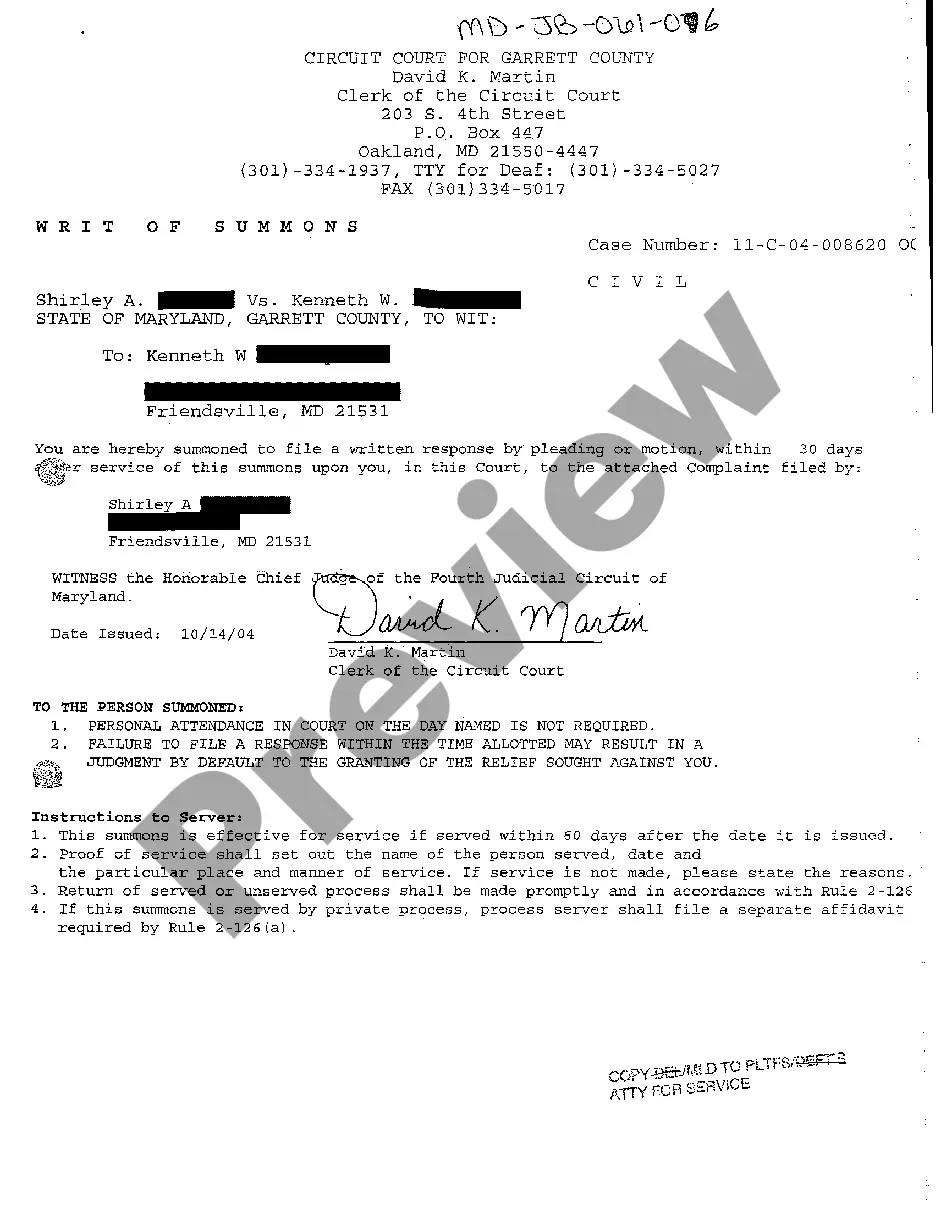

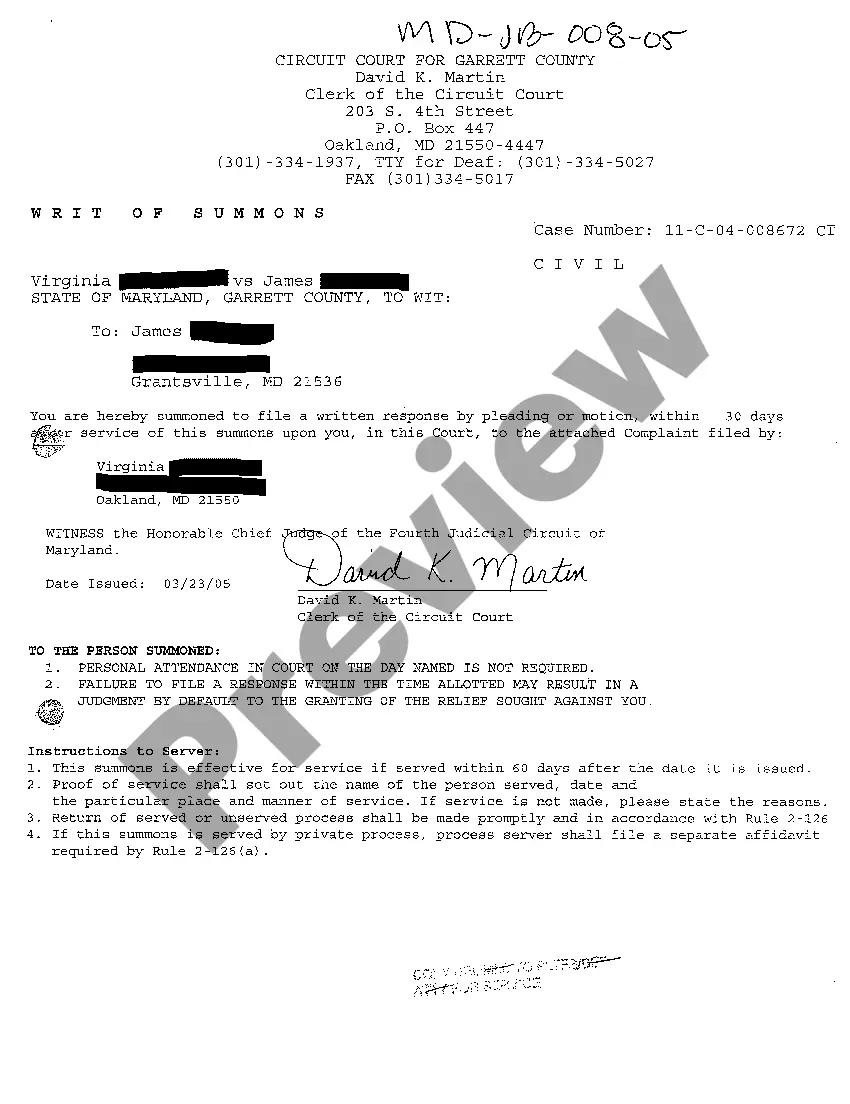

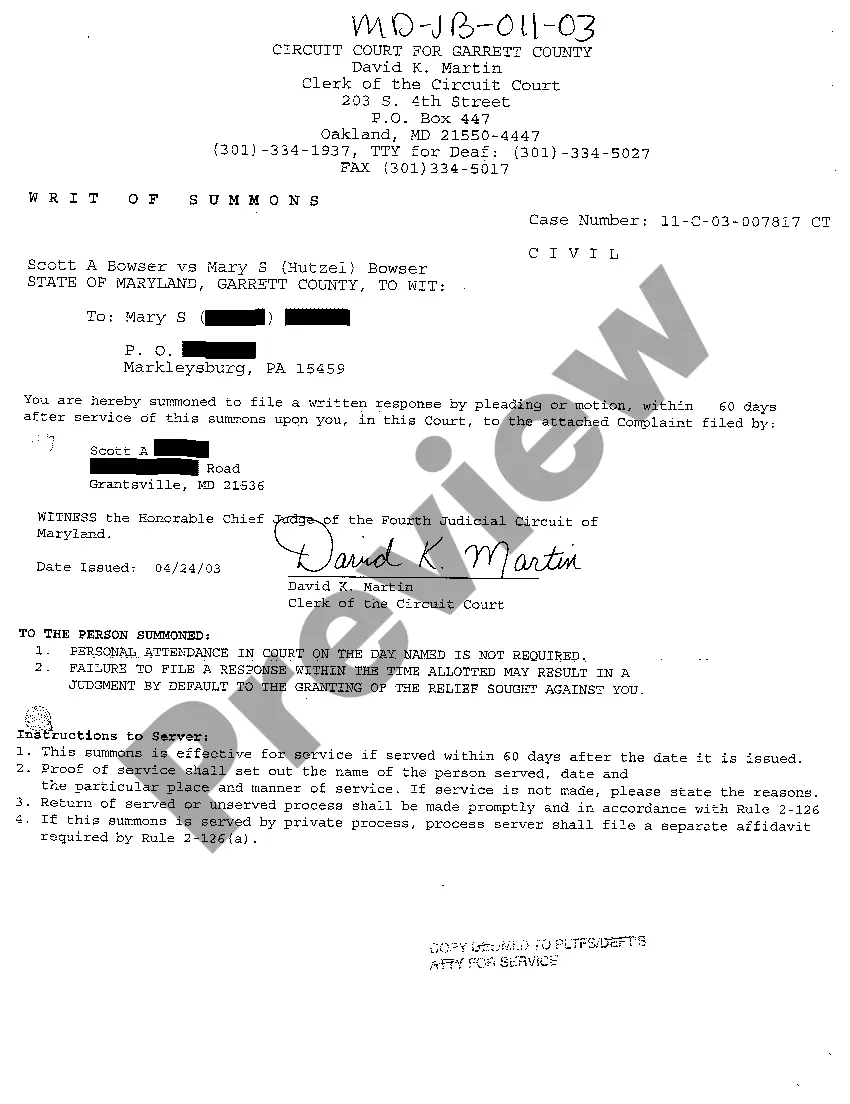

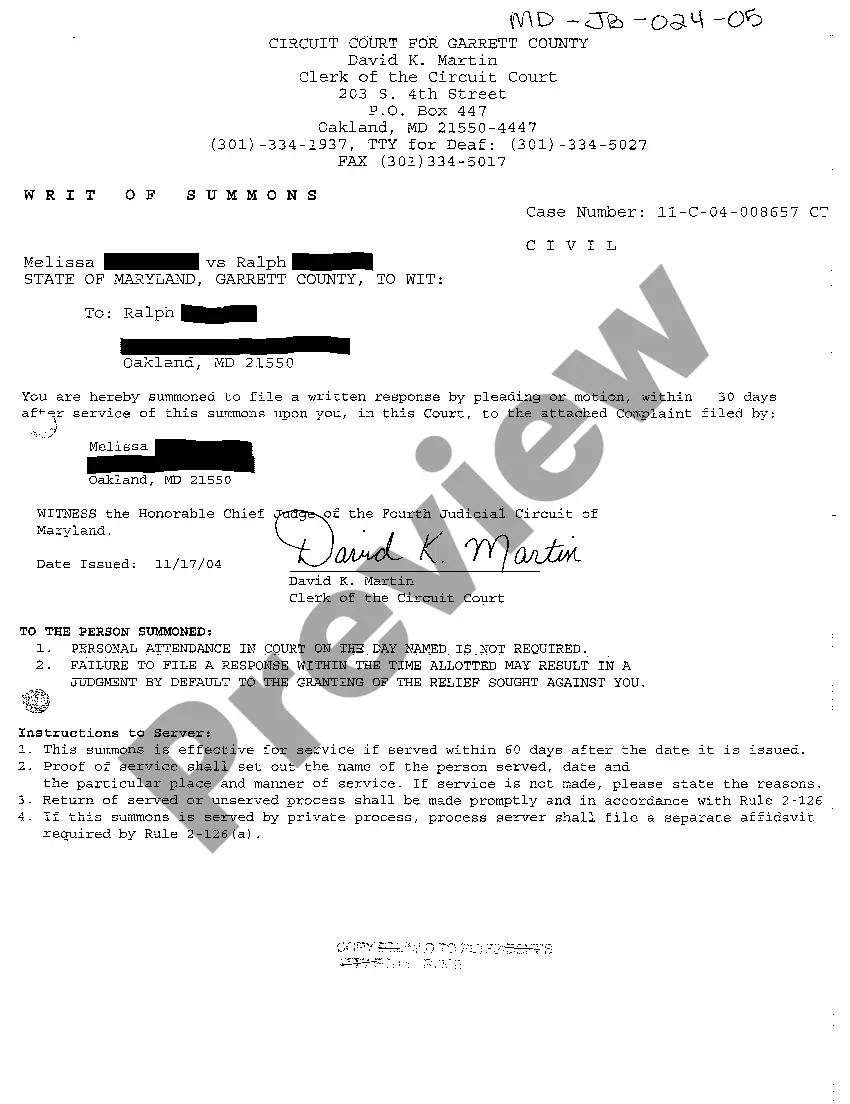

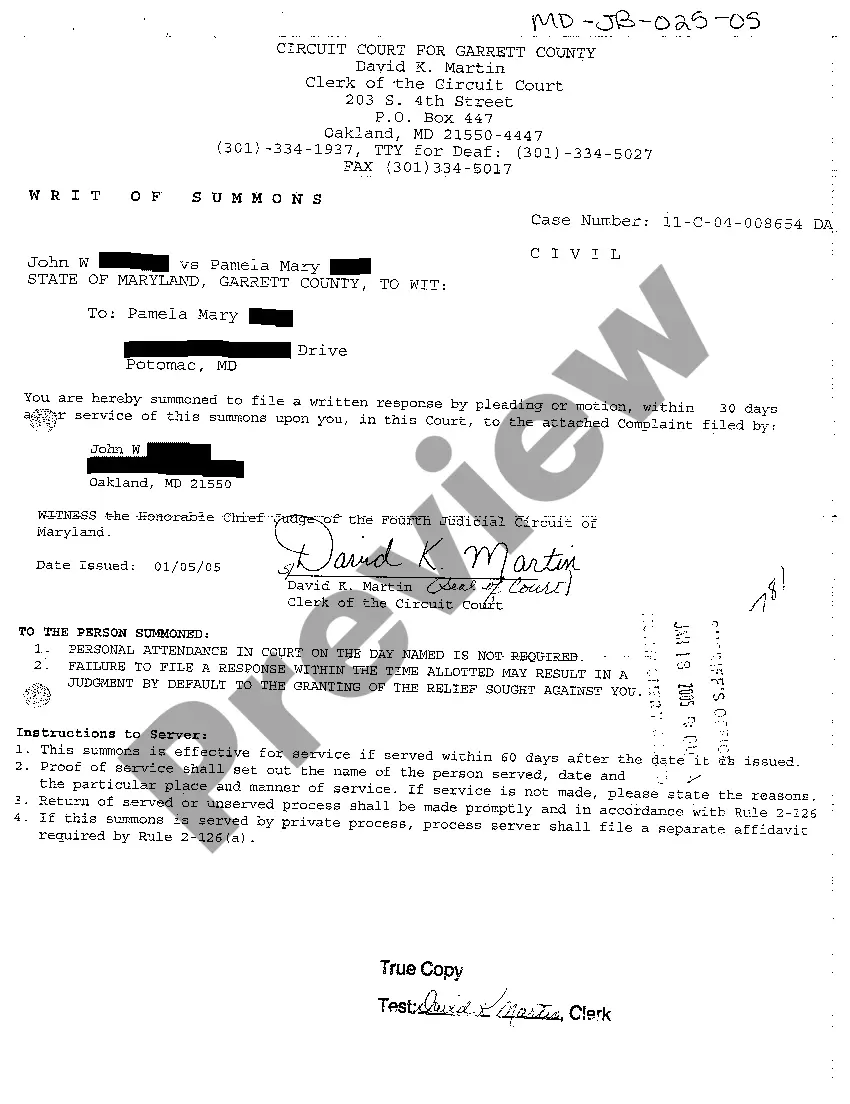

Maryland Writ of Summons

Description

How to fill out Maryland Writ Of Summons?

Greetings to the largest legal document collection, US Legal Forms. Here you can obtain any template including Maryland Writ of Summons samples and save them (as many as you desire). Create official documents within a few hours, rather than days or even weeks, without spending a fortune on a lawyer.

Obtain the state-specific example with just a few clicks and rest assured knowing that it was crafted by our experienced legal experts.

If you’re already a subscribed user, simply Log In to your account and click Download next to the Maryland Writ of Summons you require. Since US Legal Forms is online, you’ll always have availability to your downloaded templates, regardless of the device you are using. Access them in the My documents section.

Once you’ve finalized the Maryland Writ of Summons, send it to your legal advisor for verification. It’s an extra step but essential for ensuring you’re fully protected. Register for US Legal Forms today and gain access to a vast number of reusable templates.

- If you don't possess an account yet, what are you waiting for? Follow our guidelines below to begin.

- If this is a form specific to your state, verify its authenticity in your state.

