Maryland Small Estate Petition for Administration

Description

Key Concepts & Definitions

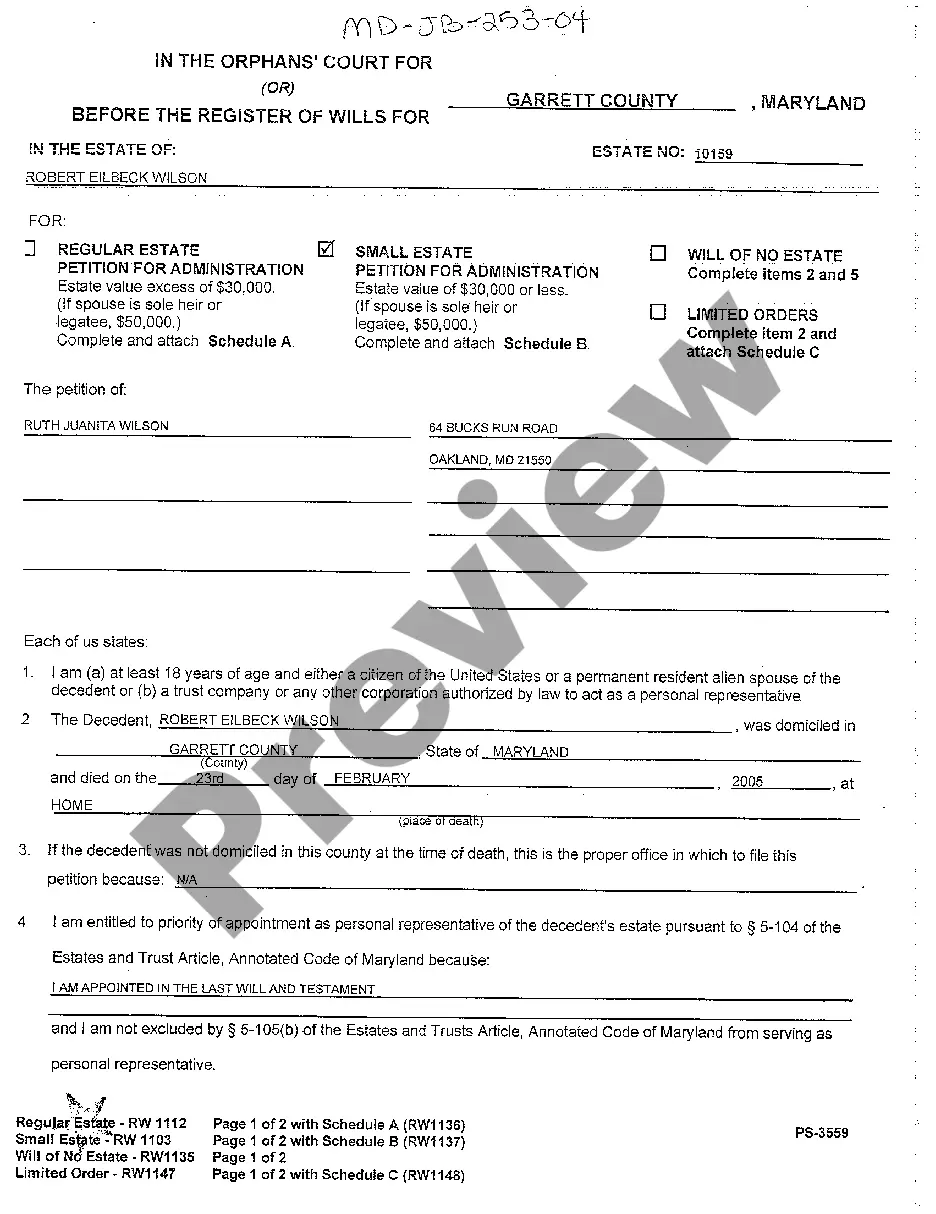

