Maryland Promissory Note with Installment Payments

Description

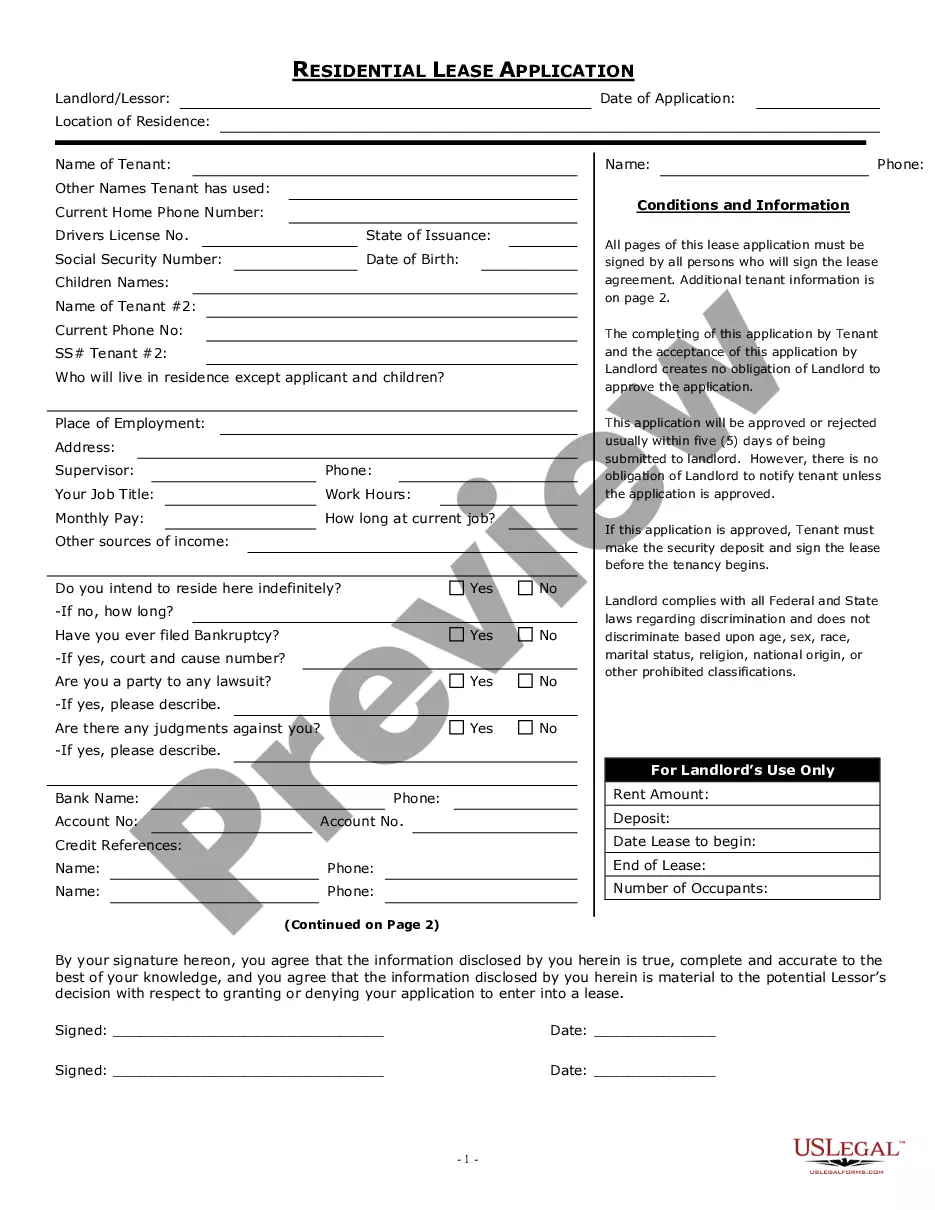

How to fill out Promissory Note With Installment Payments?

You have the ability to spend time online trying to locate the legal document template that fulfills the state and federal standards you desire.

US Legal Forms provides a vast selection of legal forms that are reviewed by experts.

You can download or print the Maryland Promissory Note with Installment Payments from our service.

First, confirm that you have selected the correct document template for the county/city of your choice. Check the form description to verify you have chosen the right form. If available, use the Review option to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain option.

- After that, you can complete, modify, print, or sign the Maryland Promissory Note with Installment Payments.

- Every legal document template you purchase is yours indefinitely.

- To acquire another copy of a purchased form, go to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

Form popularity

FAQ

Yes, you can create your own Maryland Promissory Note with Installment Payments by drafting the document yourself. However, to ensure legal validity and clarity, it’s advisable to use a professionally designed template from platforms such as USLegalForms. This way, you can cover all essential elements like payment terms, default conditions, and signatures.

To create a Maryland Promissory Note with Installment Payments for a balance, first, gather the necessary information, including the total amount due, payment schedule, and interest rate if applicable. You can use a template available on platforms like USLegalForms, which simplifies the process. Clearly state the payment terms and ensure both parties sign the note to establish its validity.

