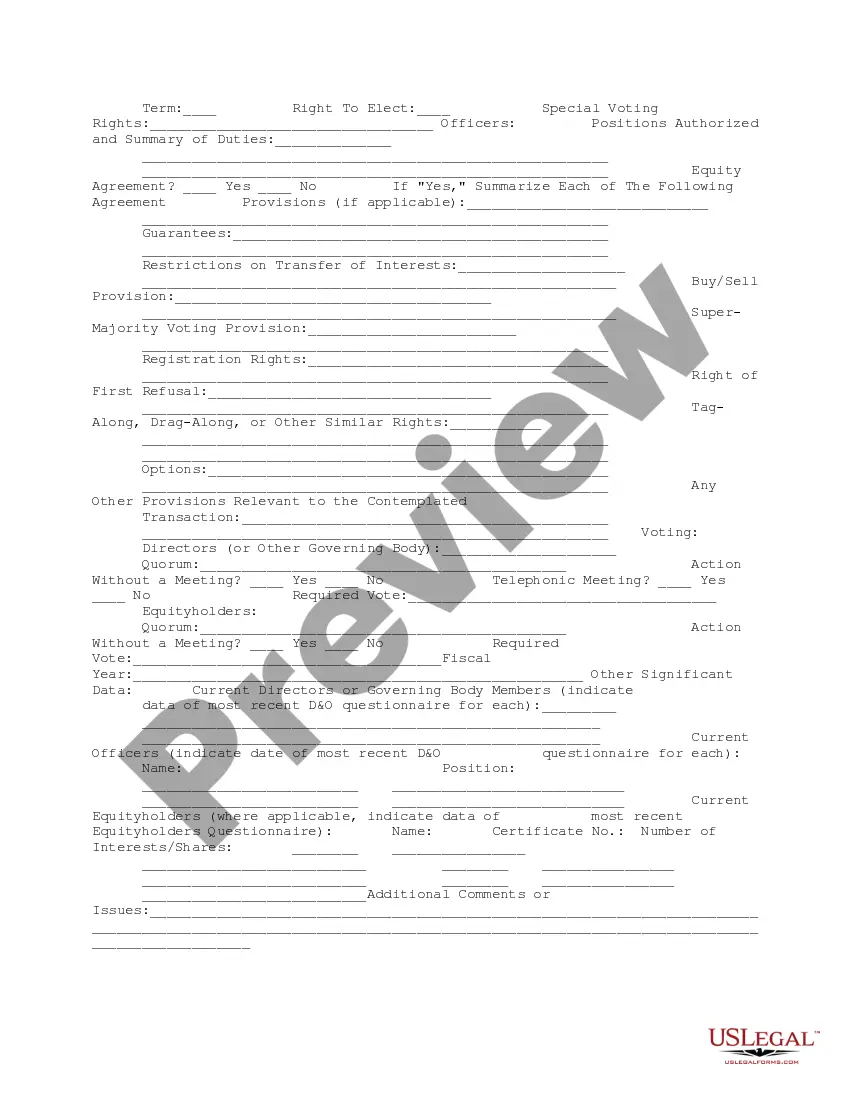

This form is a due diligence data summary to be prepared for the company and each of its Subsidiaries in business transactions.

Maryland Company Data Summary

Description

How to fill out Company Data Summary?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a vast selection of legal document templates that you can download or print.

By using the website, you will obtain thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Maryland Company Data Summary in just minutes.

If you already hold a monthly membership, sign in and download the Maryland Company Data Summary from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Finalize the transaction. Use your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device.

- Make sure to select the correct form for your city/region.

- Click the Preview button to review the form's content.

- Check the form description to ensure you have selected the right form.

- If the form does not suit your needs, utilize the Search field at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Order now button.

- Then, choose your pricing plan and provide your details to register for an account.

Form popularity

FAQ

A company search is used for various purposes such as verifying a business's credibility, checking its compliance status, and researching competitors. Entrepreneurs, investors, and consumers all benefit from this valuable resource. Utilizing the Maryland Company Data Summary allows you to conduct effective research and ensure you are making informed decisions in your business endeavors.

Yes, a Maryland business search can help you identify the owner of a business. The information often includes the names of the business's registered agents and officers. With the Maryland Company Data Summary, especially when accessed through US Legal Forms, you can easily obtain ownership information to facilitate your business or personal inquiries.

Conducting a Maryland business entity search is essential for several reasons. It helps you verify if a business name is available, assess the legitimacy of a company, or check for any outstanding obligations. By reviewing the Maryland Company Data Summary, you enable informed decisions regarding partnerships, investments, or starting your own business.

You can look up Maryland businesses by visiting the Maryland Secretary of State’s online database, or you can use user-friendly tools like US Legal Forms. Simply enter the business name or ID, and you’ll gain access to relevant company details without any hassle. Using the Maryland Company Data Summary streamlines your search, helping you find the information you need quickly.

A Maryland business search can reveal a range of information, including the company’s registration status, its business officers, and any associated filings. It provides insights into compliance, ownership, and even financial standing. Accessing the Maryland Company Data Summary through platforms like US Legal Forms allows you to gather this critical information easily and efficiently.

Yes, you can conduct a Maryland business name search through the Maryland Secretary of State’s website or trusted platforms like US Legal Forms. This search helps you check the availability of a business name in Maryland, ensuring you can secure a unique identity for your company. Utilizing the Maryland Company Data Summary simplifies this process by providing you with essential information at your fingertips.

Filing your Maryland annual report late can result in penalties, including late fees and possible administrative dissolution. The state imposes these consequences to encourage timely compliance, which protects your operational status. Keeping track of deadlines helps maintain your Maryland Company Data Summary in good standing.

Yes, annual reports are required in Maryland for LLCs and corporations to maintain compliance. These reports help the state keep track of your business activities and ensure your information, such as your Maryland Company Data Summary, remains current. Regular filing demonstrates your commitment to adhering to state laws.

If an annual report is not filed in Maryland, the state can revoke your business's good standing, leading to administrative dissolution. This means your LLC may no longer operate legally, limiting your ability to enforce contracts and conduct business. To prevent this, keep your Maryland Company Data Summary accurate and file reports promptly.

A Maryland CRN, or Corporate Registration Number, is a unique identifier assigned to your business when it registers with the state. This number forms part of your Maryland Company Data Summary and is critical for various business operations, such as filing taxes and annual reports. Keeping this number handy will streamline your business processes.