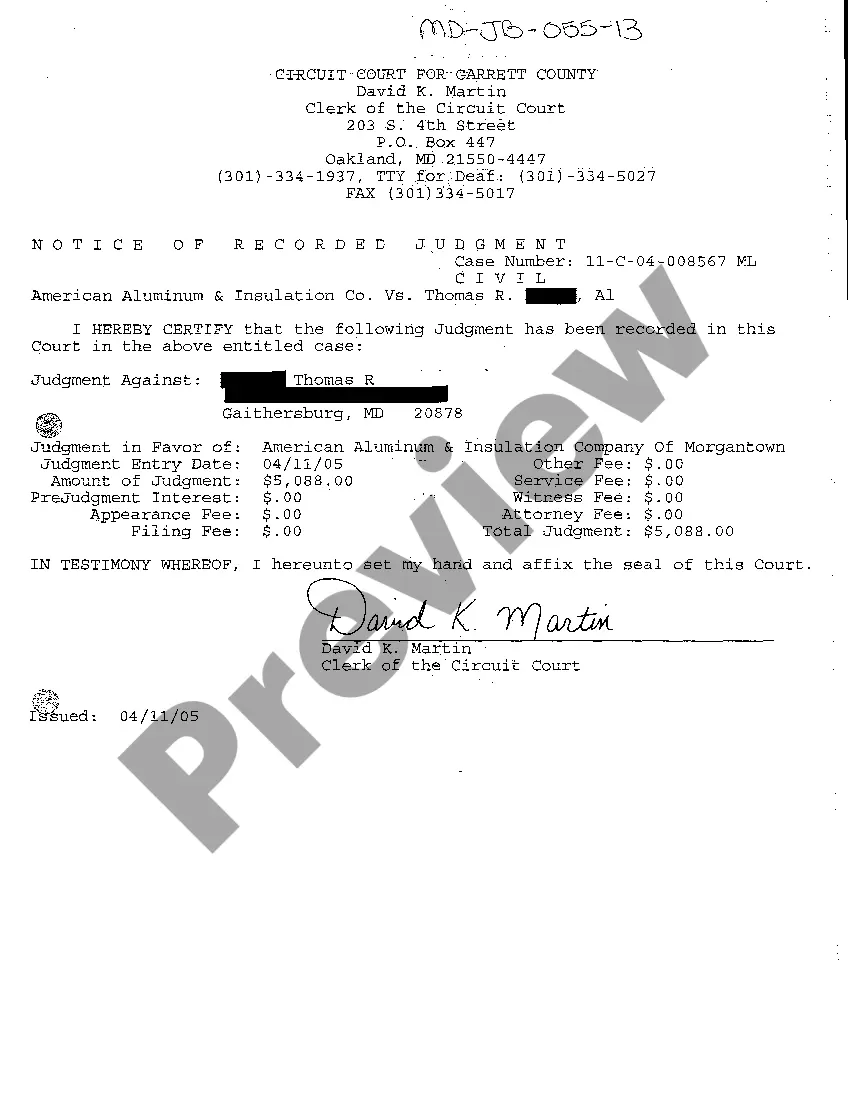

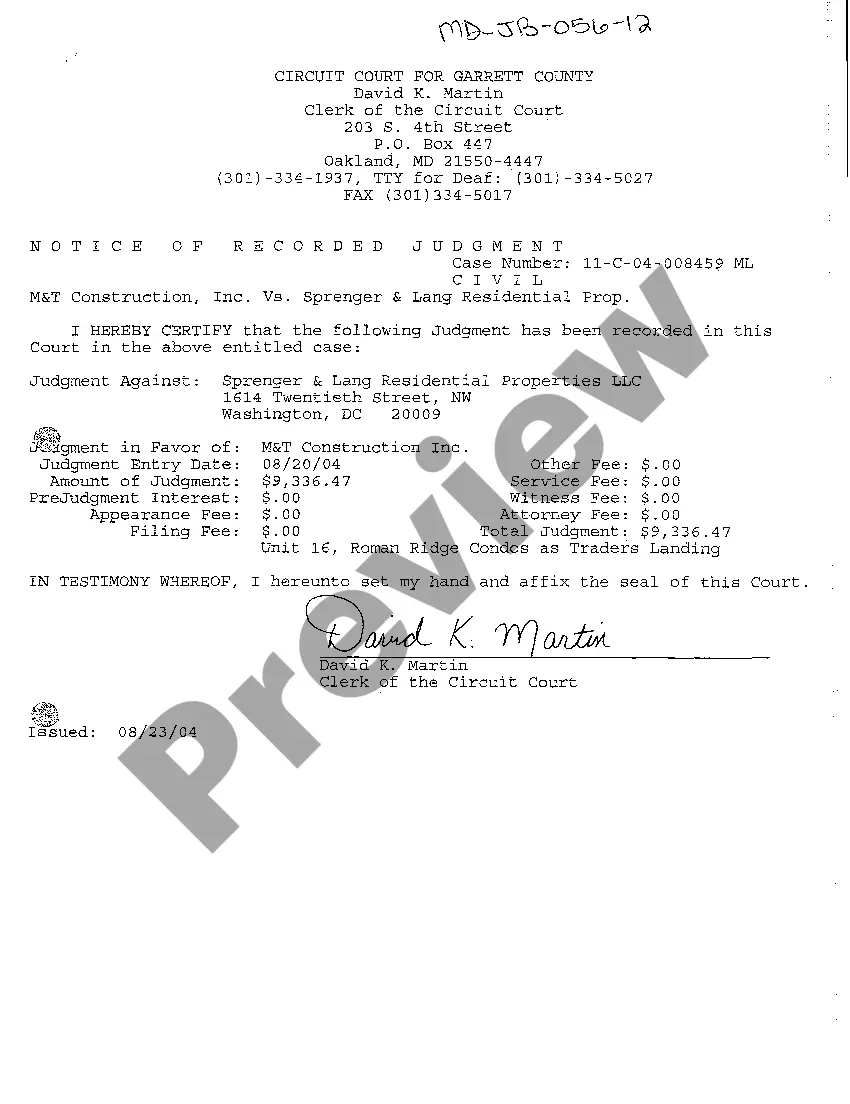

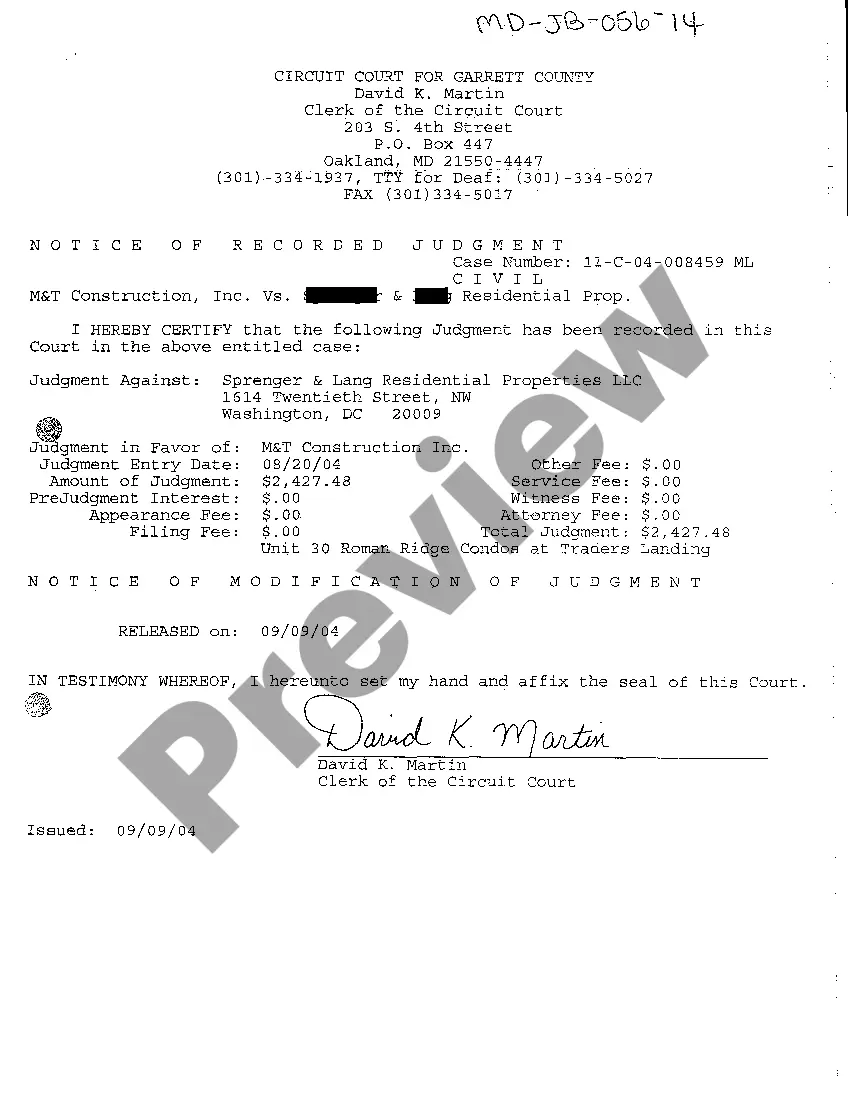

Maryland Notice of Recorded Judgment

Description

How to fill out Maryland Notice Of Recorded Judgment?

You are invited to the most important legal documents library, US Legal Forms.

Here you can obtain any template such as Maryland Notice of Recorded Judgment forms and retrieve them (as many of them as you desire).

Prepare official documents in merely a few hours, rather than days or weeks, without paying a fortune for a lawyer.

If the example meets your needs, just click Buy Now. To create an account, select a pricing option. Use a credit card or PayPal to sign up. Save the template in your preferred format (Word or PDF). Print the document and complete it with your or your business’s details. Once you’ve completed the Maryland Notice of Recorded Judgment, send