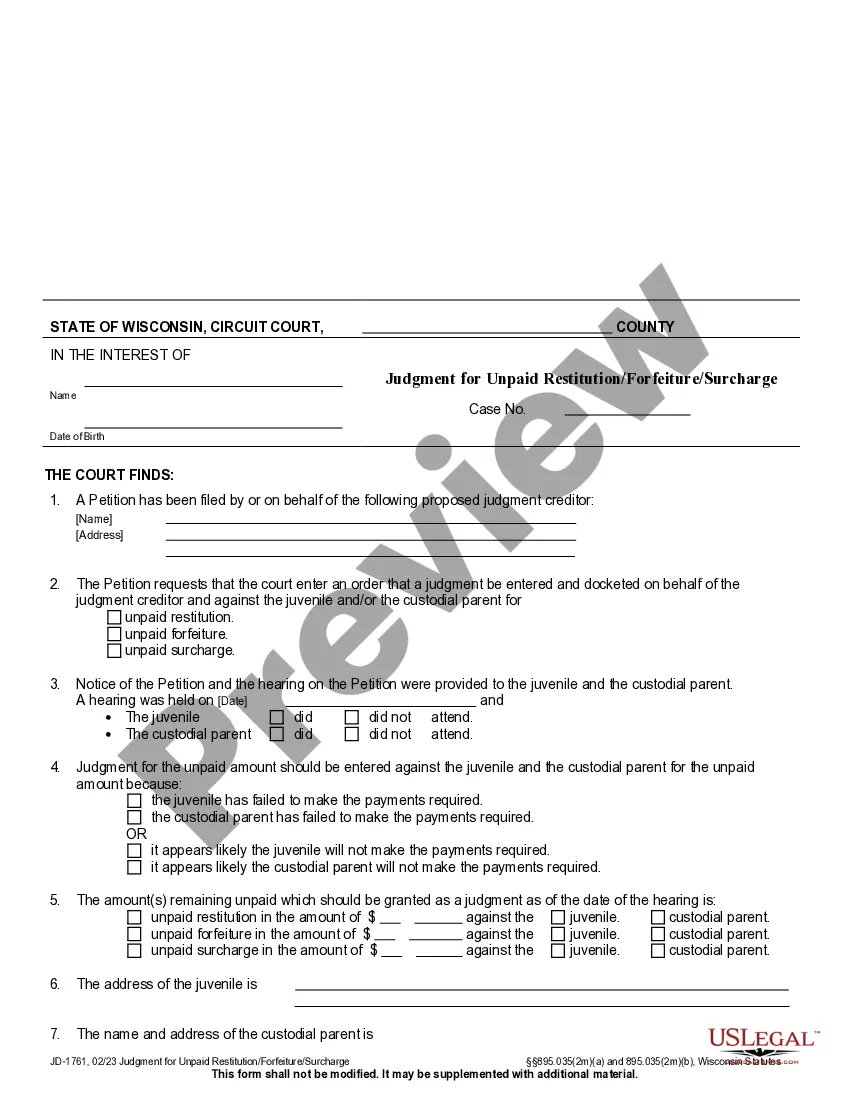

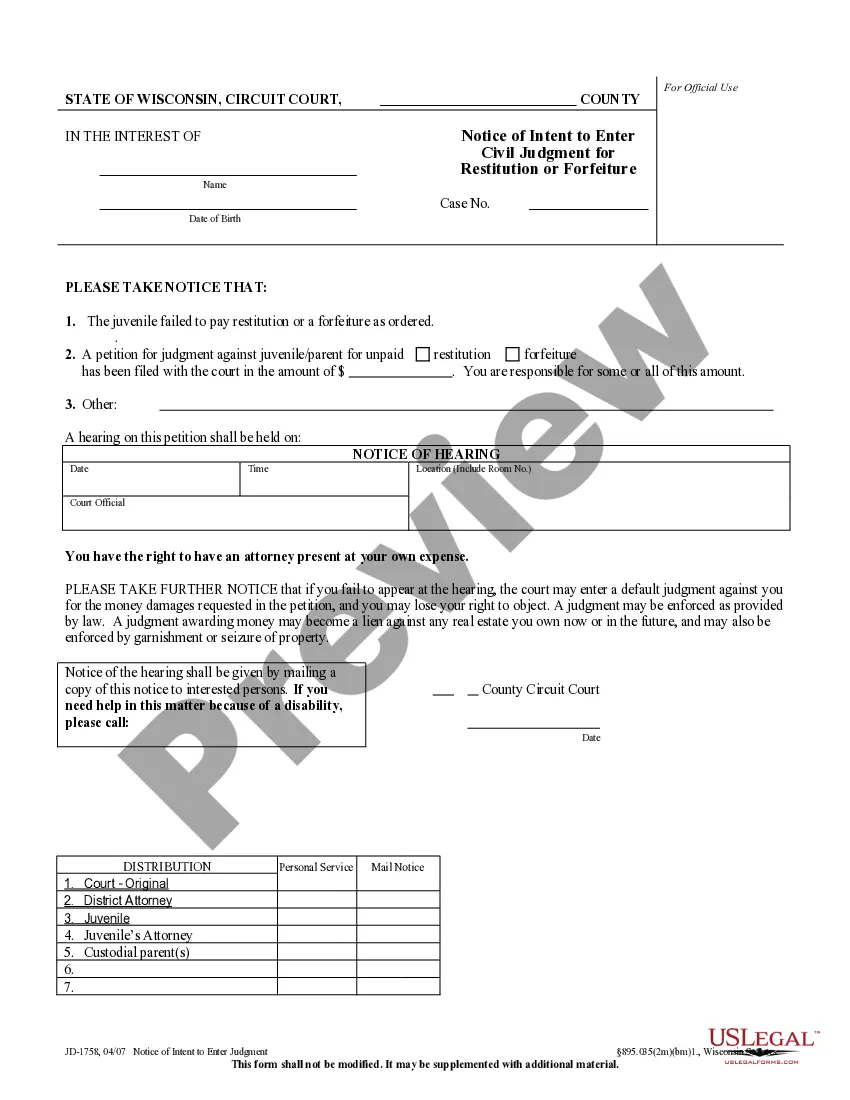

Maryland Chapter 13 Plan Supplemental Form — 506 Lien Value or Avoid is a document used in the Maryland bankruptcy court system to determine the value of any lien on the property of the debtor filing for bankruptcy. This form is part of the Chapter 13 Plan, which must be filed with the court in order for a debtor to be eligible for Chapter 13 bankruptcy. The form requires the debtor to list all liens on their property, including the name of the creditor, the amount of the lien, and the total value of the lien. The form also allows the debtor to state whether they wish to surrender the lien, or if they wish to redeem it. The form must be signed and notarized in order to be valid. There are two types of Maryland Chapter 13 Plan Supplemental Form — 506 Lien Value or Avoid: the 506A and 506B. The 506A form is used for secured liens, while the 506B form is used for unsecured liens.

Maryland Chapter 13 Plan Supplemental Form - 506 Lien Value or Avoid

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Chapter 13 Plan Supplemental Form - 506 Lien Value Or Avoid?

If you are searching for a method to suitably prepare the Maryland Chapter 13 Plan Supplemental Form - 506 Lien Value or Avoid without engaging a lawyer, then you are exactly in the correct place.

US Legal Forms has established itself as the most comprehensive and trustworthy library of formal templates for every personal and business circumstance. Each document you discover in our online service is crafted in accordance with national and state statutes, ensuring that your paperwork is properly arranged.

Another significant advantage of US Legal Forms is that you will never misplace the documents you acquired - you can access any of your downloaded forms in the My documents section of your profile whenever necessary.

- Ensure that the document displayed on the page aligns with your legal circumstances and state statutes by reviewing its text description or examining the Preview mode.

- Type the document name in the Search tab at the top of the page and select your state from the list to locate another template in case of any discrepancies.

- Proceed with the content verification and click Buy now when you are assured of the document's compliance with all the requirements.

- Log in to your account and click Download. If you do not have one already, sign up for the service and choose a subscription plan.

- Use your credit card or the PayPal option to complete payment for your US Legal Forms subscription. The document will be ready for download immediately after.

