Maryland Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises

Description

How to fill out Letter Tendering Payment In Order To Obtain Release Of Mortgaged Premises?

Finding the right legitimate record template can be a have difficulties. Needless to say, there are plenty of layouts available online, but how will you discover the legitimate form you want? Use the US Legal Forms web site. The support gives a huge number of layouts, including the Maryland Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises, which can be used for organization and personal needs. All of the forms are checked by professionals and meet state and federal specifications.

When you are previously registered, log in in your profile and click the Obtain switch to obtain the Maryland Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises. Make use of your profile to appear from the legitimate forms you have purchased earlier. Proceed to the My Forms tab of your respective profile and obtain an additional version of your record you want.

When you are a whole new end user of US Legal Forms, allow me to share basic instructions that you should stick to:

- Initial, make sure you have chosen the right form for your area/state. It is possible to check out the shape while using Review switch and look at the shape explanation to make sure it will be the best for you.

- In the event the form will not meet your needs, make use of the Seach discipline to discover the right form.

- When you are certain that the shape is suitable, click on the Acquire now switch to obtain the form.

- Opt for the costs prepare you want and enter in the essential info. Create your profile and buy the order making use of your PayPal profile or credit card.

- Choose the file formatting and acquire the legitimate record template in your gadget.

- Full, revise and print out and signal the obtained Maryland Letter Tendering Payment in Order to Obtain Release of Mortgaged Premises.

US Legal Forms is the biggest library of legitimate forms in which you can see different record layouts. Use the service to acquire appropriately-produced files that stick to condition specifications.

Form popularity

FAQ

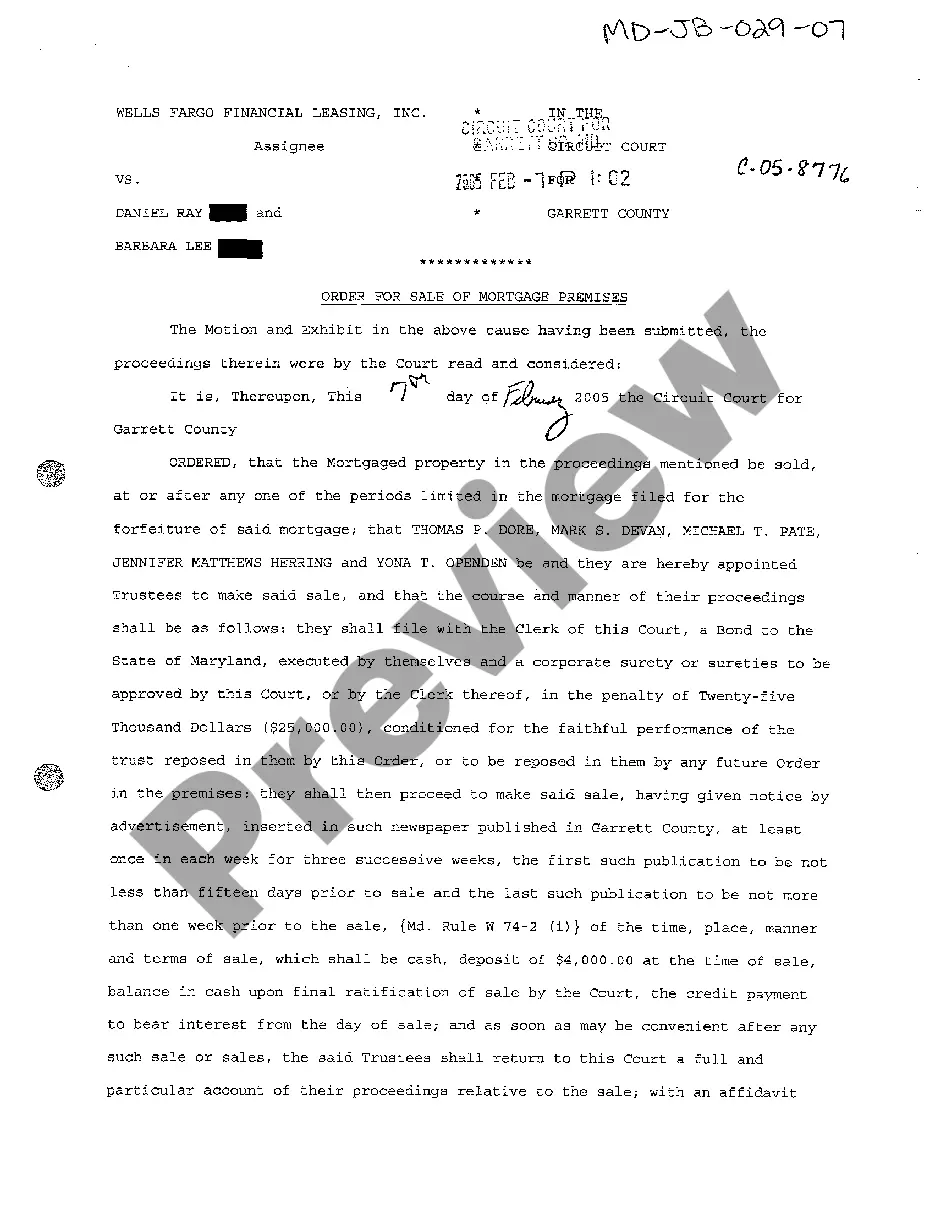

Foreclosure Process Foreclosure proceedings can legally begin when you have not paid your mortgage for 90 days. The next step is a ?Notice of Foreclosure Action.? Maryland law requires that the notice be sent both certified and first class mail at least 45 days before filing a foreclosure action.

A Maryland tax lien attorney and a Maryland tax sale attorney can help you understand this provision of law if you face foreclosure or tax sale. The right of redemption typically lasts 180 days after the sale, giving the owner enough time to pay off the delinquent taxes and some interest and fees.

A person required to send the Commissioner a copy of a notice of intent to foreclose under Real Property Article, § 7-105.1, Annotated Code of Maryland, shall meet that requirement by making an electronic submission within 5 business days of mailing a notice of intent to foreclose through the Maryland Foreclosure ...

The homeowner can be evicted from the property as soon as 15 days after the court ratifies the sale. Homeowners are encouraged to plan for alternative housing earlier in the process to avoid a forced eviction.

This is basically a document telling you that the lender will foreclose on your property if you do not take action to stop it. Ignoring it will only lead to further legal trouble, and it could prevent you from being able to negotiate with the lender to find a solution that allows you to keep your home.

What does the Notice of Intent to Accelerate mean? In short, the Notice means you are running out of time before your mortgage lender forecloses. Most mortgages contain acceleration clauses. ?Acceleration? means that your mortgage company can demand the entire balance of the mortgage, not just the amount past due.

Ways to Stop Foreclosure in Maryland Declare Bankruptcy. Yes, bankruptcy is a way through which foreclosure can be stopped. ... Applying for Loan Modification. ... Reinstating Your Loan. ... Plan for Repayment. ... Refinancing. ... Sell Out Your Home. ... Short Sale. ... Deed In Lieu of Foreclosure.

Approximately half of the states in the United States, including Virginia and Maryland, are ?deed of trust states,? which means they typically allow foreclosure by non-judicial sale. The District of Columbia is also a deed of trust jurisdiction.