Maryland Partial Assignment of Life Insurance Policy as Collateral

Description

How to fill out Partial Assignment Of Life Insurance Policy As Collateral?

Choosing the best authorized file template can be a have difficulties. Of course, there are a variety of web templates available on the net, but how can you get the authorized type you want? Use the US Legal Forms website. The support provides thousands of web templates, like the Maryland Partial Assignment of Life Insurance Policy as Collateral, that you can use for organization and private needs. Each of the kinds are examined by experts and meet federal and state demands.

In case you are previously authorized, log in in your bank account and click on the Acquire button to get the Maryland Partial Assignment of Life Insurance Policy as Collateral. Make use of your bank account to search through the authorized kinds you possess purchased earlier. Check out the My Forms tab of the bank account and have one more copy from the file you want.

In case you are a whole new customer of US Legal Forms, allow me to share basic recommendations that you should follow:

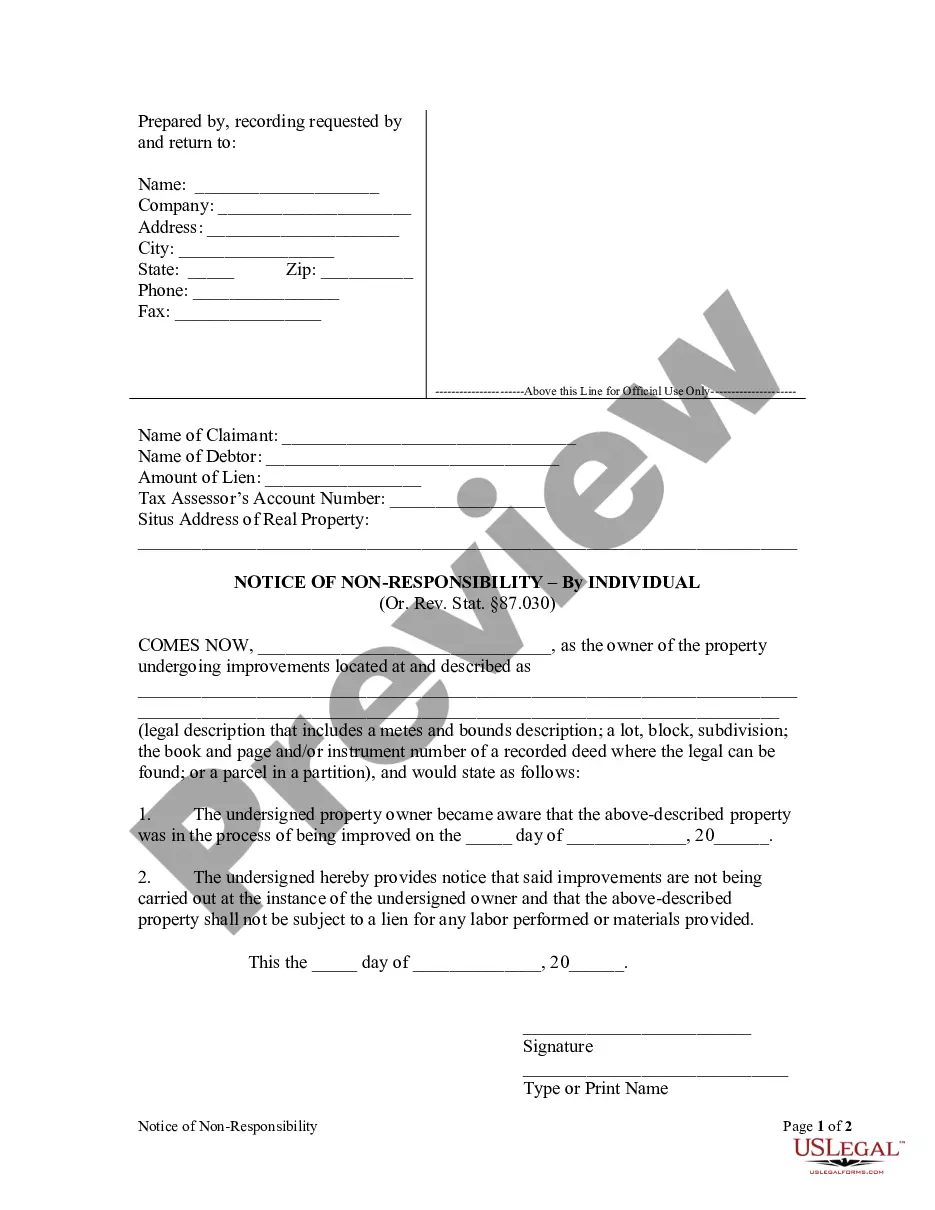

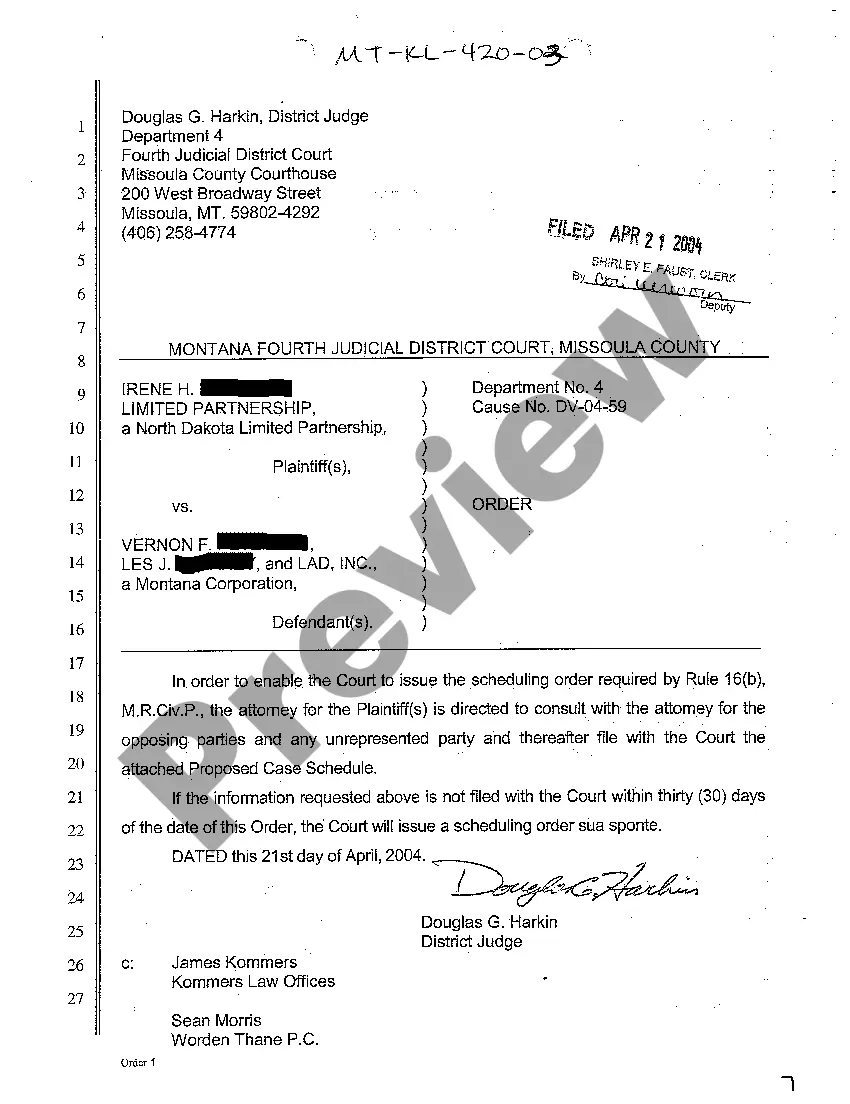

- Initial, be sure you have selected the right type to your city/state. You may examine the shape while using Review button and study the shape information to make sure it will be the best for you.

- In the event the type will not meet your expectations, take advantage of the Seach discipline to discover the appropriate type.

- Once you are certain the shape is proper, click the Purchase now button to get the type.

- Select the pricing plan you desire and type in the necessary details. Make your bank account and pay money for an order using your PayPal bank account or credit card.

- Select the submit file format and down load the authorized file template in your device.

- Total, revise and produce and signal the attained Maryland Partial Assignment of Life Insurance Policy as Collateral.

