Maryland Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

About this form

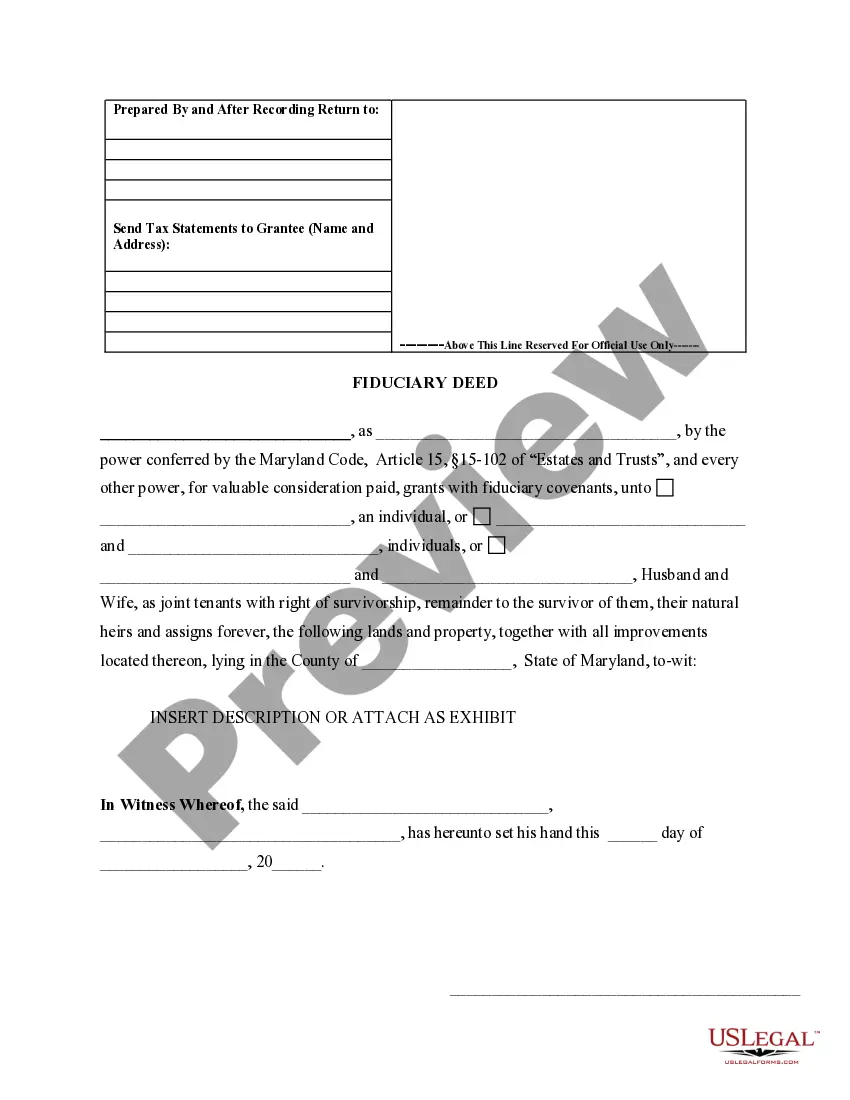

The Fiduciary Deed is a legal document used by executors, trustees, trustors, administrators, and other fiduciaries to transfer property on behalf of others. This form allows these individuals to convey property titles in accordance with their legal authority and responsibilities, distinguishing it from standard deeds which may not involve fiduciary duties. It serves to document the transfer of ownership while ensuring that it is executed within the bounds of the law, particularly in the state of Maryland.

