Maryland Self-Employed Industrial Laundry Services Contract

Description

How to fill out Self-Employed Industrial Laundry Services Contract?

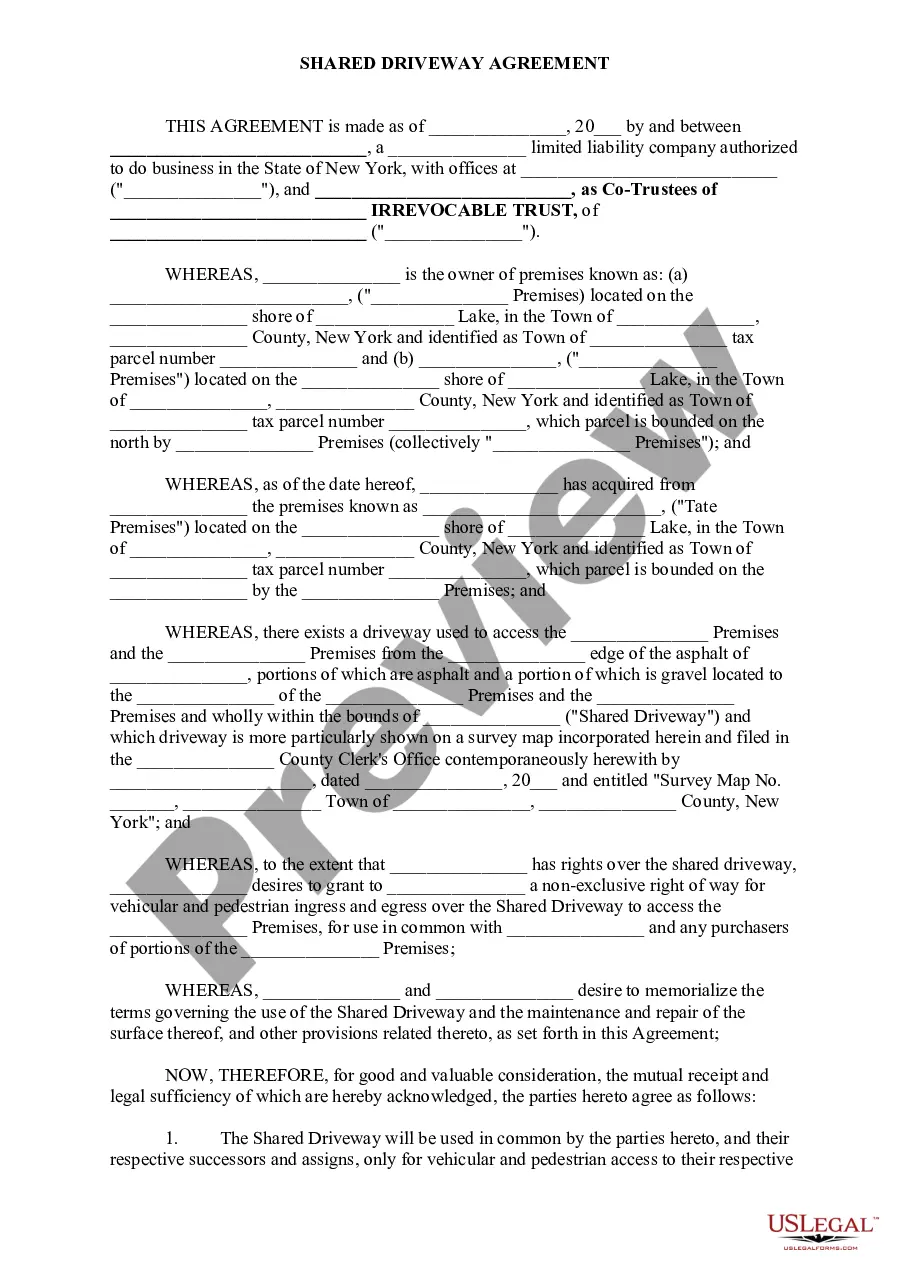

Selecting the appropriate authorized document template can be a challenge. Certainly, there are numerous templates accessible online, but how do you locate the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Maryland Self-Employed Industrial Laundry Services Contract, that can be utilized for business and personal purposes. All of the forms are reviewed by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Maryland Self-Employed Industrial Laundry Services Contract. Use your account to view the legal forms you may have ordered previously. Go to the My documents tab of your account and obtain another copy of the document you require.