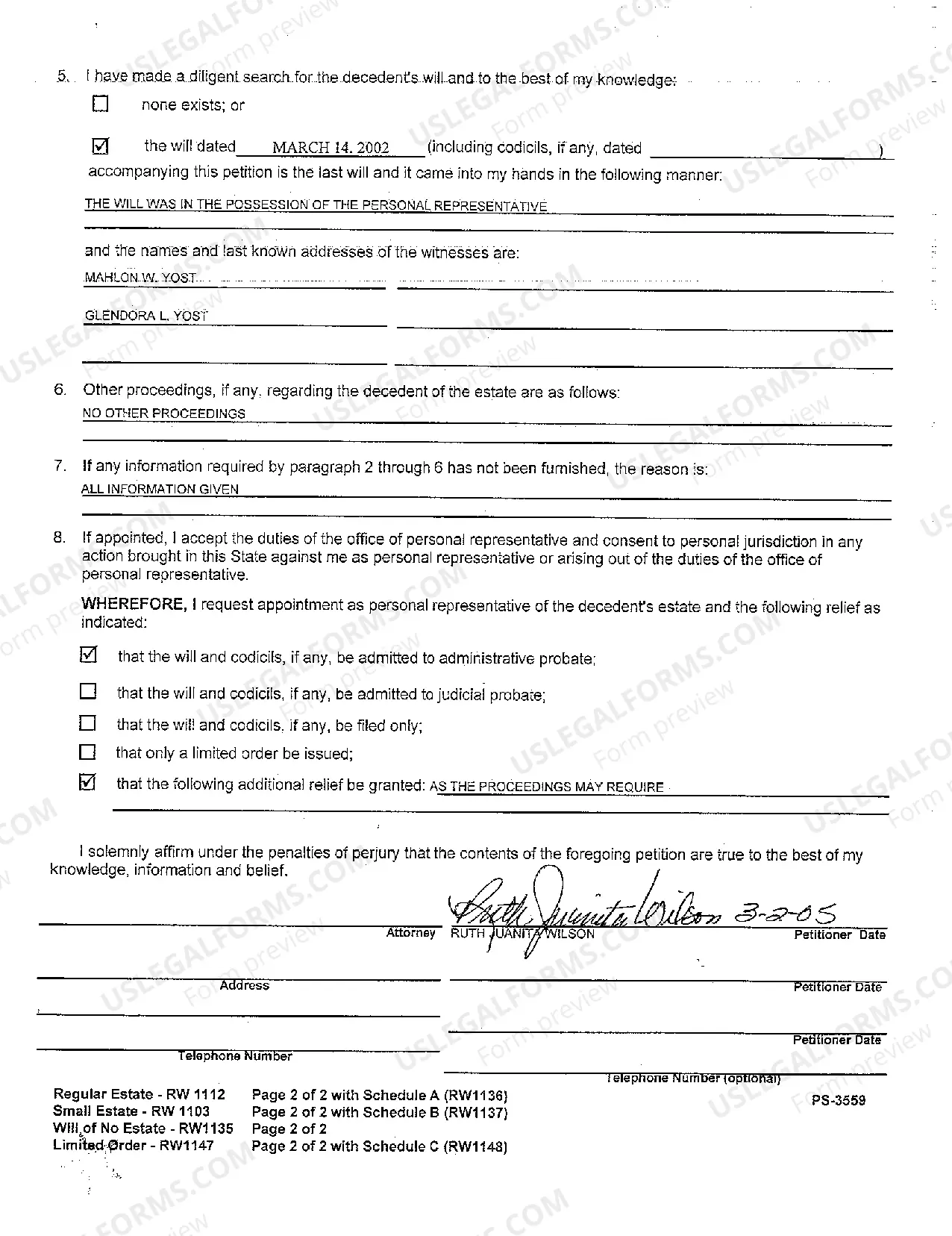

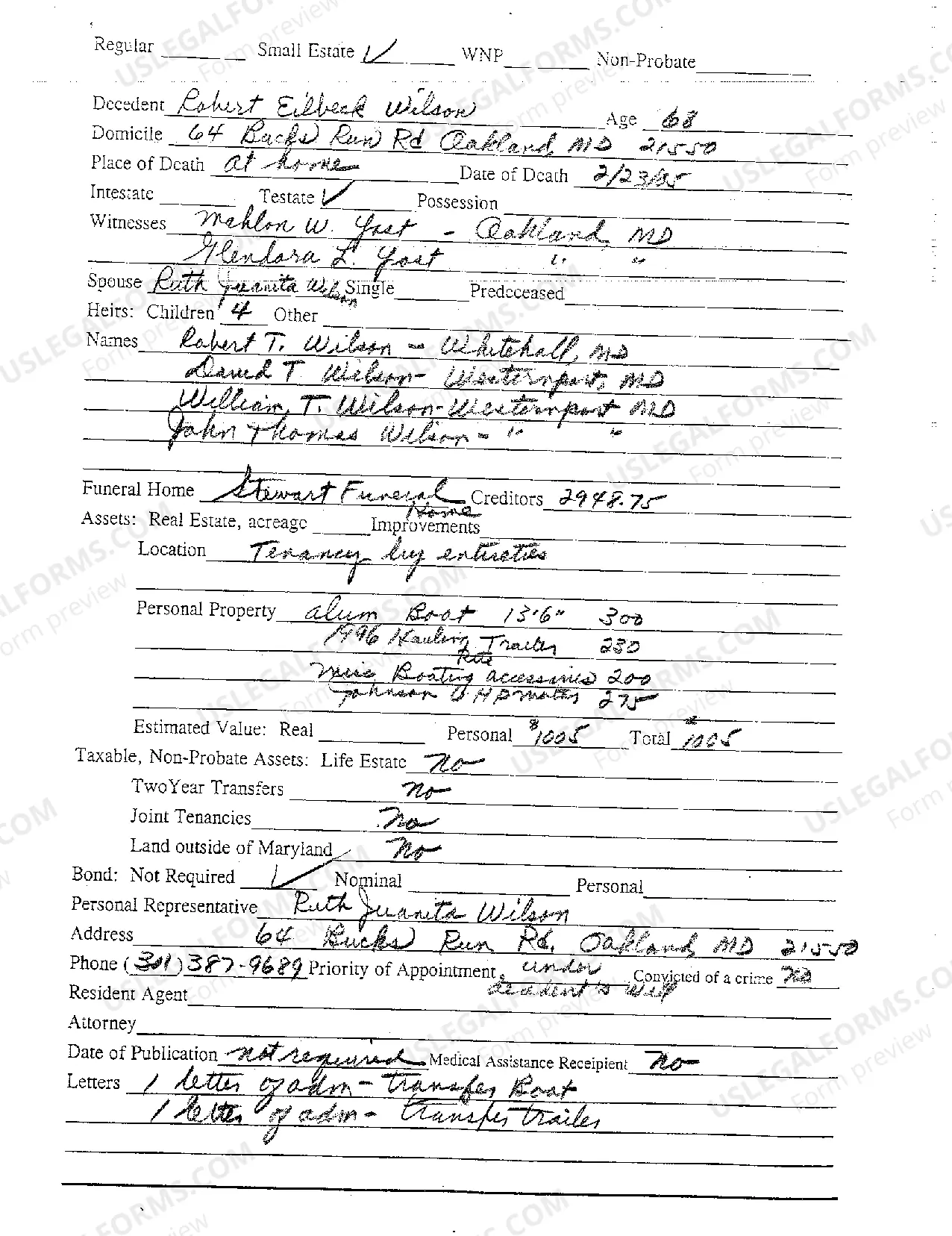