Form components explained

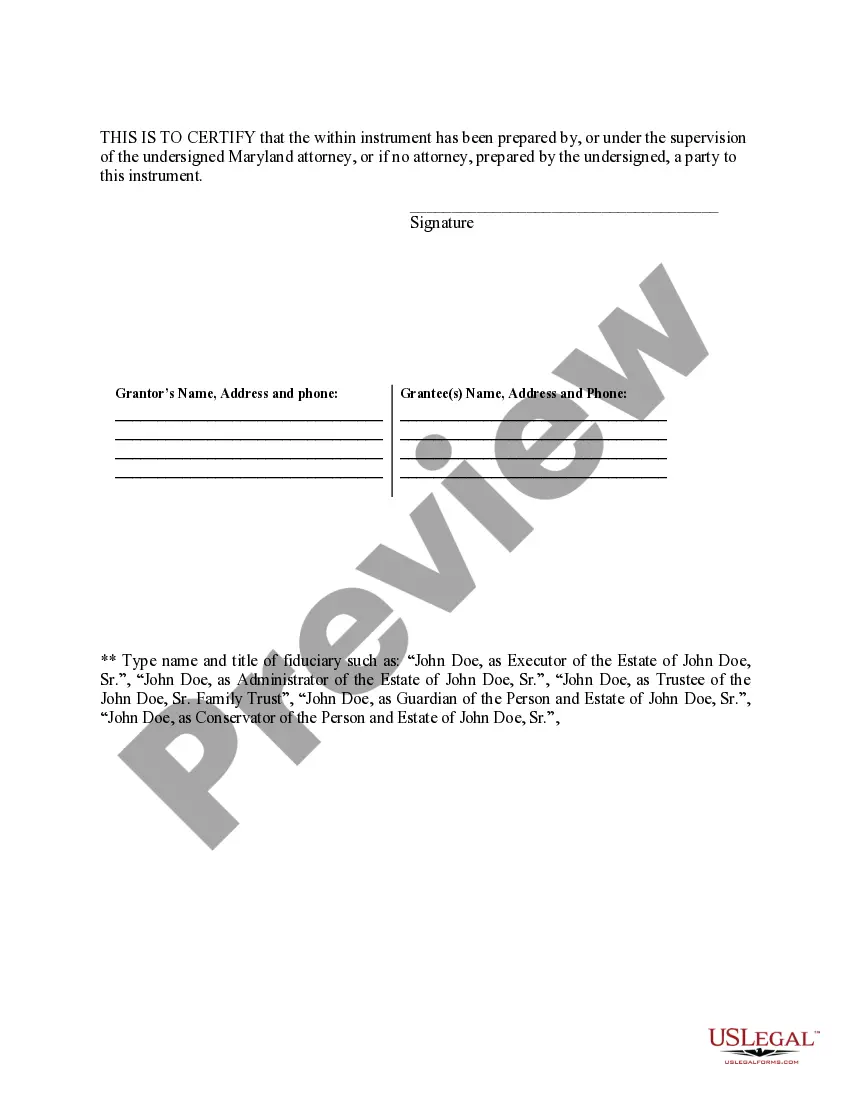

- Identification of the grantor and their fiduciary role (e.g., executor, trustee).

- Description of the property being transferred, including its location.

- Details regarding the grantee, including their name and relationship to the grantor.

