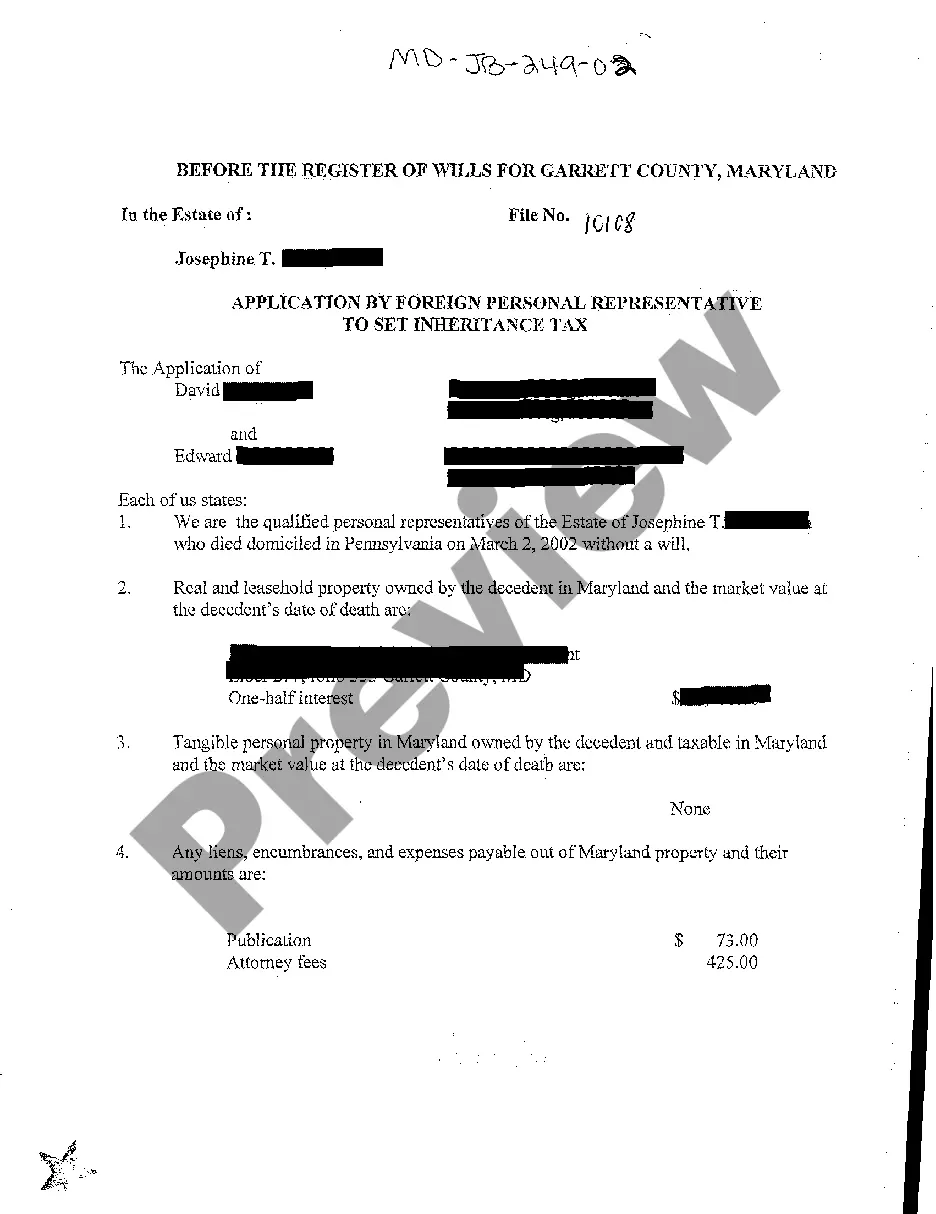

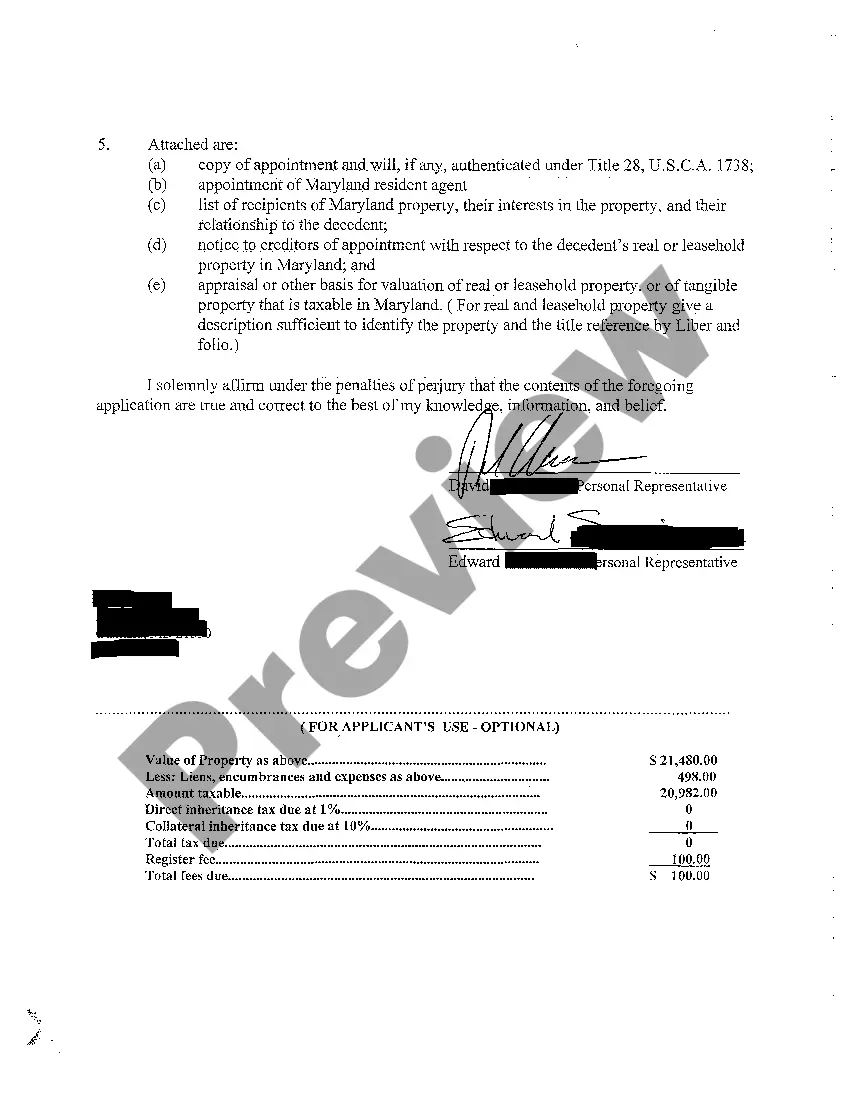

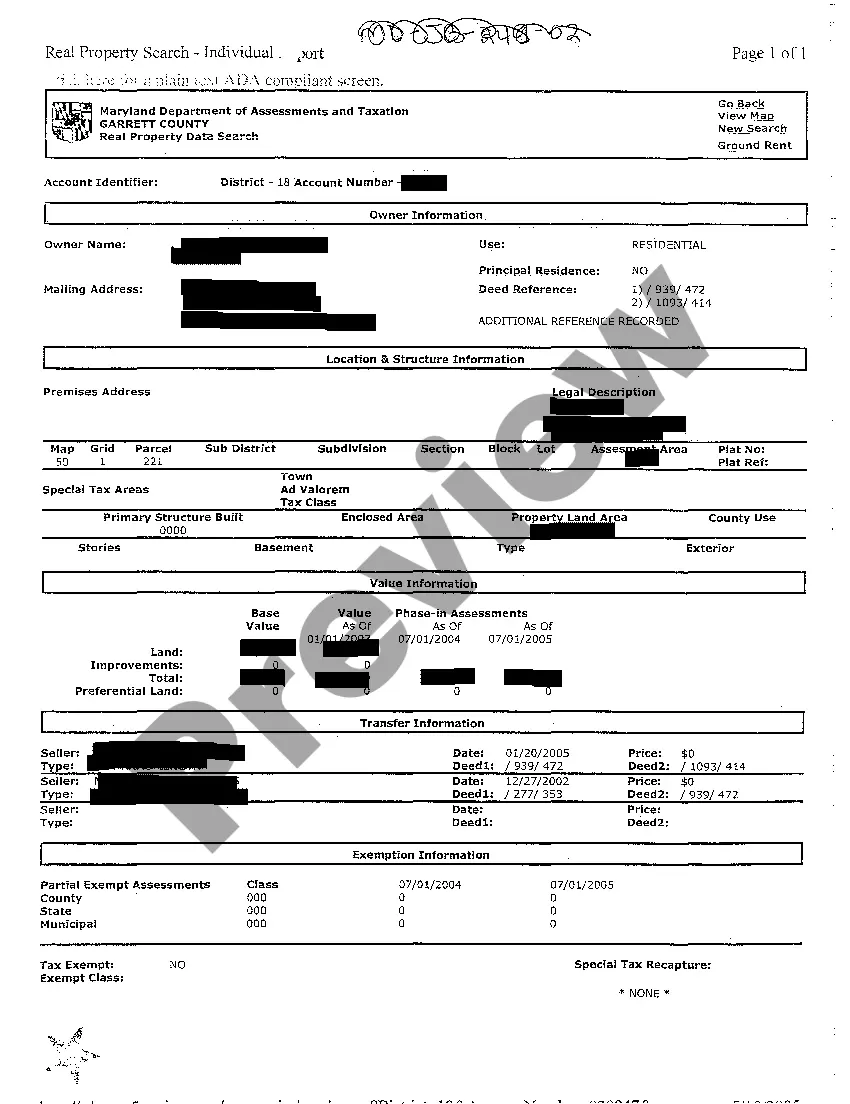

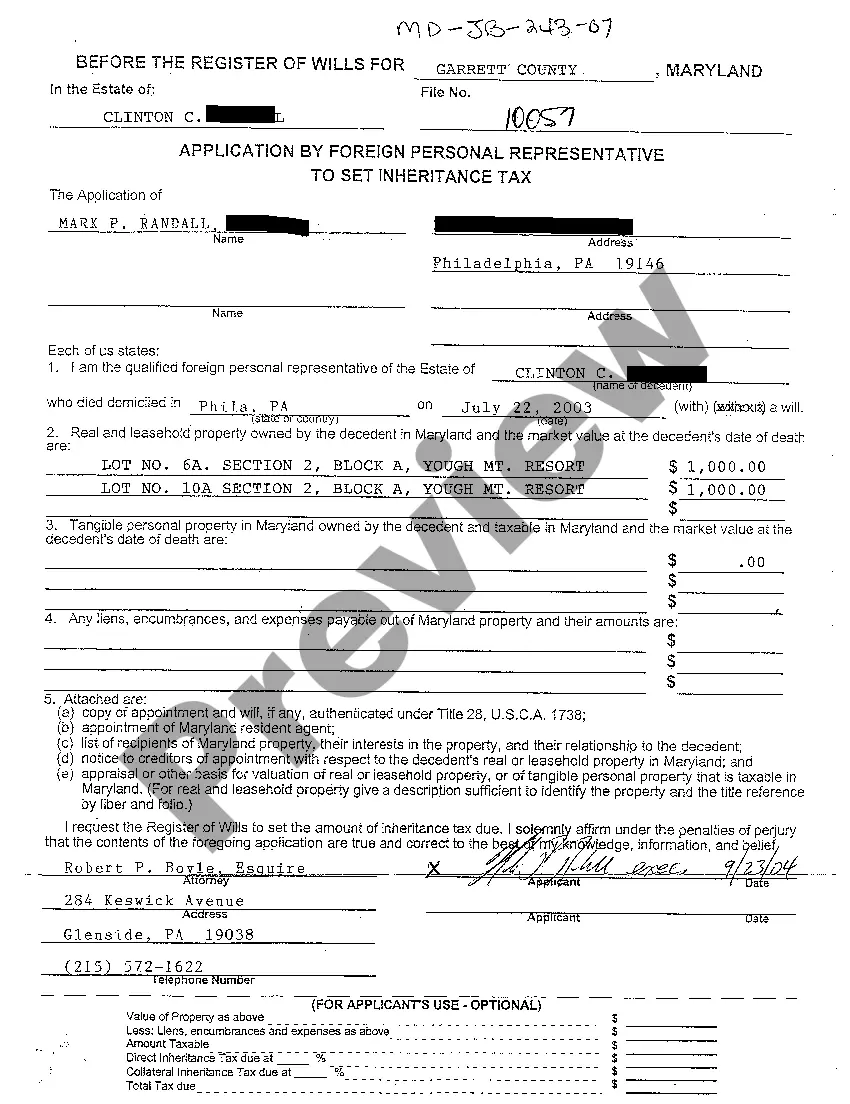

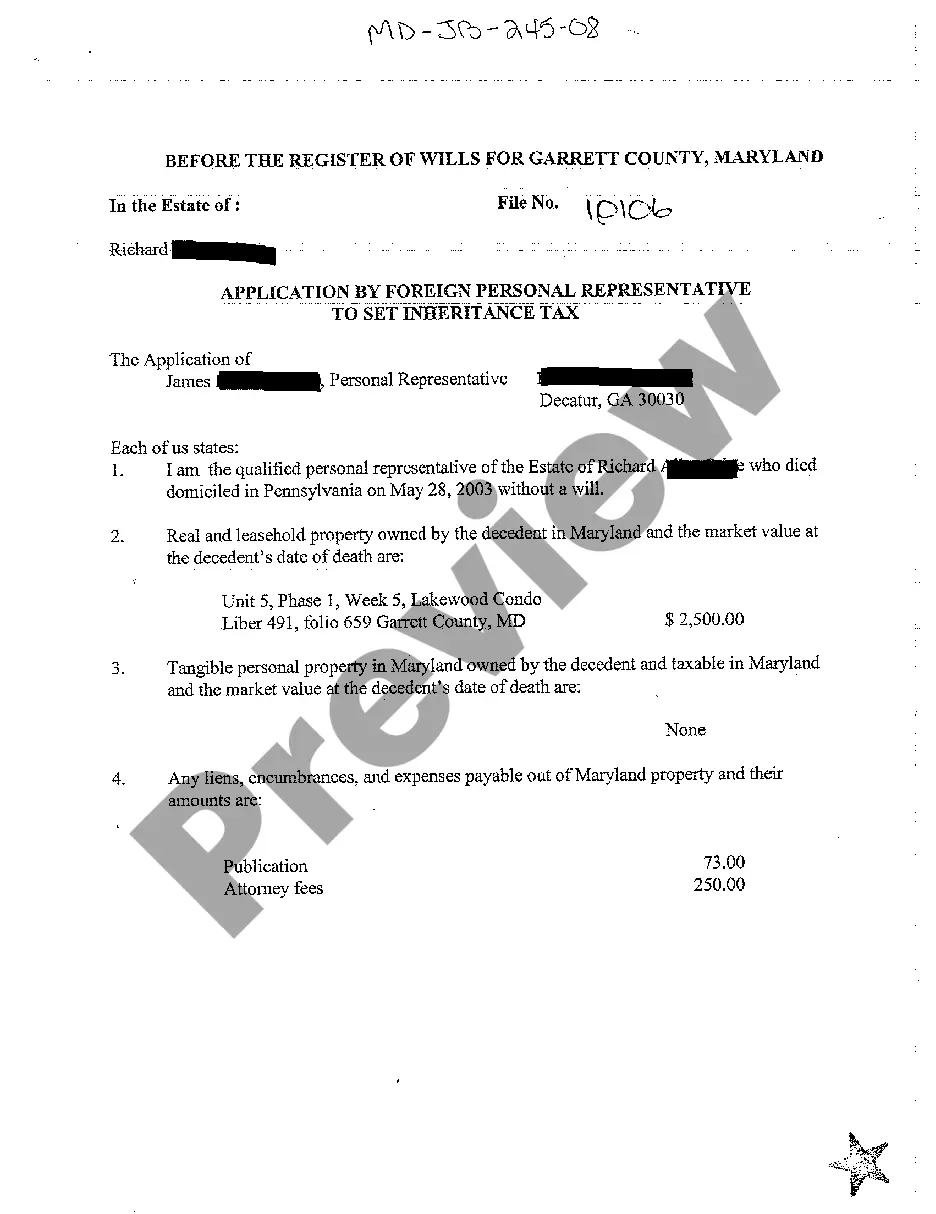

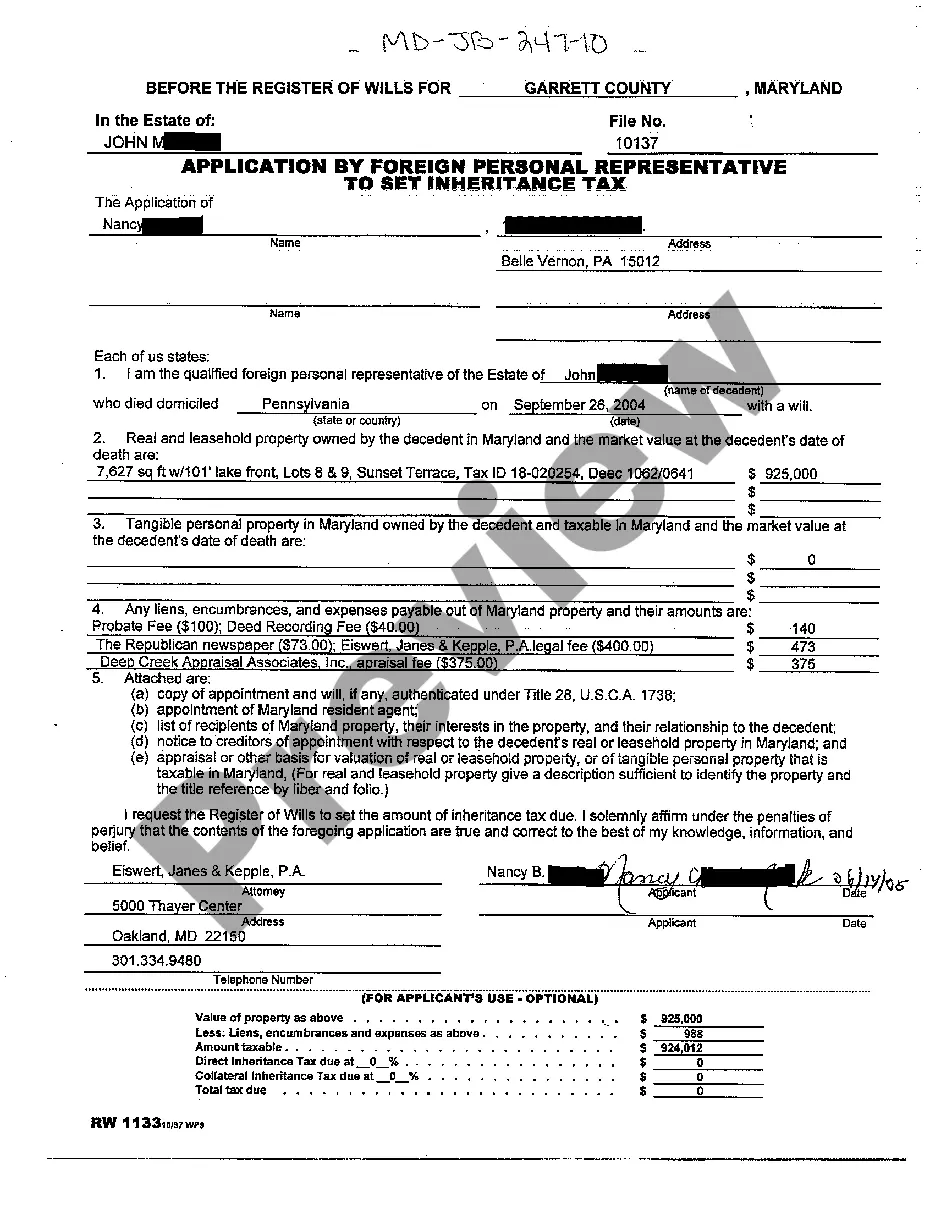

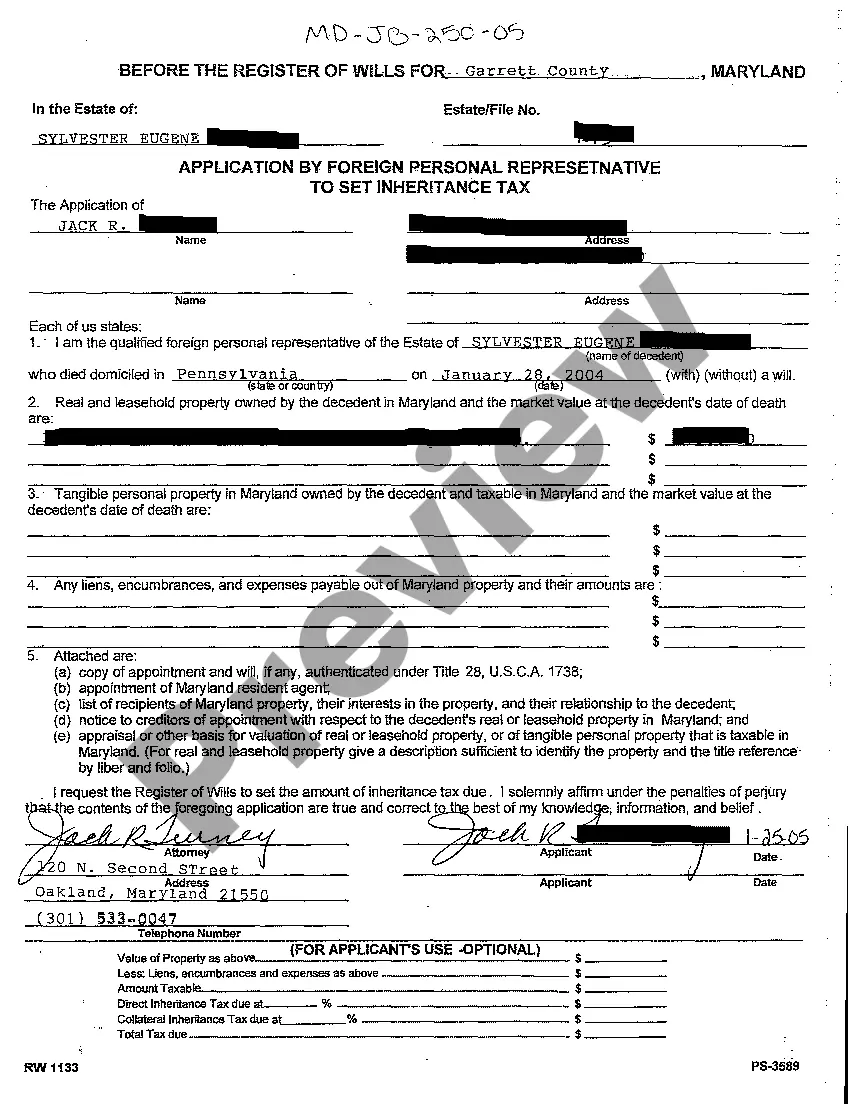

Maryland Application by Foreign Personal Representative to Set Inheritance Tax

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Application By Foreign Personal Representative To Set Inheritance Tax?

