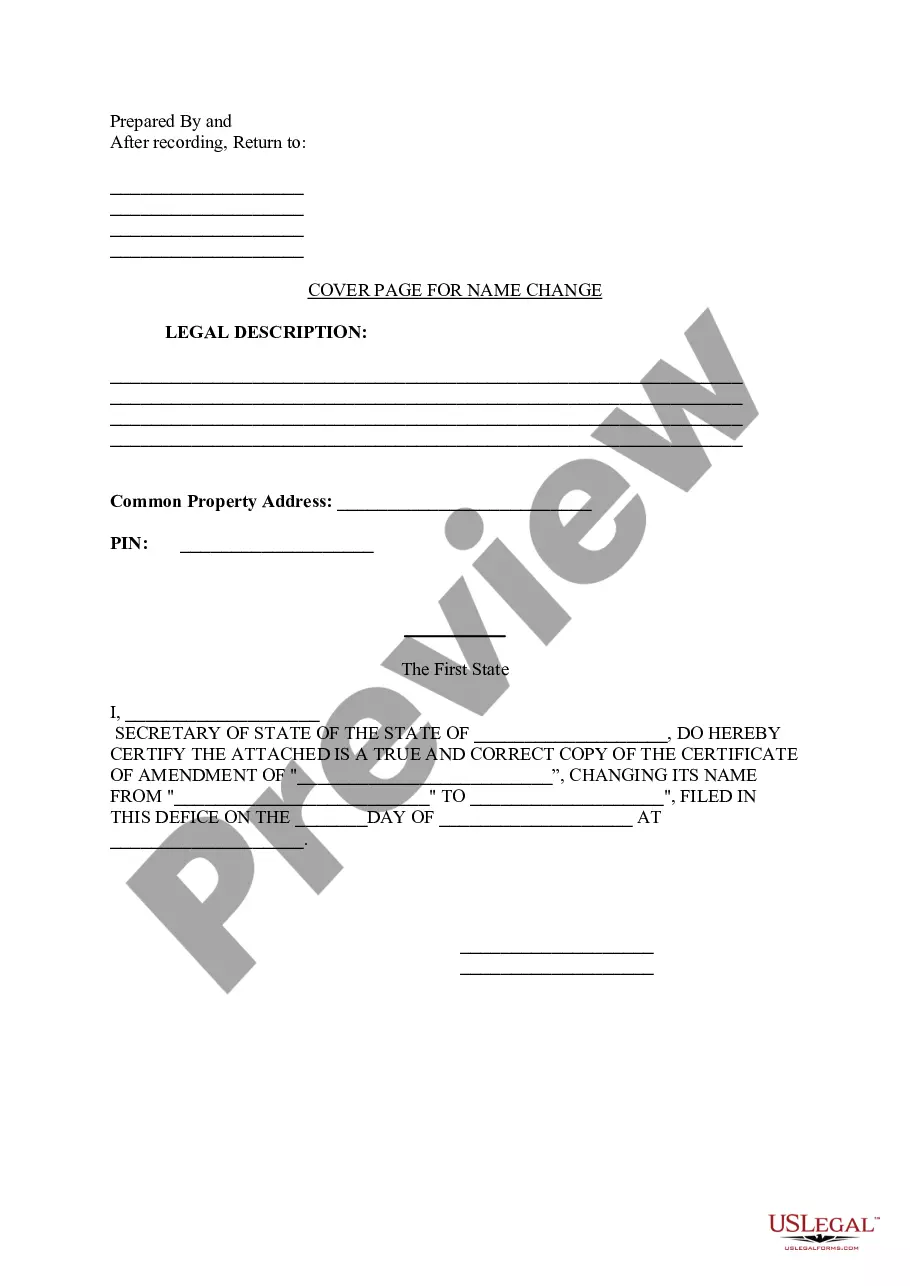

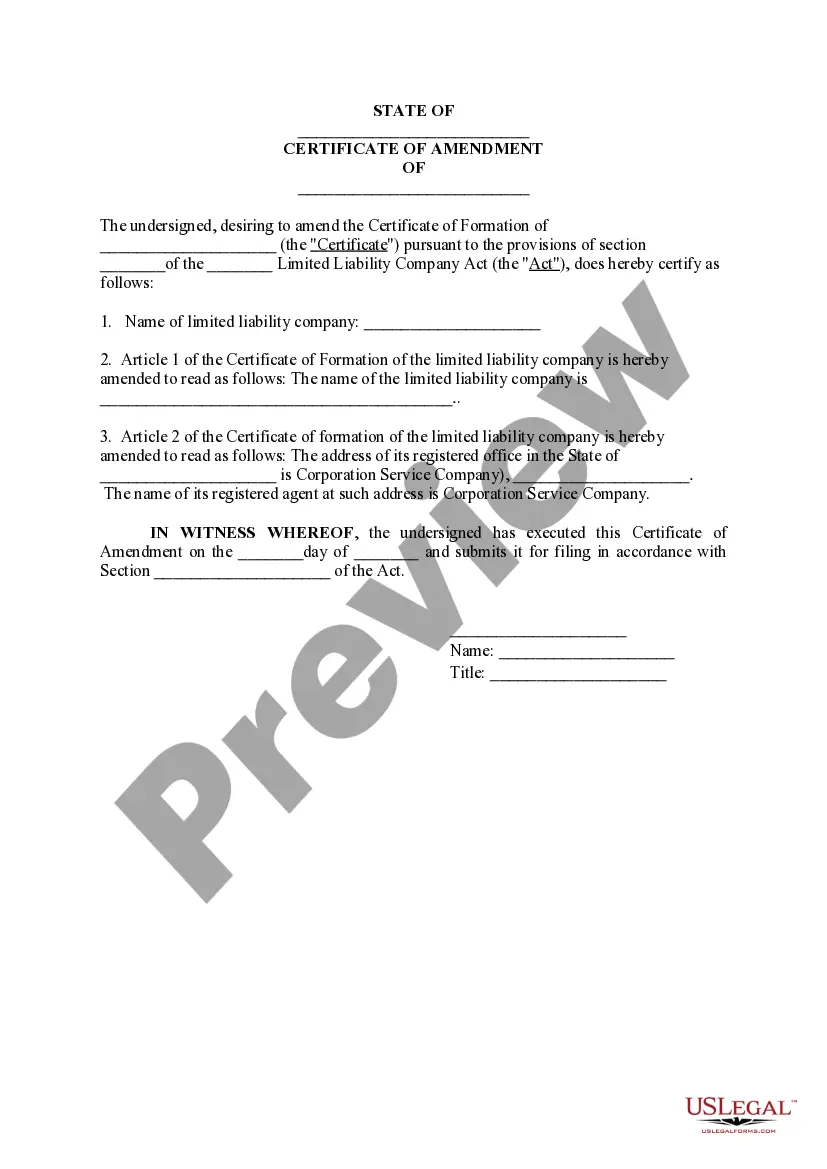

Utah Certificate of Amendment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

