Maryland Self-Employed Independent Contractor Payment Schedule

Description

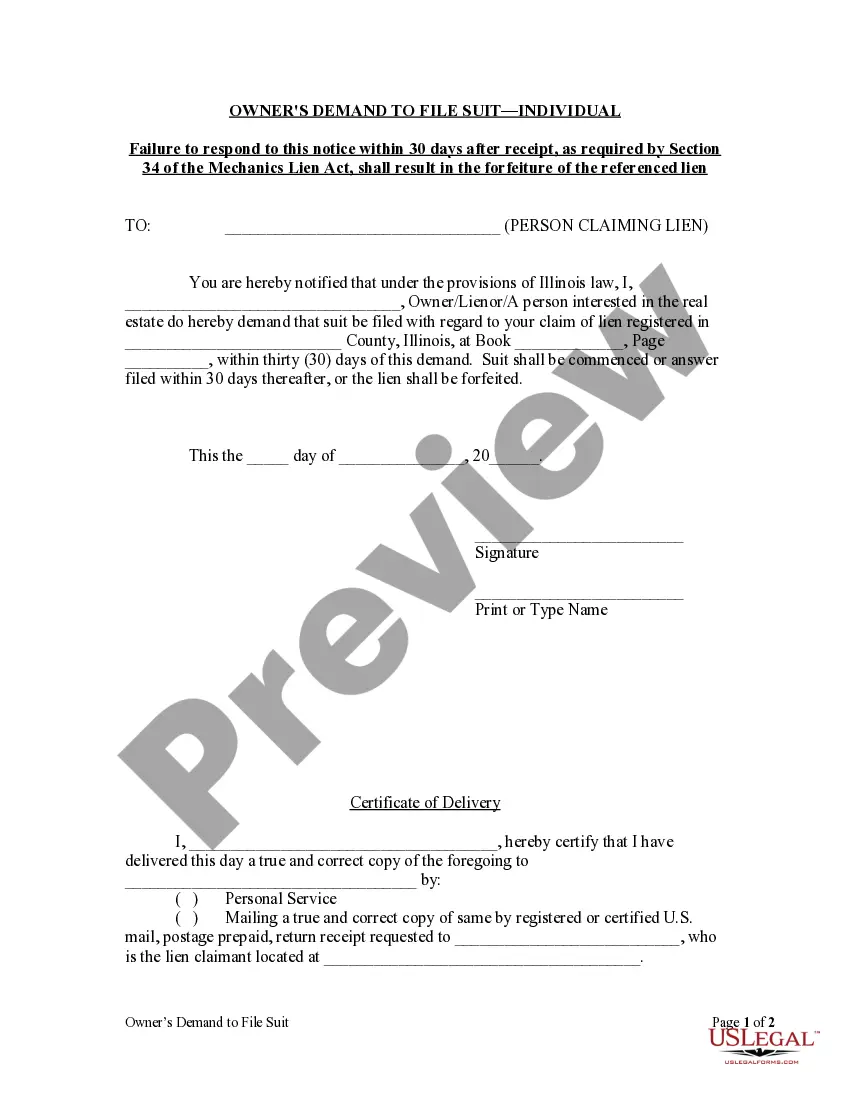

How to fill out Self-Employed Independent Contractor Payment Schedule?

You can allocate time on the Internet searching for the legal document template that meets the state and federal requirements you require.

US Legal Forms provides a vast array of legal forms that have been reviewed by specialists.

It is easy to download or print the Maryland Self-Employed Independent Contractor Payment Schedule from the service.

If available, utilize the Preview button to review the document template as well. To find another variation of the form, use the Search field to locate the template that fits your needs and requirements. Once you have identified the template you want, click Purchase now to proceed. Select the pricing plan you desire, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, alter, and sign and print the Maryland Self-Employed Independent Contractor Payment Schedule. Download and print a vast number of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to manage your business or personal requirements.

- If you possess a US Legal Forms account, you may Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Maryland Self-Employed Independent Contractor Payment Schedule.

- Every legal document template you acquire is yours indefinitely.

- To obtain an extra copy of the purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the easy instructions below.

- First, ensure you have selected the correct document template for your county/city of choice.

- Review the form summary to confirm you have chosen the appropriate template.

Form popularity

FAQ

When reporting income from self-employment, you should use Schedule C (Form 1040) to detail your business income and expenses. This schedule allows you to calculate your net profit or loss from self-employment activities. Additionally, ensure you keep track of your earnings and follow the Maryland Self-Employed Independent Contractor Payment Schedule for accurate reporting. Utilizing platforms like uslegalforms can simplify this process by providing the necessary forms and guidance.

To report payments to independent contractors, you need to gather all necessary financial records, including invoices and payment receipts. You should use Form 1099-NEC to report any payments made to contractors totaling $600 or more during the year. It is essential to file this form with the IRS and provide a copy to the contractor. By following the Maryland Self-Employed Independent Contractor Payment Schedule, you ensure compliance with state and federal regulations.

Filling out Schedule C as an independent contractor starts with gathering income records and expense receipts. After reporting your income at the top, you will need to complete various sections, detailing your expenses. This process is crucial for maintaining your Maryland Self-Employed Independent Contractor Payment Schedule and can be made easier with templates from USLegalForms.

To fill out Schedule C for an independent contractor, begin by entering your income, then deduct any eligible business expenses. Be precise in listing your deductions to ensure compliance and maximize savings. This careful accounting is vital for your Maryland Self-Employed Independent Contractor Payment Schedule.

Filling out an independent contractor agreement involves detailing the work to be performed, payment terms, and other important conditions based on your specific arrangement. Ensure clarity in the scope of work, deadlines, and payment schedules. Utilizing a template from USLegalForms can help streamline this process and ensure your Maryland Self-Employed Independent Contractor Payment Schedule aligns with the agreement.

Yes, you can fill out your own Schedule C, but it may be complex, depending on your business activities. If you keep accurate records of your income and expenses, you'll find the process manageable. However, if you're unsure, consider using resources like USLegalForms for guidance on completing your Maryland Self-Employed Independent Contractor Payment Schedule accurately.

Yes, independent contractors typically use Schedule C to report their income and expenses to the IRS. Schedule C allows you to outline your business income and claim deductions for eligible business expenses. Understanding how to effectively use Schedule C is essential for managing your Maryland Self-Employed Independent Contractor Payment Schedule.

The $2500 expense rule refers to a tax guideline that allows self-employed individuals in Maryland, including independent contractors, to deduct certain business expenses without needing extensive documentation. Specifically, you can deduct expenses that do not exceed $2500 per item. This simplifies record-keeping and makes it easier to track expenses under your Maryland Self-Employed Independent Contractor Payment Schedule.

Independent contractors, much like those on 1099 forms, negotiate their payment terms based on client relationships and project scope. Payments may occur at different stages, such as upfront deposits, upon completion, or at specified intervals. Defining these terms is vital for your Maryland Self-Employed Independent Contractor Payment Schedule. Consider utilizing resources from uslegalforms to ensure your terms are clear and legally sound.

Accepting payments as an independent contractor involves selecting payment methods that suit both you and your clients. You can use invoicing software to keep track of payments and set clear due dates. Adhering to a Maryland Self-Employed Independent Contractor Payment Schedule can further ensure timely payments and foster trust with your clients, which is essential for your success.