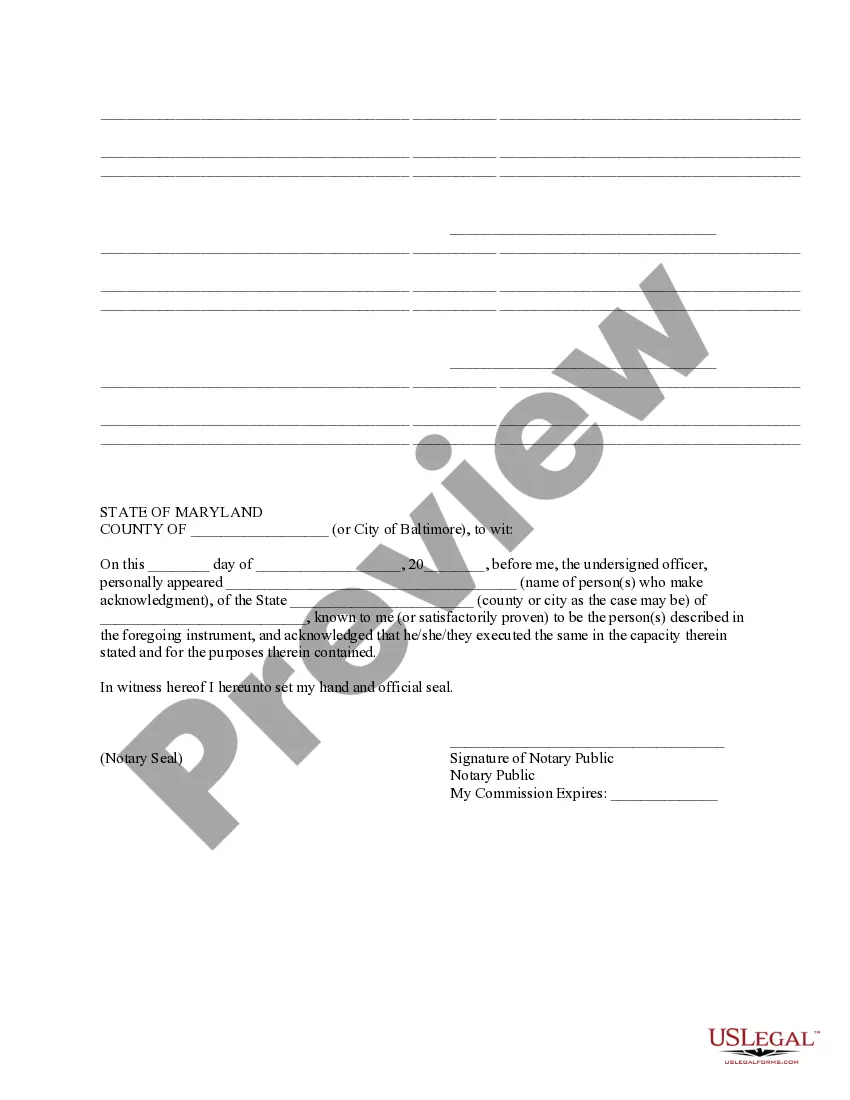

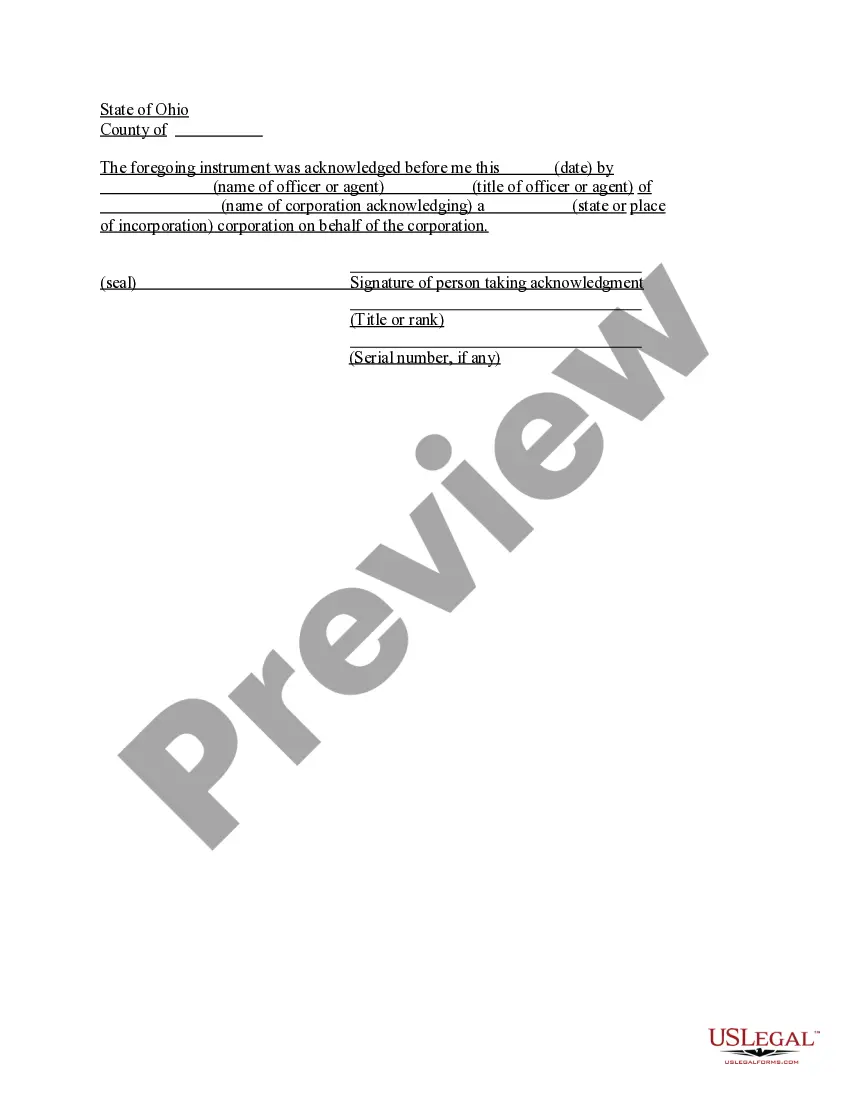

- Signature lines for the grantor and witnesses, as well as the notary acknowledgment section.

- A section for the attorneyâs certification if applicable.

