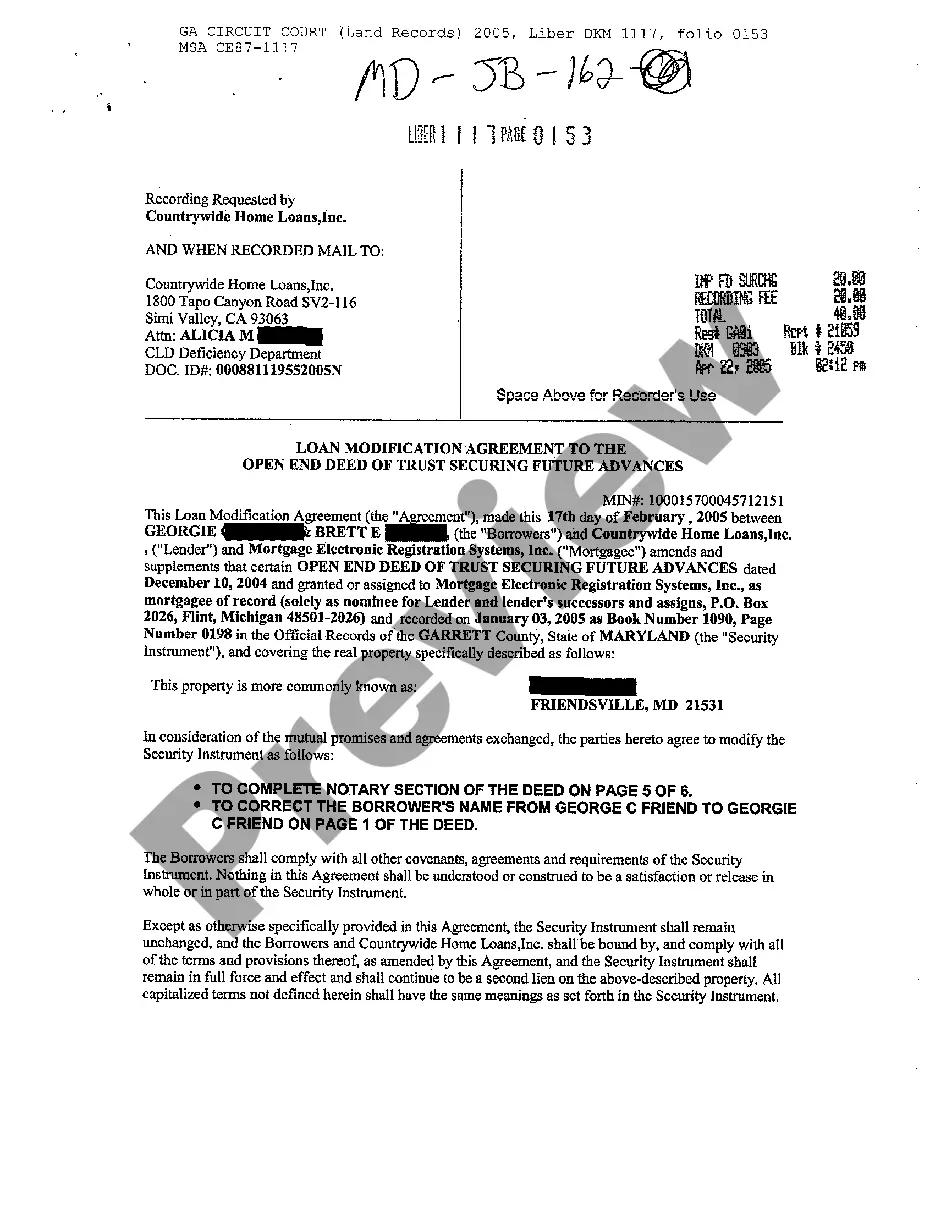

Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances

Description

How to fill out Maryland Loan Modification Agreement To The Open End Of Trust Securing Future Advances?

