Maryland Balloon Unsecured Promissory Note

Description

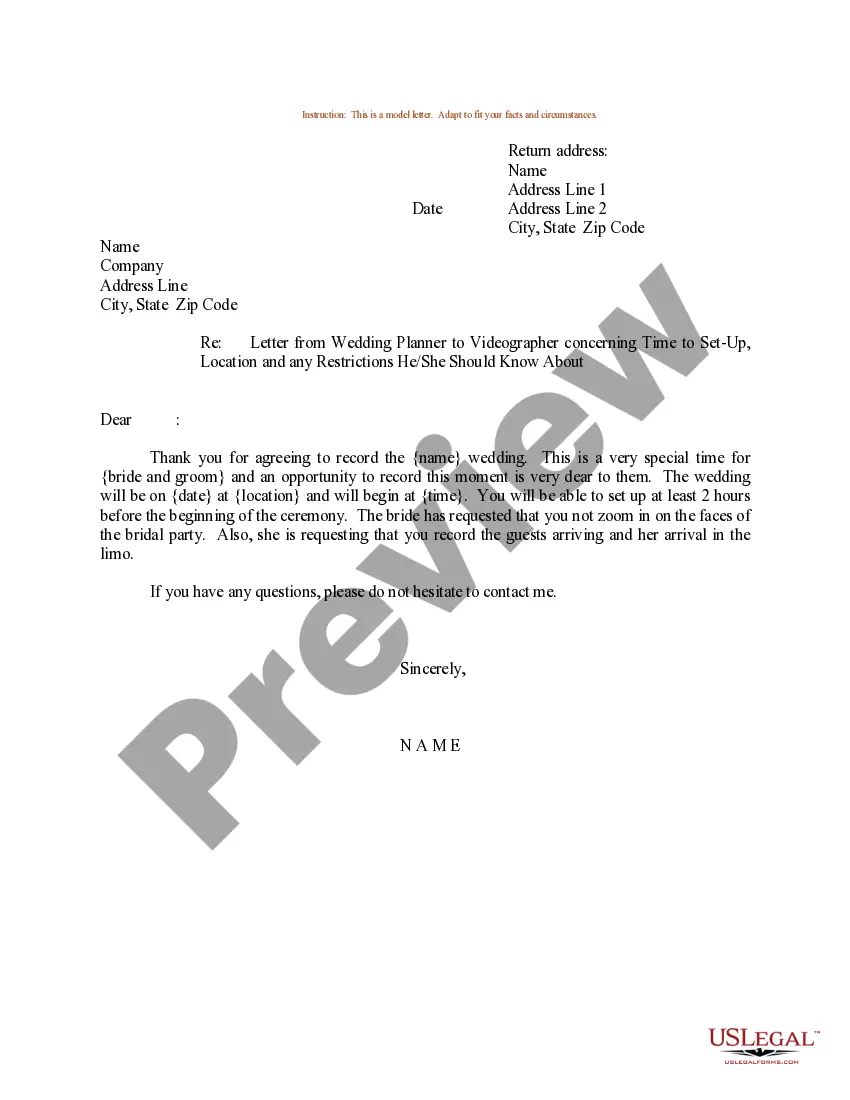

How to fill out Balloon Unsecured Promissory Note?

