This form is a simple model for a bill of sale for personal property used in connection with a business enterprise. Adapt to fit your circumstances.

Maryland Simple Bill of Sale for Personal Property Used in Connection with Business

Description

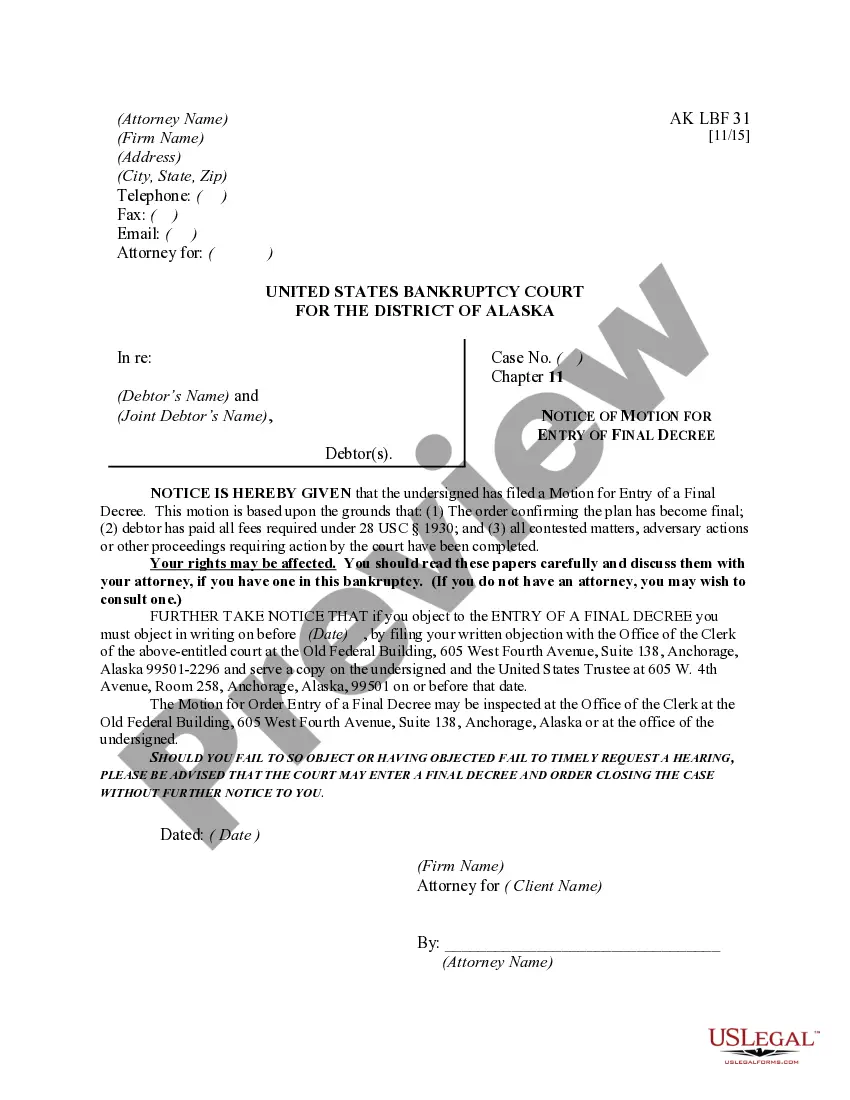

How to fill out Simple Bill Of Sale For Personal Property Used In Connection With Business?

Locating the appropriate legal document template can be a challenge.

Of course, there are many formats available online, but how do you obtain the specific legal document you need.

Use the US Legal Forms website. The platform provides a wide variety of templates, including the Maryland Simple Bill of Sale for Personal Property Used in Connection with Business, suitable for both business and personal use.

You can view the document with the Review button and read the document description to confirm it is suitable for your needs.

- All documents are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Maryland Simple Bill of Sale for Personal Property Used in Connection with Business.

- Utilize your account to browse the legal documents you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- For new users of US Legal Forms, here are some basic instructions to follow.

- First, make sure you have selected the correct form for your specific city/state.

Form popularity

FAQ

All corporations, limited liability companies (LLCs), limited liability partnerships (LLPs), and limited partnerships must file personal property returns with the Department of Assessments and Taxation. 2.

Motor vehicles registered in Maryland are generally exempt. Vehicles with interchangeable registrations, such as dealers and finance companies, (classes 1-5) are taxed as personal property. All personal property is exempt from state property taxes.

Personal Income TaxA percentage of the Maryland Adjusted Gross Income for Calendar Year 20192.83 percent and starting Calendar Year 20203.2 percent. Personal Property$2.75 per $100 of assessed value. Real Property$1.10 per $100 of assessed value.

There are a few documents which sellers of vehicles in Maryland will need:Vehicle certificate of title (Fill out Form VR-018 if you need a duplicate title)Notarized bill of sale, if applicable (Form VR-181)Odometer Disclosure (Form VR-197), if applicable.

If the title was issued in Maryland, it can be used as your application for titling and registering the vehicle. If the vehicle is from a state that does not issue a title as proof of ownership, a registration document and a bill of sale may be submitted as proof of ownership.

Overview of Maryland TaxesMaryland's average effective property tax rate of 1.06% is just below the national average, which is 1.07%. However, because Maryland generally has high property values, Maryland homeowners pay more in annual property taxes than homeowners in most other states.

Although the state does not have personal property tax rates, there are some counties that do.

Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.

Property tax rates are expressed as a dollar amount per $100 of assessment. For example, for a property with a fair market value of $100,000, the property taxes would be calculated by dividing the assessment by 100 and multiplying the product by the property tax rate.

On the Maryland Certificate of Title there is a space for the purchase price, and you will not need a bill of sale, unless the vehicle is 7 years old or newer and the vehicle is being sold for less than the book value.