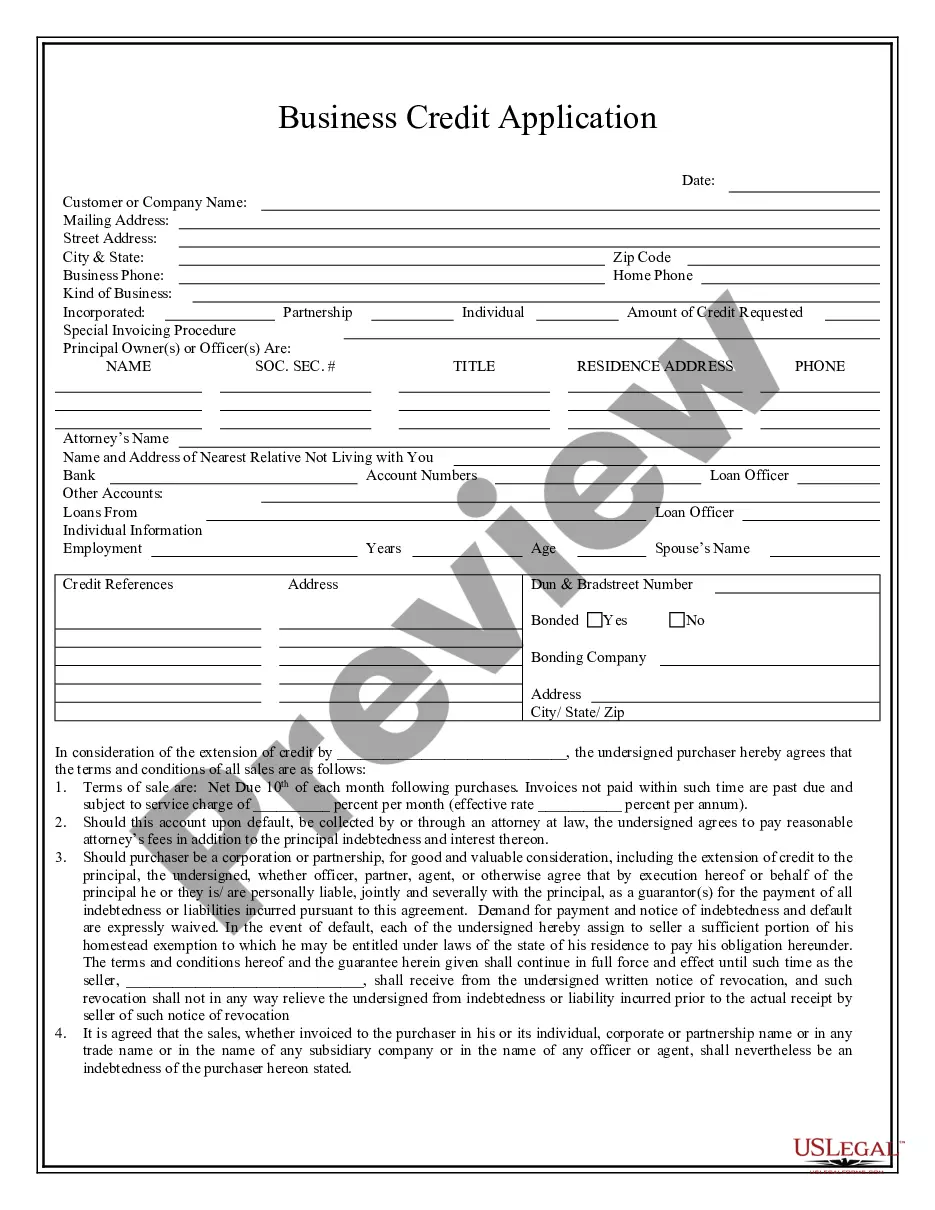

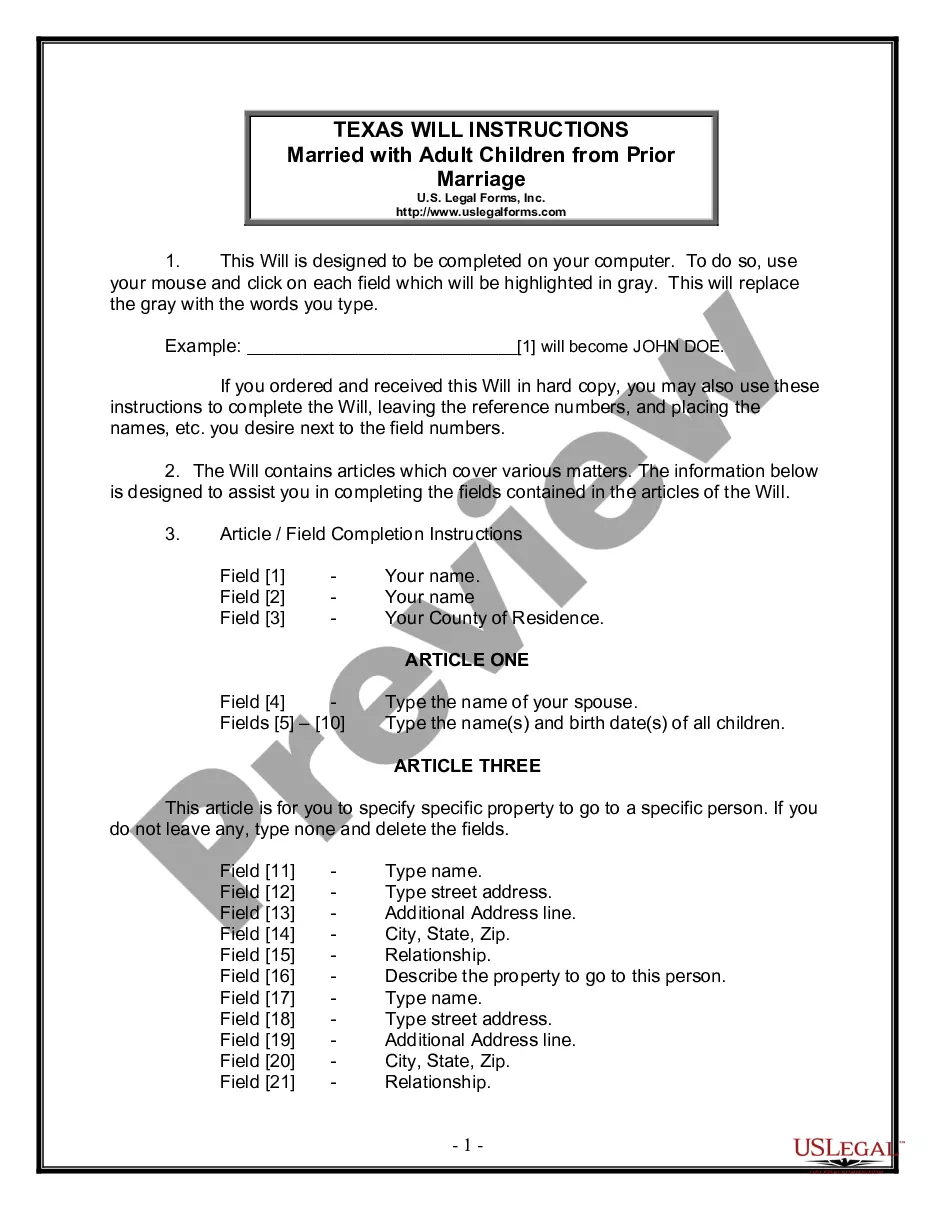

Looking for another form?

How to fill out Utah Certificate Of Amendment?

Searching for a Utah Certificate of Amendment on the internet can be stressful. All too often, you find files which you think are ok to use, but find out later they are not. US Legal Forms provides over 85,000 state-specific legal and tax forms drafted by professional legal professionals according to state requirements. Have any form you are looking for quickly, hassle-free.

If you already have the US Legal Forms subscription, just log in and download the sample. It’ll automatically be included to the My Forms section. If you don’t have an account, you should sign up and choose a subscription plan first.

Follow the step-by-step guidelines below to download Utah Certificate of Amendment from our website:

- Read the document description and click Preview (if available) to check if the template suits your expectations or not.

- In case the document is not what you need, get others using the Search engine or the listed recommendations.

- If it’s right, click on Buy Now.

- Choose a subscription plan and create an account.

- Pay via credit card or PayPal and download the document in a preferable format.

- After getting it, you may fill it out, sign and print it.

Obtain access to 85,000 legal templates from our US Legal Forms catalogue. In addition to professionally drafted samples, customers are also supported with step-by-step instructions on how to find, download, and complete forms.

Form popularity

FAQ