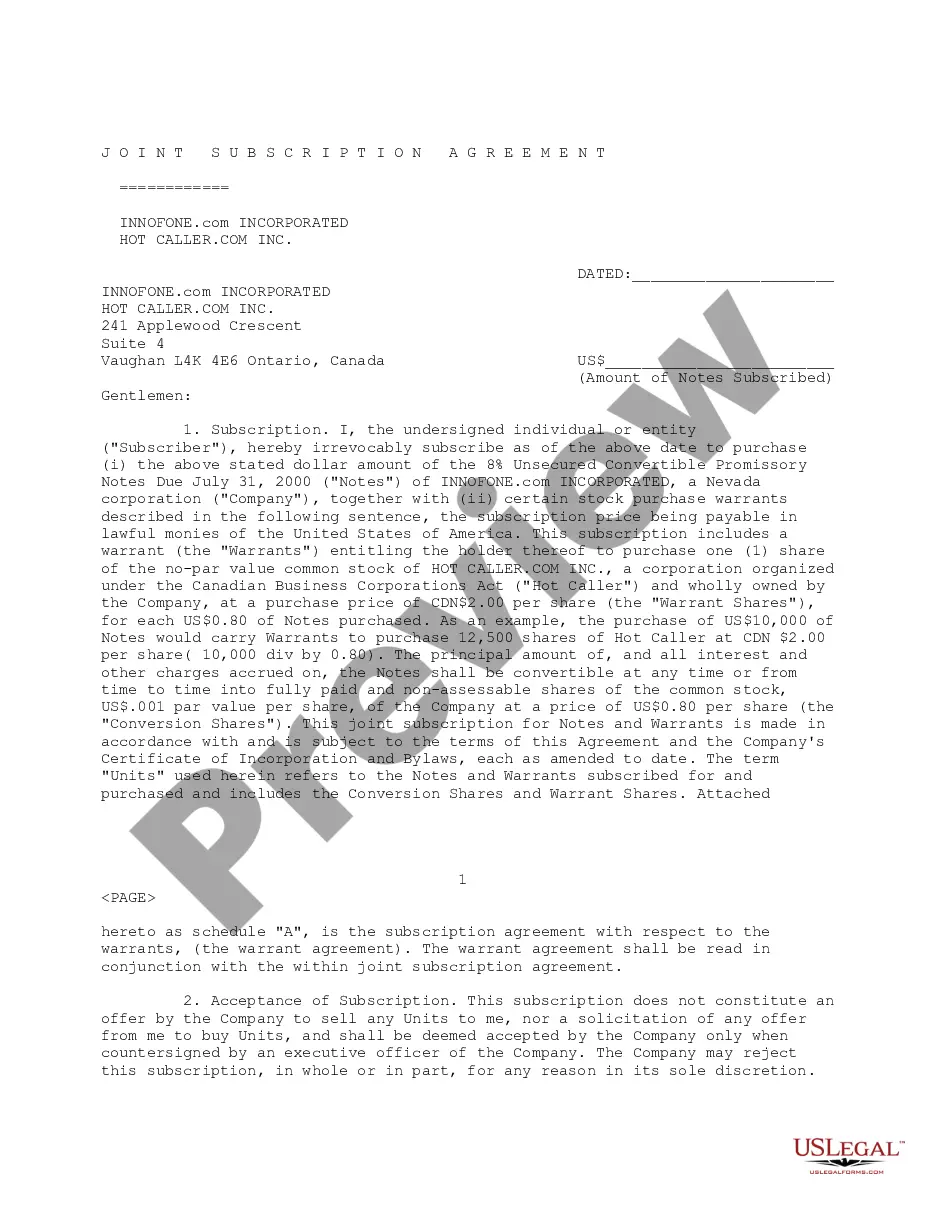

A promissory note is often referred to as a financial instrument or debt instrument. It serves as evidence of the borrower's obligation to repay the stated amount, making it essential in lending arrangements. Specifically, a Maryland Promissory Note with Installment Payments specifies how and when payments are to be made, providing clarity to both the borrower and the lender. Platforms like uslegalforms can help you draft a precise note that meets your specific needs.

A promissory note can be considered invalid if it lacks essential elements like signatures, clear terms, or legal consideration. Additionally, if the document is coercively signed or if it contains fraudulent information, it becomes unenforceable in a court of law. Moreover, failing to include specific repayment terms or dates can also invalidate the note. To avoid pitfalls, consult US Legal Forms to create a legally sound Maryland promissory note with installment payments.

In Maryland, a promissory note does not legally require notarization to be valid. What is crucial is that both parties agree to and sign the note. However, notarizing the document can provide additional assurance, especially for larger loans. By using resources like US Legal Forms, you can streamline the note creation process and decide if notarization fits your needs.

In Maryland, notarization is not typically required for the assignment of promissory notes. While notarization can add an important element of authenticity, it is not a legal necessity for your agreement to be binding. However, having it notarized can help resolve potential disputes down the line. To ensure that your assignment is effective and secure, consider reviewing templates available on platforms like US Legal Forms.

For a promissory note in Maryland to be valid, it must clearly state the amount borrowed, the repayment terms, and include the signatures of both parties. Additionally, the note should specify the interest rate, if applicable, and the due date. Without these elements, the note may not be enforceable. Utilizing platforms like US Legal Forms can ensure you have a compliant and effective Maryland promissory note with installment payments.

An installment promissory note is a financial agreement whereby a borrower agrees to repay the principal sum to the lender in a series of scheduled payments. In the context of a Maryland promissory note with installment payments, these payments usually include both principal and interest. This type of note offers a clear repayment structure, making it easier for both parties to manage finances. Overall, it provides security for the lender while providing manageable payments for the borrower.

A Maryland promissory note with installment payments can be valid without notarization. Generally, as long as both parties agree to the terms and sign the document, it holds legal weight. However, notarization can add an extra layer of security and authenticate the identities of the parties involved. It's often recommended, especially in legal agreements.

The format of a promissory note typically includes a title, date, parties involved, principal amount, repayment terms, and signatures. Organize the information clearly to make it easy to understand. A well-structured Maryland Promissory Note with Installment Payments ensures all vital elements are present, establishing the expectations between parties. It’s essential for enforceability.