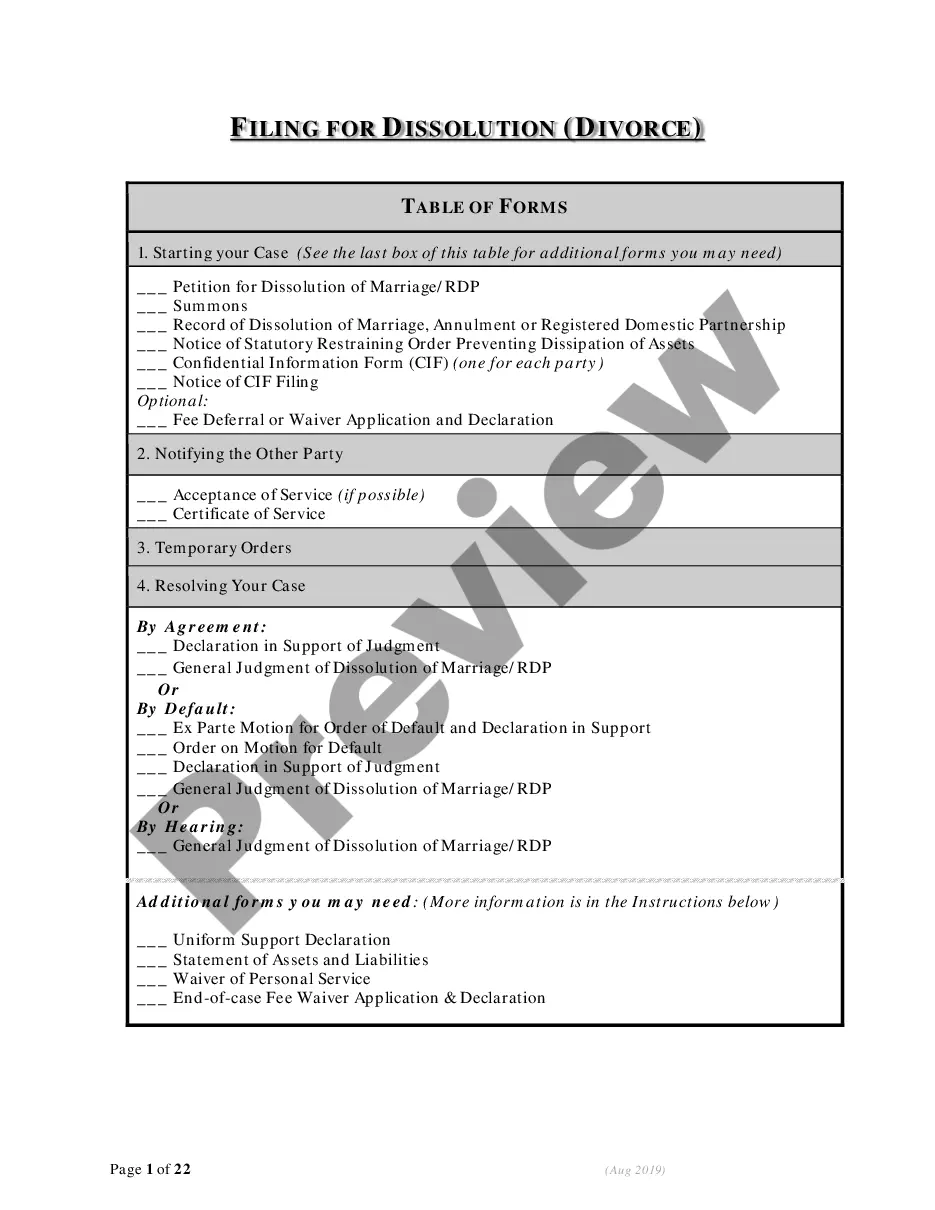

This form is a contract for the lease of personal property. The lessor demises and leases to the lessee and the lessee takes and rents from the lessor certain personal property described in Exhibit "A".

Maryland Contract for the Lease of Personal Property

Description

How to fill out Contract For The Lease Of Personal Property?

You can allocate time on the web attempting to locate the approved document template that meets the federal and state standards you desire.

US Legal Forms offers thousands of legal documents that can be evaluated by specialists.

You may obtain or print the Maryland Contract for the Lease of Personal Property from our service.

