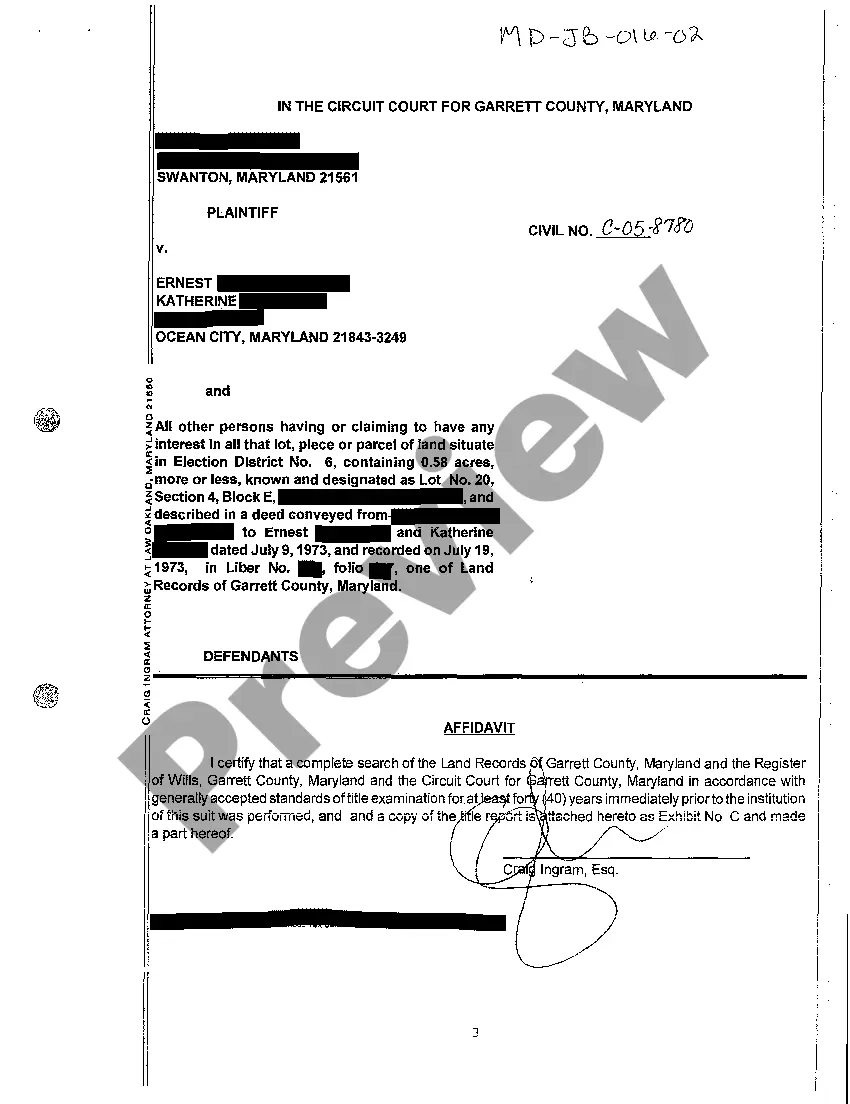

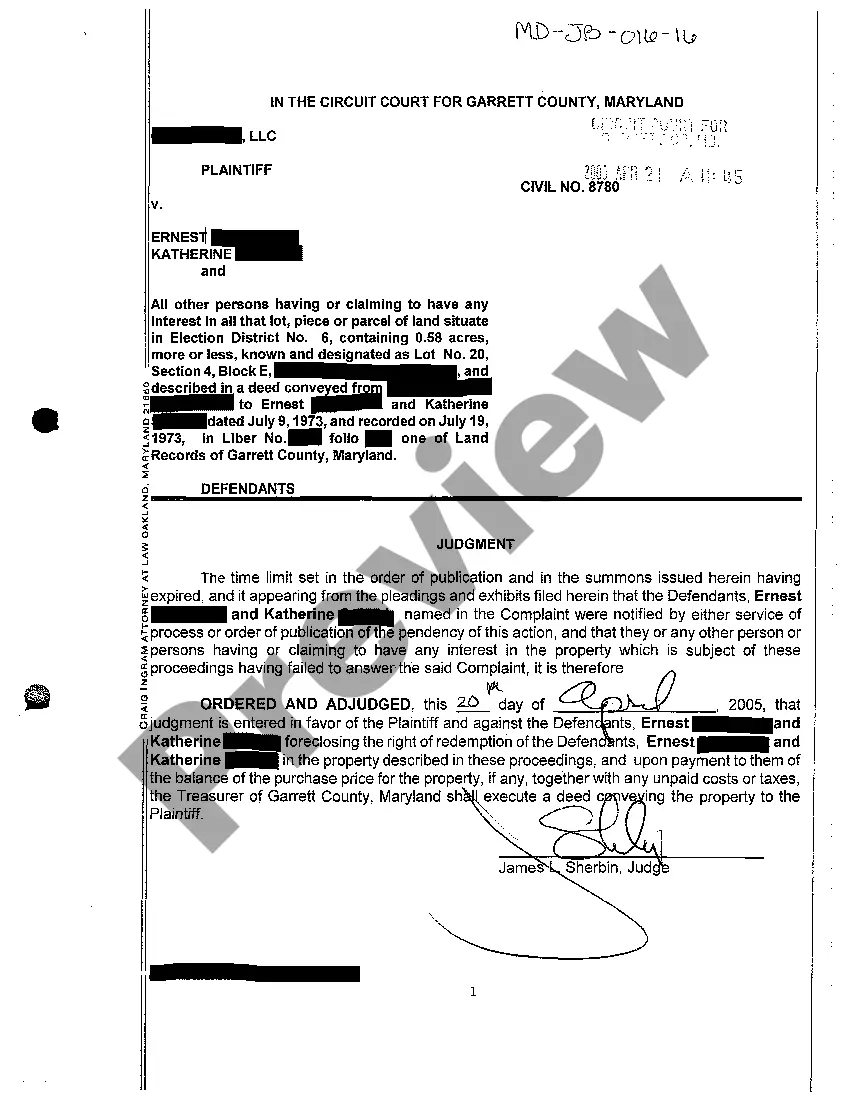

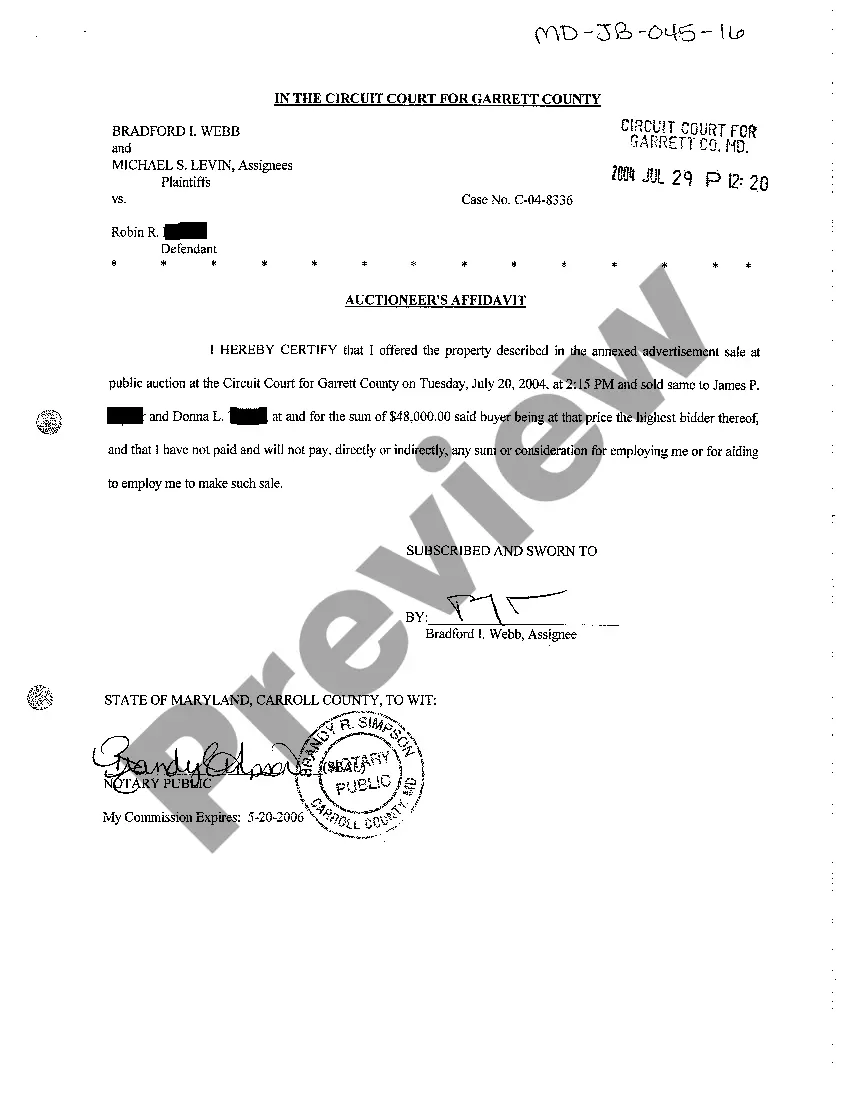

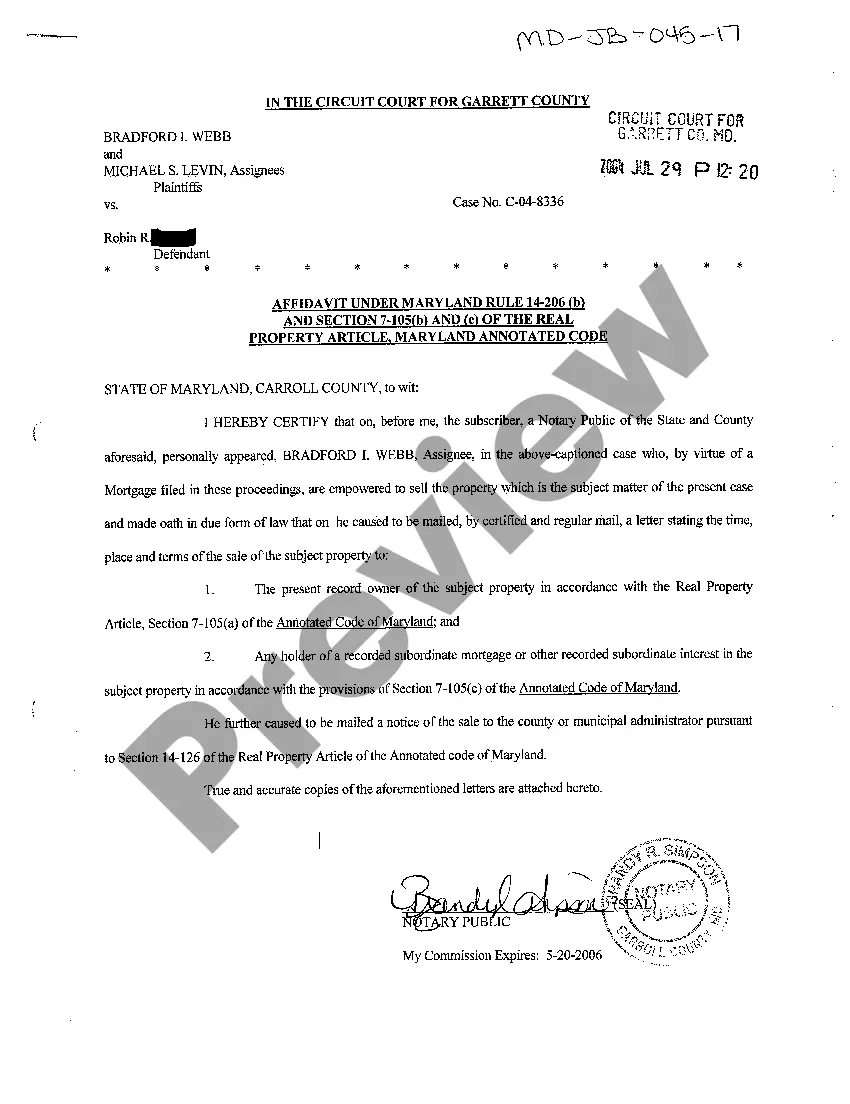

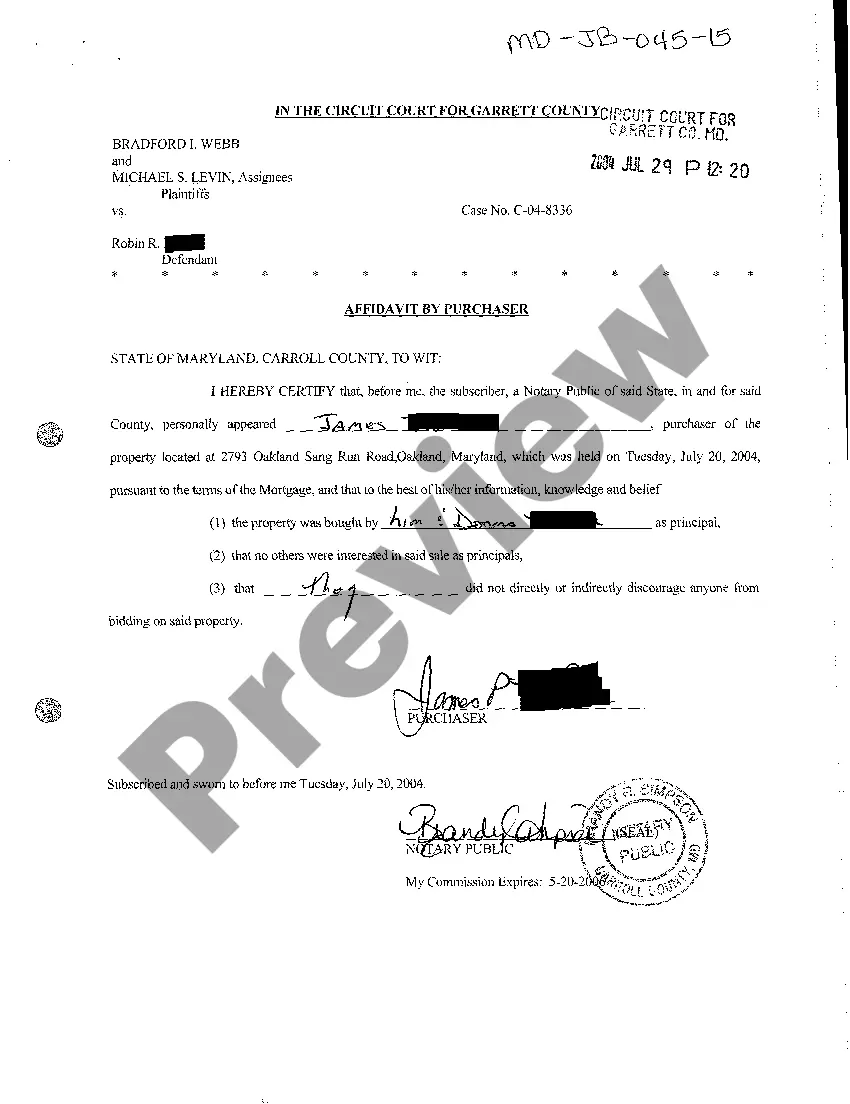

Maryland Affidavit by Purchaser

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

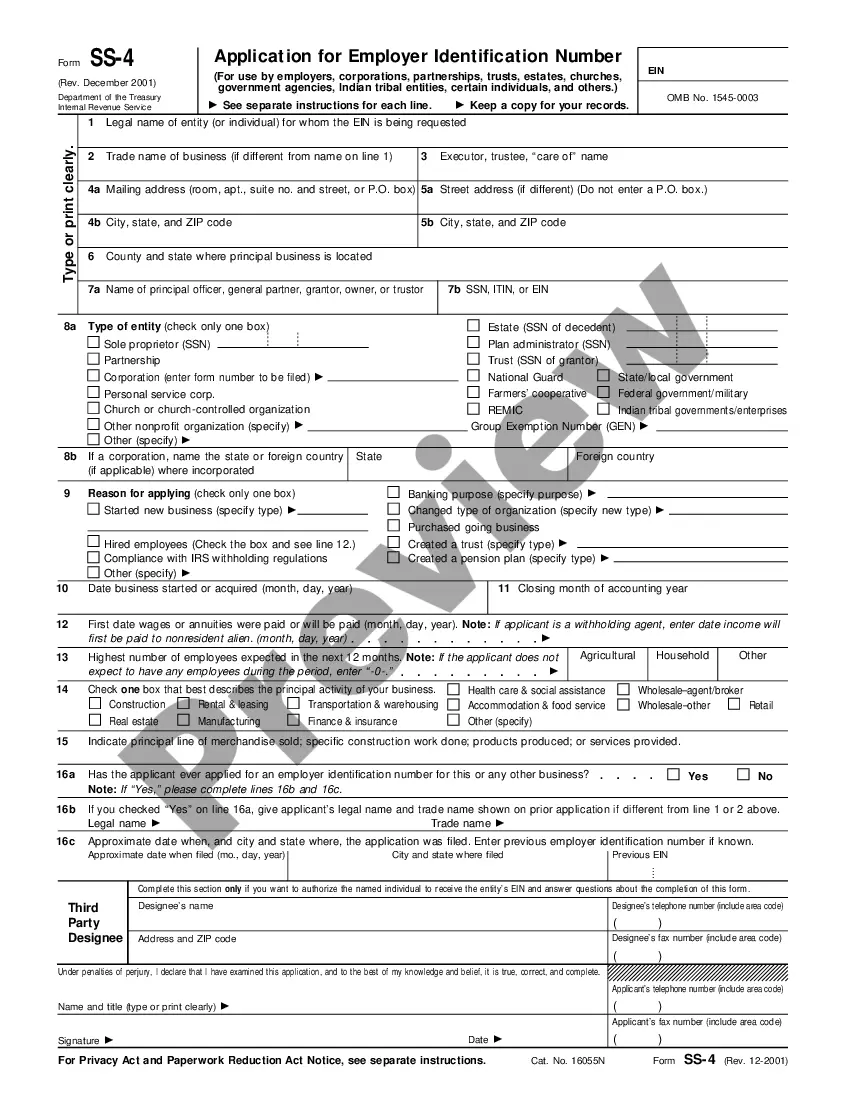

Looking for another form?

How to fill out Maryland Affidavit By Purchaser?

Welcome to the premier library of legal documents, US Legal Forms. Here you can discover any template, such as the Maryland Affidavit by Purchaser, and save as many copies as you desire.

Prepare official paperwork in hours rather than days or weeks, without the need to spend a fortune on an attorney. Obtain