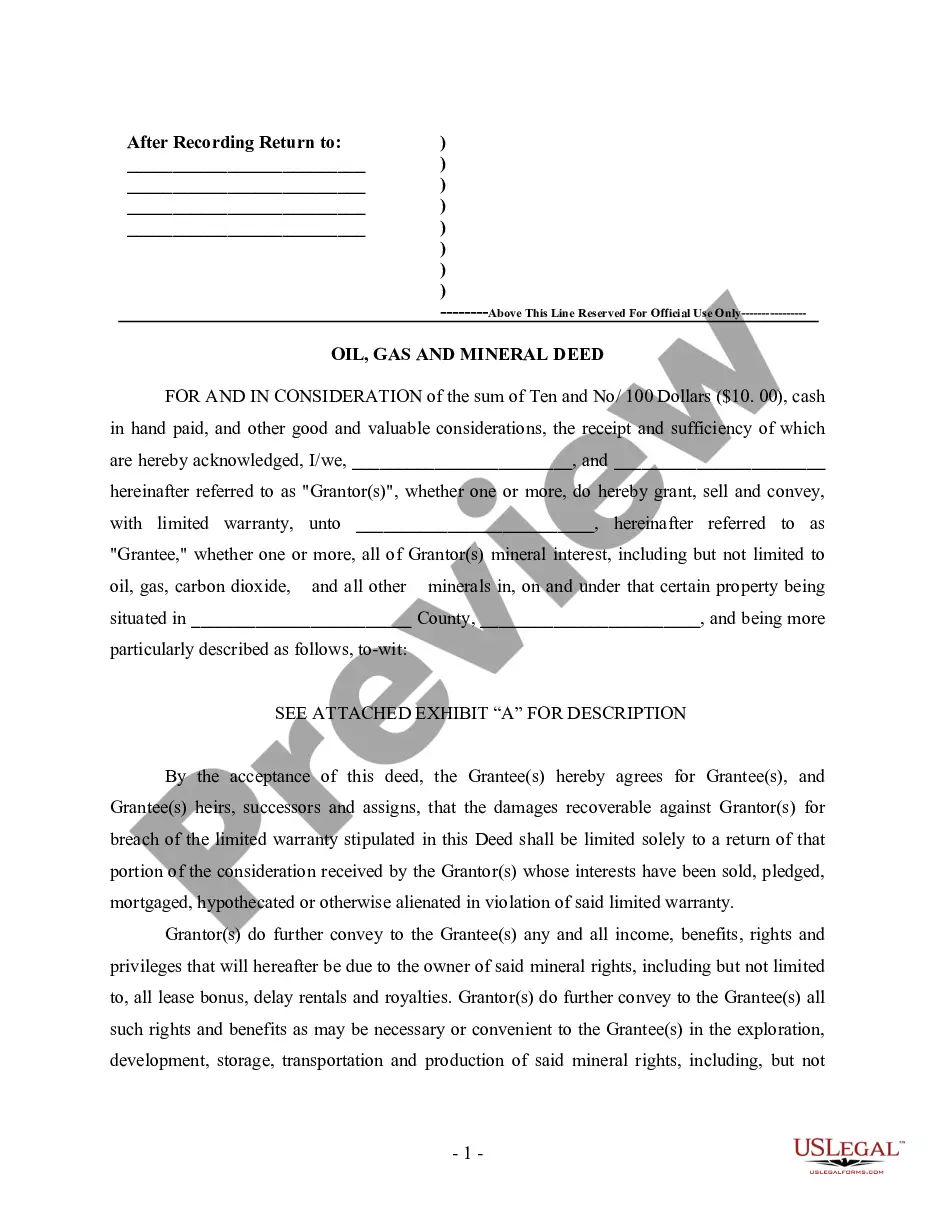

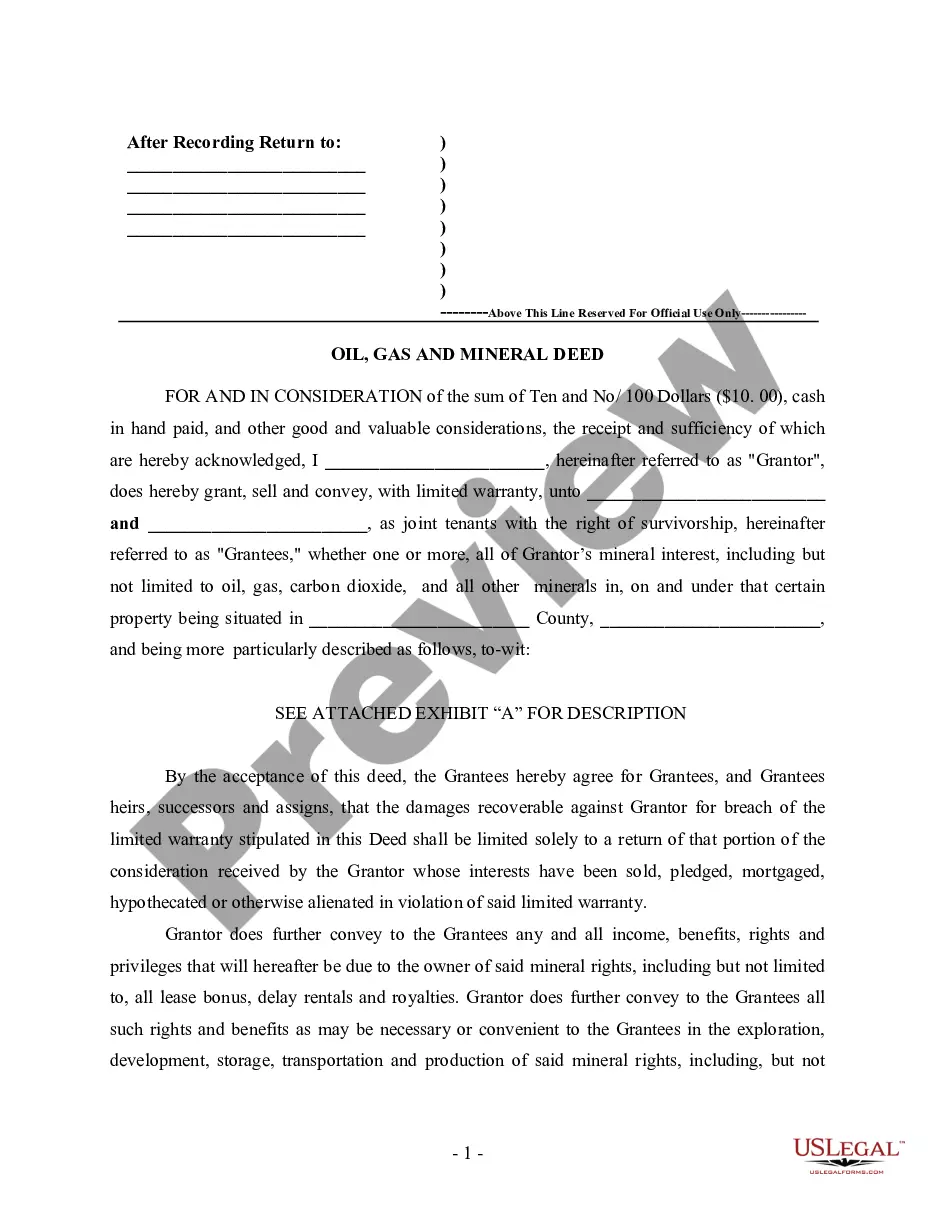

Maryland Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual

Description

How to fill out Oil, Gas And Mineral Deed - Individual Or Two Individuals To An Individual?

Have you been in a position that you need documents for both professional or specific purposes almost every day.

There are numerous legitimate document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms offers thousands of form templates, including the Maryland Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual, that are designed to meet federal and state requirements.

When you find the appropriate form, click Buy now.

Select the pricing plan you need, provide the required information to create your account, and pay for the order with your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Maryland Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

- Utilize the Review option to inspect the form.

- Check the details to ensure you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and specifications.

Form popularity

FAQ

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

A landowner may own the rights to everything on the surface, but not the rights to underground resources such as oil, gas, and minerals. In the United States, landowners possess both surface and mineral rights unless they choose to sell the mineral rights to someone else.

Avoid the Risks and Responsibilities of Ownership: Owning mineral rights comes with its own set of responsibilities and risks. By selling your mineral rights, you transfer those responsibilities and risks to the buyer. You no longer have to worry about things like production, or regulatory compliance.

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

To estimate mineral rights value for producing properties, take the average of your last 3 months of royalty income. Once you have a monthly average, plug it into the mineral rights calculator below. You can expect to sell mineral rights for around 4 years to 6 years times the average monthly income you receive.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.