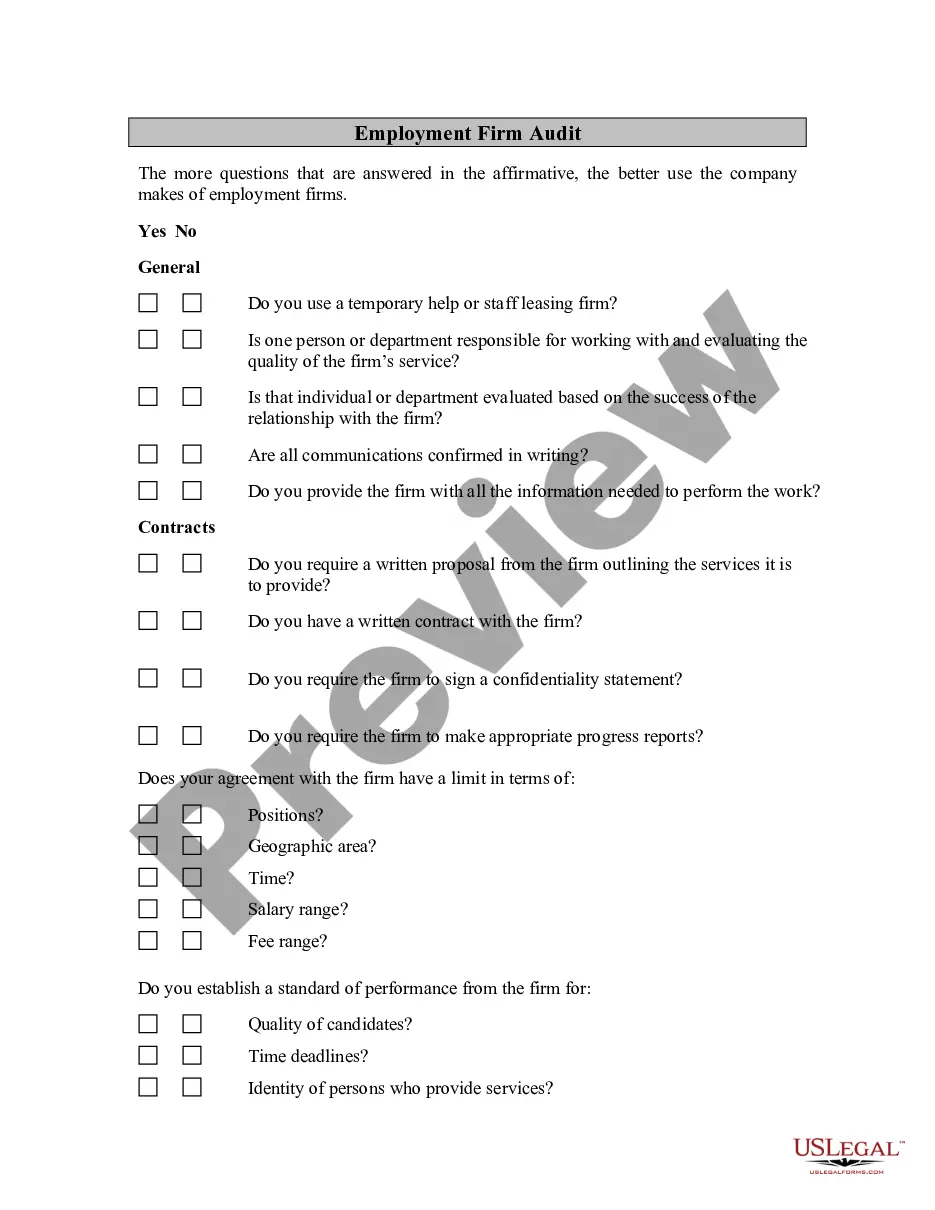

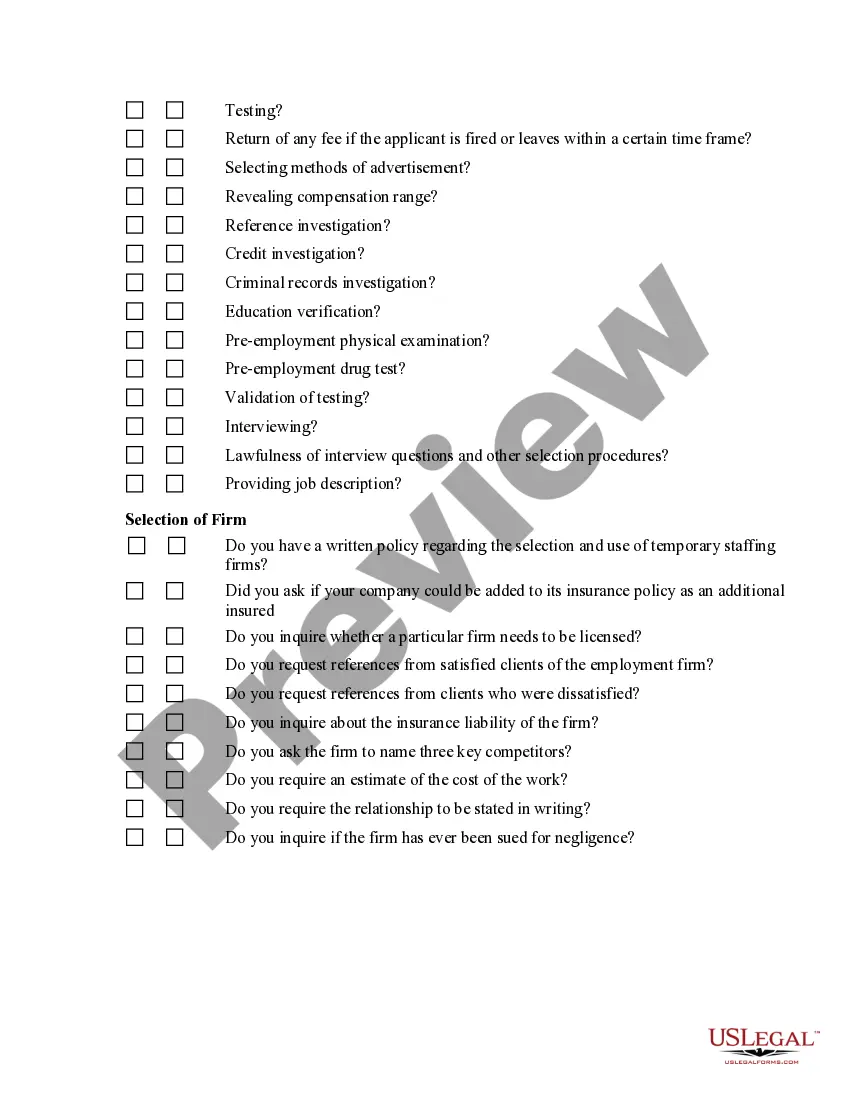