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can preview the form using the Preview button and read the form description to confirm it is the right one for you. If the form does not fulfill your requirements, utilize the Search feature to locate the appropriate form. Once you are confident that the form is suitable, click the Purchase now button to acquire the form. Choose the pricing option you wish and enter the required information. Create your account and finalize the transaction with your PayPal account or credit card. Select the document format and download the legal document template for your needs. Complete, modify, print, and sign the obtained Maryland Self-Employed Industrial Laundry Services Contract. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to obtain professionally-crafted documents that adhere to state regulations.

Form popularity

FAQ

In-house laundry refers to facilities that manage their own laundry operations, handling everything from washing to drying on their premises. On the other hand, contract laundry involves outsourcing these services to a professional laundry company, which can improve efficiency and reduce operational costs. With a Maryland Self-Employed Industrial Laundry Services Contract, businesses can benefit from expert services without the overhead of managing laundry operations themselves. This allows companies to focus on their core activities while ensuring high-quality laundry service.

Independent contractors in Maryland must adhere to several legal requirements. First, you need to register your business with the state and obtain any necessary permits or licenses. Additionally, for a Maryland Self-Employed Industrial Laundry Services Contract, it is essential to understand tax obligations, including self-employment taxes. Utilizing resources like US Legal Forms can help you navigate these requirements effectively.

Yes, Maryland does require certain contractors to obtain a license. Specifically, if you plan to perform work that falls under specific trades, like electrical or plumbing services, a contractor license is necessary. For those offering Maryland Self-Employed Industrial Laundry Services, understanding licensing requirements is crucial to ensure compliance and avoid penalties. The US Legal Forms platform can provide guidance on obtaining the appropriate licenses.

In Maryland, while an LLC is not legally required to have an operating agreement, it is highly recommended. An operating agreement clearly outlines the management structure and operating procedures for your business. For a Maryland Self-Employed Industrial Laundry Services Contract, having this document can clarify roles and responsibilities among members. It also helps protect your limited liability status.

MD Form 1 must be filed by individuals who earn self-employment income in Maryland, including those with a Maryland Self-Employed Industrial Laundry Services Contract. This filing is crucial for reporting income and calculating taxes. To ensure compliance and avoid complications, it's advisable to familiarize yourself with the filing process, and tools like US Legal Forms can provide necessary assistance.

In Maryland, service labor is generally not subject to sales tax, but there are exceptions. For example, services related to tangible personal property may be taxable. If your business involves a Maryland Self-Employed Industrial Laundry Services Contract, it’s important to understand how these tax laws apply to your services. Resources like US Legal Forms can help clarify these tax obligations.

Individuals who earn income in Maryland, including those running a Maryland Self-Employed Industrial Laundry Services Contract, must file a Maryland return. This includes residents, non-residents, and those who have earned income in the state. Understanding your filing requirements helps you avoid penalties and ensures you are meeting state obligations.

MD Form 1 is required for individuals who have self-employment income, including those with a Maryland Self-Employed Industrial Laundry Services Contract. This form helps report income and calculate taxes owed. If you earn income from self-employment in Maryland, it’s important to understand your filing obligations to stay compliant.

Yes, LLCs in Maryland must file an annual report to maintain good standing. This report includes updates on business activities and any changes in membership. If you operate under a Maryland Self-Employed Industrial Laundry Services Contract, ensuring timely filing of your annual report is essential to avoid penalties. Platforms like US Legal Forms can simplify this process.

The independent contractor rule defines the criteria under which a worker can be classified as an independent contractor rather than an employee. This classification affects tax responsibilities and liability issues. For those engaged in a Maryland Self-Employed Industrial Laundry Services Contract, knowing these criteria helps in maintaining compliance and maximizing tax benefits. Consider consulting resources like US Legal Forms for guidance.