- Select the format in which you would like to receive your Maryland Chapter 13 Plan Supplemental Form - 506 Lien Value or Avoid and download it by clicking the corresponding button.

- Import your template to an online editor for swift completion and signing or print it out to create a physical copy manually.

Form popularity

FAQ

To object to a Chapter 13 plan, you must file a formal objection with the bankruptcy court. This involves detailing your specific concerns about the plan, such as potential unfairness to creditors or improper valuation of assets. Utilizing the Maryland Chapter 13 Plan Supplemental Form - 506 Lien Value or Avoid can assist in preparing your objections effectively.

If your total monthly income over the course of the next 60 months is less than $7,475 then you pass the means test and you may file a Chapter 7 bankruptcy. If it is over $12,475 then you fail the means test and don't have the option of filing Chapter 7.

If you filed for bankruptcy to avoid foreclosure or are behind in house payments, your Chapter 13 plan payment could be more or less $1500 per month. Additionally, high income, high debt Chapter 13 filers would usually be required to make payments between $2000 and $3000, or even more.

After filing the Chapter 13 petition, the debtor files a Chapter 13 plan. The plan proposes to pay creditors, including the IRS, over a period of 36 to 60 months. Sixty months is the maximum and most common payment period. Payments are typically in monthly installments.

This chapter of the Bankruptcy Code provides for adjustment of debts of an individual with regular income. Chapter 13 allows a debtor to keep property and pay debts over time, usually three to five years.

Although you may be able to negotiate a shorter timespan if you have no disposable income, this isn't always possible. But here's some good news: Chapter 13 plans can't go beyond 60 months by law. It's good to know there's a firm endpoint within sight, even if your plan will be 5 years long.

In a Chapter 13, an objection to confirmation is basically a written statement from the Chapter 13 Trustee or a creditor of the debtor that there is something wrong with the case that needs to be fixed before the confirmation hearing.

Is there a grace period for Chapter 13 payments? A Chapter 13 payment plan doesn't have a grace period. Thirty days after your Chapter 13 filing date, you are required to begin making plan payments to the bankruptcy trustee for your case.

Objections must be filed within 21 days after the conclusion of the 341 meeting. Plan can be confirmed without further notice or hearing absent timely objections.