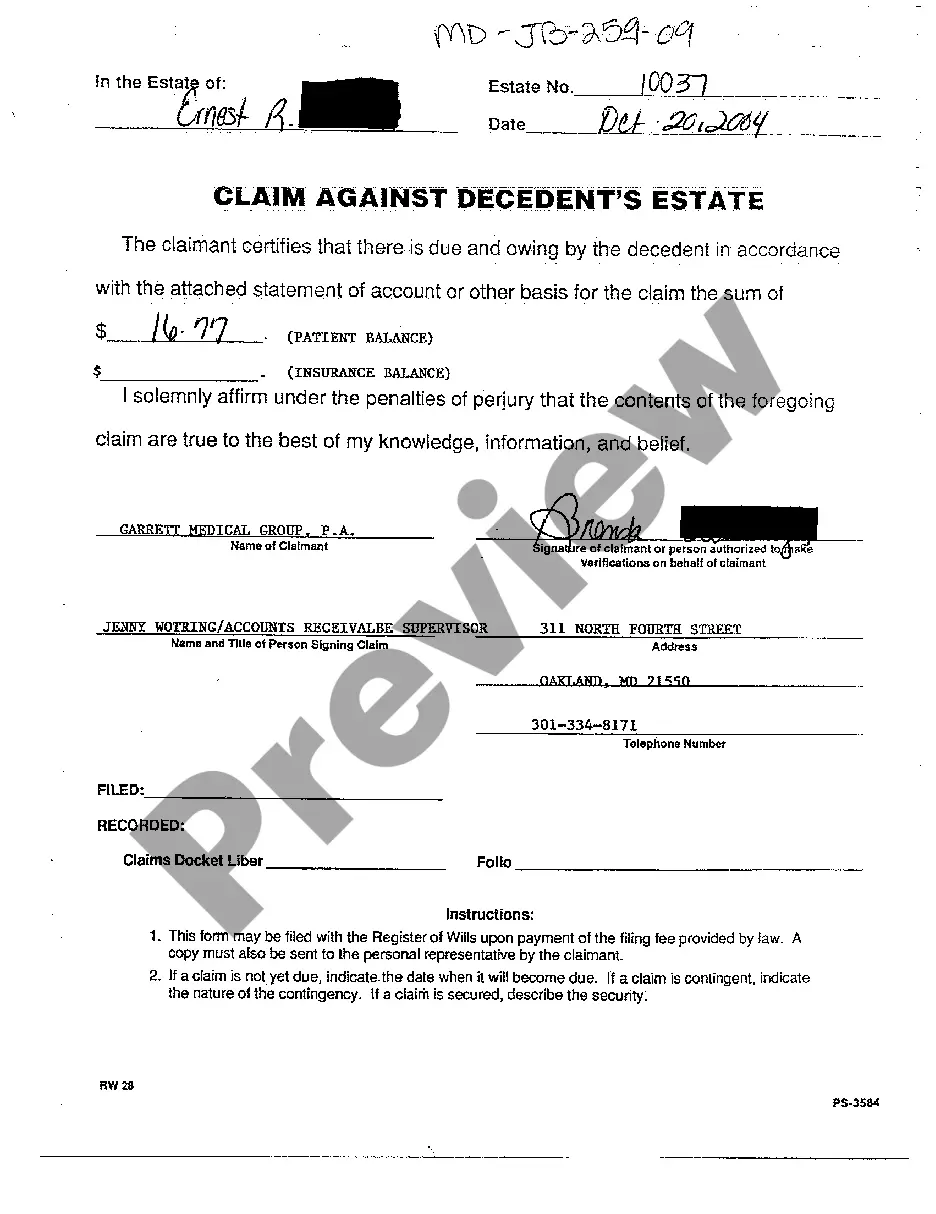

Maryland Claim Against Decedent's Estate

Description

Key Concepts & Definitions

Decedents Estate: This refers to all the property that belonged to a person at the time of their death, which is now to be distributed according to their will or state law. Creditor Claims: These are claims made by creditors to recover debts owed by the decedent's estate. Personal Representative: An individual appointed to administer the decedent's estate. This might be an executor named in the will or an administrator appointed by the court if there is no will.