The Division will accept requests for corporate archive searches, Certificates of Existence, certified copies and copies of records by mail at: 160 East 300 South, Box 146705, Salt Lake City, Utah 84114-6705; via fax at: (801) 530-6438; or in person at the Division offices at: 160 East 300 South, 2nd Floor, Salt Lake

Step 1: Get Your Certificate of Organization Forms. You can download and mail in your Utah Certificate of Organization, OR you can create an account and file online. Step 2: Fill Out the Certificate of Organization. Step 3: File the Certificate of Organization.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

It's required by the state. According to Utah Code Section 48-3a-102(16), all members of a Utah LLC must enter into an operating agreement to regulate the internal affairs of the company. It'll prevent conflict among your business partners.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

An operating agreement is mandatory as per laws in only 5 states: California, Delaware, Maine, Missouri, and New York. LLCs operating without an operating agreement are governed by the state's default rules contained in the relevant statute and developed through state court decisions.

Hold a meeting of members and pass a resolution to dissolve the company. File the annual and other required reports with the state agency. Pay off all the outstanding business debts of the company. Pay all the outstanding taxes and fees owed by the company.

The Division will accept requests for corporate archive searches, Certificates of Existence, certified copies and copies of records by mail at: 160 East 300 South, Box 146705, Salt Lake City, Utah 84114-6705; via fax at: (801) 530-6438; or in person at the Division offices at: 160 East 300 South, 2nd Floor, Salt Lake

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.