Greetings to the paramount collection of legal documents, US Legal Forms. Here, you will discover any template such as the Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances forms and store them (as many as you require). Create official papers in mere hours, instead of days or weeks, without spending a fortune on a lawyer. Obtain your state-specific template in just a few clicks and rest assured knowing it was crafted by our qualified attorneys.

If you are already a registered user, simply Log In to your account and then select Download next to the Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances you desire. Because US Legal Forms is an online service, you will always have access to your stored documents, regardless of the device you are using. Locate them within the My documents section.

If you don't possess an account yet, what are you waiting for? Explore our instructions provided below to get started.

After you’ve completed the Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances, submit it to your attorney for review. It’s an additional step but a crucial one for ensuring you’re fully protected. Join US Legal Forms today and gain access to a vast array of reusable templates.

- If this is a document specific to your state, verify its applicability in the state of your residence.

- Review the description (if available) to ensure it’s the correct template.

- Utilize the Preview feature to gain further insights.

- If the template meets your needs, click Buy Now.

- To create your account, choose a subscription plan.

- Use a credit card or PayPal account to register.

- Download the template in your preferred format (Word or PDF).

- Print the document and fill it out with your/your business’s details.

Form popularity

FAQ

A future advance endorsement is an addition to a mortgage that allows for future advances on the loan secured by the property. This endorsement is significant because it enables borrowers to increase their loan amounts as needed, often with fewer requirements than a traditional loan. Through a Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances, you can benefit from the flexibility of future advances while securing your financial goals.

The future advance clause on an open-end mortgage outlines the lender's ability to provide additional funds at a later date. This clause is important because it helps homeowners access needed capital for various purposes without going through a complete refinancing process. By utilizing a Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances, borrowers can take full advantage of these future funding opportunities.

The acceleration clause in a mortgage instrument allows the mortgagee to advance the due date of the unpaid balance. This clause is crucial because it gives lenders the right to demand full payment if certain conditions are not met. Understanding how this clause works is essential for anyone considering a Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances.

The future advance clause allows lenders to make additional loans under the same mortgage agreement without needing to create a new document. This feature benefits borrowers by providing quick access to funds when unexpected expenses arise. For those interested in a Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances, understanding this clause is crucial. It ensures that you can secure future financing while leveraging the existing mortgage, leading to more manageable financial solutions.

A future advance clause open-end mortgage is a type of mortgage that permits the borrower to access additional funds after the initial loan has closed. This clause allows both the lender and borrower to benefit from a flexible financial arrangement. By including this in a Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances, borrowers can ensure they have access to ongoing financing without needing to renegotiate the terms each time.

Maryland primarily uses deeds of trust instead of traditional mortgages. In this structure, a third party, often a title company or bank, holds the deed of trust on behalf of the lender. This setup provides a streamlined process for foreclosures and allows quicker resolution in the event of default. Knowing this can help you better navigate a Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances.

A future advance clause allows a lender to make additional loans to a borrower under existing terms. For example, if a borrower takes out an initial loan of $100,000, a future advance clause might permit the lender to provide up to an additional $50,000 without the need for a new deed of trust. This flexibility can be great for funding renovations or other unforeseen expenses. Incorporating this clause in a Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances can simplify future borrowing.

The deed of trust securing future advances is a legal document that provides a lender with a claim against a property. It allows the lender to make additional loans against the property in the future without needing a new mortgage. This type of structure is beneficial for securing continuous financing while protecting the lender's interest. Understanding how this plays into the Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances can be essential for managing your loan options.

The future advance clause on an open end mortgage allows a lender to extend additional loans to the borrower without needing to create a new mortgage. This feature is particularly beneficial when working with a Maryland Loan Modification Agreement to the Open End of Trust Securing Future Advances, as it provides flexibility for future funding. Borrowers can access necessary funds in a streamlined manner without the hassle of additional paperwork. By incorporating this clause, both the lender and borrower can ensure smoother financial transactions as circumstances change.