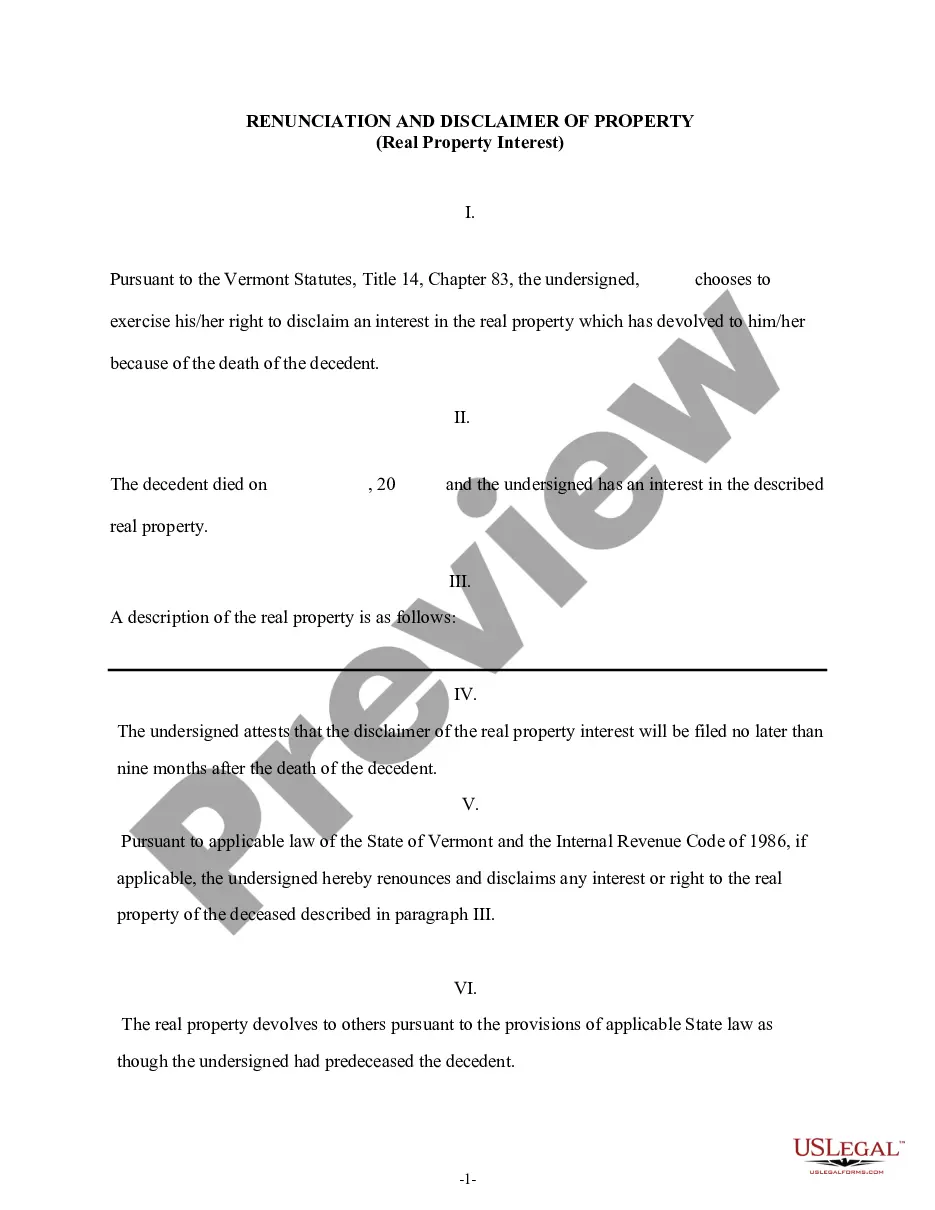

If available, use the Review button to view the document template as well.

- If you currently possess a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can complete, modify, print, or sign the Maryland Contract for the Lease of Personal Property.

- Every legal document template you receive is yours permanently.

- To acquire an additional copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are utilizing the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the appropriate document template for your state/city of choice.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

Maryland law defines a "lease option agreement" as "any clause in a lease agreement or separate document that confers on the tenant some power, either qualified or unqualified, to purchase the landlord's interest in the property." (See Md. Code Ann., Real Prop.

A notary can play an important role in making sure that a contract is legally enforceable, even if notarization isn't necessary. Just like wills, there is generally no requirement that a contract be notarized in order to be legally binding.

How to create a lease agreementCollect each party's information.Include specifics about your property.Consider all of the property's utilities and services.Know the terms of your lease.Set the monthly rent amount and due date.Calculate any additional fees.Determine a payment method.Consider your rights and obligations.More items...

A lease purchase agreement in real estate is a rent-to-own contract between a tenant and a landlord for the former to purchase the property at a later point in time. The renter pays the seller an option fee at an agreed-upon purchase price, giving them exclusive rights to buy the property.

Your Rights Under the Law If you do decide to enter a rent-to-own agreement, be aware that Maryland law provides some protections for rent-to-own consumers. The lessor must give you a written receipt for any payment made by cash or money order.

A lease option allows the landlord to retain the legal title of the lease option property, without the mundane management responsibilities. Lease options are also an ideal way of securing long term tenants. Most lease-options are for an average term of between 7 and 10 years.

No, lease agreements do not need to be notarized in Maryland. As long as they are agreed upon, or written leases are signed by both parties, a lease is a valid contract. The landlord and tenant can request to have the lease notarized if they wish, but it is not required in order for the lease to be binding in Maryland.

No, lease agreements do not need to be notarized in Maryland. As long as they are agreed upon, or written leases are signed by both parties, a lease is a valid contract. The landlord and tenant can request to have the lease notarized if they wish, but it is not required in order for the lease to be binding in Maryland.

Is it mandatory to notarize a rental agreement? No, it is not essential to notarize a rental agreement as long as it is printed on stamp paper and is duly signed by both parties and two witnesses.

Here are a few must-have clauses for the rent agreement.Amount of rent, security deposit, other payments.Duration of agreement and renewal criteria.List of fittings, fixtures.Registration of agreement.Restrictions.20 Sept 2018