Maryland Self-Employed Waste Services Contract for Private Company

Description

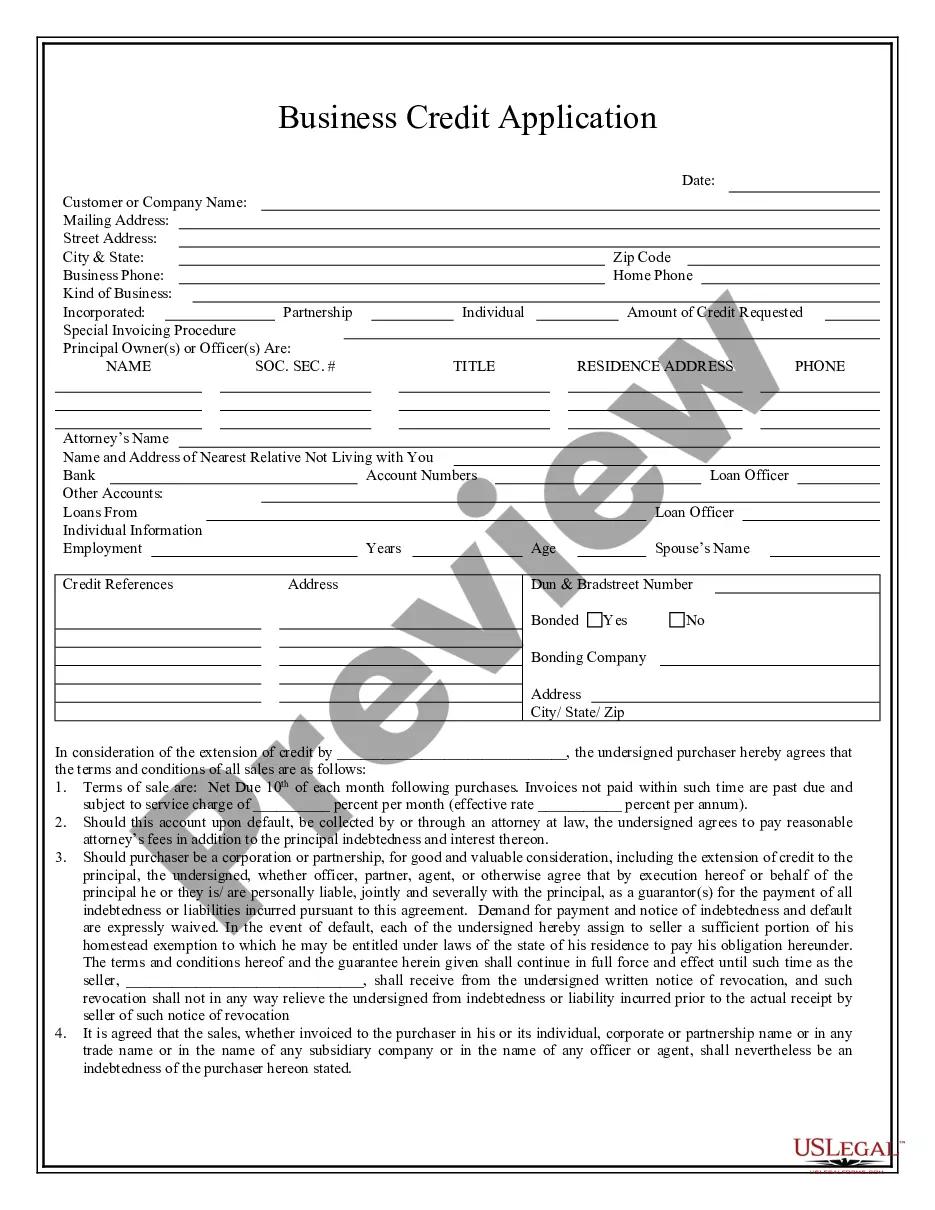

How to fill out Self-Employed Waste Services Contract For Private Company?

