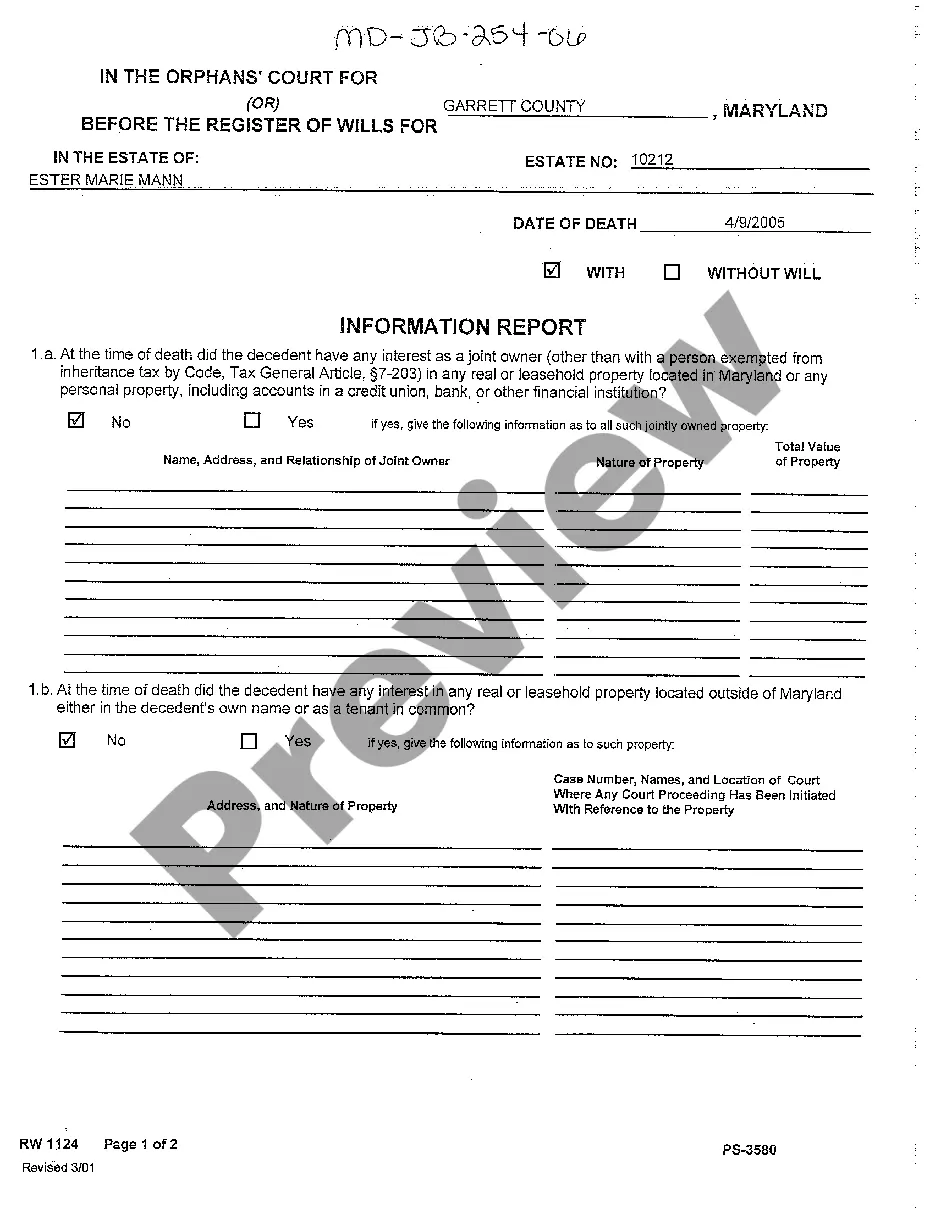

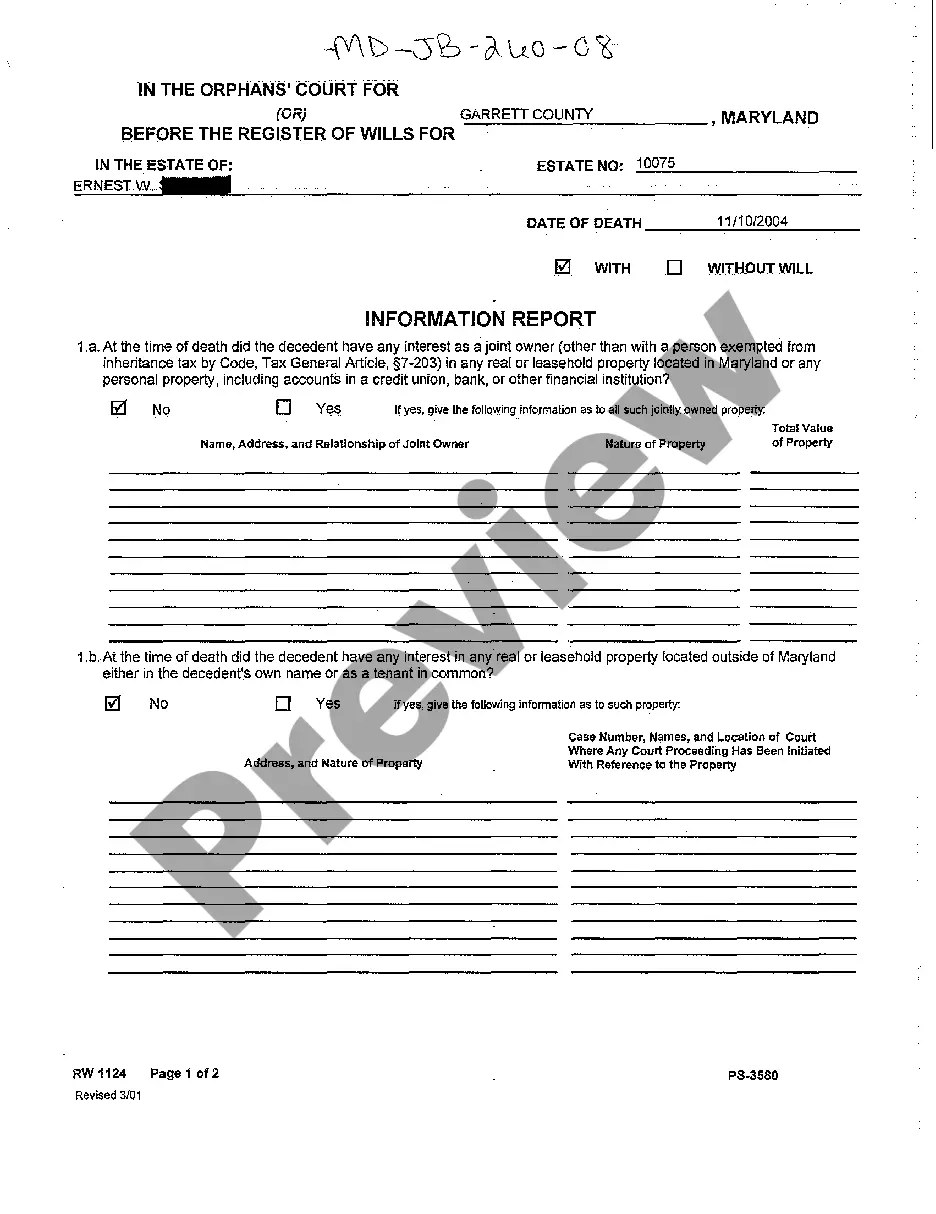

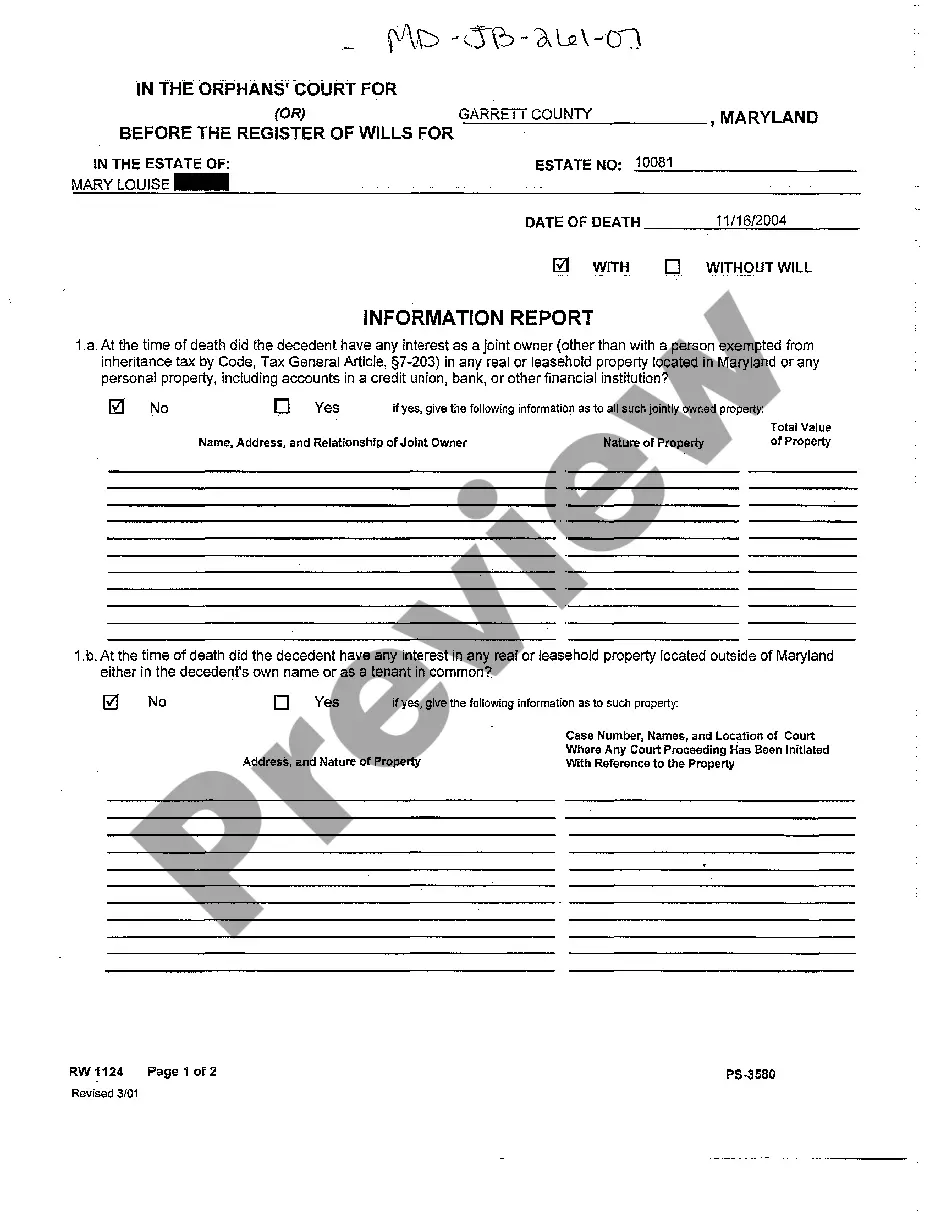

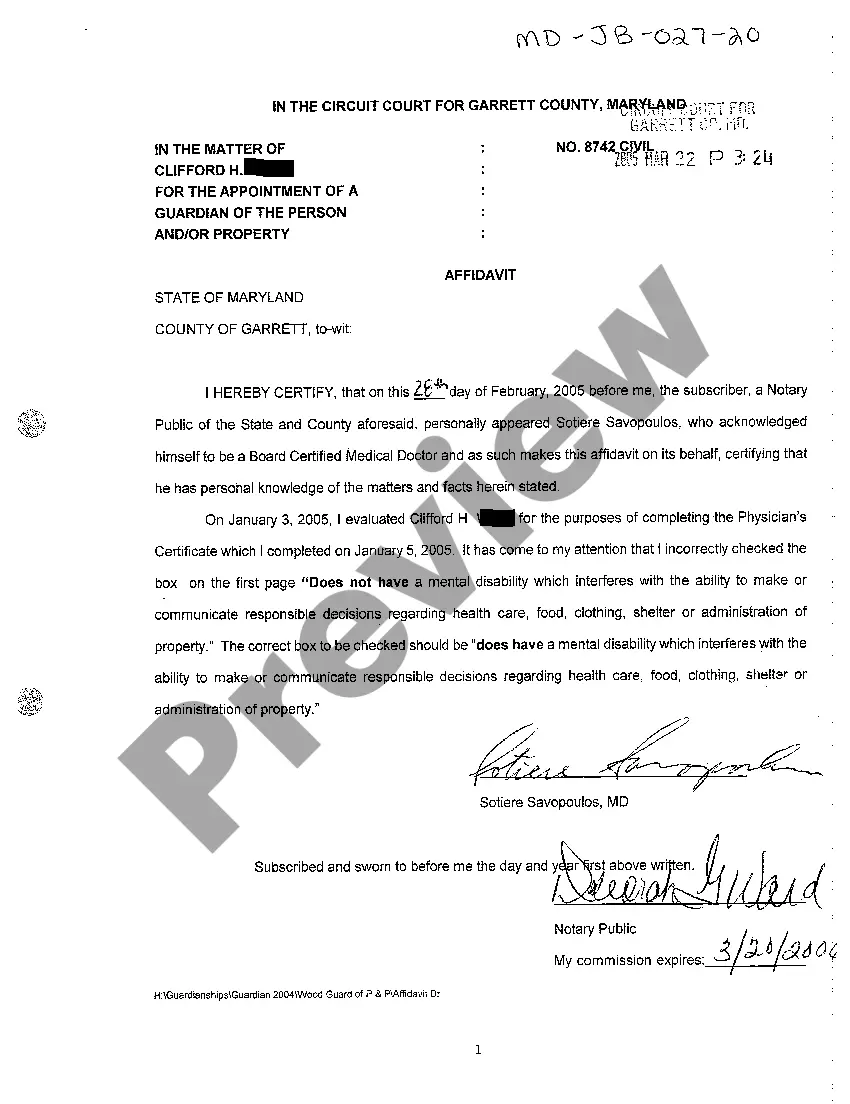

Maryland Information Report

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Information Report?

You are invited to the most extensive legal documents repository, US Legal Forms.

Here you can acquire any template including Maryland Information Report samples and retain them (as many as you desire/need). Create official papers in merely a few hours, instead of days or even weeks, without having to expend a fortune on a lawyer.

Obtain the state-specific form in just a few clicks and rest assured knowing that it was prepared by our skilled legal experts.

- If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Information Report you need.

- Given that US Legal Forms is internet-based, you’ll typically have access to your downloaded documents, regardless of the device you’re utilizing.

- View them within the My documents section.