Common use cases

This Fiduciary Deed is necessary when a fiduciary needs to transfer real estate ownership as part of fulfilling their duties. Common scenarios include the following: transferring property as part of an estate settlement, executing a trust, or managing assets for a person under guardianship. It ensures that the legal transfer is properly documented and recognized by the state.

Intended users of this form

The following individuals and parties should consider using the Fiduciary Deed:

- Executors of an estate who are responsible for distributing property according to a will.

- Trustees managing a trust that holds real estate.

- Administrators appointed to oversee an estate in the absence of a will.

- Guardians or conservators acting on behalf of individuals unable to manage their own affairs.

- Trustors who wish to transfer property into a trust.

Instructions for completing this form

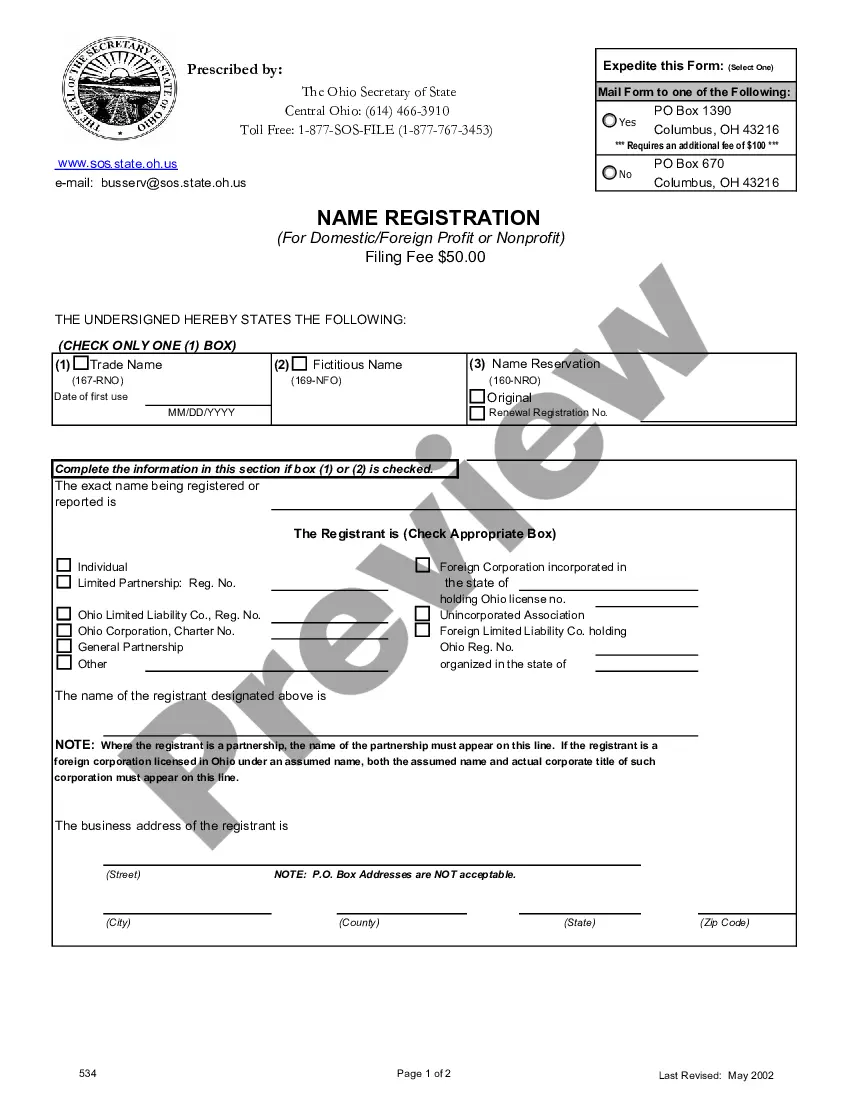

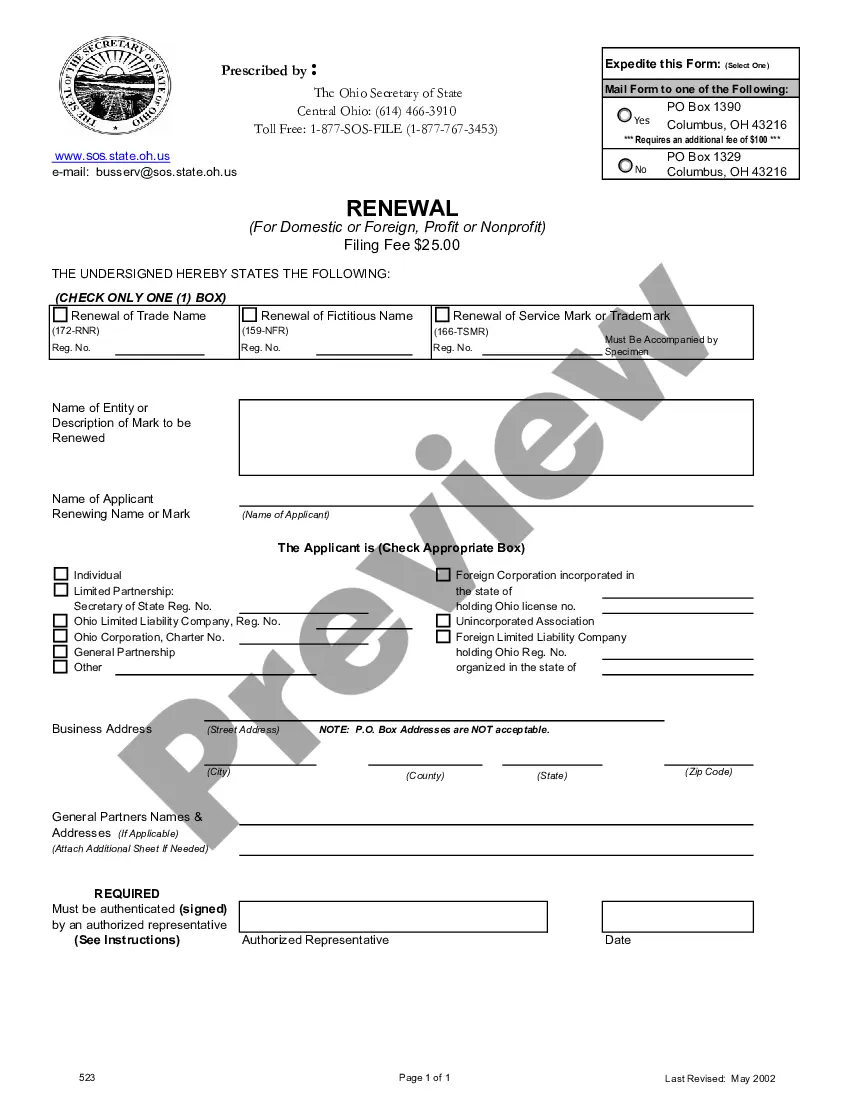

- Identify the parties involved, including the grantor (fiduciary) and the grantee.

- Provide a detailed description of the property being transferred, including its legal description.

- Include the date of the transfer and signatures of the grantor and witnesses.

- Obtain notarization of the document to ensure its validity.

- Fill out any required supplementary documents, such as the Land Instrument Intake Sheet.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to properly identify all parties involved.

- Omitting the property description or using vague language.

- Neglecting to obtain notarization where required.

- Not filing the necessary intake forms with the local jurisdiction.

- Forgetting to get signatures from all required witnesses.

Why use this form online

- Convenient access to legal forms that can be completed at your own pace.

- Editability allows for easy adjustments before final completion.

- Reliability of forms revised by licensed attorneys to ensure compliance with Maryland laws.

- No need for trips to legal offices; complete forms from home.

Summary of main points

- The Fiduciary Deed facilitates the legal transfer of property by fiduciaries.

- Proper completion and notarization are essential for legal validity.

- Understanding your role as a fiduciary is crucial before using the form.

- Always check local requirements for additional filings or procedures necessary for the deed.

Looking for another form?

Form popularity

FAQ

Realty trusts are a method of owning real estate used primarily in Massachusetts.The owner can make the gifts without having to record new deeds at the registry of deeds. Typically, a realty trust will refer to a schedule of beneficiaries which lists the true owners of the property.

