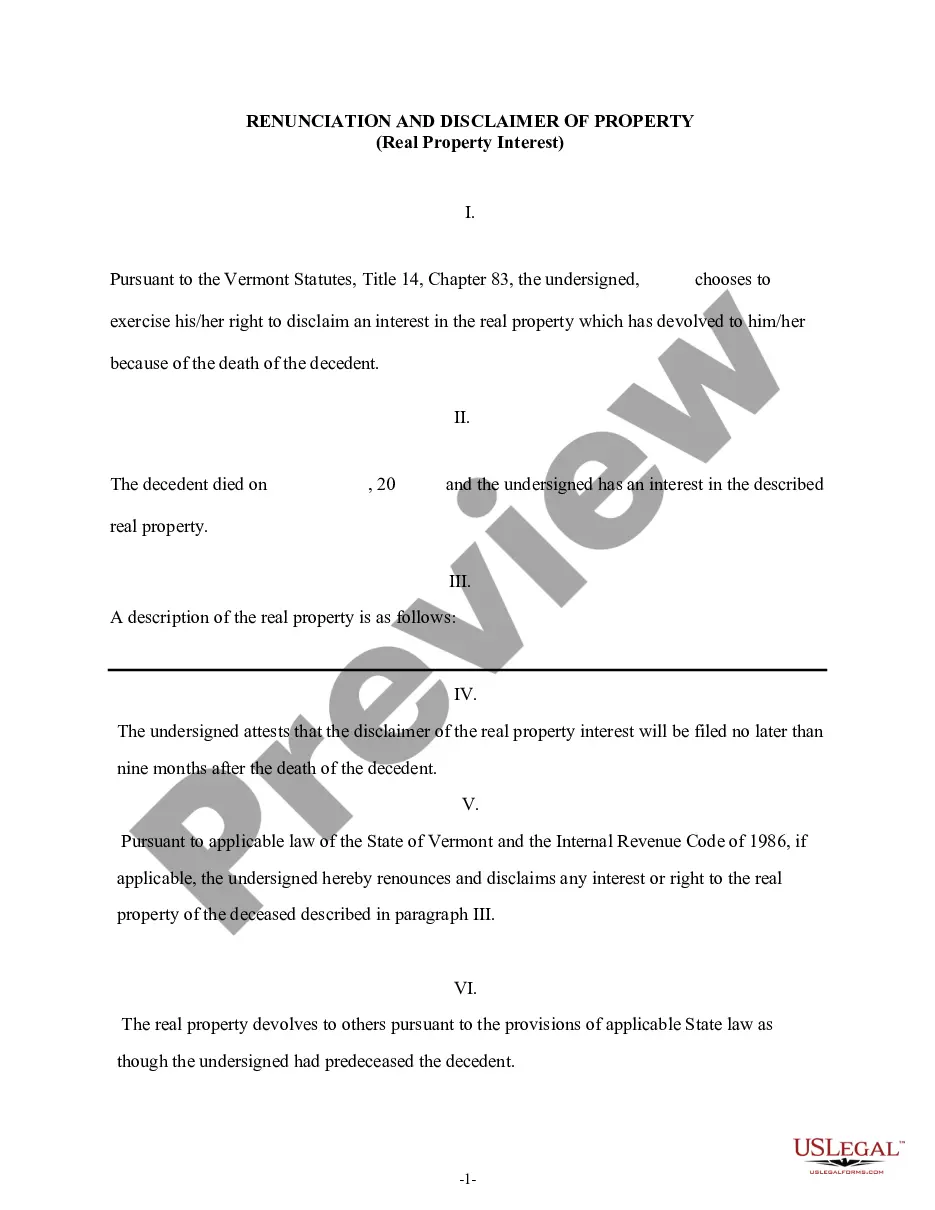

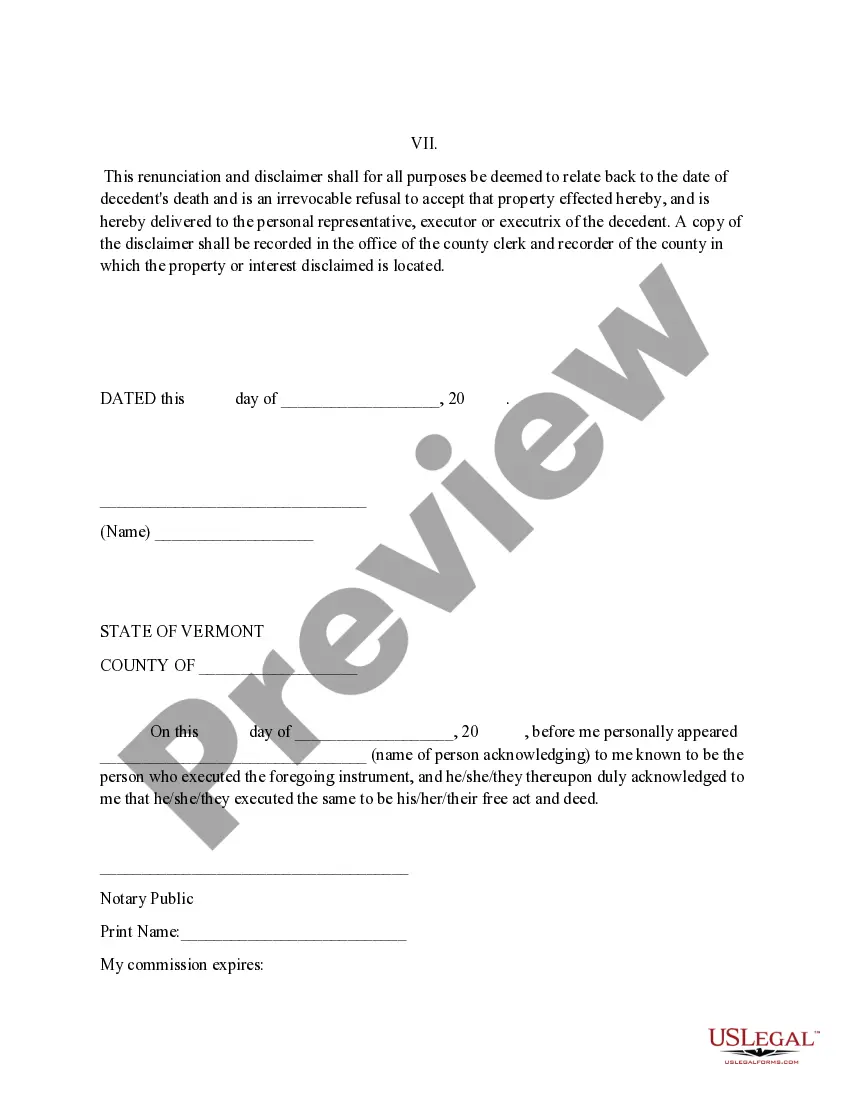

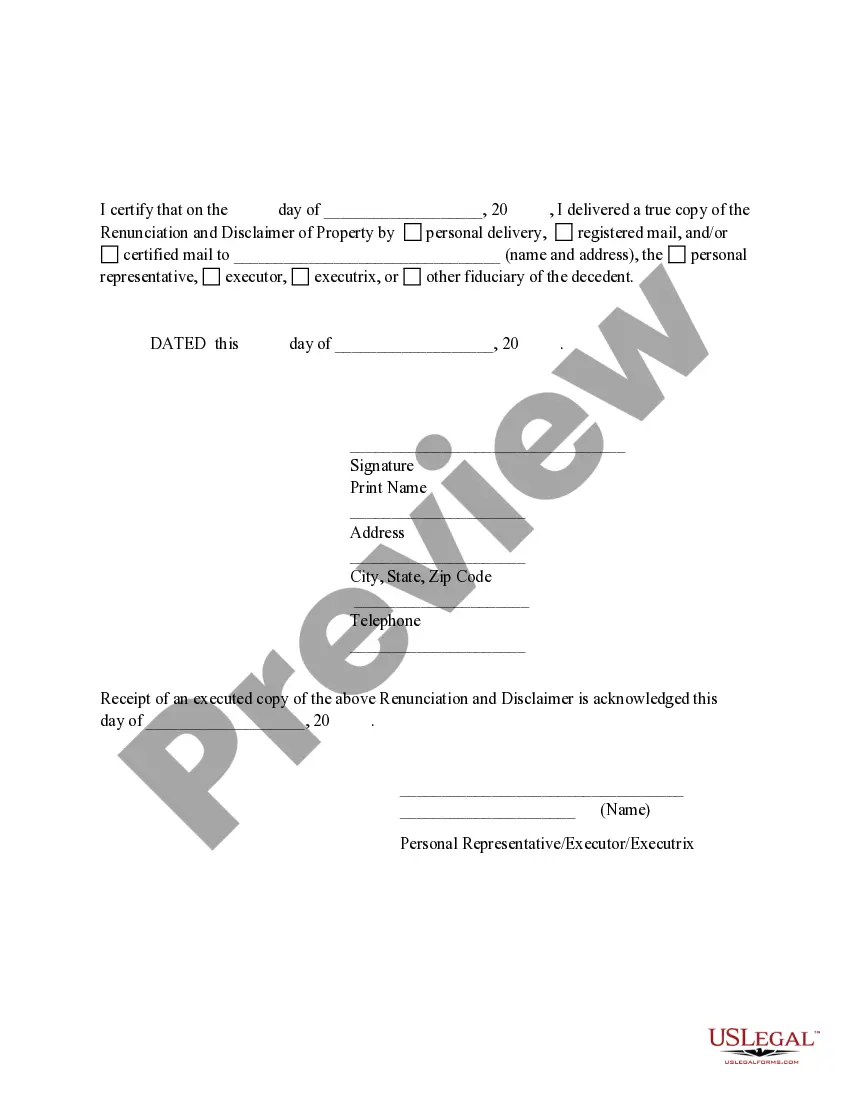

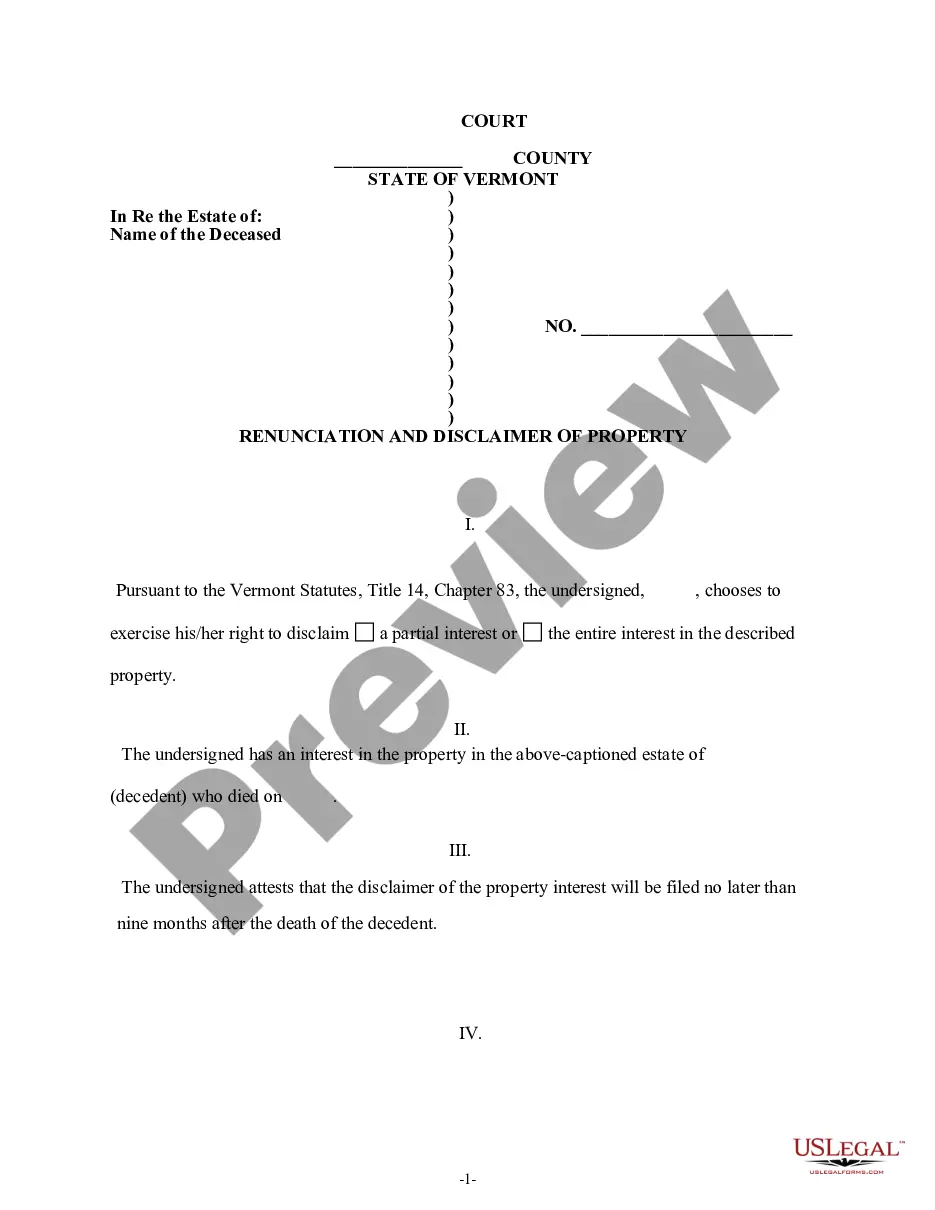

This form is a Renunciation and Disclaimer of a Real Property Interest, where the beneficiary gained an interest in the real property upon the death of the decedent, but, has chosen to renounce his/her interest in the real property pursuant to the Vermont Statutes, Title 14, Chapter 83. The property will now devolve to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify the delivery of the document.

Vermont Renunciation And Disclaimer of Real Property Interest

Description

