Maryland Modification of Partnership Agreement to Reorganize Partnership

Description

How to fill out Modification Of Partnership Agreement To Reorganize Partnership?

Finding the appropriate legal document template can be challenging.

Certainly, there are numerous designs available online, but how will you secure the legal format you require.

Utilize the US Legal Forms site. This service offers a vast array of templates, including the Maryland Modification of Partnership Agreement to Reorganize Partnership, which you can use for business and personal needs.

You can review the form using the Preview button and check the form description to confirm it is the right one for you.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to get the Maryland Modification of Partnership Agreement to Reorganize Partnership.

- Access your account to view the legal forms you have previously purchased.

- Navigate to the My documents tab in your account and acquire another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your area/county.

Form popularity

FAQ

To transfer ownership of an LLC in Maryland, you should first review your operating agreement for specific provisions regarding ownership changes. Next, execute a bill of sale to document the transaction and ensure proper record-keeping. If necessary, file a Maryland Modification of Partnership Agreement to Reorganize Partnership to formalize the new ownership arrangement. This approach will help maintain clarity and transparency among all parties involved.

In general, creditors cannot go after the personal assets of an LLC owner due to the limited liability protections offered. However, specific circumstances, such as fraud or personal guarantees, can expose owners to personal liability. If you face complex issues regarding LLC ownership, consulting a legal expert about a Maryland Modification of Partnership Agreement to Reorganize Partnership can be beneficial. They can guide you through potential avenues for resolving disputes.

To change the articles of organization in Maryland, you must file Articles of Amendment with the State Department of Assessments and Taxation. This document must detail the modifications and must be signed by a member or manager of the LLC. Utilizing a Maryland Modification of Partnership Agreement to Reorganize Partnership can simplify this process, as it provides a structured outline for necessary changes. Keep in mind that all amendments should comply with Maryland's guidelines.

To change ownership of an LLC with the IRS, you need to submit the IRS Form 8832 to elect how you want the LLC taxed. Additionally, it is important to update your operating agreement to reflect the new ownership structure. Consider including a Maryland Modification of Partnership Agreement to Reorganize Partnership to help clarify roles and responsibilities, which can prevent future disputes. Keeping your IRS records accurate ensures your LLC remains compliant.