It is feasible to spend hours online searching for the legal documents template that meets the state and federal requirements you need.

US Legal Forms provides thousands of legal documents that are evaluated by professionals.

You can easily acquire or print the Maryland Self-Employed Waste Services Contract for Private Company from the services.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, modify, print, or sign the Maryland Self-Employed Waste Services Contract for Private Company.

- Every legal document template you obtain is yours permanently.

- To get another copy of the purchased form, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have chosen the right document template for your area/city of your choice.

- Review the form description to confirm you have selected the correct document.

- If available, use the Review button to examine the document template as well.

- If you want to find another version of your document, use the Search field to locate the template that meets your needs and specifications.

- Once you have found the template you require, click Purchase now to proceed.

- Select the pricing plan you want, enter your details, and register for your account on US Legal Forms.

- Complete the payment.

- You can use your Visa or Mastercard or PayPal account to pay for the legal document.

- Choose the format of your document and download it to your device.

- Make adjustments to your document if necessary.

- You can complete, modify, sign, and print the Maryland Self-Employed Waste Services Contract for Private Company.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal documents.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

When writing a self-employed contract, start by defining the parties involved and the services to be provided. Include details about payment, deadlines, and any necessary legal clauses. For added support, you can reference the Maryland Self-Employed Waste Services Contract for Private Company, which offers guidance and templates to ensure your contract is comprehensive and legally sound.

To write a self-employment contract, include your business name, the services offered, payment terms, and duration of the contract. Clearly outline the expectations and responsibilities of both parties to avoid misunderstandings. Using the Maryland Self-Employed Waste Services Contract for Private Company can streamline this process by providing a structured template.

Yes, while Maryland does not legally require an LLC to have an operating agreement, it is highly recommended. An operating agreement outlines the management structure and operational guidelines for the LLC, which can prevent future disputes. For further clarity, consider the Maryland Self-Employed Waste Services Contract for Private Company, which can offer templates for creating such documents.

To write a contract for a 1099 employee, begin with clear identification of the contractor and the services they will provide. Specify payment terms, project milestones, and any relevant legal obligations. Utilizing a template like the Maryland Self-Employed Waste Services Contract for Private Company can help ensure compliance and clarity.

Independent contractors must meet certain legal requirements, including having a written contract, maintaining their own business licenses, and managing their own tax obligations. It is crucial to clearly define the nature of the relationship to avoid misclassification. For guidance, refer to the Maryland Self-Employed Waste Services Contract for Private Company, which outlines essential contractual obligations.

Yes, you can write your own legally binding contract as long as it meets the legal requirements of your state. Be sure to include clear terms, signatures from both parties, and specific details related to the agreement. For complex agreements like the Maryland Self-Employed Waste Services Contract for Private Company, using a reliable template can simplify the process.

Writing a simple employment contract involves outlining the job title, responsibilities, compensation, and duration of employment. You should also include clauses related to confidentiality and termination. For a more comprehensive approach, consider the Maryland Self-Employed Waste Services Contract for Private Company, which provides essential templates and guidance for such agreements.

To write a contract agreement for services, start by clearly defining the parties involved and their respective roles. Include specific details such as the scope of work, payment terms, deadlines, and any applicable laws, like the Maryland Self-Employed Waste Services Contract for Private Company guidelines. Ensure both parties review and sign the contract to make it legally binding.

MD Form 1 must be filed by all Maryland corporations and limited liability companies. This requirement ensures that your business complies with state regulations, especially if you are operating under a Maryland Self-Employed Waste Services Contract for Private Company. Staying compliant with filing requirements can help you avoid penalties and maintain your good standing. Make sure to stay informed about your obligations to keep your business running smoothly.

Filing Form 1 late in Maryland can result in significant penalties, including late fees and potential loss of good standing. The state may impose a fine, and your business may not be able to enter into contracts, such as a Maryland Self-Employed Waste Services Contract for Private Company, until the issue is resolved. It is advisable to file on time to avoid these complications and maintain your business's operational status.