Maryland Job Description Worksheet

Description

How to fill out Job Description Worksheet?

If you desire to be thorough, obtain, or produce authentic document templates, utilize US Legal Forms, the premier selection of legitimate formats, which are accessible online.

Take advantage of the site's easy and convenient search function to locate the documents you require.

Various templates for business and personal use are categorized by type and jurisdiction, or keywords.

Step 4. Once you have found the form you need, click on the Acquire now button. Select the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You may utilize your Visa or MasterCard or PayPal account to finalize the purchase.

- Use US Legal Forms to acquire the Maryland Job Description Worksheet in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to get the Maryland Job Description Worksheet.

- You can also find forms you previously obtained in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

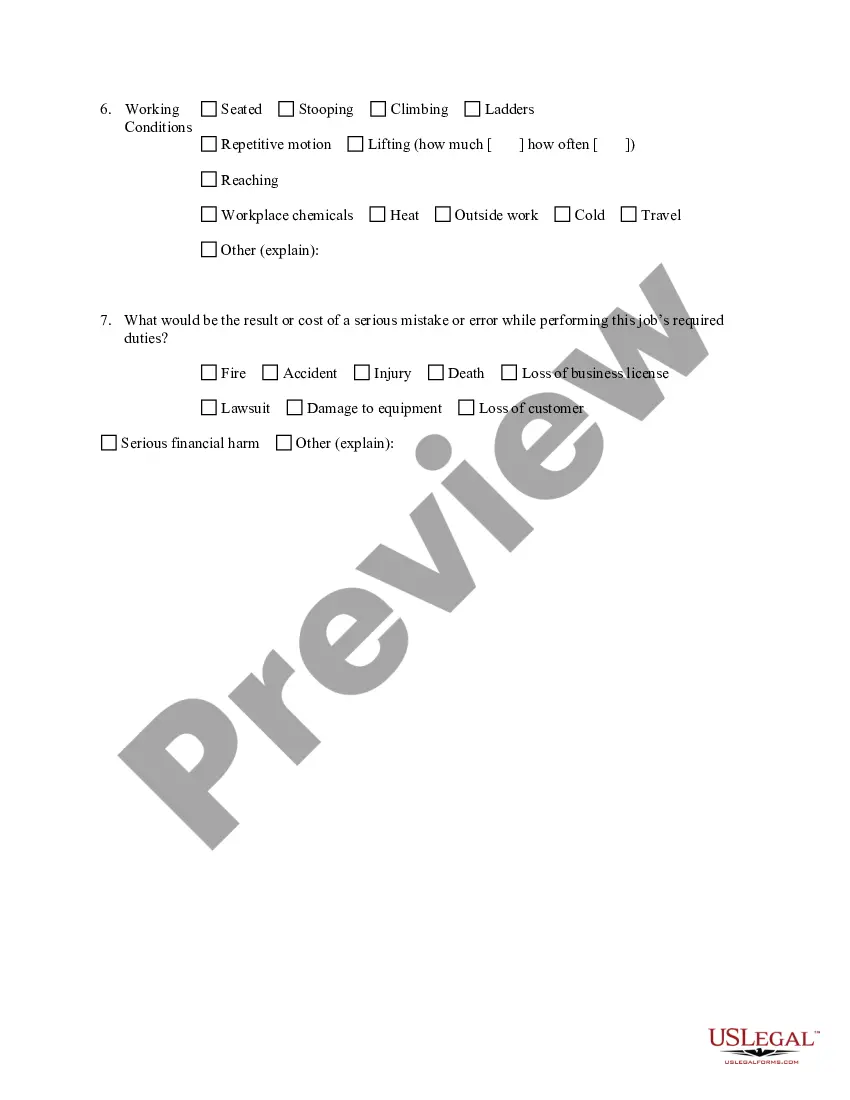

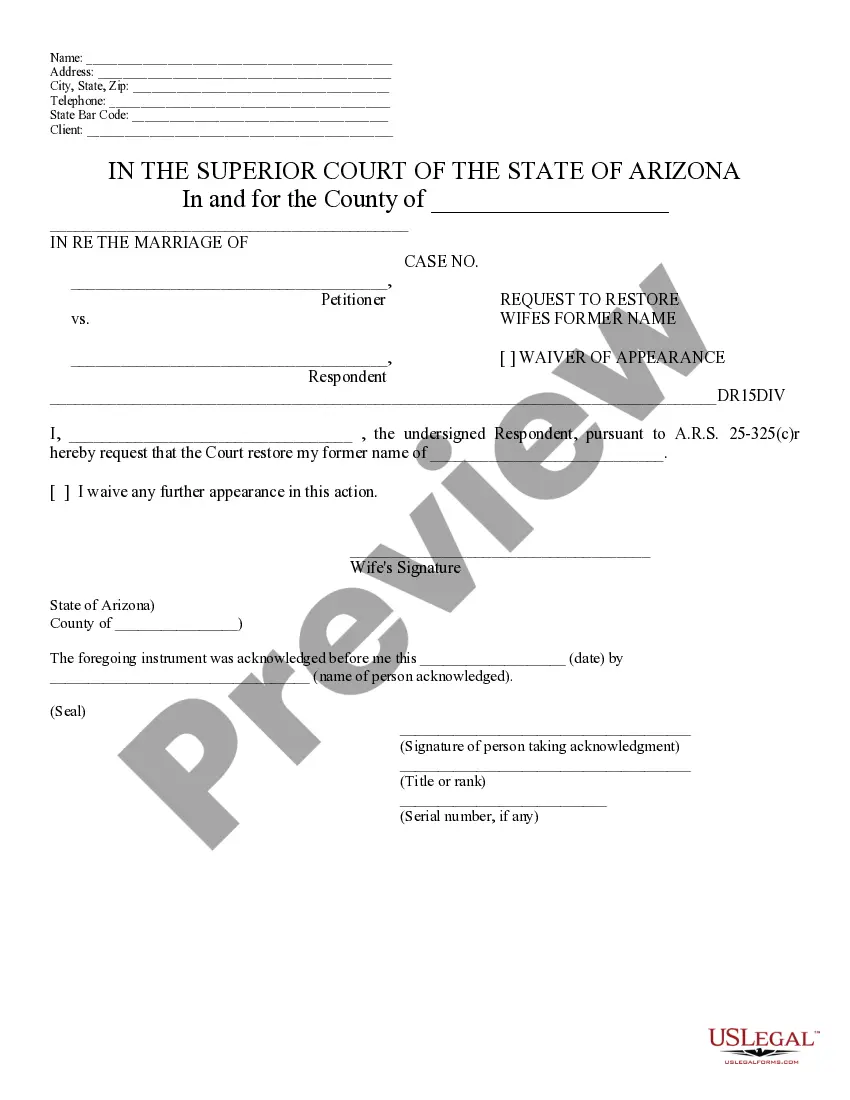

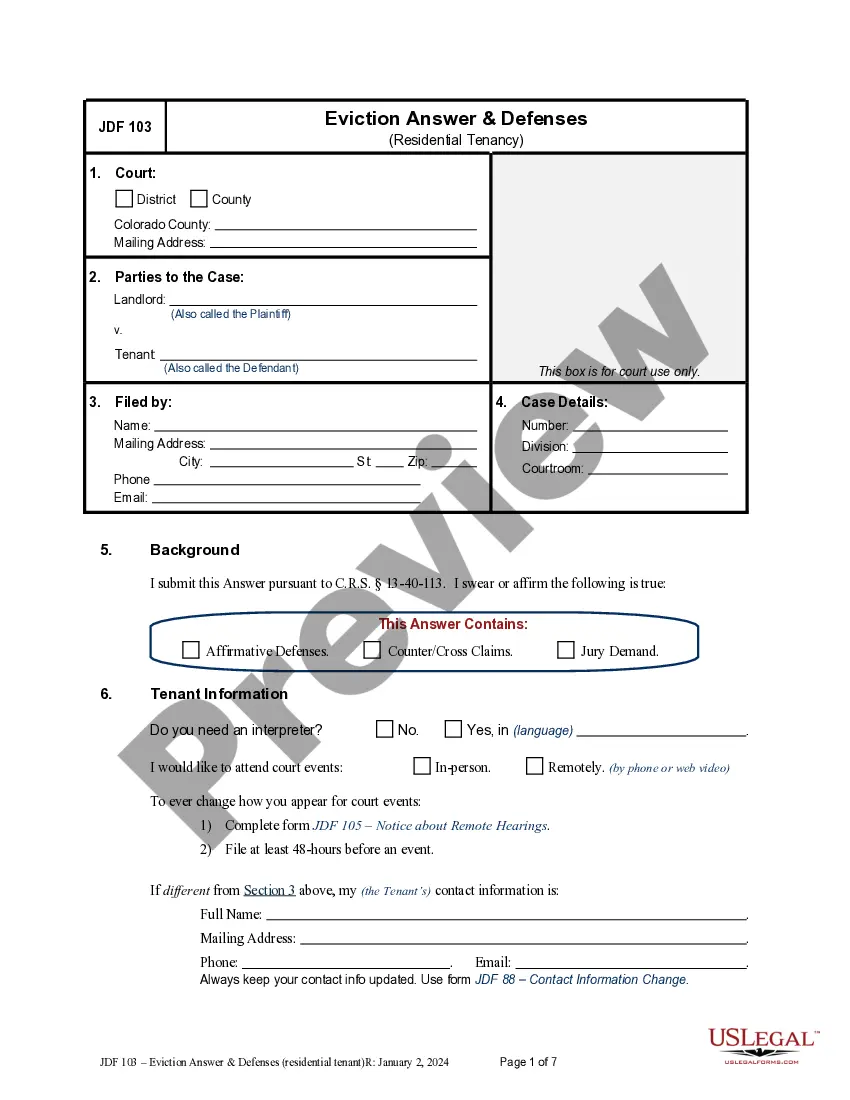