Step-by-Step Guide on Filing an A09 Claim Against a Decedent's Estate

- Identify the Estate: Confirm the full legal name and last known address of the deceased, identifying the right estate to file the claim against.

- Obtain the Claim Form: Get the appropriate form used in the jurisdiction where the estate is being probated. This may be provided by the court or the estate's personal representative.

- Complete the Claim Form: Fill out the claim form thoroughly, providing all requested information including the nature and amount of the claim.

- Submit the Claim Form: File the claim with the probate court and serve a copy to the personal representative within the timeframe specified by state law.

- Attend Court, if Necessary: If the claim is disputed, be prepared to substantiate the claim in probate court.

Risk Analysis

- Rejection of Claims: Claims against a decedent's estate can be rejected for various reasons including improper filing or lack of substantiating documentation.

- Time Sensitivity: Failing to file claims within statutory deadlines can result in the forfeiture of the right to claim.

- Legal Complexity: The process can involve complexities related to estate planning, small business interests, real estate, and landlord-tenant issues that might necessitate professional legal assistance.

Common Mistakes & How to Avoid Them

- Mistake: Failing to file within the legal deadline. Avoidance: Always check the deadline immediately upon the death of the decedent and ensure timely submission.

- Mistake: Incomplete paperwork. Avoidance: Double-check that all sections of the claim form are correctly and fully filled out. Seek professional help if uncertain.

Best Practices

- Document Collection: Gather all necessary documents, including contracts or invoices related to the claim, before starting the filing process.

- Legal Consultation: Engage a lawyer who specializes in estate or probate law to review your claim and the associated documents.

- Follow Up: Keep in touch with the court or the personal representative to ensure your claim is being processed.

FAQ

- What if the personal representative does not communicate? - You may need to contact the probate court for further guidance or representation.

- Can a claim be amended? - Yes, but it usually requires formal submission of an amended claim form and might be restricted after certain deadlines.

How to fill out Maryland Claim Against Decedent's Estate?

You are welcome to the greatest legal files library, US Legal Forms. Here you will find any sample including Maryland Claim Against Decedent's Estate forms and download them (as many of them as you wish/need). Make official documents in a couple of hours, instead of days or even weeks, without having to spend an arm and a leg with an attorney. Get the state-specific example in a few clicks and be confident with the knowledge that it was drafted by our accredited legal professionals.

If you’re already a subscribed consumer, just log in to your account and click Download near the Maryland Claim Against Decedent's Estate you want. Because US Legal Forms is online solution, you’ll always have access to your downloaded templates, regardless of the device you’re using. Locate them inside the My Forms tab.

If you don't come with an account yet, what are you awaiting? Check out our instructions listed below to start:

- If this is a state-specific document, check out its applicability in the state where you live.

- View the description (if offered) to understand if it’s the right template.

- See more content with the Preview option.

- If the example matches all your needs, click Buy Now.

- To make your account, pick a pricing plan.

- Use a credit card or PayPal account to sign up.

- Download the file in the format you want (Word or PDF).

- Print out the document and fill it out with your/your business’s info.

As soon as you’ve completed the Maryland Claim Against Decedent's Estate, send out it to your legal professional for verification. It’s an extra step but an essential one for being certain you’re fully covered. Sign up for US Legal Forms now and get a large number of reusable examples.

Form popularity

FAQ

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.

There is a strict time limit within which an eligible individual can make a claim on the Estate. This is six months from the date that the Grant of Probate was issued. For this reason, Executors are advised to wait until this period has lapsed before distributing any of the Estate to the beneficiaries.

A claimant may make a claim against the estate, within the time allowed for presenting claims, (1) by serving it on the personal representative, (2) by filing it with the register and serving a copy on the personal representative, or (3) by filing suit.

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

Small Estate: property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

Godoy. After someone dies, anyone who thinks they are owed money or property by the deceased can file a claim against the estate. Estate claims range from many different types of debts, such as mortgages, credit card debt, loans, unpaid wages, or breach of contract.

1Any spouse or civil partner.2Any former spouse or civil partner, provided they have not remarried or registered a new civil partnership, and provided no court order was made at the time of their split that specifically precludes them from bringing such a claim.Dependants' claims against an estate Personal Law Donut\nwww.lawdonut.co.uk > personal > claiming-an-inheritance > dependants-cl...