it to your attorney for approval. It’s an extra step but an essential one to ensure you’re fully protected. Join US Legal Forms today and access a vast collection of reusable samples.

- Obtain the state-specific form in a few clicks and feel assured knowing it was created by our skilled attorneys.

- If you’re already a registered user, simply Log In to your account and click Download next to the Maryland Notice of Recorded Judgment you need.

- Since US Legal Forms is online, you will always have access to your downloaded files, regardless of the device you’re using.

- Locate them in the My documents section.

- If you don't have an account yet, what are you waiting for.

- Follow our instructions provided below to begin.

- If this is a document specific to your state, verify its legality in your state.

- Check the description (if available) to determine if it’s the appropriate sample.

Form popularity

FAQ

Collecting on a judgment in Maryland involves multiple steps, starting with obtaining a Maryland Notice of Recorded Judgment. This notice gives you the legal backing to pursue the debtor's assets. Once you have the notice, you can explore various methods, such as wage garnishment or bank levies. Each method has specific legal requirements, so consider using platforms like US Legal Forms for guidance through the collection process.

To file a judgment lien in Maryland, you must first obtain a Maryland Notice of Recorded Judgment from the court where you received your judgment. This document serves as proof of your judgment. After obtaining it, you will need to file the notice with the local land records office in the county where the debtor owns property. This process ensures that your claim is legally recognized and secures your position regarding the debtor's assets.

