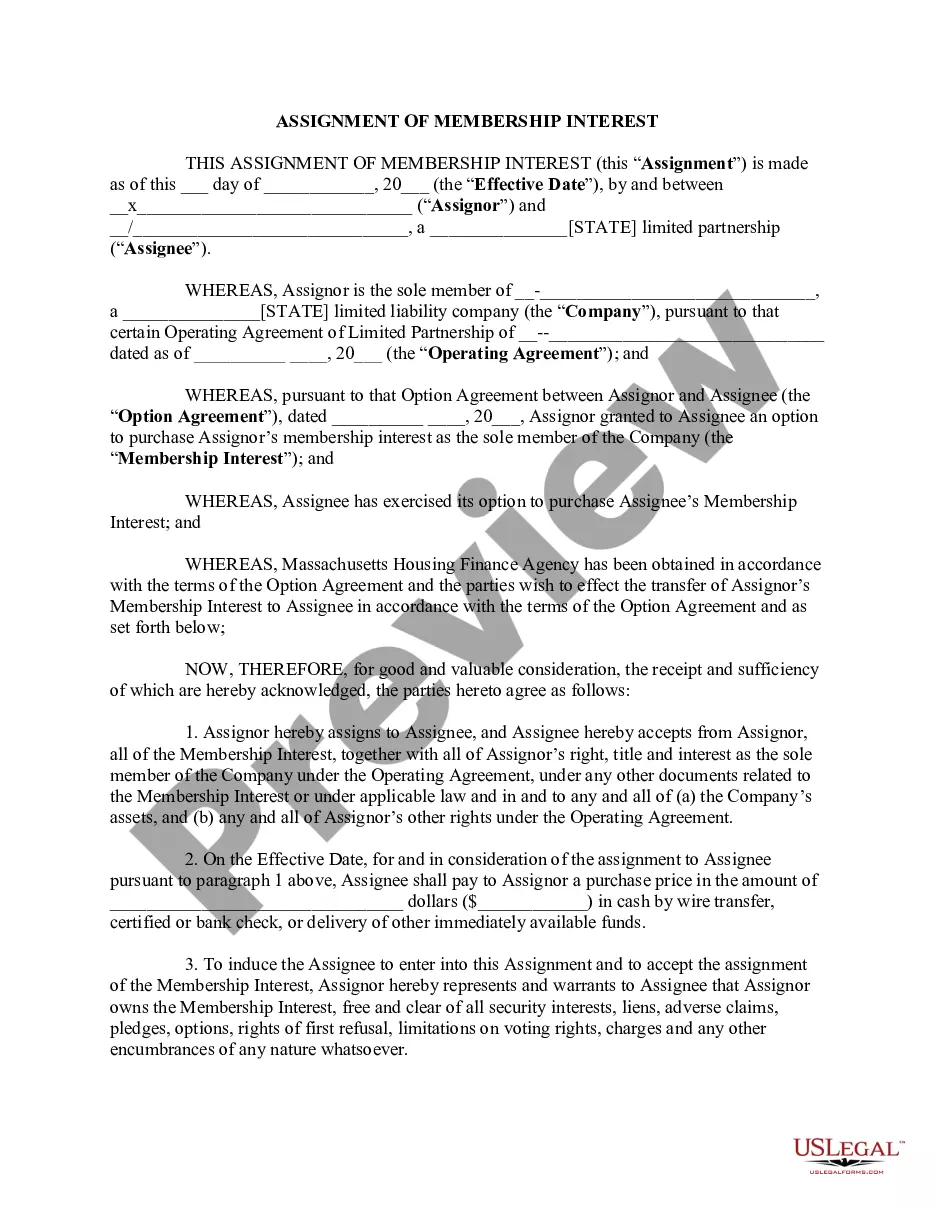

Oregon Assignment of Profits of Business

Description

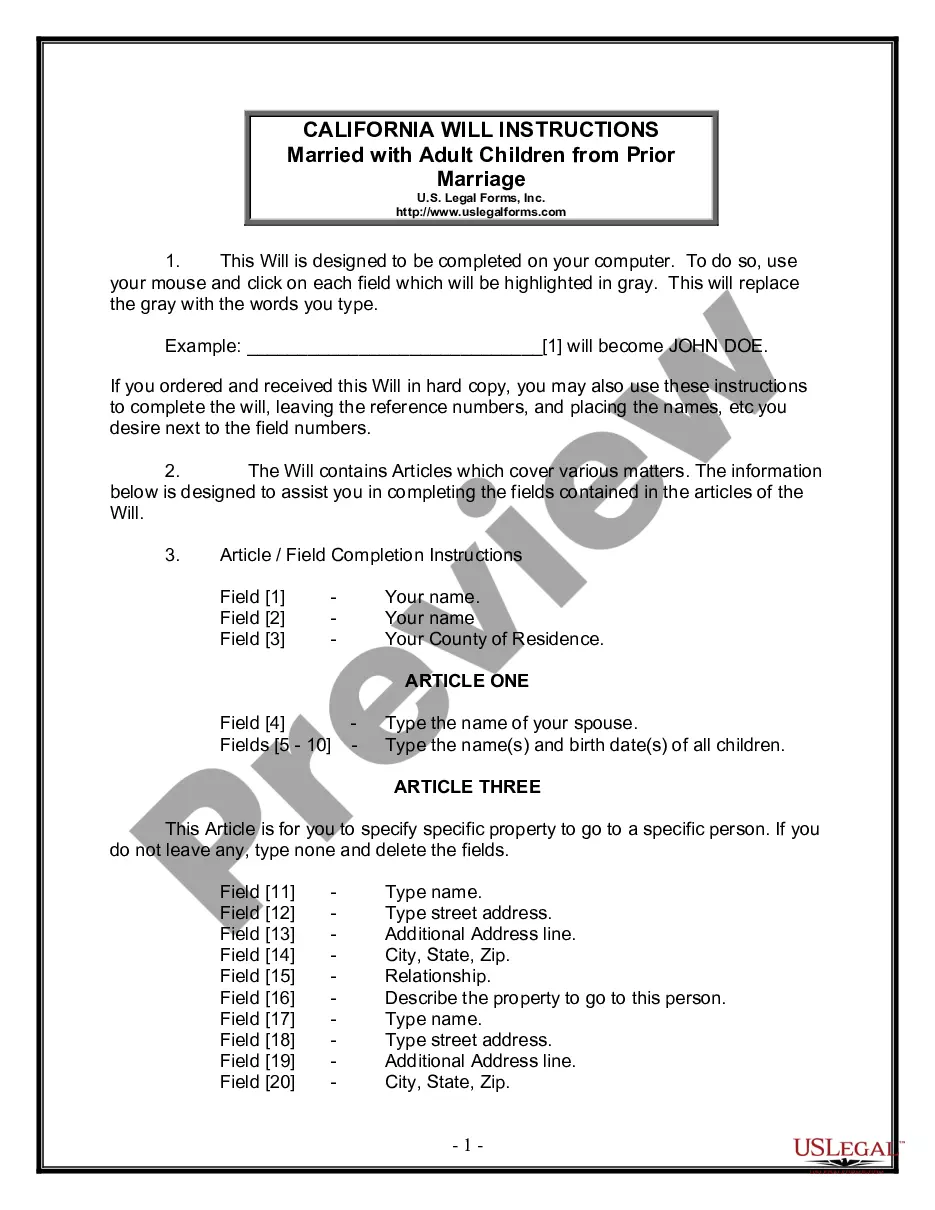

How to fill out Assignment Of Profits Of Business?

Are you in a location where you require documentation for either business or personal activities almost every day? There are numerous legal document templates accessible online, but finding reliable forms isn't simple.

US Legal Forms provides thousands of form templates, including the Oregon Assignment of Profits of Business, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Afterwards, you can download the Oregon Assignment of Profits of Business template.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Oregon Assignment of Profits of Business at any time, if needed. Click on the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive assortment of legal documents, to save time and avoid mistakes. The service offers professionally created legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- Obtain the form you require and ensure it is for the correct state/area.

- Click the Preview button to review the document.

- Examine the details to confirm you have selected the right form.

- If the form is not what you need, use the Search field to find a form that fits your requirements.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Select a convenient file format and download your version.

Form popularity

FAQ

The 10-day drop rule in Oregon allows individuals who move into the state to avoid residency classification if they leave within 10 days of their arrival. This rule is especially useful for those conducting short business ventures or trips. If you are exploring opportunities related to the Oregon Assignment of Profits of Business, understanding this rule can help you avoid unnecessary tax concerns during your limited stay.