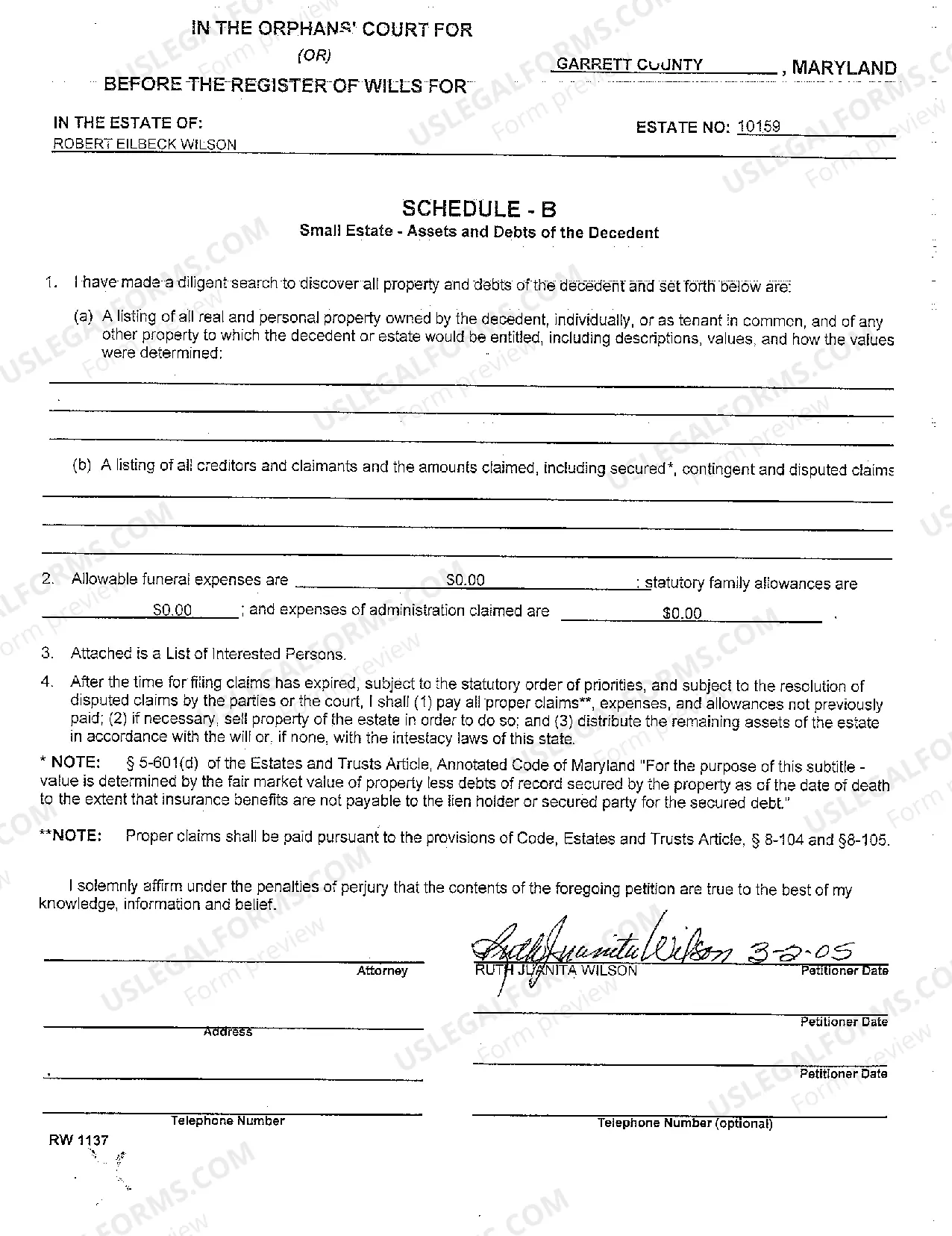

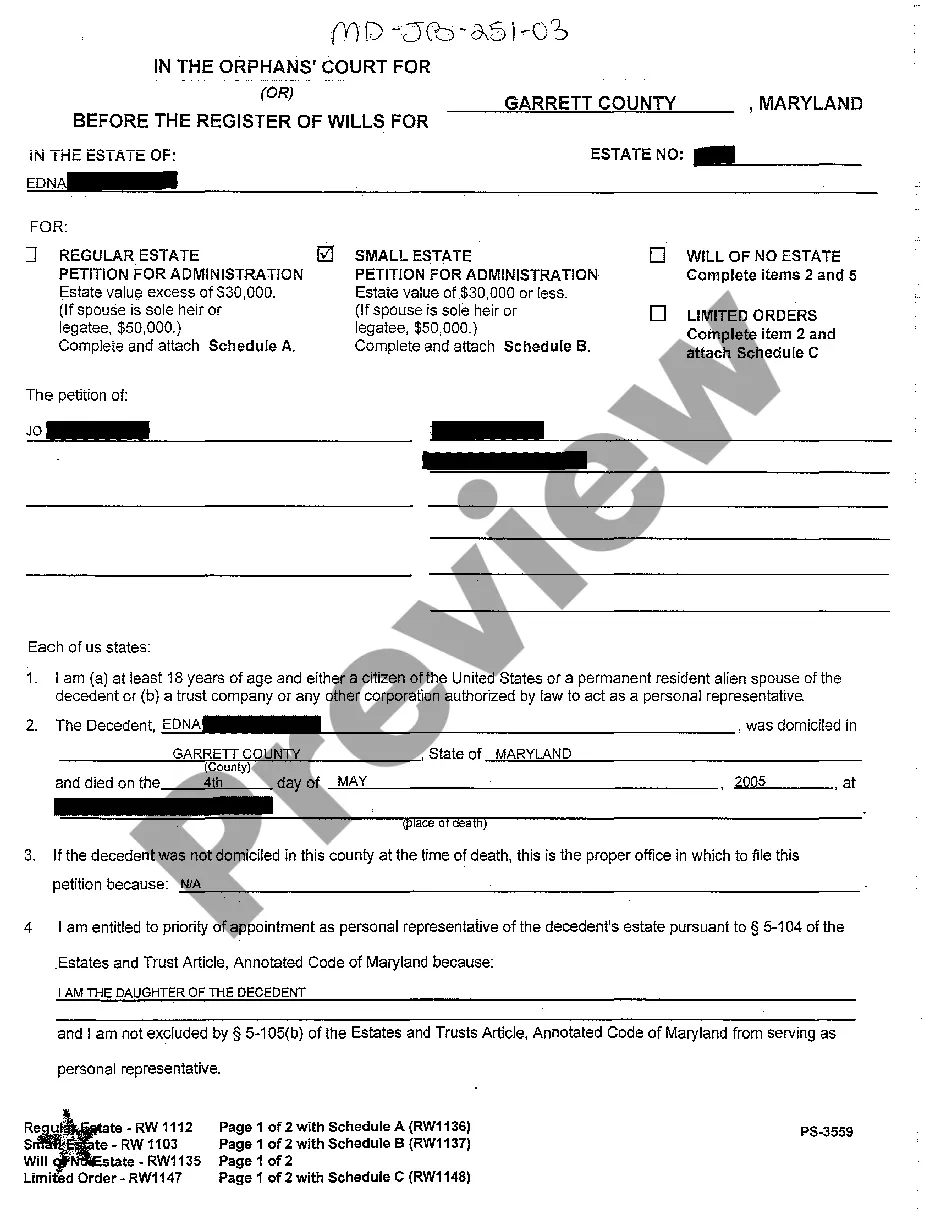

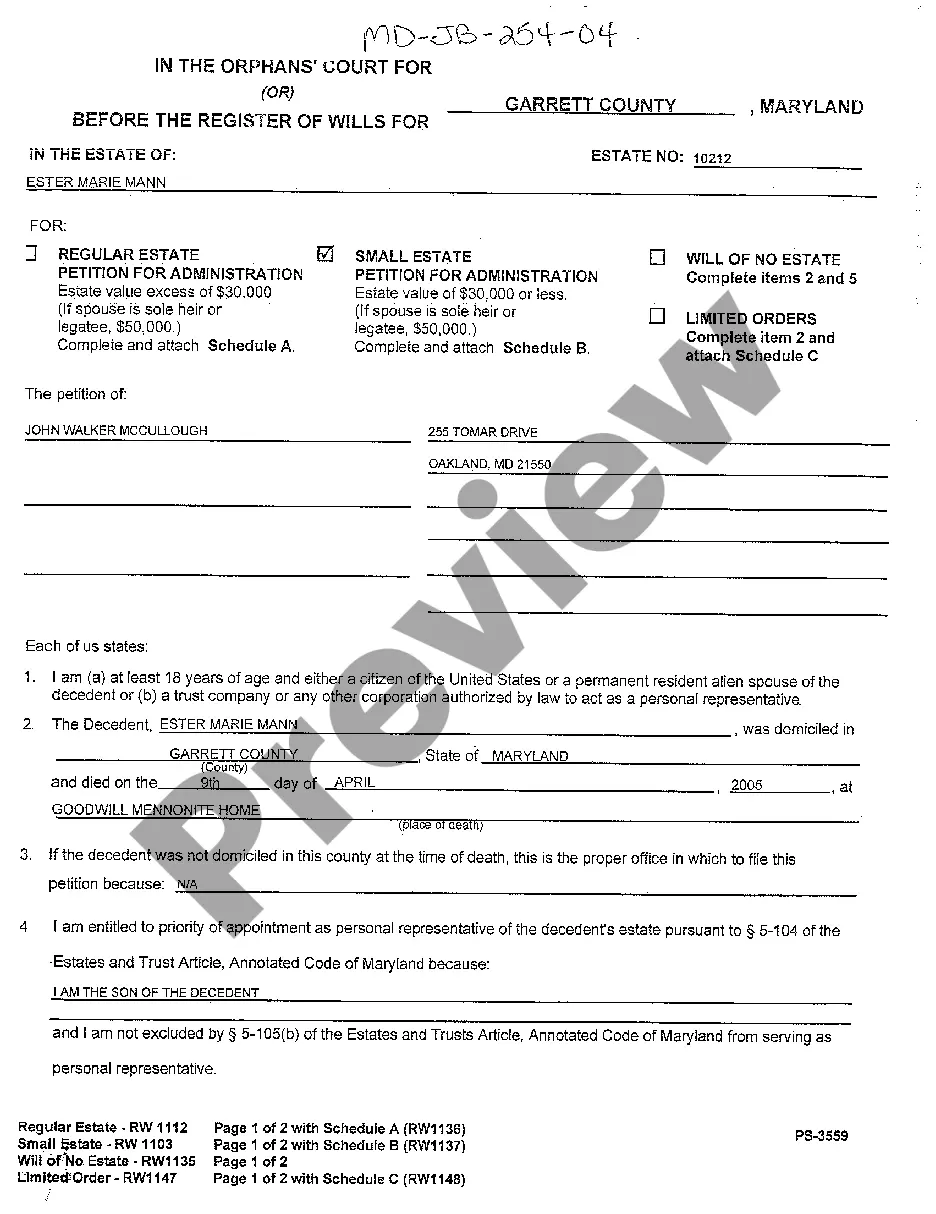