You are invited to the finest legal documents library, US Legal Forms. Here you can discover any sample such as Maryland Application by Foreign Personal Representative to Establish Inheritance Tax forms and save them (as many of them as you wish/require). Prepare formal documents within a few hours, rather than days or weeks, without spending a fortune with an attorney. Obtain your state-specific template in just a few clicks and feel assured knowing that it was prepared by our licensed lawyers.

If you’re already a registered customer, just Log In to your account and click Download next to the Maryland Application by Foreign Personal Representative to Establish Inheritance Tax you require. Because US Legal Forms is online-based, you’ll typically gain access to your saved templates, regardless of the device you’re using. Find them within the My documents tab.

If you don't have an account yet, what are you waiting for? Review our instructions below to get started.

Once you’ve finished the Maryland Application by Foreign Personal Representative to Establish Inheritance Tax, send it to your lawyer for verification. It’s an additional step but a crucial one for ensuring you’re fully protected. Join US Legal Forms today and access thousands of reusable samples.

- If this is a state-specific document, verify its relevance in the state where you reside.

- Review the description (if available) to determine if it’s the correct sample.

- View more content using the Preview option.

- If the sample meets all of your criteria, click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Save the document in the format you prefer (Word or PDF).

- Print the document and complete it with your/your business’s information.

Form popularity

FAQ

Yes, US inheritance tax can apply to non-US citizens. If a non-citizen inherits property located in the United States, they may be subject to Maryland Application by Foreign Personal Representative to Set Inheritance Tax. This process ensures compliance with state laws and facilitates the proper handling of tax obligations. Consulting with legal resources can provide clarity on this matter.

After a loved one dies, his or her estate must be settled. While most people want the settlement process to be done ASAP, probate in Maryland, including Howard County, can take between 9 to 18 months, presuming there is no challenges to a Will or any litigation.

When the register of wills or orphan's court appoints a personal representative, it grants the representative letters of administration. Letters of administration empower the representative to distribute the assets in the estate.The court rules for estate administration are found in Title 6 of the Maryland Rules.

Petition for Administration. List of Assets and Debts. Notice of Appointment / Notice to Creditors / Notice to Unknown Heirs. Bond of Personal Representative Form. List of Interested Persons. Paid Funeral Bill. Copy of Death Certificate - available from Division of Vital Records.