- Review the description (if available) to determine if it’s the correct template.

- Explore additional material with the Preview option.

- If the template satisfies all of your requirements, simply click Buy Now.

- To create your account, choose a pricing plan.

- Use a credit card or PayPal account to register.

- Download the document in your preferred format (Word or PDF).

- Print the document and complete it with your/your enterprise’s information.

Form popularity

FAQ

What to Do If You Receive a Writ of Summons. As the defendant, after receiving a writ, you must then decide if you wish to contest the claim. If you choose not to contest the claim, the plaintiff can apply for a judgment without trial.Subsequent to your appearance, you must then serve your defence on the plaintiff.

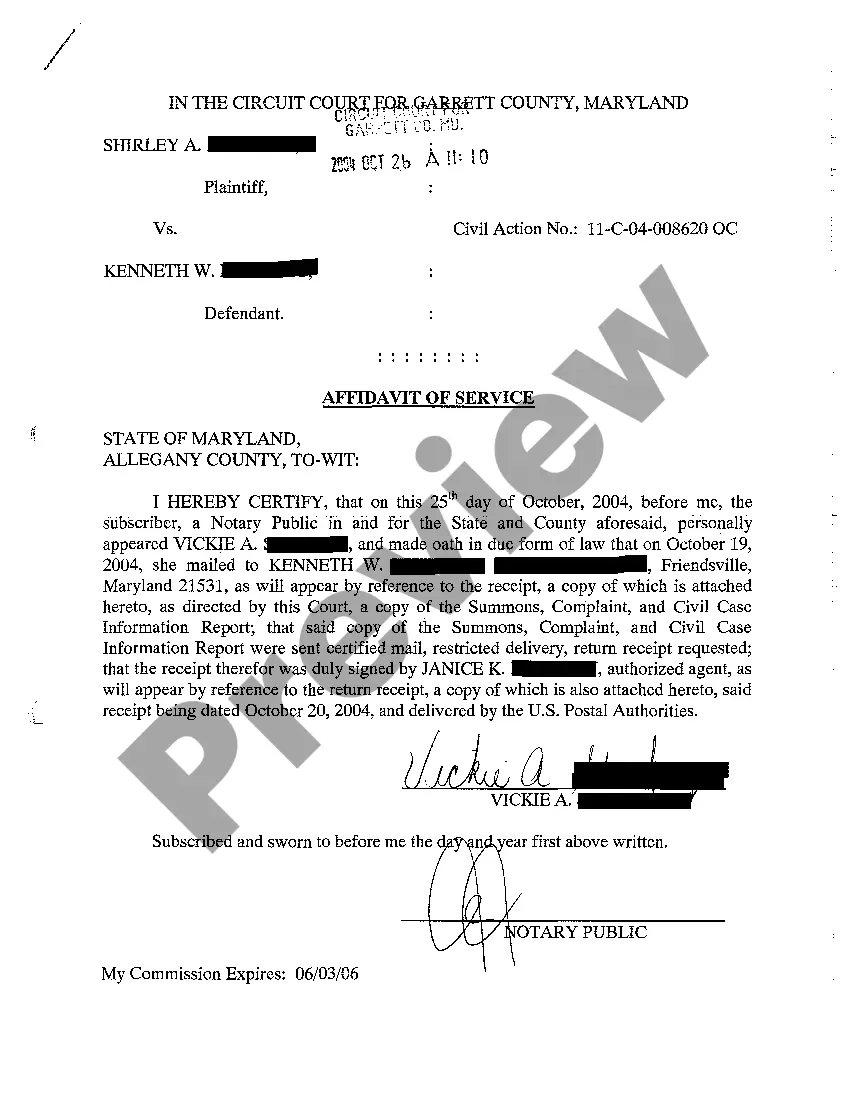

Once the court has accepted your complaint, a "Writ of Summons" will be issued and you must be sure the defendant is notified of the case through a legal procedure called service of process. The Writ of Summons has an expiration date, so pay close attention to the date by which you must have the defendant served.

In order to let the opposing party, or defendant, know you are filing a civil action, you must serve the opposing party with a copy of your complaint. This service is accomplished by issuing a summons through the Clerk's Office. The Court has a standard summons form.

Defend yourself in court; File a cross claim, counter claim or third party claim; Assert that the Writ of Summons was not served properly; or. Simply ignore the debt collection case.