Maryland Sale of Goods, Short Form

Description

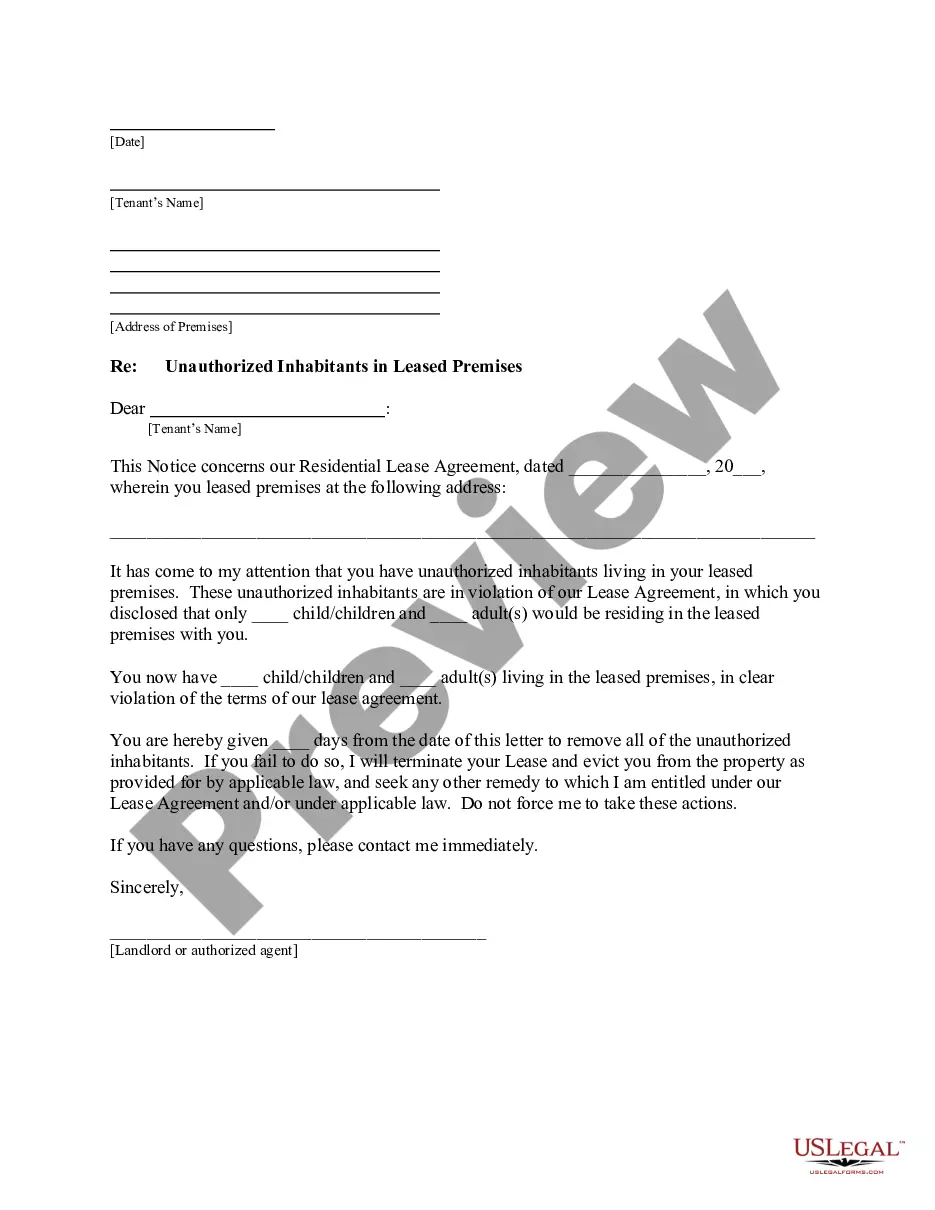

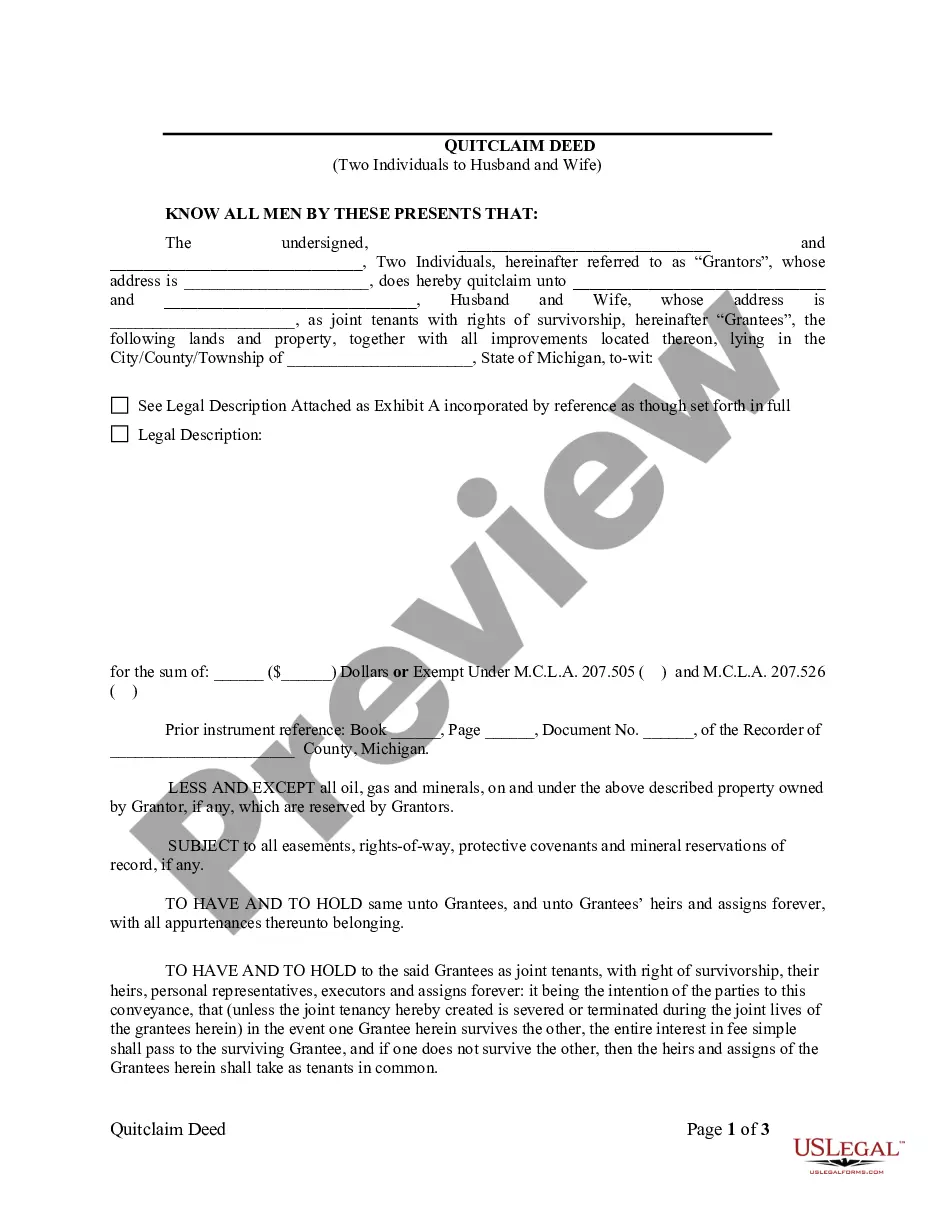

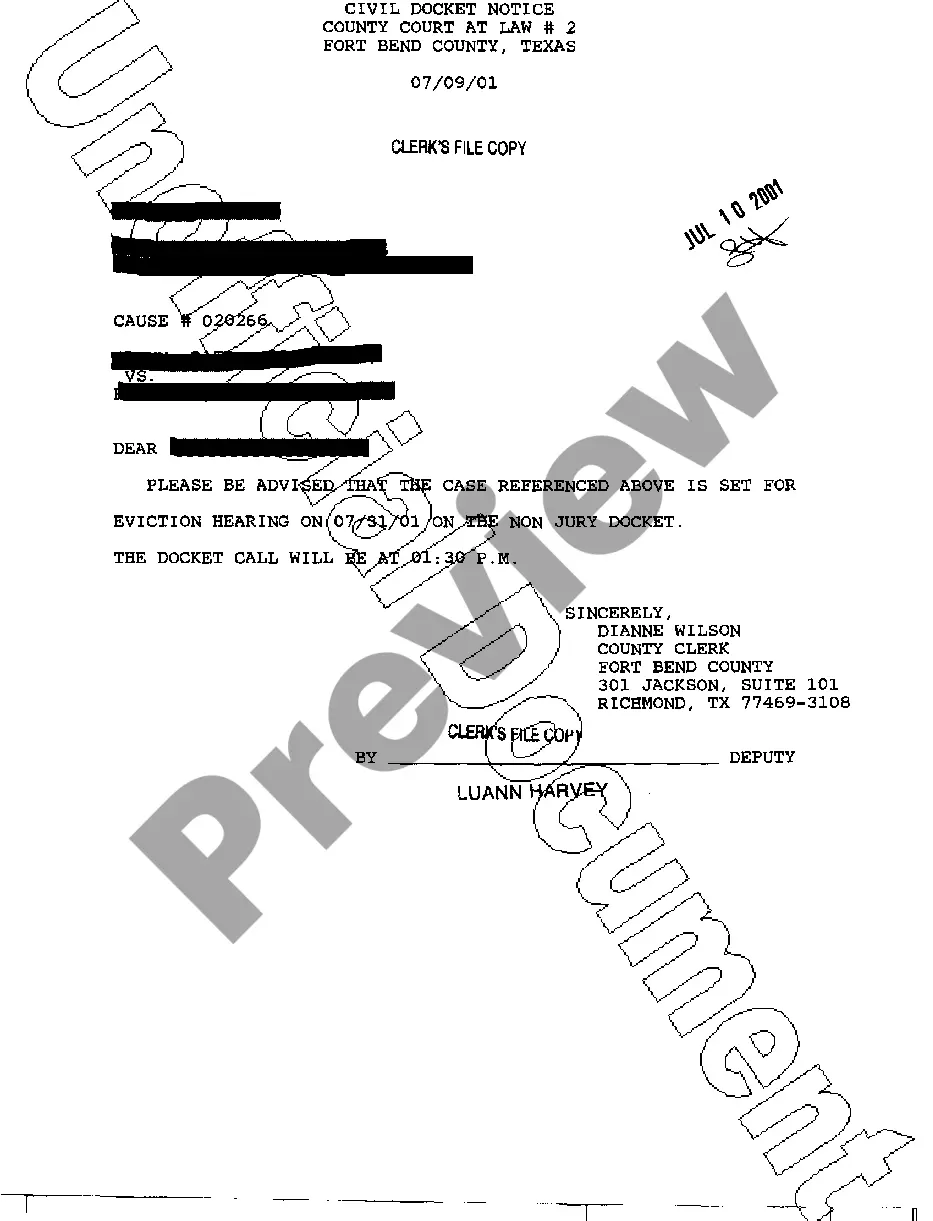

How to fill out Sale Of Goods, Short Form?

You can dedicate several hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast array of legal documents that can be reviewed by experts.

You can download or print the Maryland Sale of Goods, Short Form from the platform.

Review the form description to confirm you have chosen the correct template. If available, use the Review option to preview the document template as well. To find another version of the form, use the Search field to locate the template that matches your needs and requirements. Once you have found the template you wish, click Get now to proceed. Select the pricing plan you prefer, enter your details, and create an account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal form. Choose the format of the document and download it to your device. Make changes to your document if necessary. You can complete, modify, sign, and print the Maryland Sale of Goods, Short Form. Download and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- Afterward, you can complete, modify, print, or sign the Maryland Sale of Goods, Short Form.

- Every legal document template you obtain is yours permanently.

- To retrieve an additional copy of the purchased form, navigate to the My documents tab and choose the appropriate option.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for your location that you choose.