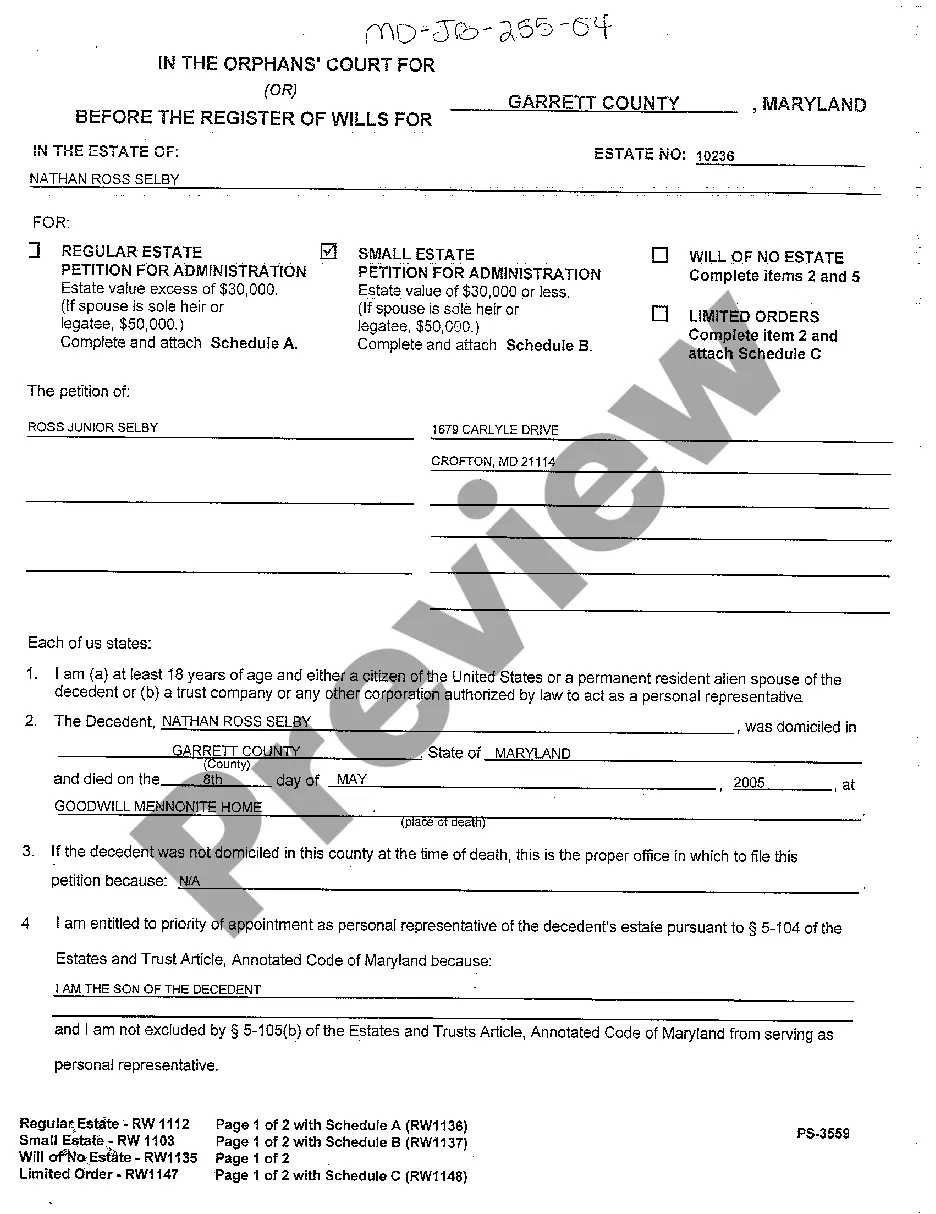

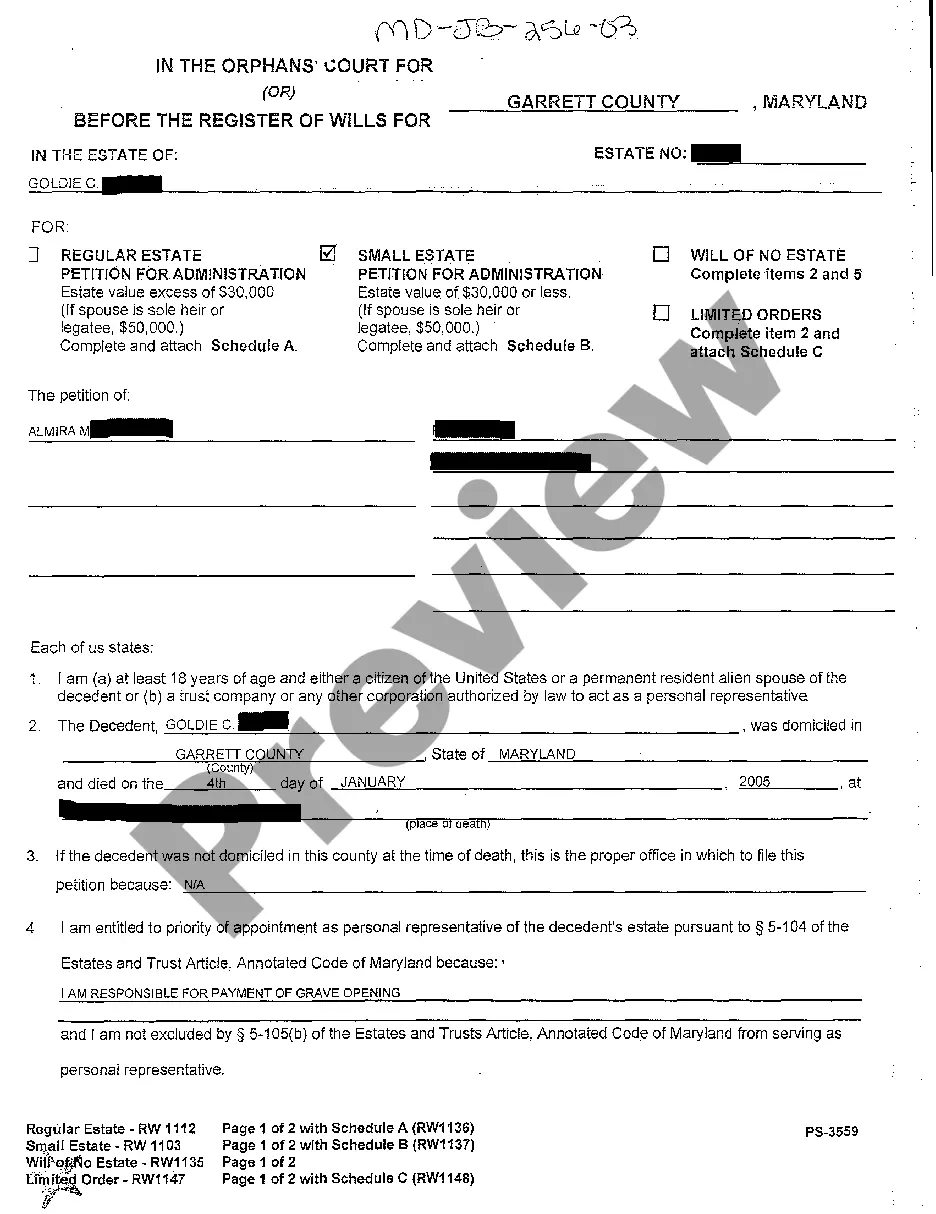

A04 Small Estate Petition for Administration: A legal document used in the United States to administer the estate of a deceased person without a formal probate process when the estate's assets fall below a certain threshold defined by state law. This petition allows for a simplified handling of the estate, which can include distribution of assets to heirs.