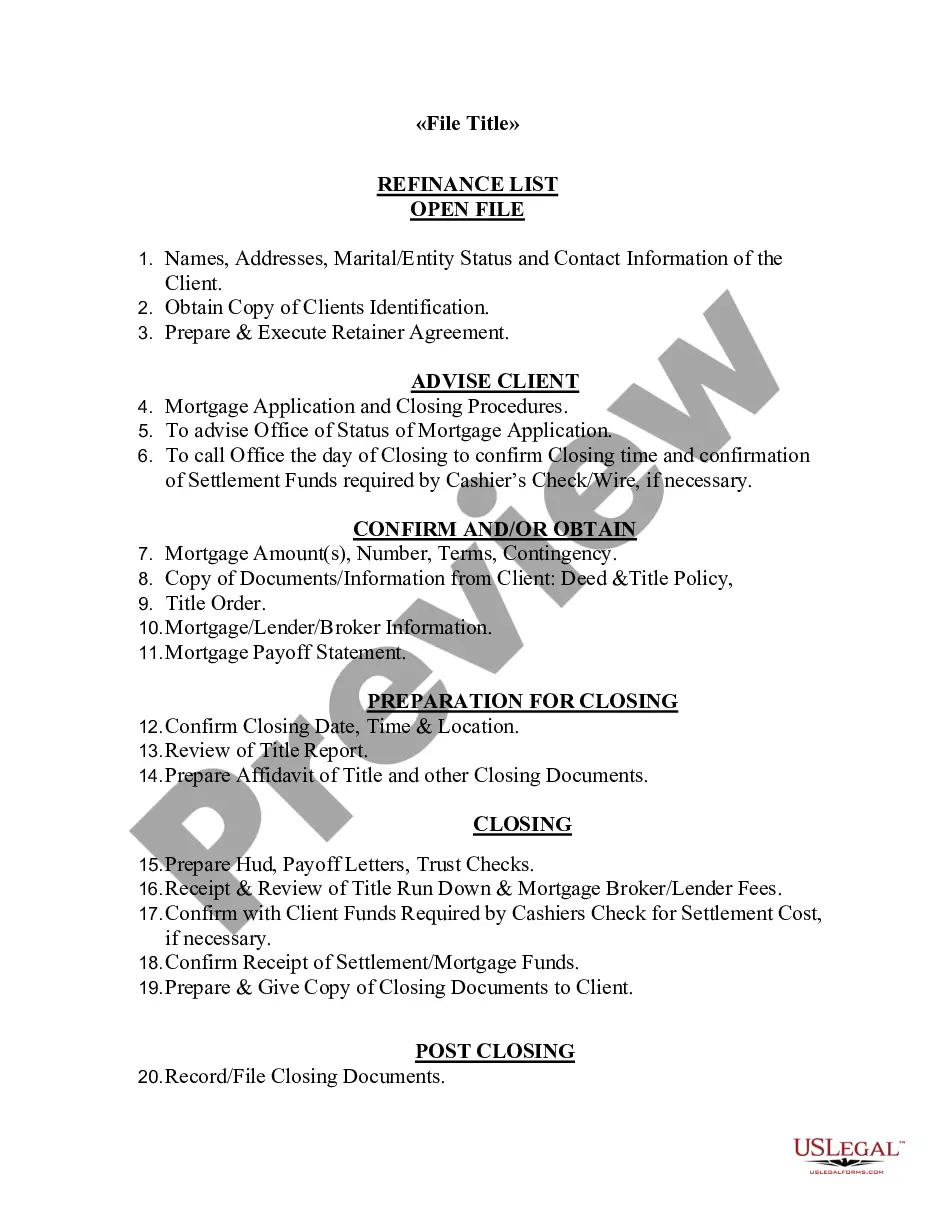

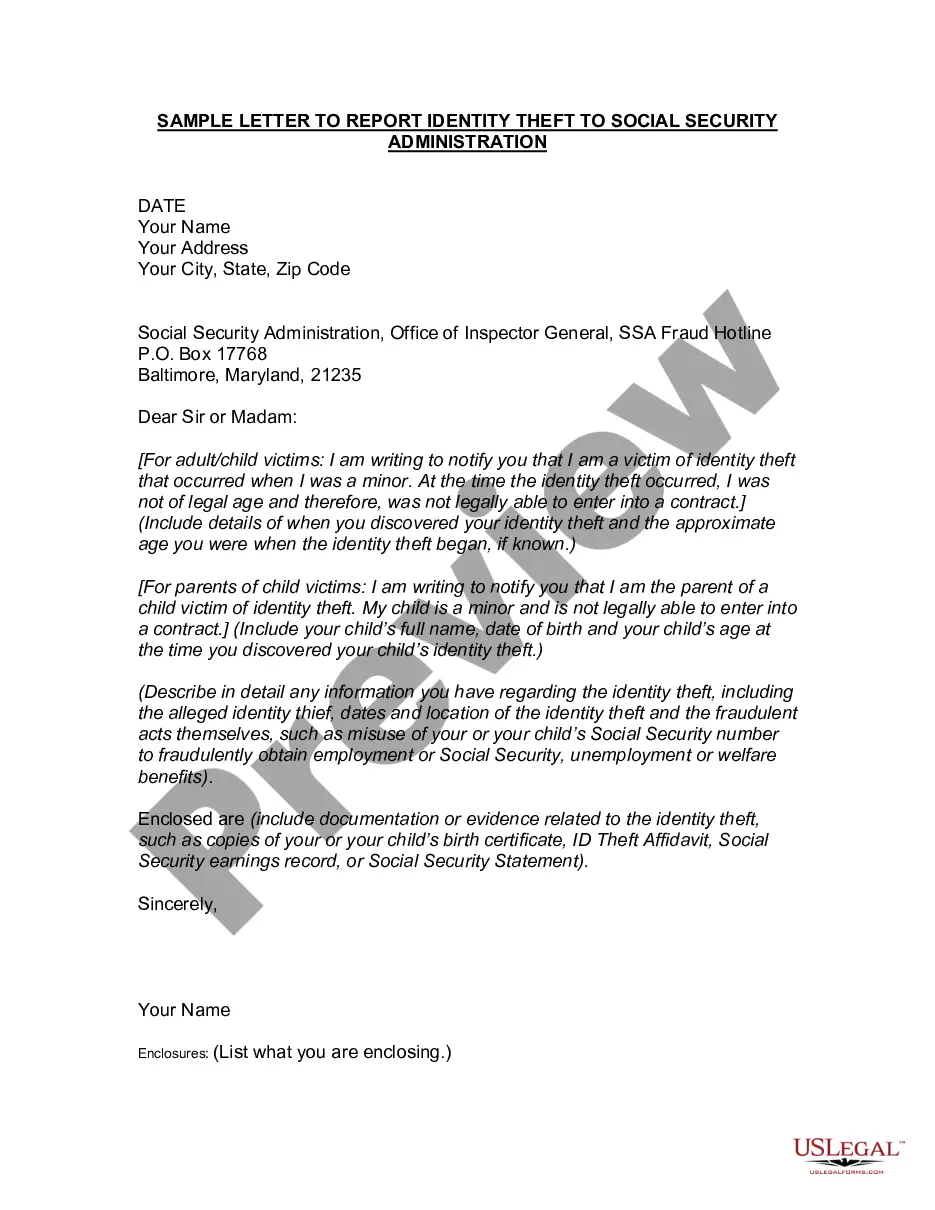

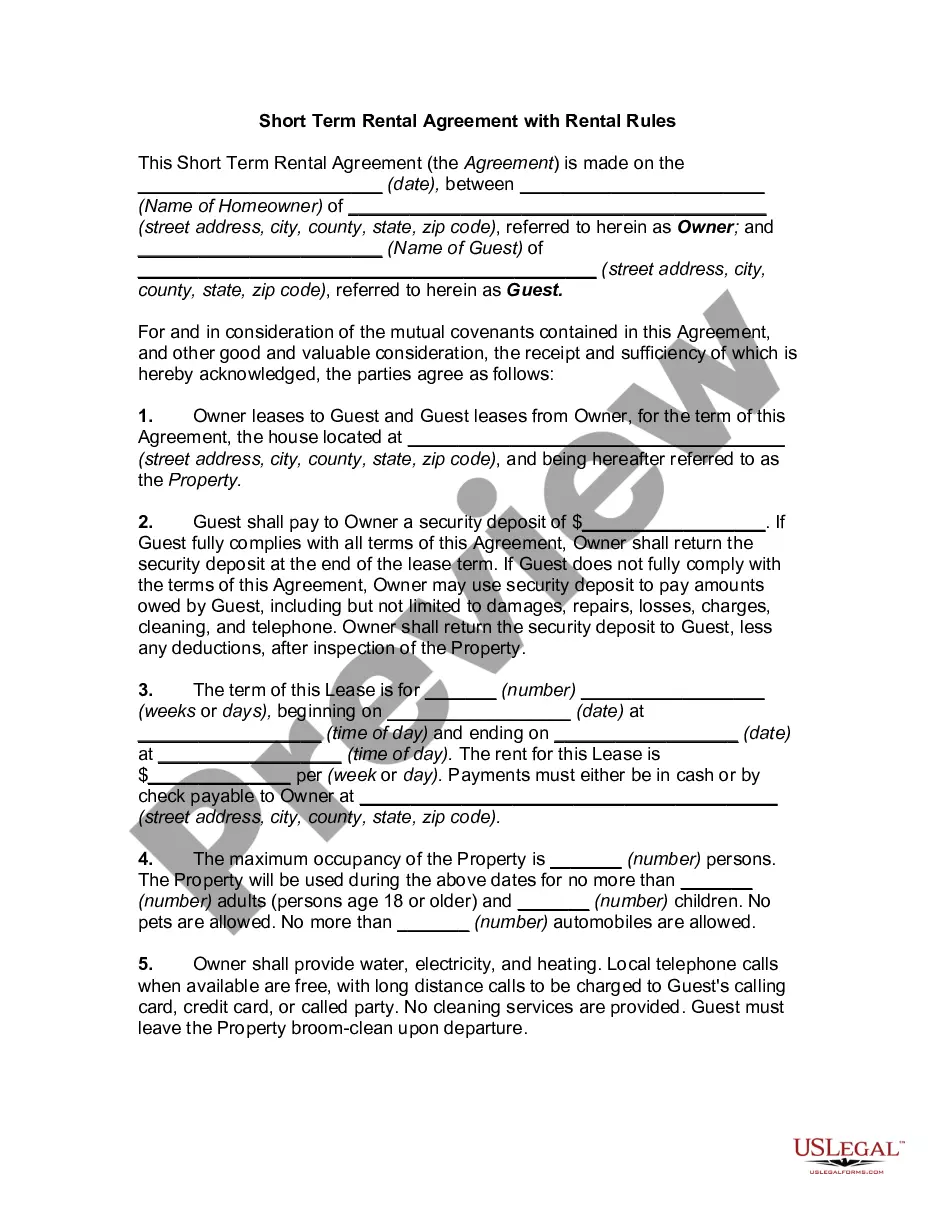

Locating the appropriate authentic document template can be challenging. Clearly, numerous templates are accessible online, but how will you find the genuine form you need? Visit the US Legal Forms website. The service offers a vast array of templates, such as the Maryland Balloon Unsecured Promissory Note, which can be utilized for both business and personal purposes. All documents are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and select the Download button to obtain the Maryland Balloon Unsecured Promissory Note. Use your account to browse through the legal documents you have previously purchased. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple instructions to follow: First, ensure you have selected the correct template for your city/county. You can review the form using the Review button and read the form description to confirm it meets your requirements. If the form does not fulfill your needs, use the Search field to find the suitable template. Once you are confident the template is correct, click the Buy now button to purchase the form.

