A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Maryland Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

How to fill out Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

It is feasible to spend countless hours online attempting to locate the legal document template that aligns with the state and federal requirements you seek.

US Legal Forms provides a wide array of legal documents that are reviewed by professionals.

You can effortlessly download or print the Maryland Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check through your service.

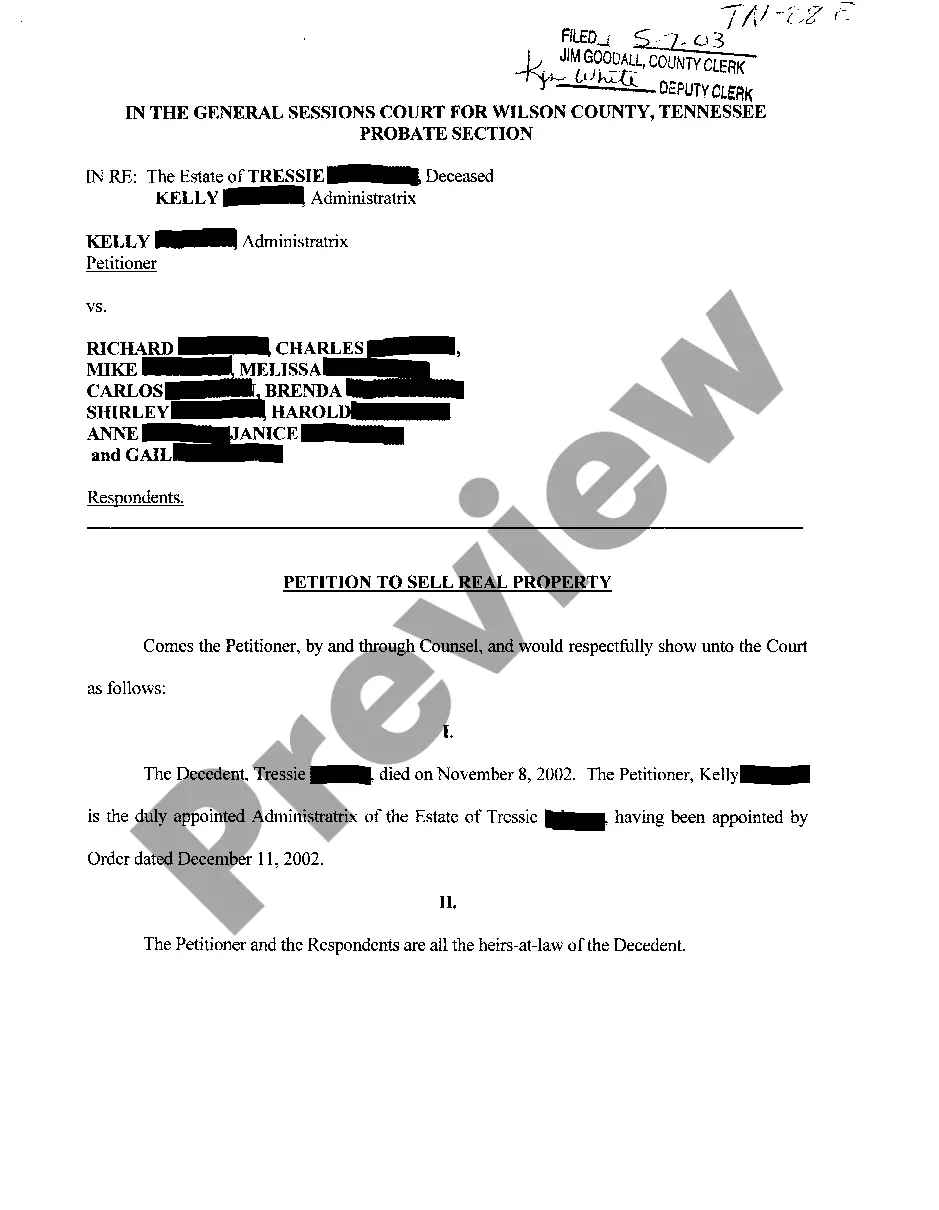

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- Afterwards, you can complete, modify, print, or sign the Maryland Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

- Every legal document template you acquire is yours indefinitely.

- To get another copy of the obtained form, visit the My documents tab and click on the corresponding button.

- If you're using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city you choose.

- Read the form description to confirm you have selected the appropriate form.

Form popularity

FAQ

In most cases, when you receive a postdated check, you can deposit or cash a postdated check at any time. Debt collectors may be prohibited from processing a check before the date on the check, but most individuals are free to take postdated checks to the bank immediately.

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

Generally, state law provides that if you notified your bank or credit union about a post-dated check a reasonable time before it received the check, your notice is valid for six months. During that time, the bank or credit union should not cash the check before the date you wrote on the check.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed. Ask your bank or credit union for their specific policy for postdated checks in their account disclosures.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.

Postdating a check is done by writing a check for a future date instead of the actual date the check was written. This is typically done with the intention that the check recipient will not cash or deposit the check until the future indicated date.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.