Step-by-Step Guide

- Determine Eligibility: Verify that the estate's total value falls below the state's threshold for a small estate, which typically ranges from $30,000 to $150,000 depending on the state.

- Collect Required Documents: Gather necessary documents such as the death certificate, list of assets, and heirship affidavit.

- Fill Out the Petition: Complete the A04 form, diligently filling all required sections. Details should include assets, debts, and heir information.

- File the Petition: Submit the completed petition along with any required fees to the local probate court.

- Notify Heirs and Creditors: Inform all potential heirs and known creditors of the estate administration process.

- Distribute Assets: Once approved, distribute the assets of the estate as dictated by the petition.

Risk Analysis

- Legal Risks: Incorrect information or failure to notify creditors and heirs could lead to challenges of the petition, potentially leading to legal actions against the administrator.

- Financial Risks: Underestimating the value of the estate might result in ineligibility for small estate administration, causing delays and increased costs.

- Compliance Risks: Non-compliance with state laws and regulations can result in penalties, or invalidate the administration process, leading to potential re-filing and additional fees.

Common Mistakes & How to Avoid Them

- Overlooking Assets: Ensure a thorough inventory of all estate assets to stay within legal small estate limits. Utilizing professional appraisal services when necessary can prevent this error.

- Failing to Notify Interested Parties: Maintain transparent communications with all heirs and creditors to avoid any disputes or legal challenges.

- Incomplete Paperwork: Double-check all forms for completeness and accuracy before submission to avoid delays. Consider consulting with an estate attorney.

How to fill out Maryland Small Estate Petition For Administration?

You are invited to the most important legal documents repository, US Legal Forms.

Here you can locate any template including Maryland Small Estate Petition for Administration forms and download them (as many as you wish/need).

Prepare official documents within a few hours, rather than days or even weeks, without spending a fortune on a lawyer or attorney.

If the document fulfills all of your needs, simply click Buy Now. To create an account, select a pricing plan. Use a credit card or PayPal account to subscribe. Download the file in the format you prefer (Word or PDF). Print the document and fill it out with your or your business’s information. Once you’ve completed the Maryland Small Estate Petition for Administration, submit it to your lawyer for confirmation. It’s an additional step but a crucial one for ensuring you’re fully protected. Join US Legal Forms today and access a multitude of reusable templates.

- Obtain the state-specific template in just a few clicks and feel confident knowing it was created by our state-certified attorneys.

- If you’re an existing subscriber, simply Log In to your account and click Download next to the Maryland Small Estate Petition for Administration you desire.

- Since US Legal Forms is an online service, you’ll always have access to your stored files, regardless of the device you’re using.

- View them under the My documents section.

- If you do not have an account yet, what are you waiting for.

- Follow our guidelines below to get started.

- If this is a state-specific template, verify its applicability in your residing state.

- Review the description (if available) to determine if it’s the correct form.

Form popularity

FAQ

Small Estate: property of the decedent subject to administration in Maryland is established to have a value of $50,000 or less ($100,000 or less if the spouse is the sole heir).

When the register of wills or orphan's court appoints a personal representative, it grants the representative letters of administration. Letters of administration empower the representative to distribute the assets in the estate.The court rules for estate administration are found in Title 6 of the Maryland Rules.

Appointment of Executor or Administrator In the absence of a will, the court appoints an administrator for the estate, typically the next of kin. Completion of the executor or administrator appointment takes about six to eight weeks once the executor files the petition or the court makes a selection.

Do you always need probate or letters of administrationYou usually need probate or letters of administration to deal with an estate if it includes property such as a flat or a house.you discover that the estate is insolvent, that is, there is not enough money in the estate to pay all the debts, taxes and expenses.