Use the service to download professionally designed documents that adhere to state requirements.

- Select the pricing plan you prefer and enter the required details.

- Create your account and pay for the order using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Maryland Balloon Unsecured Promissory Note.

- US Legal Forms is the largest collection of legal templates where you can find a variety of document formats.

Form popularity

FAQ

Promissory notes, including Maryland Balloon Unsecured Promissory Notes, can be tradable, depending on their terms and market demand. Factors like the creditworthiness of the borrower and the note's structure affect tradability. Engaging with platforms such as US Legal Forms can provide insight on potential buyers and the requirements for trading notes securely.

Yes, you can sell a Maryland Balloon Unsecured Promissory Note to interested buyers. This process typically involves negotiating terms and transferring ownership through legal documentation. Using platforms like US Legal Forms can simplify the sale, as they offer tools and guidance for selling notes effectively.

To sell a Maryland Balloon Unsecured Promissory Note, start by determining its value and gathering relevant paperwork. Contact potential buyers, such as investors or financial institutions, and present your note’s details. Platforms like US Legal Forms can help you navigate the selling process and ensure all necessary legal documentation is prepared correctly.

Yes, a properly executed promissory note can hold up in court, provided it includes all necessary details and complies with state laws. A Maryland Balloon Unsecured Promissory Note should clearly outline the terms to ensure enforceability. This legal backing gives both parties confidence in the agreement should any disputes arise.

Companies often issue unsecured notes to access capital without pledging assets as collateral. This approach can help organizations maintain operational flexibility while attracting investors who are willing to take on more risk for potential returns. A Maryland Balloon Unsecured Promissory Note provides companies an efficient method to finance operations or projects without immediate asset commitment.