Form popularity

FAQ

To obtain a CRN in Maryland, you must register your business with the state's tax authority. The registration can often be completed online, making it convenient to secure your CRN quickly. For more streamlined support during this process, uslegalforms offers valuable resources and guidance.

No, a sales and use tax number is not the same as an EIN, or Employer Identification Number. An EIN is primarily for tax identification for businesses, while a sales and use tax number specifically pertains to sales tax collection. Understanding the distinction is essential in the Maryland Sale of Goods, Short Form.

Getting a Maryland sales and use tax number involves registering via the Maryland Comptroller’s website. You will provide business information and details regarding your sales activities. For a smooth experience, consider utilizing uslegalforms, which offers straightforward guidance and resources.

To obtain a sales and use tax number in Maryland, you need to register your business with the Maryland Comptroller’s office. This process can be completed online or through paper forms, providing you with the necessary identification for tax collection. Using uslegalforms can simplify this registration process.

A CRN, or Central Registration Number, in Maryland is a unique identifier assigned to businesses for sales and use tax purposes. Getting a CRN helps to streamline tax reporting and compliance. Consider uslegalforms for assistance in obtaining your CRN effectively.

Sales tax exemptions in Maryland apply to specific items and transactions, such as certain nonprofit organizations or sales for resale. Familiarizing yourself with these exemptions can enhance your compliance and efficiency in the Maryland Sale of Goods, Short Form. Check with the Maryland Comptroller for accurate details.

Maryland has a specific list of items that are exempt from sales tax. These include groceries, prescription medications, and certain agricultural products. It is essential to understand these exemptions to benefit from Maryland Sale of Goods, Short Form.

In Maryland, certain transactions and sales are not subject to sales tax. For instance, most food items purchased for home consumption, prescription drugs, and some medical supplies are typically exempt. This concept aligns with Maryland Sale of Goods, Short Form, ensuring clarity on taxable and non-taxable items.

To contact the Maryland Department of Assessments and Taxation, you can call their office at 1-866-630-0009. Their staff can assist you with inquiries related to property taxes, business taxes, and any matters concerning the Maryland Sale of Goods, Short Form. Additionally, you can visit their website to find more resources and contact forms.

You can contact the Maryland sales tax office through the Maryland Comptroller's website or by calling their customer service line at 1-800-638-2937. They provide assistance with questions related to the Maryland Sale of Goods, Short Form, helping you understand your responsibilities and rights as a taxpayer. Reaching out can clarify any concerns you may have regarding sales tax.