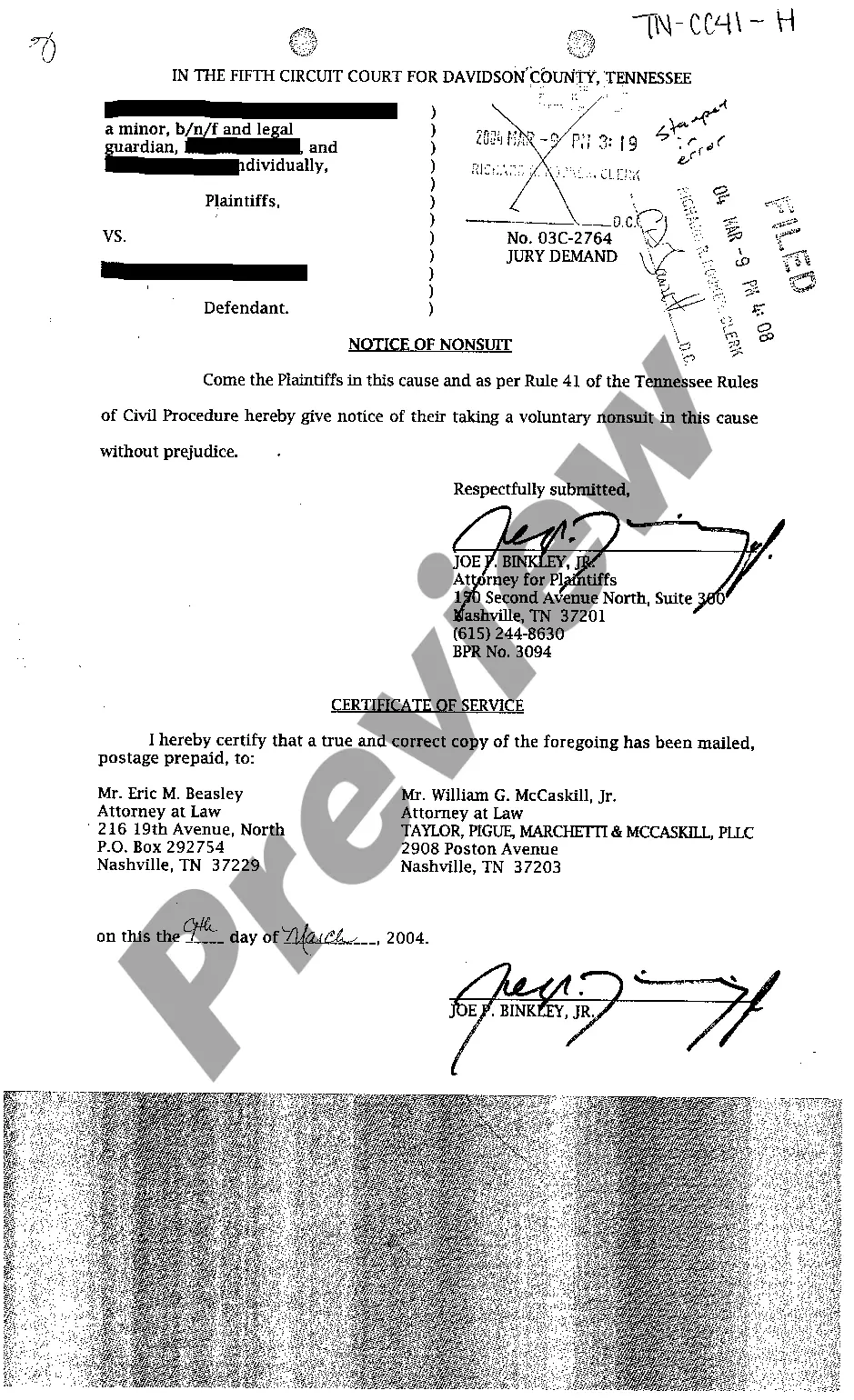

A judgment is a court order that is the decision in a lawsuit. If a judgment is entered against you, a debt collector will have stronger tools, like garnishment, to collect the debt. A judgment is an official result of a lawsuit in court.Ignore the lawsuit, or.

In Maryland, a judgment is only valid for 12 years. If you have not been able to collect your judgment within that time, you will have to renew the judgment to continue your collection efforts.

A lien is a right that prohibits the debtor from transferring their interest in a property until a debt is satisfied. The lien may be attached to any property or properties located within Maryland. Once filed, a lien will remain in force for 12 years unless removed by you after receiving payment from the debtor.

A judgment lien is created when someone wins a lawsuit against you and records the judgment against your property.It's created when someone wins a lawsuit against you and then records the judgment against your property.

In most states, the judgment creditorthe winner of the lawsuitmust record the lien via a county or state filing. In a few states, if a court enters a judgment against a debtor, a lien is automatically created on any real estate the debtor owns in that county.