the state-specific template with just a few clicks and feel confident knowing it was crafted by our licensed attorneys.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Affidavit by Purchaser you require. Since US Legal Forms is an online platform, you’ll typically retain access to your downloaded documents, regardless of the device you’re using. Locate them in the My documents section.

Once you’ve finalized the Maryland Affidavit by Purchaser, send it to your lawyer for verification. It’s an extra step but a crucial one in ensuring you’re fully protected. Join US Legal Forms now and gain access to a vast collection of reusable templates.

- If you don't yet have an account, what are you waiting for? Review our instructions below to get started.

- If this is a state-specific template, verify its validity in the state where you reside.

- Examine the description (if available) to ensure it’s the correct template.

- View more information using the Preview feature.

- If the document fits your requirements, click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account for registration.

- Save the document in your preferred format (Word or PDF).

- Print the document and complete it with your or your business’s details.

Form popularity

FAQ

MW507. Employee's Maryland Withholding Exemption Certificate. Form used by individuals to direct their employer to withhold Maryland income tax from their pay.

Maryland Employer Report of Income Withheld (MW506)

You may claim exemption from Maryland income taxes if your federal income will not exceed $10,400, whether or not you are claimed as a dependent. For more information and forms, visit the university Tax Office website.The above information comes from the University Tax Office.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each. You can use the Two Earners/Multiple Jobs worksheet on page 2 to help you calculate this.

States such as Maryland are withholding a portion of real estate proceeds from out-of-state residents, to ensure sellers pay capital gains tax to Maryland on top of the seller's home state and the federal government.

Maryland State Personal Exemption: Maryland taxpayers can claim a state personal exemption worth $3,200. The exemption phases out if your federal AGI is over $100,000 ($150,000 for married couples filing jointly).

The State of Maryland has a form that includes both the federal and state withholdings on the same form. Your current certificate remains in effect until you change it. The absence of a completed form results in being taxed at the highest rate and undeliverable paychecks.

If you claim exemption under the SCRA enter your state of domicile (legal residence) on Line 5; enter EXEMPT in the box to the right on Line 5; and attach a copy of your spousal military identification card to Form MW507. Social Security numbers must be included.