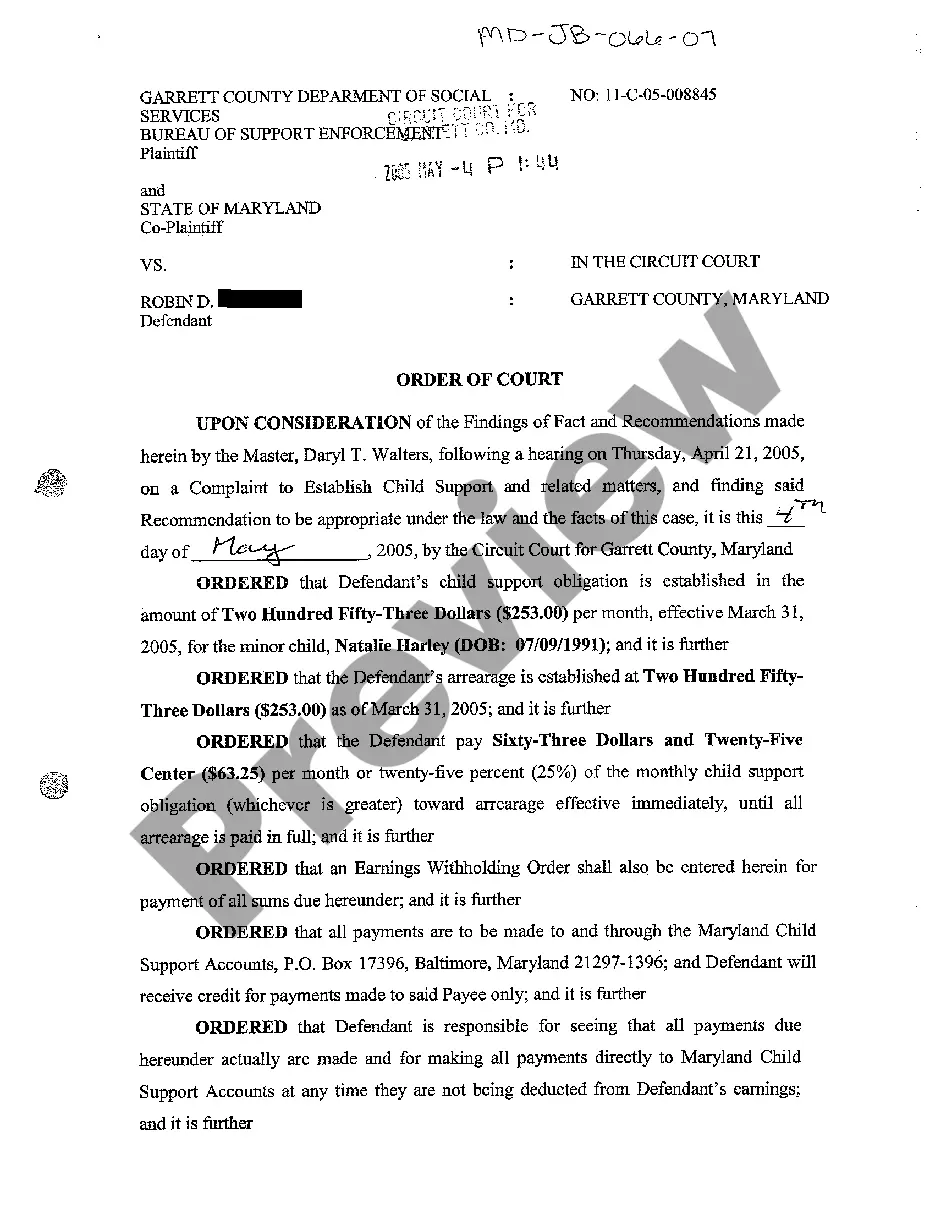

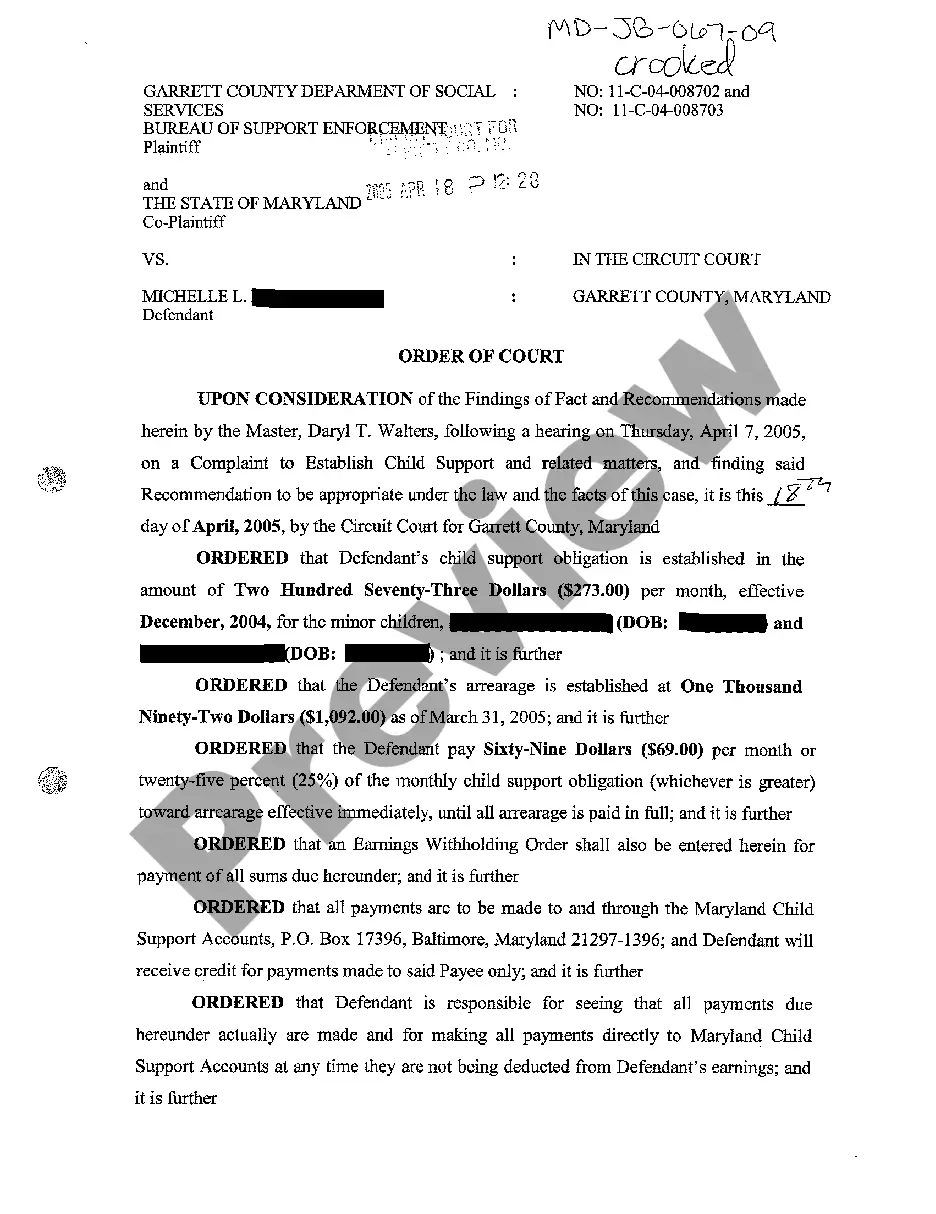

Maryland Order of Court Establishing Garnishment for the Purpose of Child Support

Description

How to fill out Maryland Order Of Court Establishing Garnishment For The Purpose Of Child Support?

You are invited to the most important legal documents repository, US Legal Forms.

Here, you will discover any template, including the Maryland Order of Court Establishing Garnishment for the Purpose of Child Support forms, and download them in any quantity you desire.

Create official documents within a few hours, rather than days or even weeks, without spending a fortune on an attorney.

If the sample meets your specifications, click Buy Now. To create an account, select a pricing plan. Use a credit or PayPal account to register. Download the document in your preferred format (Word or PDF). Print the document and fill it in with your or your business’s information. Once you’ve completed the Maryland Order of Court Establishing Garnishment for the Purpose of Child Support, send it to your attorney for validation. It’s an additional step but a crucial one to ensure that you’re fully protected. Register for US Legal Forms today and gain access to a vast collection of reusable templates.

- Obtain your state-specific template in just a few clicks and feel assured knowing it was created by our state-qualified attorneys.

- If you are already a registered user, simply Log In to your account and click Download next to the Maryland Order of Court Establishing Garnishment for the Purpose of Child Support you need.

- Since US Legal Forms operates online, you'll always have access to your saved documents, regardless of the device you're using.

- Access them in the My documents section.

- If you don't yet have an account, why delay? Follow our instructions below to get started.

- If this is a state-specific form, verify its validity in your state.

- Read the description (if available) to confirm if it’s the correct template.

Form popularity

FAQ

In determining a parent's income for child support purposes, courts typically look at the parent's gross income from all sources. They then subtract certain obligatory deductions, like income taxes, Social Security, health care, and mandatory union dues.

Under Maryland law, a person cannot agree with a spouse in order to avoid a court-ordered obligation to pay child support. Rather, there is a worksheet provided by the State of Maryland that allows you to input your own unique factors in order to estimate the amount the court will order you to pay.

In Alberta, the basic amount of child support that someone with an income of $150,000 would have to pay for one child is $1318.00 per month.

Contact the Maryland Child Support Enforcement Administration. Option #1: An Attorney or OCSE Can File a Motion to Compel Option #2: Request an Earnings Withholding Order. Option #3: File a More Serious Motion with the Court. Contact Pinder Plotkin for Help with Child Support.

Under Maryland law, child support continues until the minor child reaches the age of 18. It may be extended to age 19 if the child is still enrolled in high school.