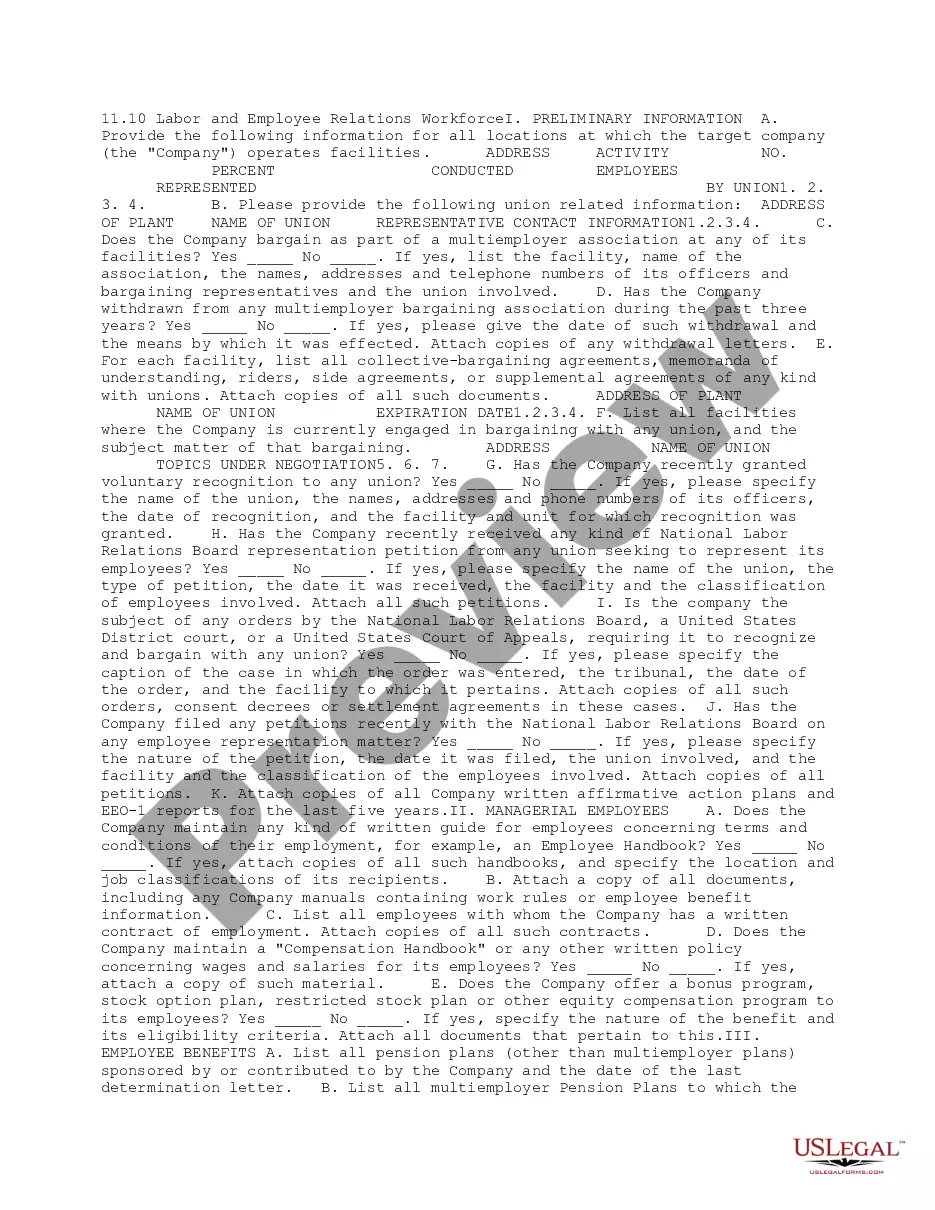

Maryland Employment Firm Audit

Description

How to fill out Employment Firm Audit?