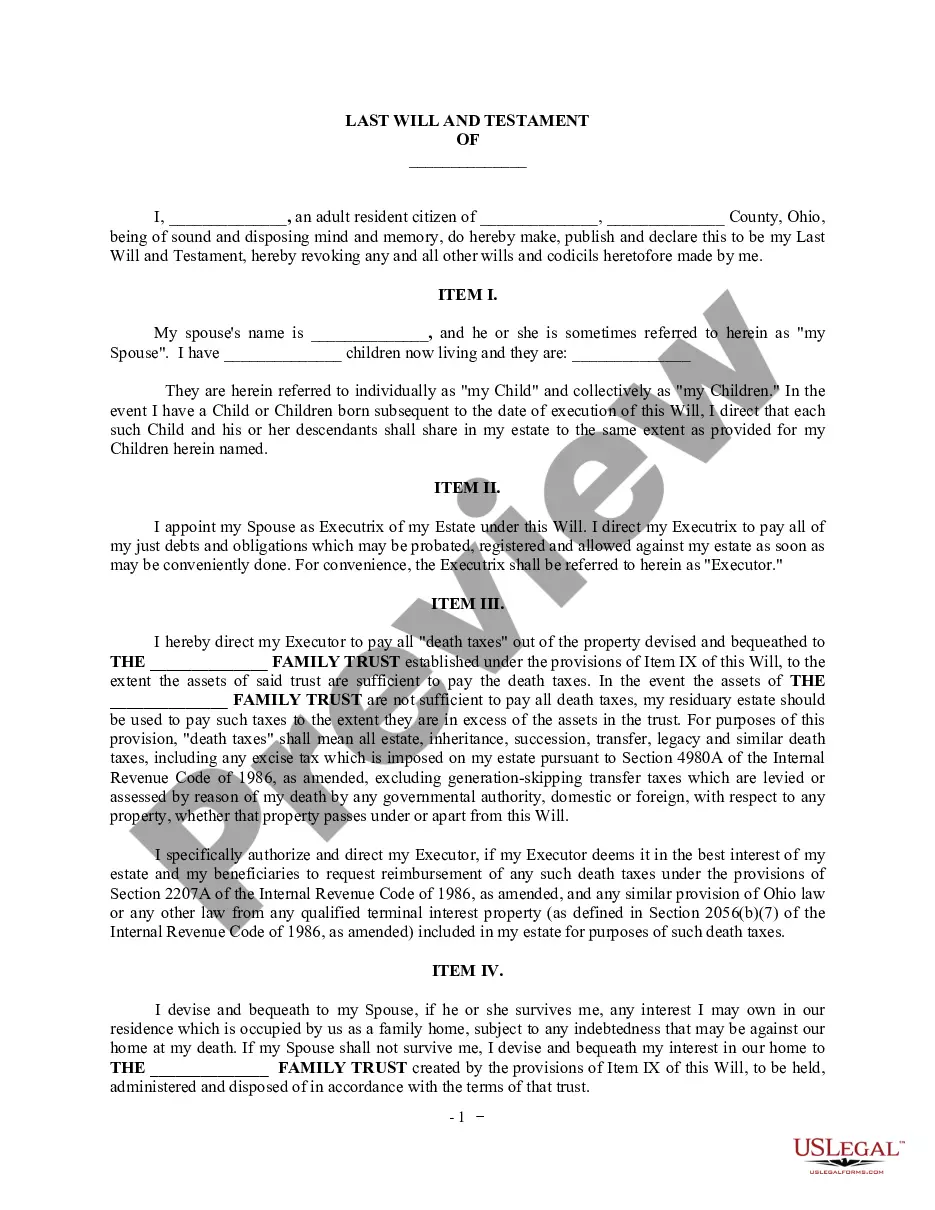

Trusts have many varied uses and benefits, primary among them: 1) ongoing professional management of assets; 2) reduction of tax liabilities and probate costs; 3) keeping assets out of a surviving spouse's estate while providing income for life; 4) care for special needs individuals; 4) protecting individuals from poor

Typically, a realty trust will refer to a schedule of beneficiaries which lists the true owners of the property. The trustees simply act on behalf of the beneficiary or beneficiaries listed on the schedule, which is not recorded at the registry of deeds.

Only the trustee not the beneficiaries can access the trust checking account. They can write checks or make electronic transfers to a beneficiary, and even withdraw cash, though that could make it more difficult to keep track of the trust's finances. (The trustee must keep a record of all the trust's finances.)

A trust account is used exclusively for money received or held by a real estate agent for or on behalf of another person in relation to a real estate transaction and is not to be used to hold moneys for any other purpose.

The purpose of a trust account in real estateTrust accounts exist to protect everyone involved in the real estate transaction. They are heavily governed by legislation and failure to comply can result in hefty penalties and even loss of licence.

Trusts allow for assets to be split between family members and are an efficient way to house complex assets. They also offer protection from creditors. Assets that belong to a trust are also not subject to executors' fees, which can amount to up to 3.5% plus VAT on the gross value of your estate.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.