- If you don't possess an account yet, what are you holding out for? Explore our instructions listed below to begin.

- If this is a state-specific document, verify its eligibility in the state where you reside.

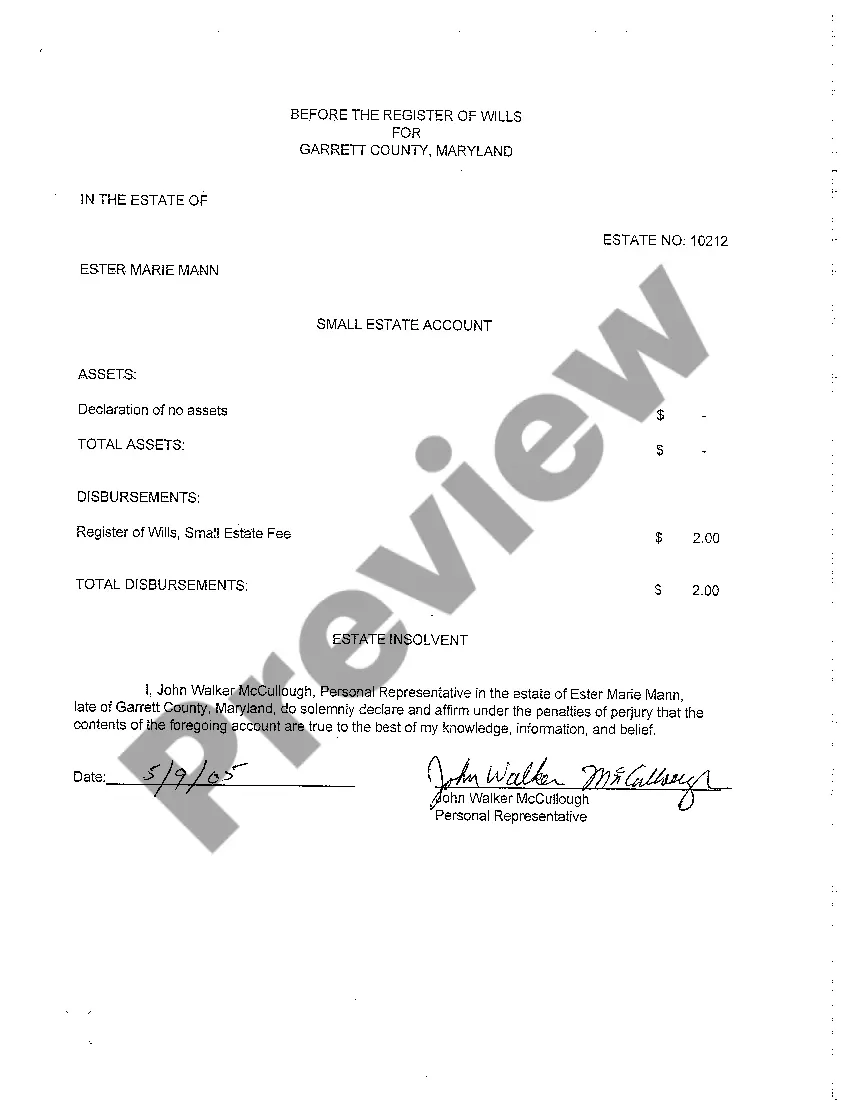

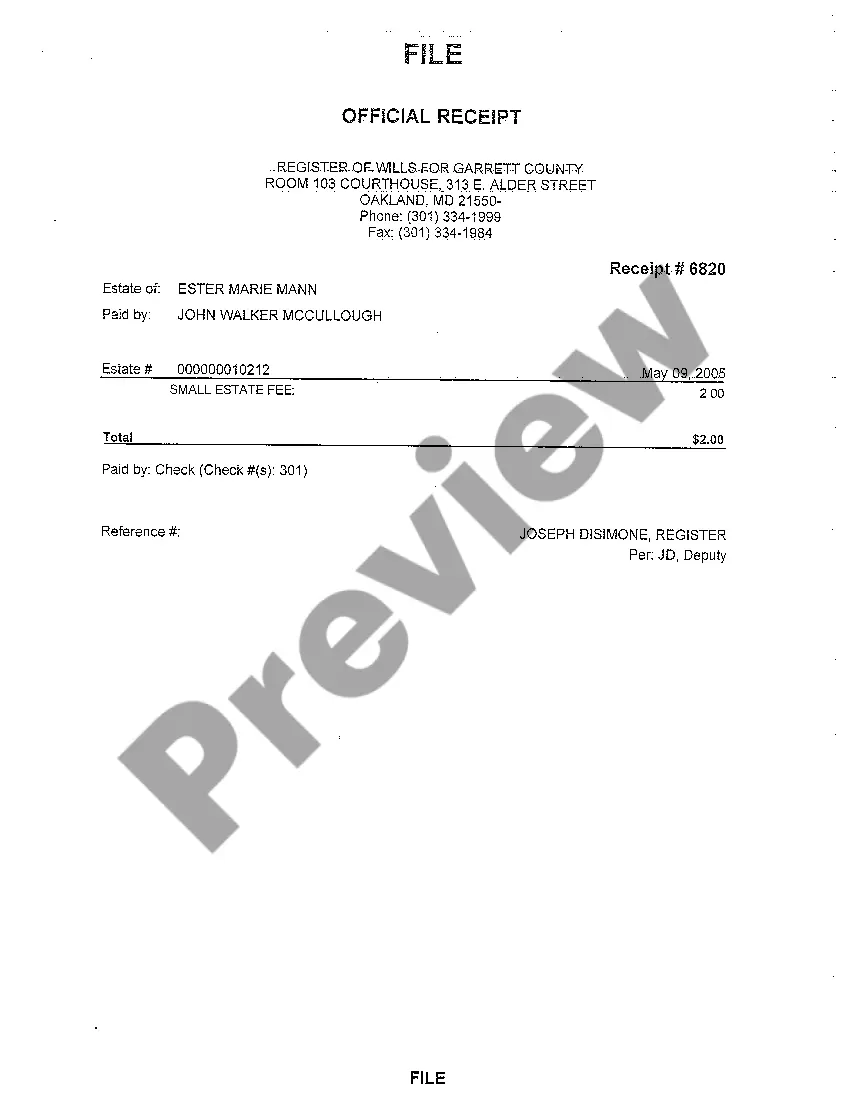

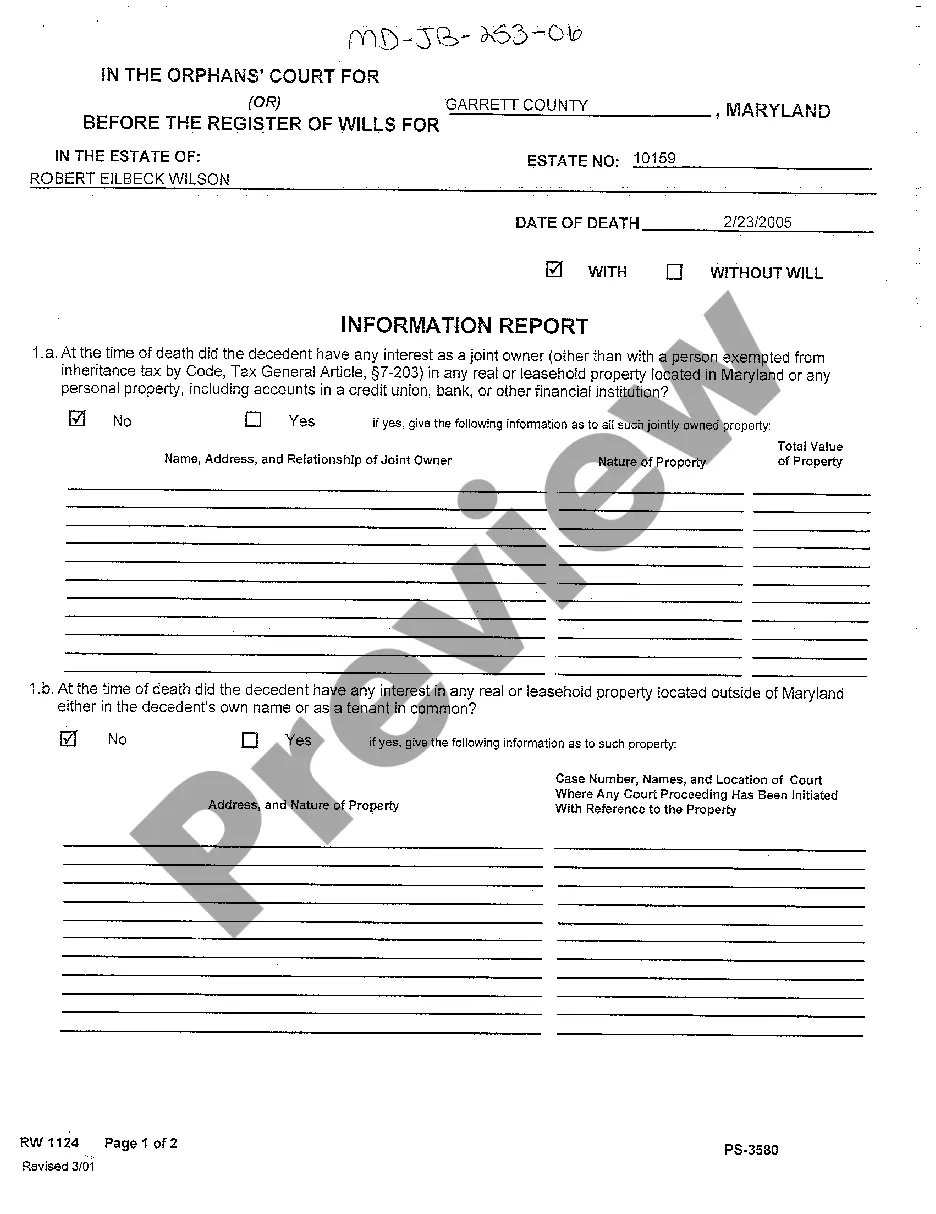

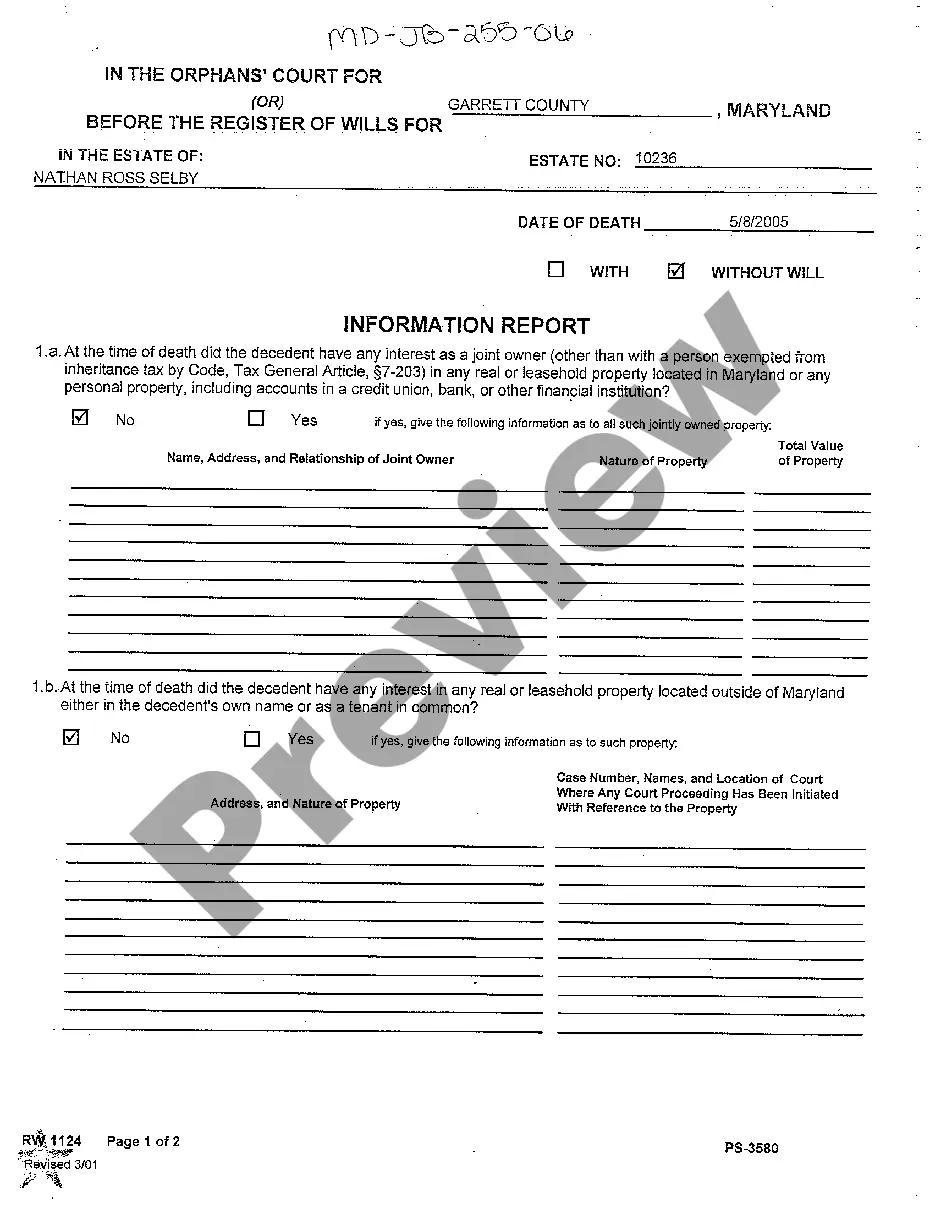

- Review the description (if available) to determine if it’s the correct template.

- Examine additional details using the Preview feature.

- If the sample fulfills all your needs, just select Buy Now.

- To establish your account, choose a pricing option.

- Utilize a credit card or PayPal account to subscribe.

- Download the template in your preferred format (Word or PDF).

- Print the document and complete it with your/your business’s details.

- Once you’ve completed the Maryland Information Report, submit it to your attorney for validation. It’s an additional step but a crucial one for ensuring you’re completely protected.

- Register for US Legal Forms now and gain access to thousands of reusable templates.

Form popularity

FAQ

To file articles of organization in Maryland, you need to visit the Maryland State Department of Assessments and Taxation website. You can complete the filing online or download the necessary forms to mail in. It's essential to ensure that your business name is available and complies with state regulations. Additionally, it's beneficial to utilize resources like US Legal Forms for guidance and templates to streamline the process.

