Maryland Supplemental Retirement Plan

Description

How to fill out Supplemental Retirement Plan?

If you have to total, down load, or printing authorized file templates, use US Legal Forms, the largest selection of authorized forms, that can be found on the Internet. Take advantage of the site`s simple and practical search to get the paperwork you will need. Different templates for company and individual functions are categorized by categories and suggests, or keywords. Use US Legal Forms to get the Maryland Supplemental Retirement Plan within a few mouse clicks.

In case you are already a US Legal Forms customer, log in for your account and then click the Obtain switch to obtain the Maryland Supplemental Retirement Plan. Also you can gain access to forms you in the past saved in the My Forms tab of your own account.

If you work with US Legal Forms initially, refer to the instructions listed below:

- Step 1. Make sure you have chosen the form for your proper city/land.

- Step 2. Take advantage of the Preview solution to check out the form`s information. Don`t forget to read the outline.

- Step 3. In case you are not happy with all the kind, make use of the Search industry at the top of the display to locate other types of your authorized kind design.

- Step 4. When you have discovered the form you will need, click on the Purchase now switch. Pick the pricing prepare you like and add your qualifications to sign up for the account.

- Step 5. Process the transaction. You can utilize your Мisa or Ьastercard or PayPal account to accomplish the transaction.

- Step 6. Find the format of your authorized kind and down load it on the device.

- Step 7. Full, change and printing or sign the Maryland Supplemental Retirement Plan.

Each authorized file design you buy is yours permanently. You might have acces to every single kind you saved in your acccount. Click on the My Forms section and select a kind to printing or down load once again.

Compete and down load, and printing the Maryland Supplemental Retirement Plan with US Legal Forms. There are many expert and express-particular forms you may use for the company or individual demands.

Form popularity

FAQ

Qualified deferred compensation plans have a limit. For example, employees can only defer up to $22,500 to their traditional 401(k) plan in 2023. Nonqualified deferred compensation plans have no limit. Employees can defer as much of their compensation as they would like.

The employer buys the insurance policy, pays the premiums, and has access to its cash value. The employee receives supplemental retirement income paid for through the insurance policy. Once the employee receives income in retirement, that benefit is taxable. At that point, the employer receives a tax deduction.

While excess benefit plans make up benefits lost because of the maximum limits on qualified plan benefits and contributions, supplemental executive retirement plans (SERPs), also known as top-hat plans, can be used for broader purposes like increasing benefits for shorter service employees, recognizing bonus payments ...

SERPs are paid out as either one lump sum or as a series of set payments from an annuity, with different tax implications for each method, so choose carefully.

Example of a SERP Even if the employee quits, the company still has access to the insurance's cash value. If the employee passes away, the company is a beneficiary of the payout and also gets tax benefits.

In general, a Nonqualified Deferred Compensation Plan refers to a plan in which the executive is deferring his own compensation and a SERP is a plan in which the employer is allocating contributions to the executive. Many plans have a combination of executive and employer contributions.

A supplemental executive retirement plan (SERP) is a set of benefits that may be made available to top-level employees in addition to those covered in the company's standard retirement savings plan. A SERP is a form of a deferred-compensation plan. It is not a qualified plan.

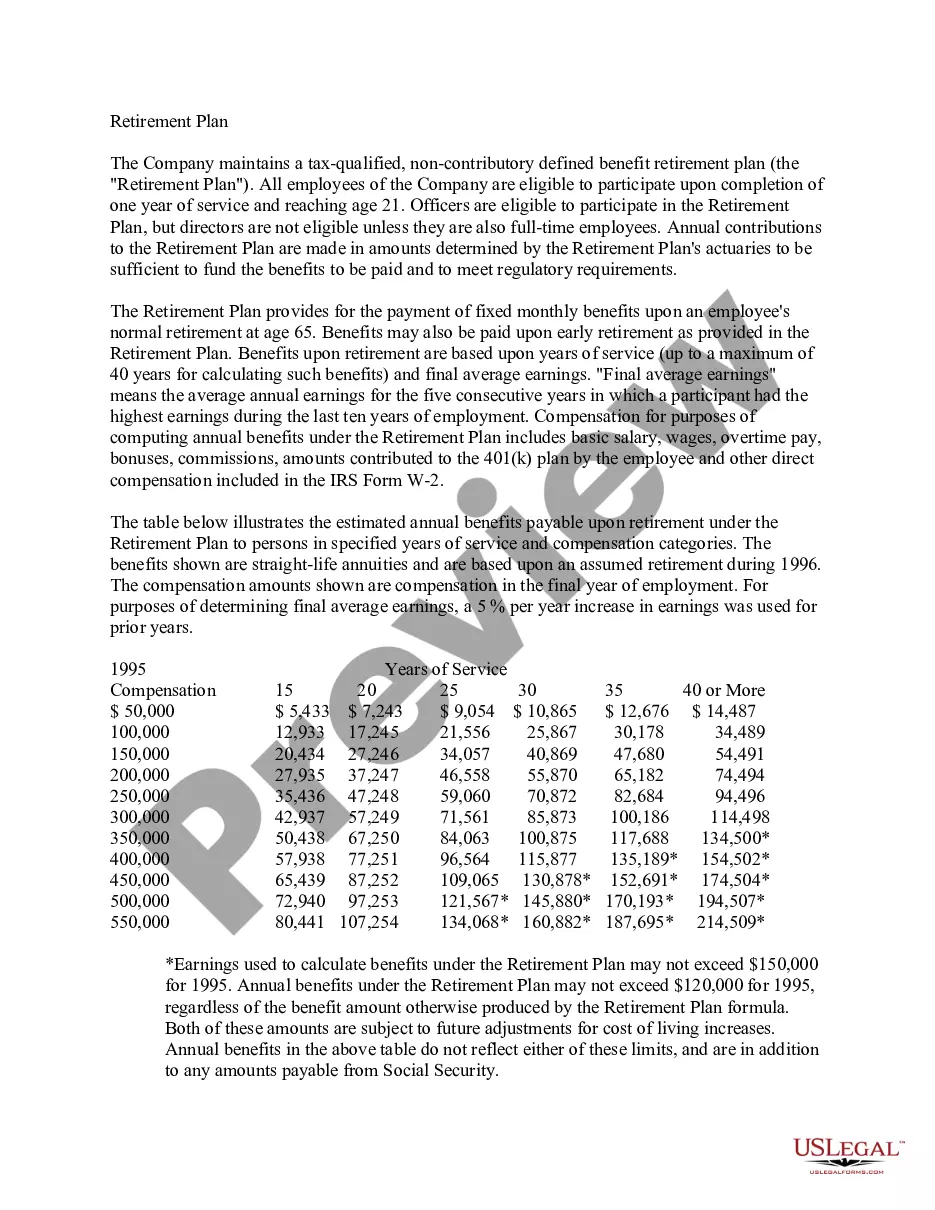

Typically, a SERP is in the form of a defined benefit plan under which benefits are based on a pension formula. Unlike restoration plans, SERPs are not designed merely to replace lost benefits, but to provide more generous benefits to covered executives. These benefits are generally paid or commence at retirement.