US Legal Forms may be the most significant catalogue of authorized kinds in which you will find a variety of file web templates. Use the service to down load appropriately-produced files that follow condition demands.

Form popularity

FAQ

Reinstatement - The process by which a life insurance company puts a policy back in force after it lapsed because of nonpayment of renewal premiums. Renewal - Continuation of a policy after its expiration date.

Which of these actions is taken when a policyowner uses a Life Insurance policy as collateral for a bank loan? Collateral assignment" A policyowner using the Life Insurance policy as collateral for a bank loan normally would make a collateral assignment.

If you don't repay the loan promptly, there is a chance that the loan balance plus loan interest will exceed the cash value of your life insurance policy. If that happens, the insurance company can surrender the policy, leaving you without any life insurance coverage.

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

A collateral assignment pledges a permanent life insurance policy's cash value and death benefits to another party and is most commonly used to secure a loan taken out by the policyowner. A collateral assignment primarily serves to protect the repayment interest of the lender.

A collateral assignment is typically used when an insurance policy is used as collateral for a loan. This is a temporary assignment until the debt is paid in full.

If you have a $500,000 life insurance policy and die while still owing $50,000 on a business loan, the lender could claim $50,000 of your death benefit ? assuming, of course, that you listed that lender as a collateral assignee.

Under partial assignment, only the designated amount is paid to the assignee. Rest of the proceeds are paid to the nominee. If your expected insurance proceeds are more than the loan amount, you should opt for partial assignment.