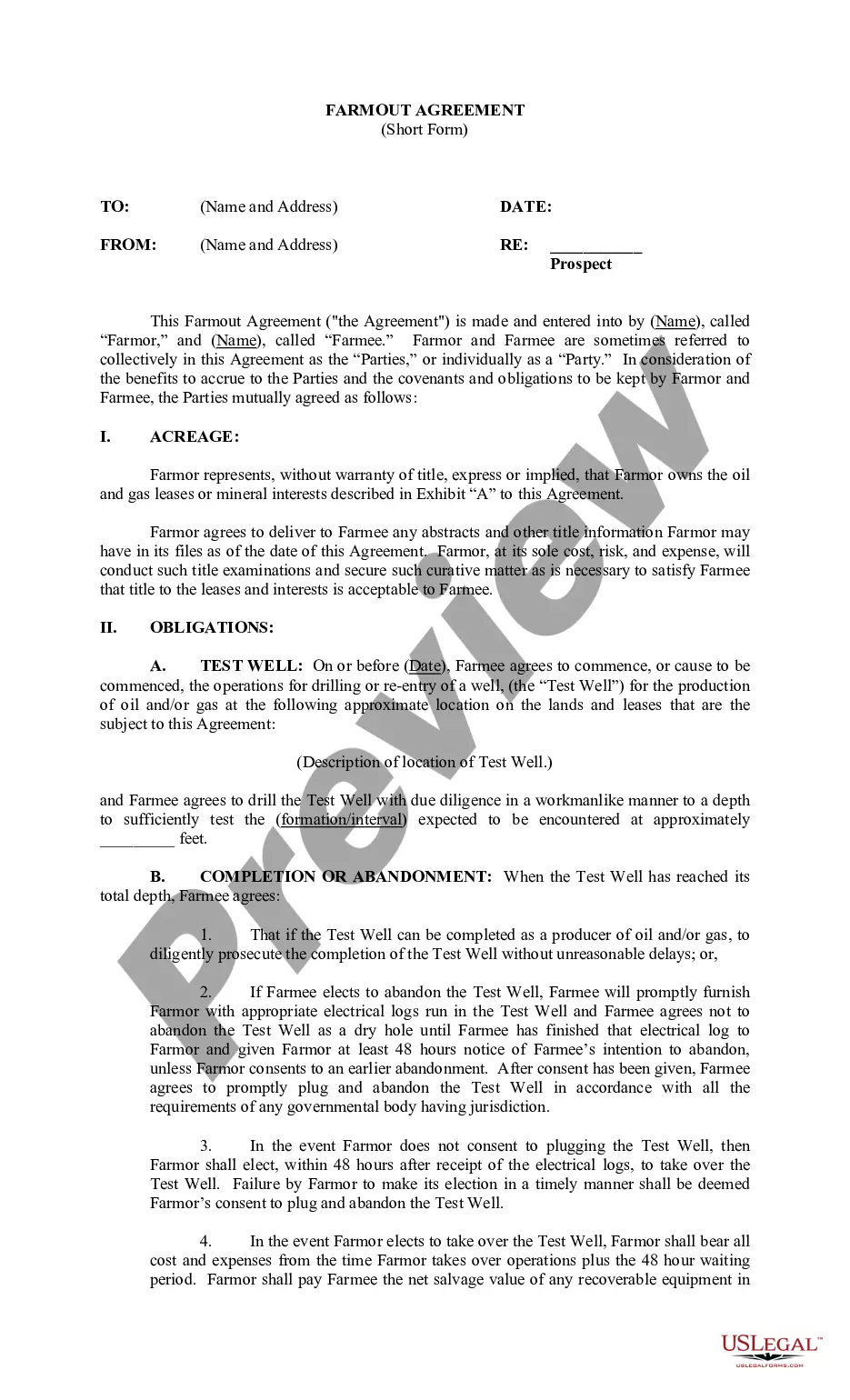

Have you ever entered a location where you require documentation for an organization or individual that is utilized almost consistently.

There are numerous authentic template documents accessible online, but finding ones you can trust is not straightforward.

US Legal Forms offers an extensive array of document templates, including the Maryland Employment Agency Audit, designed to comply with state and federal guidelines.

Select your preferred pricing plan, provide the necessary information to create your account, and finalize the order using your PayPal or Visa or MasterCard.

Choose a suitable file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- From there, you can download the Maryland Employment Agency Audit template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Acquire the template you need and confirm it aligns with your specific region/state.

- Use the Review button to assess the document.

- Check the description to ensure you have chosen the correct template.

- If the template is not what you are looking for, employ the Search field to find the template that fits your requirements.

- Once you locate the right template, click Get now.

Form popularity

FAQ

If you're not familiar with the term, an EDD audit occurs when the California Employment Development Department (EDD) launches an investigation into a business' California state payroll tax records to determine if the business has classified a worker as an independent contractor instead of an employee.

California Payroll Tax Audit Triggers An audit is often triggered by a former worker applying for unemployment insurance, which is taken as an assertion that the person was an employee of your company and entitled to unemployment payments.

What happens if I get audited by EDD? If you get an EDD audit, you could be liable to face penalties and interest on taxes that you owe. These sorts of fines include a percentage of unpaid taxes, set dollar amounts for each case of unreported employees or independent contractors, among others.

When the Employment Development Department conducts an audit, the purpose of the audit is to determine if an employer has fully paid the payroll taxes it owes under California law.