- Step 2. Use the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions in the legal form template.

Form popularity

FAQ

Filling out the Maryland W-4 form is straightforward when you understand the information you need to provide. Begin by entering your personal details, then indicate your filing status and dependents. The Maryland Job Description Worksheet can aid you in estimating your taxable income and guide you on the appropriate withholding amount, making the process clearer and more effective.

What is difference in withholding amount between Married , 0 and Married 1 personal allowance? The more allowances an employee claims, the less is withheld for federal income tax. If you claim 0 allowances, more will be withheld from your check than if you claim 1. The amount also depends on how often you get paid.

NOTE: Standard deduction allowance is 15% of Maryland adjusted gross income with a minimum of $1,500 and a maximum of $2,000 for each taxpayer. spouse - An additional $1,000 may be claimed if the taxpayer and/or spouse is at least 65 years of age and/ or blind on the last day of the tax year.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

It is better to claim 1 if you are good with your money and 0 if you aren't. This is because if you claim 1 you'll get taxed less, but you may have to pay more taxes later. If you do you'll have to address this out of pocket and if you didn't save up enough you may have to wait to take care of your tax bill.

Claiming fewer allowances on Form w-4 will result in more tax being withheld from your paychecks and less take-home pay. This might result in a larger tax refund. On the other hand, claiming too many allowances could mean that not enough tax is withheld during the year.

Tips. While claiming one allowance on your W-4 means your employer will take less money out of your paycheck for federal taxes, it does not impact how much taxes you'll actually owe. Depending on your income and any deductions or credits that apply to you, you may receive a tax refund or have to pay a difference.

By placing a 0 on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

How Many Allowances Should I Claim if I'm Single? If you are single and have one job, you can claim 1 allowance. There's also the option of requesting 2 allowances if you are single and have one job.