The corporate excise tax applies to corporations based in Oregon and is assessed on income from business conducted within the state. As of 2020, this tax has two marginal rates: 6.6% on the first $1 million of income and 7.6% on all income above $1 million.

Oregon-source income only If you have tangible or intangible property or other assets being used in Oregon, any income you receive is Oregon-source income. Your company must file an Oregon Corporation Income Tax Return, Form OR-20-INC. There are exceptions to this requirement (Public Law 86-272).

To file the Form WR electronically, as required under ORS 316.202 and ORS 314.360, you must do so using Department of Revenue's system, Revenue Online by going to this link: .

All trade or businesses, except those that derive more than 50% of their gross receipts from qualified business activities (QBA), must apportion their business income to California using a single-sales factor.

Requirements and penalties Required 1099s are the 1099-G, 1099-K, 1099-NEC, 1099-MISC, 1099-R, and W-2G. Other 1099s, including 1099-DIV and 1099-INT, are not required.

Nonresidents. Oregon taxes the income you earned while working in Oregon. Oregon doesn't tax any amount you earned while you were working outside Oregon. Nonresident telecommuters who work for an Oregon employer are taxed only on the income earned from work performed in Oregon, including sick pay or other benefits.

When filing state copies of forms 1099 with Oregon department of revenue, the agency contact information is: Department of Revenue, PO Box 14260, Salem, OR, 97309-5060 .

Choose a quarterly report filing method:Oregon Payroll Reporting System (OPRS) electronic filing.Combined Payroll Tax Reports Form OQ.Interactive voice response system, call 503-378-3981. Use only to report quarters with no payroll or no hours worked.

Apportionable income is apportioned to Oregon by multiplying the income by a multiplier equal to Oregon sales and other receipts as determined by Schedule OR-AP, part 1, divided by total sales and other receipts from the federal return (ORS 314.650).