The EDD can decide to audit if a worker makes the case that he or she is an employee rather than an independent contractor (typically found out when the employee tries to apply for unemployment insurance). Other triggers for an audit include: Filing or paying late. Errors in time records or other statement or documents.

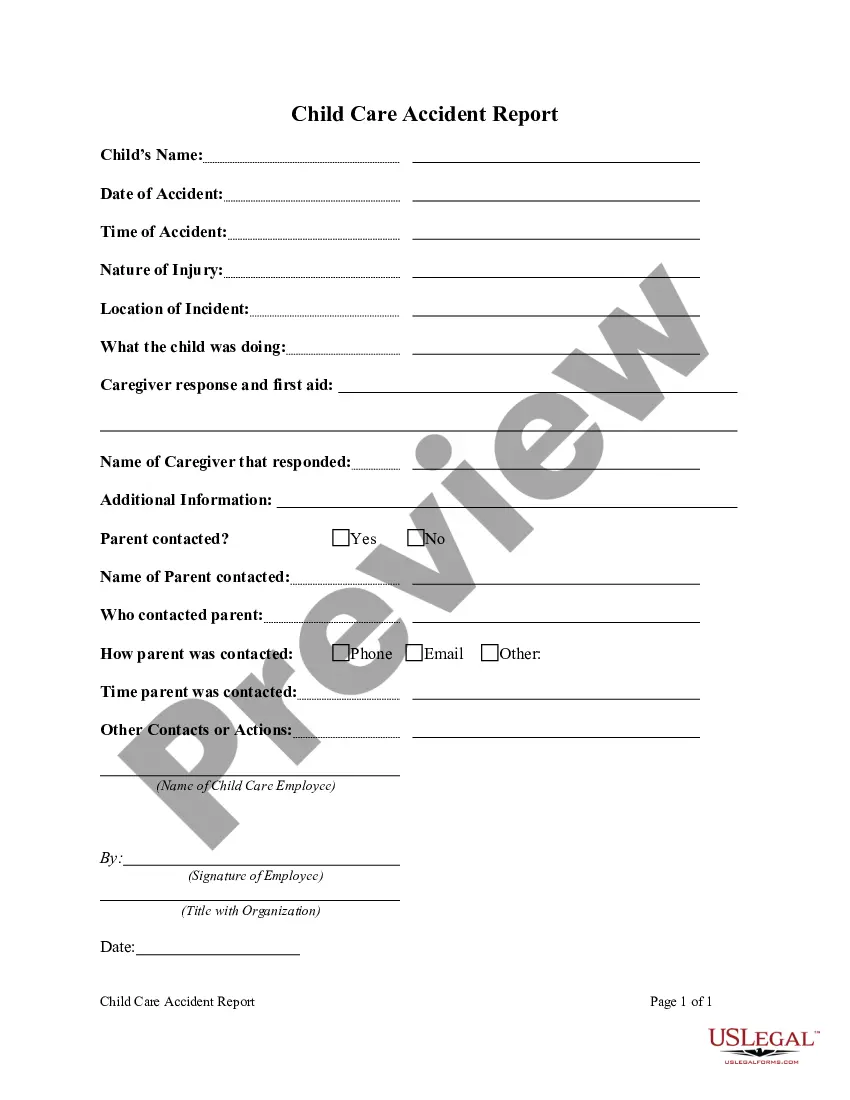

An audit can be as simple as reviewing employment files to ensure that they are in order or it can involve reviewing effectiveness of corporate HR policies, which may include interviewing supervisors, managers and employees. Audits can be broad, incorporating how a business operates and reviewing efficiencies.

Not declaring income, over-claiming tax deductions, international funds transfers and a poor record of lodging returns on time are the most common triggers for an audit.