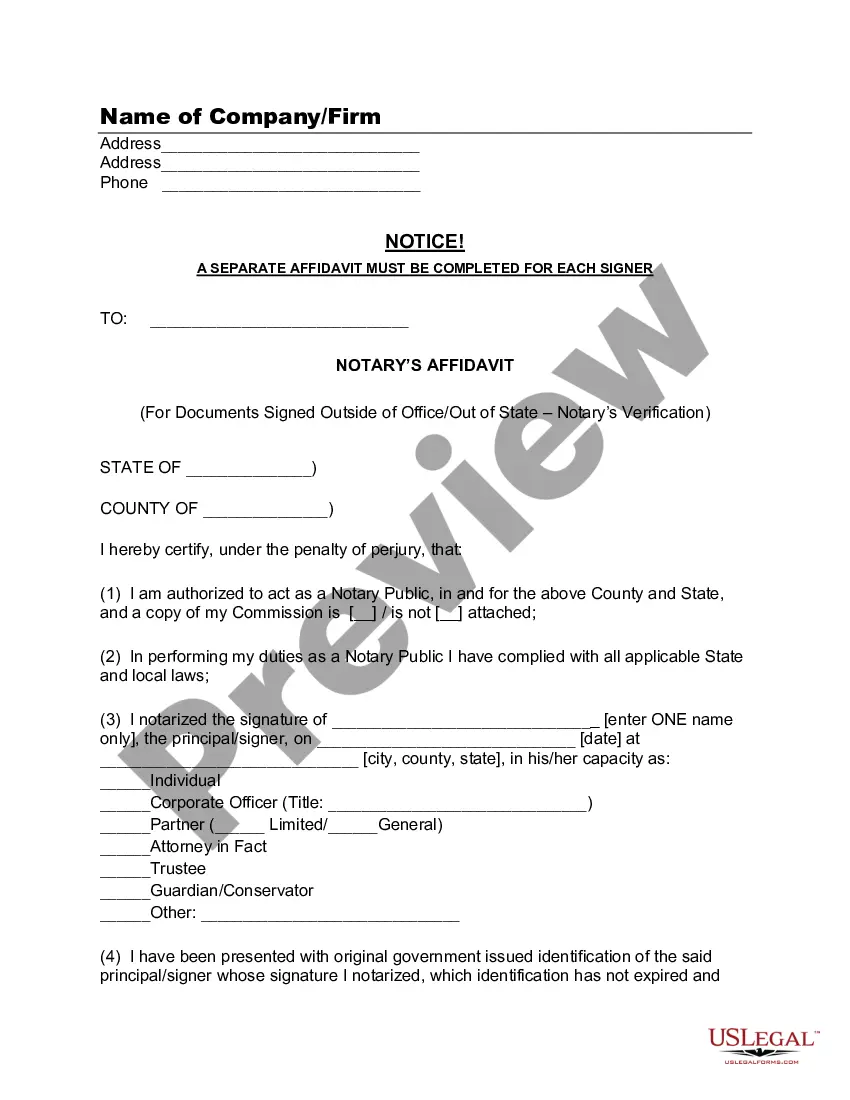

Filling out a promissory note requires clear and concise information about the parties involved, the amount borrowed, and the repayment terms. For a Maryland Balloon Unsecured Promissory Note, it is important to specify the balloon payment date and any interest rates. By carefully documenting these details, you create an enforceable agreement that protects both you and the lender.

An unsecured promissory note is typically not classified as a security. It's a personal agreement between the borrower and lender rather than a tradable financial instrument. However, it’s important to understand the legal definitions and regulations surrounding these loans. If you have questions about the specifics of a Maryland Balloon Unsecured Promissory Note, consulting a legal expert or using resources from platforms like US Legal Forms can provide clarity.

In Maryland, a promissory note does not need to be notarized to be legally binding. However, notarization can provide an additional layer of security and help verify the identities of the parties involved. It is wise to consider having your Maryland Balloon Unsecured Promissory Note notarized, especially for larger amounts. This step can aid in preventing disputes over the terms of the agreement.

A promissory note for a balloon payment specifies that the borrower will make smaller payments over time, followed by a larger payment at the end of the term. This arrangement can be beneficial for those who expect to have more funds available later. In the case of a Maryland Balloon Unsecured Promissory Note, the final 'balloon' payment can lead to significant financial planning. Borrowers need to ensure they can cover the lump sum when it is due.

A secured promissory note is backed by collateral, which means if the borrower fails to repay, the lender can claim the asset to recover the debt. In contrast, a Maryland Balloon Unsecured Promissory Note does not require collateral, making it riskier for the lender. Borrowers benefit from less stringent requirements when obtaining unsecured notes. However, this often leads to higher interest rates.