing, your deduction on line 17 would be your Standard Deduction amount.

For Maryland tax purposes, a taxpayer only is allowed to expense up to $25,000, reduced dollar-for-dollar by the amount over $200,000, of the cost of Section 179 property that is purchased and put in service for a trade or business for the tax year.

In addition to the exemptions allowed on your federal return, you and your spouse are permitted to claim exemptions for being age 65 or over or for blindness. These additional exemptions are in the amount of $1,000 each. If any other dependent claimed is 65 or over, you also receive an extra exemption of up to $3,200.

The personal exemption is $3,200.

The new federal limitation impacts your Maryland return because you must addback the amount of state income taxes you claimed as federal itemized deductions. The addback is limited to $10,000 ($5,000 for married filing separately) and is reported on line 17b of the Maryland Form 502.

Complete Form MW507 so that your employer can withhold the correct Maryland income tax from your pay. Consider completing a new Form MW507 each year and when your personal or financial situation changes.

Telephone Assistance Call 1-800-MD TAXES or 410-260-7980 from Central Maryland.

Under current law, § 10-306.1 of the Tax-General Article requires a corporation, in determining Maryland modified income, to add back otherwise deductible interest expenses or intangible expenses if the expenses are directly or indirectly paid to one or more related members, as defined.