How to fill out Vermont Renunciation And Disclaimer Of Real Property Interest?

Looking for a Vermont Renunciation And Disclaimer of Real Property Interest on the internet can be stressful. All too often, you find papers that you just think are alright to use, but find out afterwards they’re not. US Legal Forms provides over 85,000 state-specific legal and tax documents drafted by professional attorneys according to state requirements. Have any form you’re looking for within minutes, hassle free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll immediately be added in to the My Forms section. In case you don’t have an account, you must sign up and pick a subscription plan first.

Follow the step-by-step instructions below to download Vermont Renunciation And Disclaimer of Real Property Interest from the website:

- See the form description and hit Preview (if available) to check if the template meets your requirements or not.

- If the document is not what you need, get others with the help of Search field or the listed recommendations.

- If it’s right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via bank card or PayPal and download the template in a preferable format.

- Right after getting it, you may fill it out, sign and print it.

Get access to 85,000 legal templates from our US Legal Forms catalogue. Besides professionally drafted samples, customers are also supported with step-by-step instructions concerning how to get, download, and fill out forms.

Form popularity

FAQ

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

It must be in writing. It must be made within 9 months of the date of death of the decedent. The disclaimant cannot receive any benefits from the assets.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

A disclaimer trust is a clause typically included in a person's will that establishes a trust upon their death, subject to certain specifications. This allows certain assets to be moved into the trust by the surviving spouse without being subject to taxation.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.