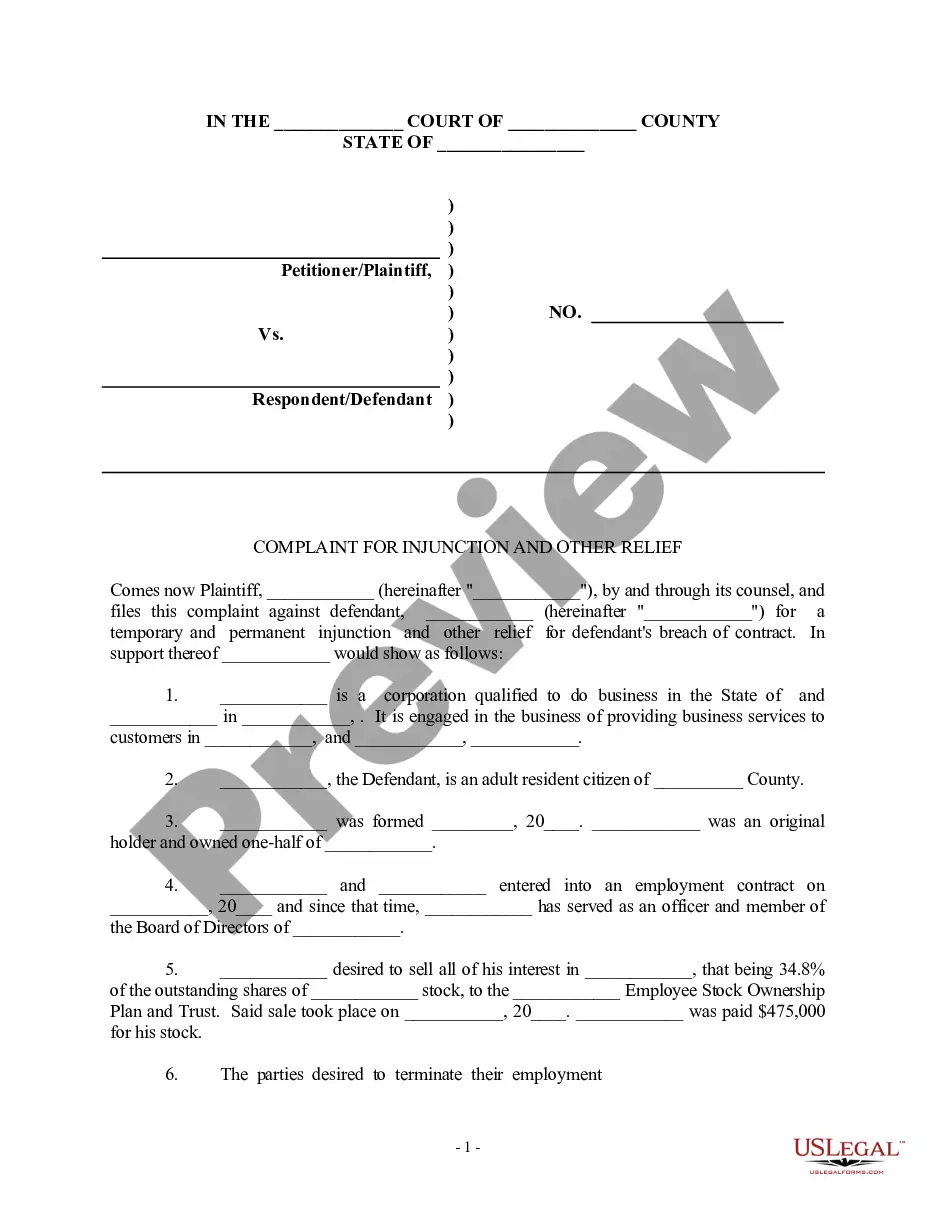

A payroll audit can occur for many reasons: someone from the government comes calling because you may have done something wrong; an employee makes a claim of unfair pay practices, or; you simply decide to review your own procedures, either internally or by using and independent third party such as an accountant.

Some helpful tips include:Document everything.Be accurate when paying both wages and taxes.Treat your workers fairly to avoid complaints.Be honest when dealing with the government.Read the audit documents thoroughly.Familiarize yourself with your rights.Carefully review the EDD's request for documents.More items...?

The EDD conducts benefit audits on a daily, weekly, and quarterly basis to help pay Unemployment Insurance (UI) benefits to only eligible claimants, help you control your UI costs, and protect the integrity of the UI Program and UI Trust Fund.