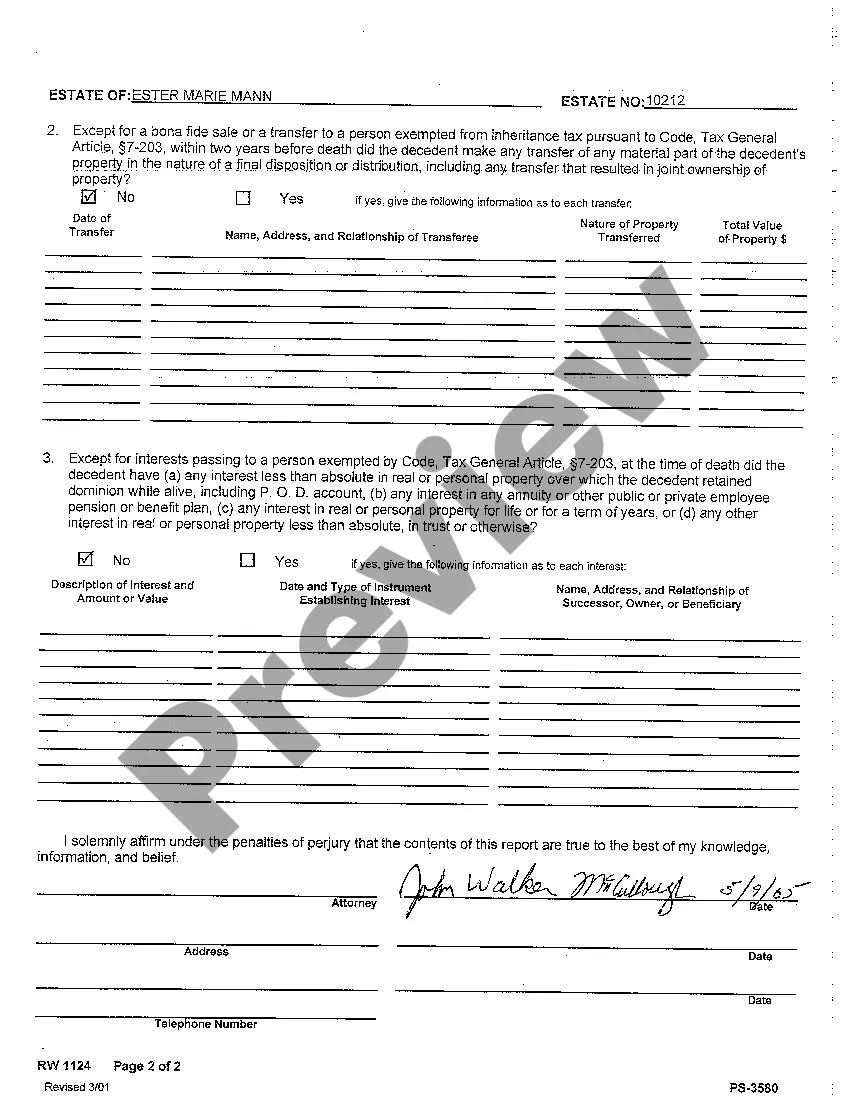

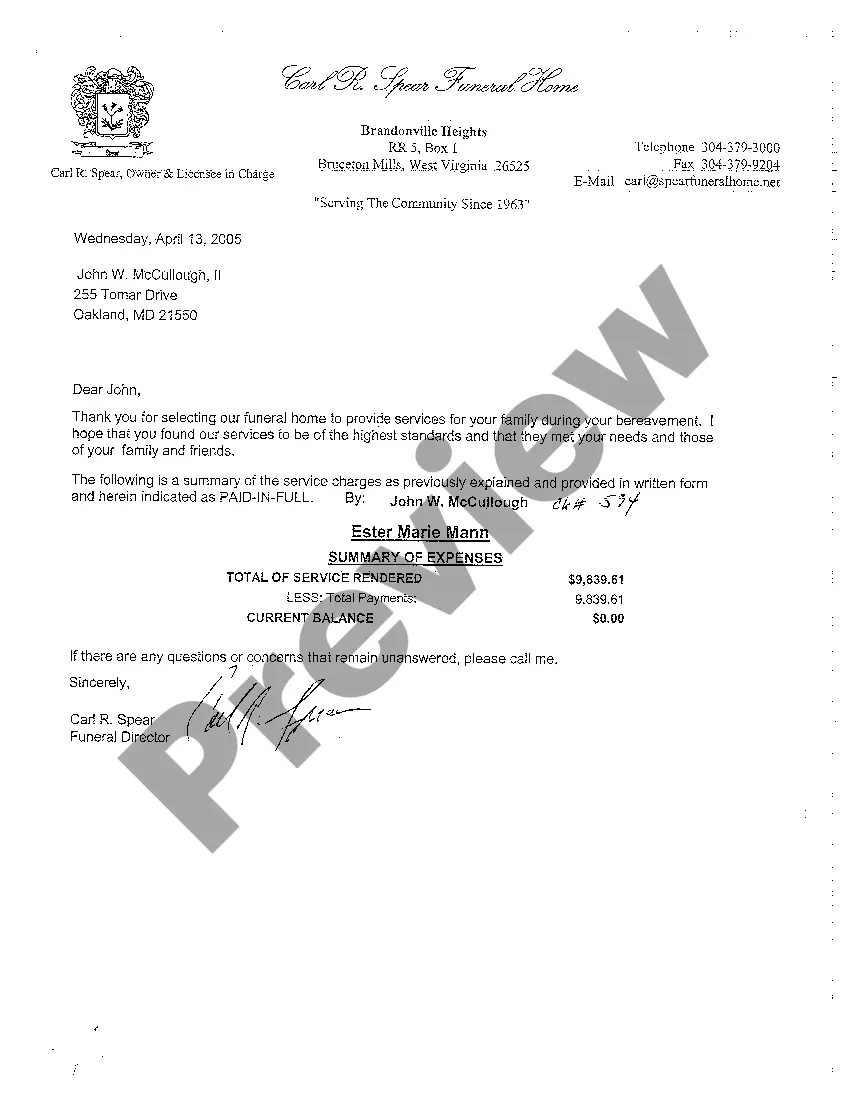

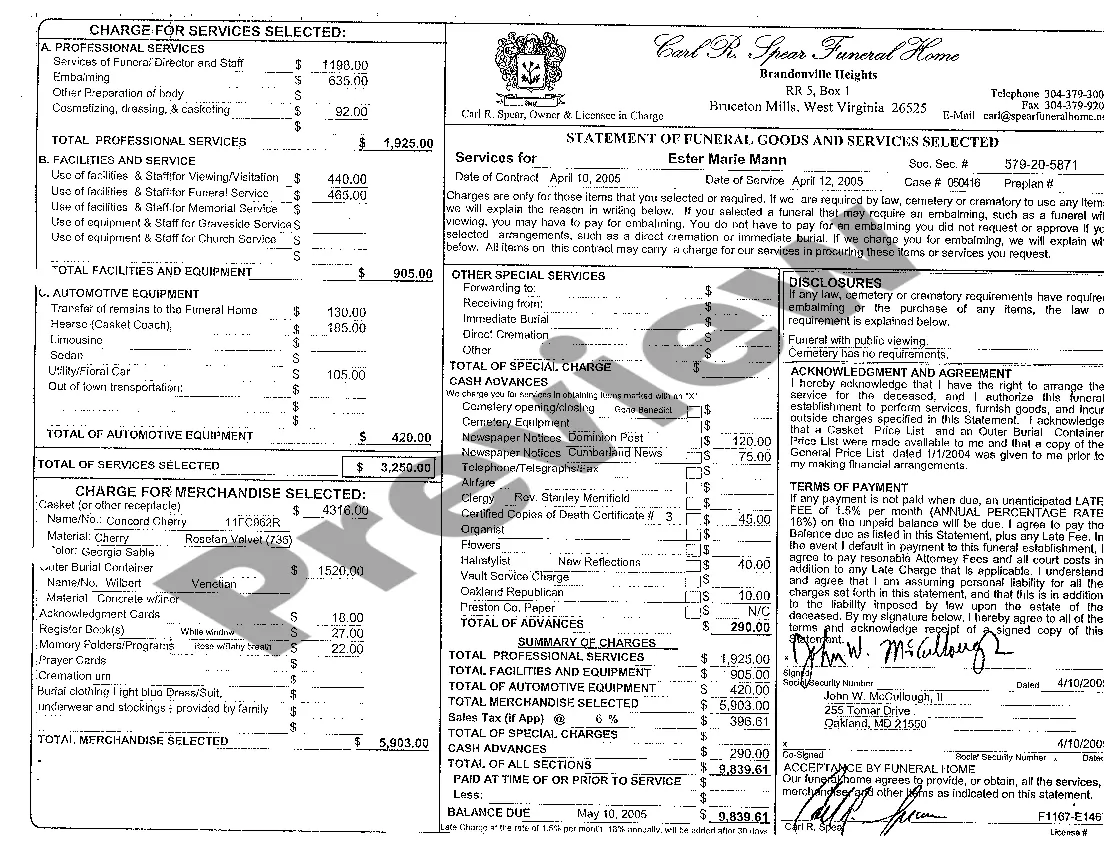

Length of Probate Process in Maryland The administration of an estate often takes approximately one year. This includes marshaling all of the assets, valuing the assets as of the date of death and then making the distribution.

Maryland is a reasonable compensation state for executor fees. Maryland executor compensation has a restriction, though. Maryland executor fees, by law, should not exceed certain amounts. Reasonable compensation is not to exceed 9% if less than $20,000; and $1,800 plus 3.6% of the excess over $20,000.

Create an inventory of the deceased person's property and determine the estate size according to Maryland Law. Petition the Maryland Register of Wills to begin the probate process. Prove the will in court. Pay the deceased person's debts and expenses.

If a person owns assets in his or her individual name and dies without a Will, assets remaining after payment of administration expenses, debts and taxes (if any) are distributed to the person's heirs as provided under Maryland Intestacy Laws (the person is said to have died intestate).