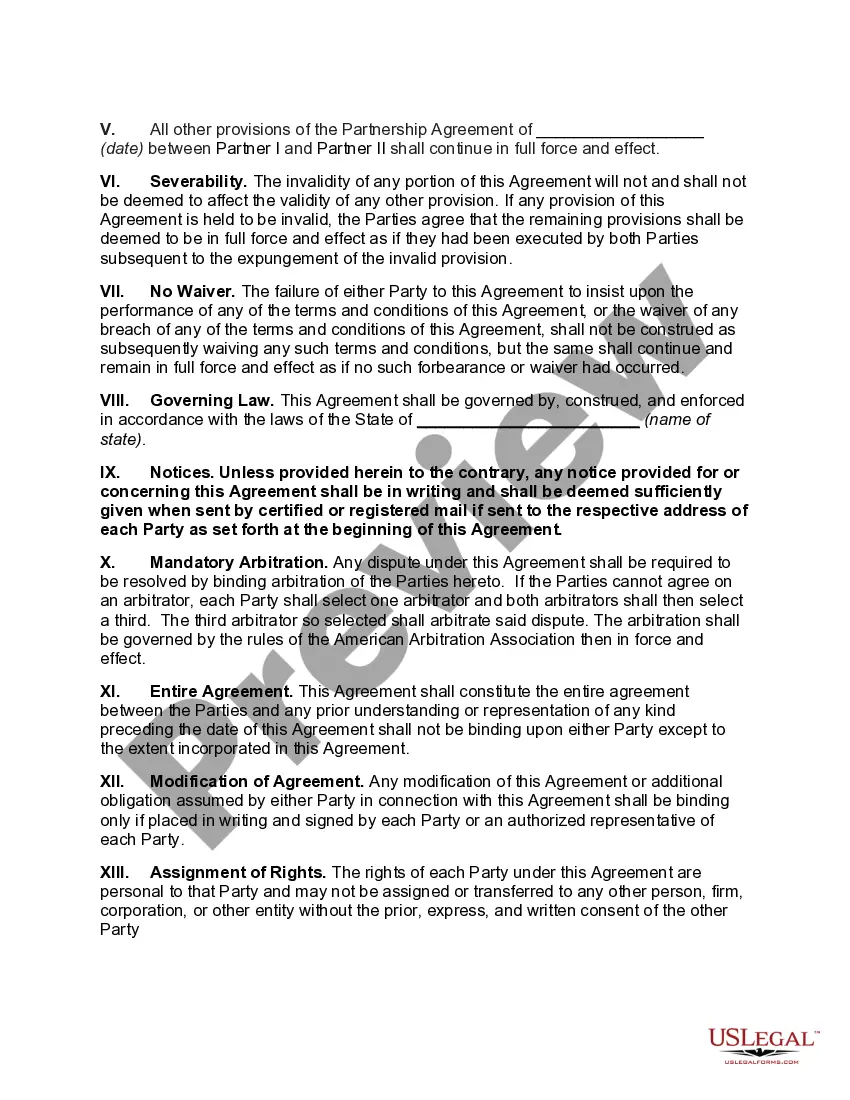

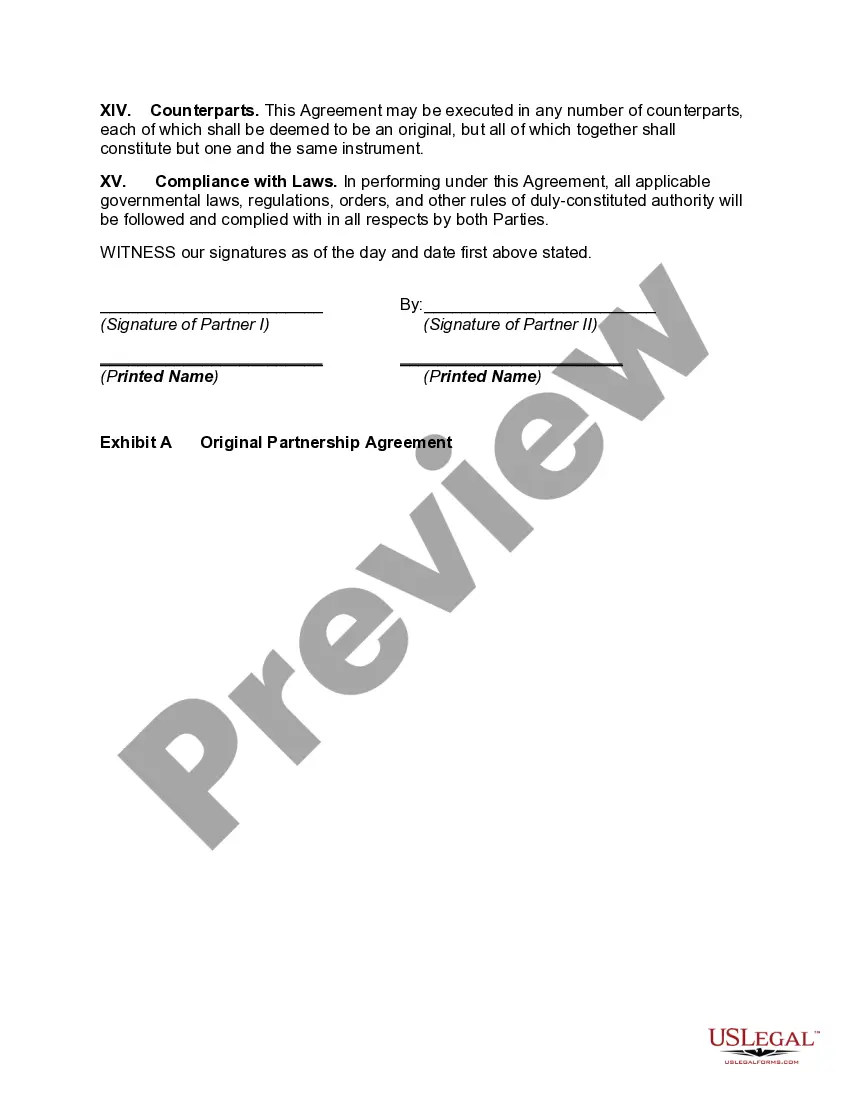

Absolutely, a partnership agreement can be amended if all partners agree to the changes. The process typically involves drafting a Maryland Modification of Partnership Agreement to Reorganize Partnership to ensure clarity and consensus among partners. It’s advisable to consult legal experts to ensure compliance and proper documentation.

To amend a partnership deed, draft a new document that specifies the changes to the original terms. This is often referred to as a Maryland Modification of Partnership Agreement to Reorganize Partnership. Ensure that each partner reviews and signs this document to validate the amendments legally.

Yes, an agreement can be amended if all parties consent to the changes. For a partnership agreement, this often involves creating a Maryland Modification of Partnership Agreement to Reorganize Partnership, which outlines the new terms. All partners must sign this amendment for it to be effective.

Yes, partners can be changed in a partnership firm. This typically involves creating a Maryland Modification of Partnership Agreement to Reorganize Partnership, which documents the changes and secures consent from all existing partners. It’s crucial to follow proper procedures to ensure all partners agree and to maintain the integrity of the partnership.

To change the terms of a partnership agreement, you must draft a Maryland Modification of Partnership Agreement to Reorganize Partnership. This document should clearly outline the new terms and ensure that all partners agree to the changes. Each partner should sign the amendment to make it legally binding, and consider seeking legal assistance if needed.

To amend the articles of organization in Maryland, start by downloading the amendment form from the Maryland State Department of Assessments and Taxation website. Complete the form accurately, indicating the changes clearly. After submitting the form, you can expect some processing time. Ensure that your changes align with your partnership objectives, especially when considering a Maryland modification of partnership agreement to reorganize partnership.