Maryland Issuance of Common Stock in Connection with Acquisition

Description

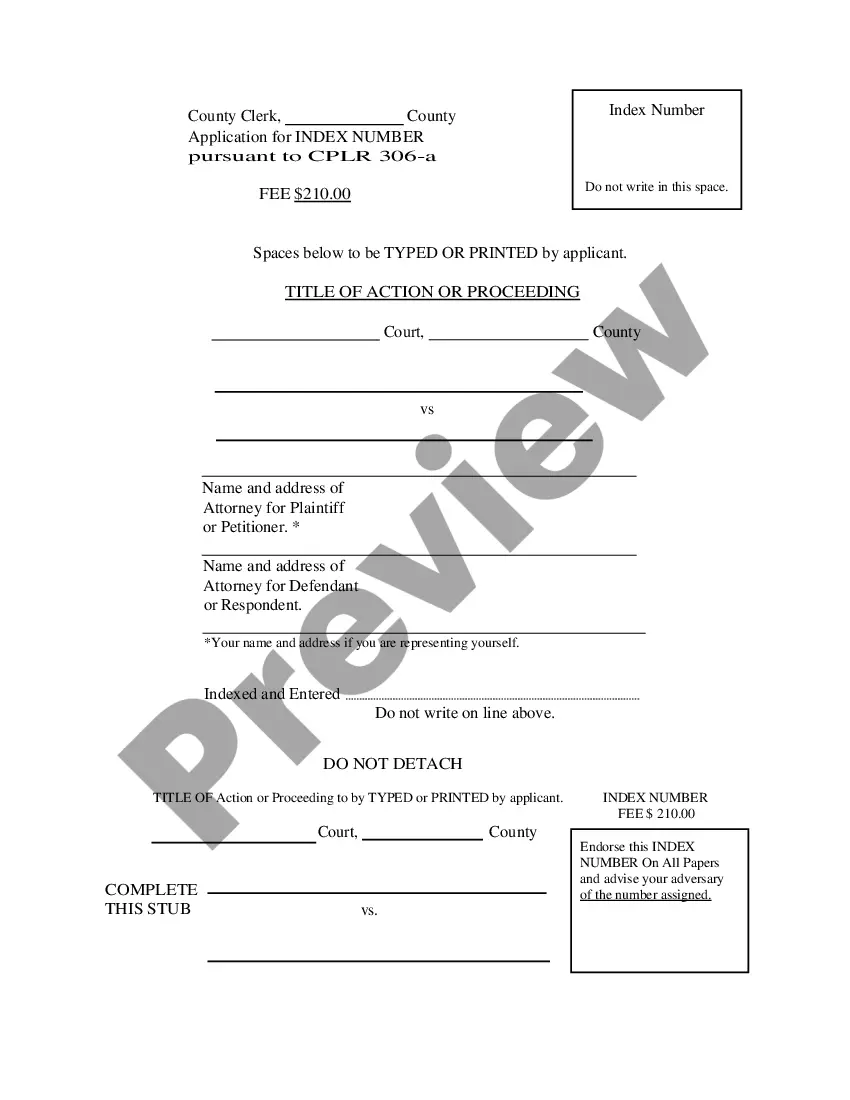

How to fill out Issuance Of Common Stock In Connection With Acquisition?

US Legal Forms - among the greatest libraries of lawful types in the States - provides an array of lawful document layouts you are able to download or print out. Making use of the website, you can find 1000s of types for enterprise and personal functions, categorized by groups, says, or search phrases.You will find the latest versions of types such as the Maryland Issuance of Common Stock in Connection with Acquisition in seconds.

If you already possess a monthly subscription, log in and download Maryland Issuance of Common Stock in Connection with Acquisition from the US Legal Forms collection. The Download switch will show up on each and every develop you view. You get access to all in the past delivered electronically types in the My Forms tab of your respective profile.

If you want to use US Legal Forms initially, listed here are basic directions to get you started out:

- Be sure you have picked the correct develop for your personal city/state. Click on the Preview switch to examine the form`s information. See the develop description to ensure that you have selected the appropriate develop.

- When the develop doesn`t satisfy your needs, use the Look for field on top of the monitor to get the one which does.

- Should you be pleased with the shape, validate your decision by clicking on the Buy now switch. Then, pick the pricing prepare you like and give your accreditations to register to have an profile.

- Procedure the financial transaction. Make use of charge card or PayPal profile to perform the financial transaction.

- Find the structure and download the shape on the system.

- Make modifications. Fill up, revise and print out and sign the delivered electronically Maryland Issuance of Common Stock in Connection with Acquisition.

Each template you included in your account lacks an expiry time and is also yours for a long time. So, in order to download or print out one more copy, just visit the My Forms portion and then click about the develop you require.

Obtain access to the Maryland Issuance of Common Stock in Connection with Acquisition with US Legal Forms, one of the most considerable collection of lawful document layouts. Use 1000s of skilled and condition-particular layouts that meet your small business or personal requires and needs.

Form popularity

FAQ

Following careful review of the order of the District Court, on February 24, 2022, the Board amended the Funds' by-laws to provide that the Control Share By-Law shall be of no force and effect for so long as the judgment of the District Court is effective and that if the judgment of the District Court is reversed, ...

Under the Control Share Statute, a Fund shareholder who acquires ?control shares? in a ?control share acquisition? has no voting rights with respect to those shares on any matters relating to voting, except to the extent approved by the Fund's other shareholders at a shareholder meeting by the vote of two-thirds of all ...

Sale of Common Stock means the sale by way of merger or otherwise by the Company's stockholders of more than two-thirds of the outstanding Common Stock of the Company to a third party not Affiliated with the Company (i) for cash, or (ii) for common stock that is listed for trading on a national securities exchange or ...

Upon issuance, common stock is generally recorded at its fair value, which is typically the amount of proceeds received. Those proceeds are allocated first to the par value of the shares (if any), with any excess over par value allocated to additional paid-in capital.

[7] For example, the Maryland Control Share Acquisition Act (MCSAA) provides that ?control shares? are those shares with more than one-tenth (but less than one third), one-third (but less than a majority), or a majority of the power to vote in the election of directors.

(a) As used in this section, ?control-share acquisition? means the acquisition, directly or indirectly, by any person of ownership of, or the power to direct the exercise of voting power with respect to, issued and outstanding control shares.

"Control share acquisition" means the direct or indirect acquisition, other than in an excepted acquisition, by any person of beneficial ownership of shares of a public corporation that, except for this article, would have voting rights and would, when added to all other shares of such public corporation which then ...