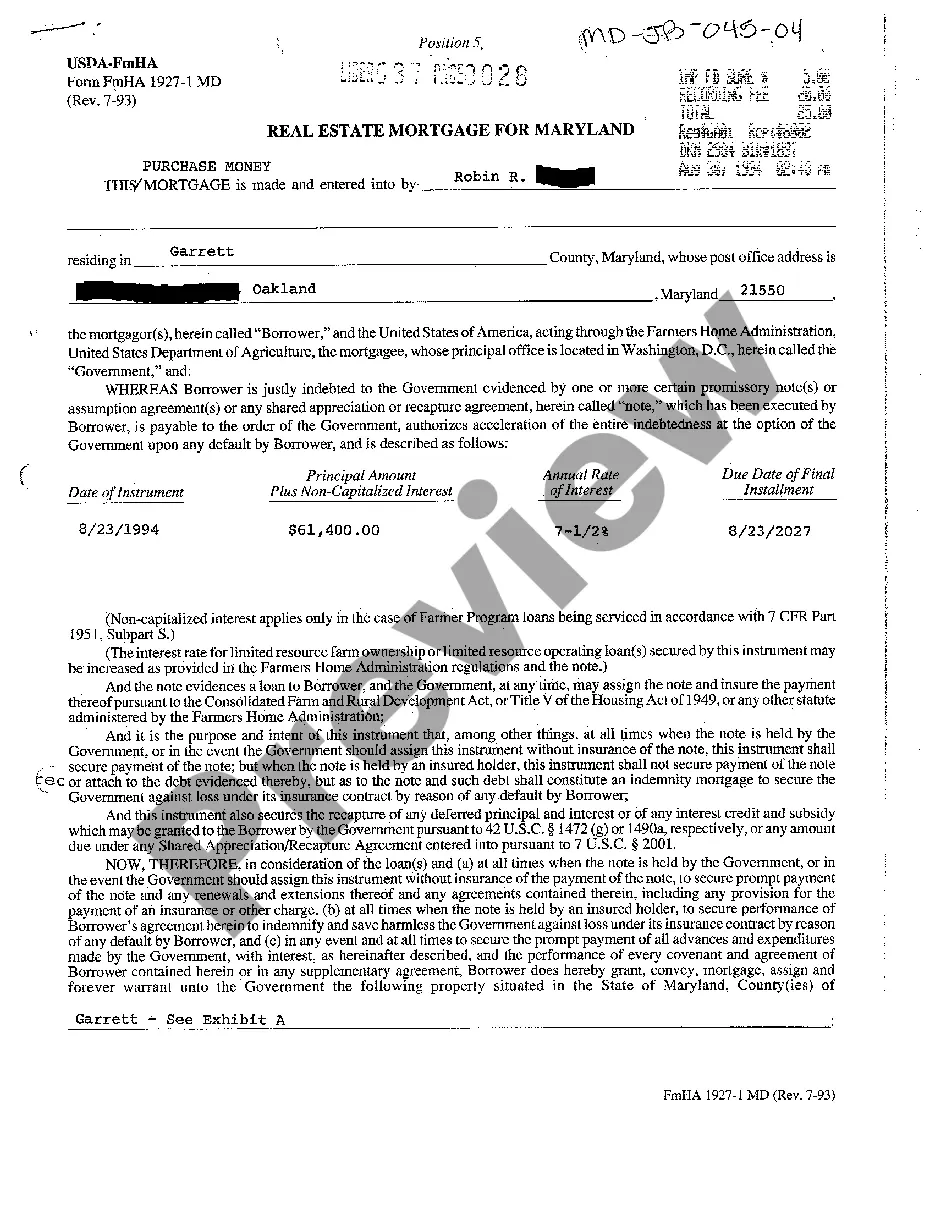

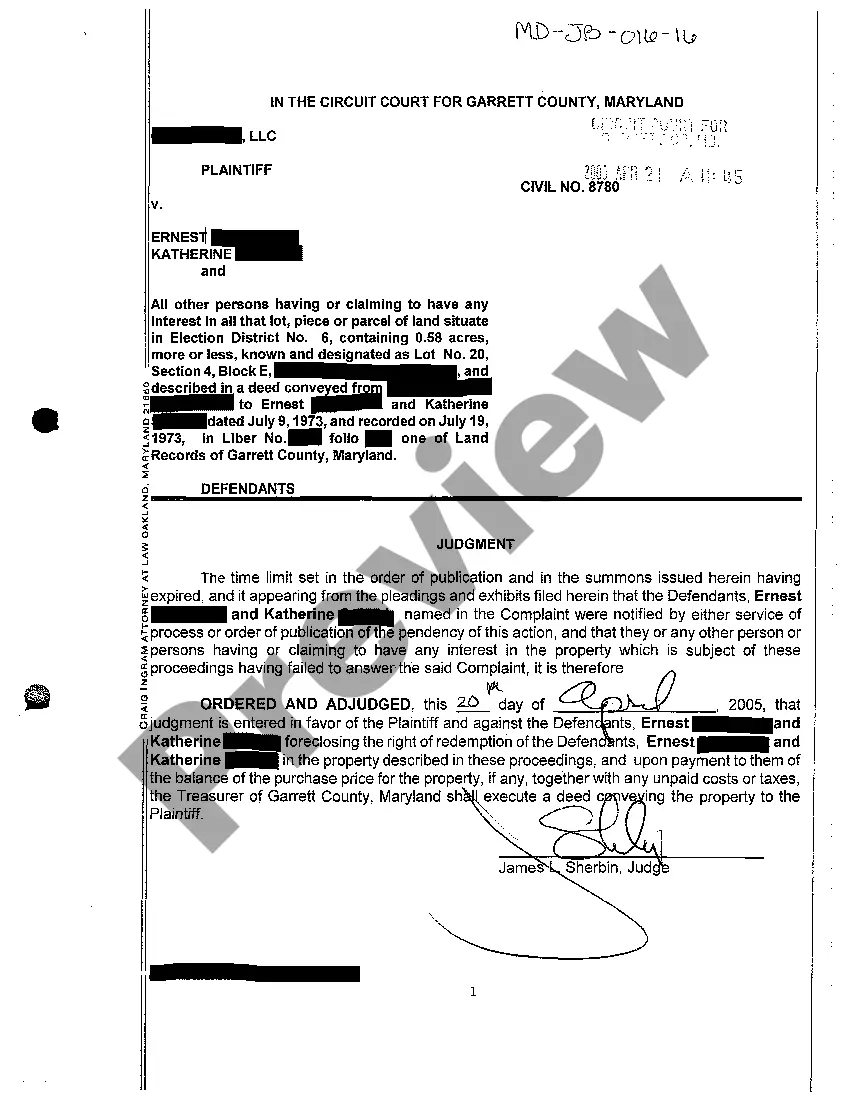

Maryland Judgment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Judgment?

You are invited to the largest legal documentation library, US Legal Forms. Here you can discover any template such as Maryland Judgment templates and preserve them (as many as you desire). Prepare official documents in a few hours, rather than days or weeks, without spending a fortune on a lawyer or attorney.

Obtain your state-specific example with just a few clicks and be assured that it was created by our certified legal professionals.

If you’re already a subscribed user, simply Log In to your account and then click Download beside the Maryland Judgment you need. Since US Legal Forms is an online service, you’ll always have access to your saved templates, regardless of the device you’re using. View them in the My documents section.

Print the document and complete it with your or your business’s information. Once you’ve finished the Maryland Judgment, forward it to your attorney for verification. It’s an additional step, but a crucial one to ensure you’re fully protected. Join US Legal Forms today and gain access to a vast array of reusable samples.

- If you don't have an account yet, what are you waiting for? Review our instructions listed below to get started.

- If this is a state-specific form, verify its applicability in the state you reside in.

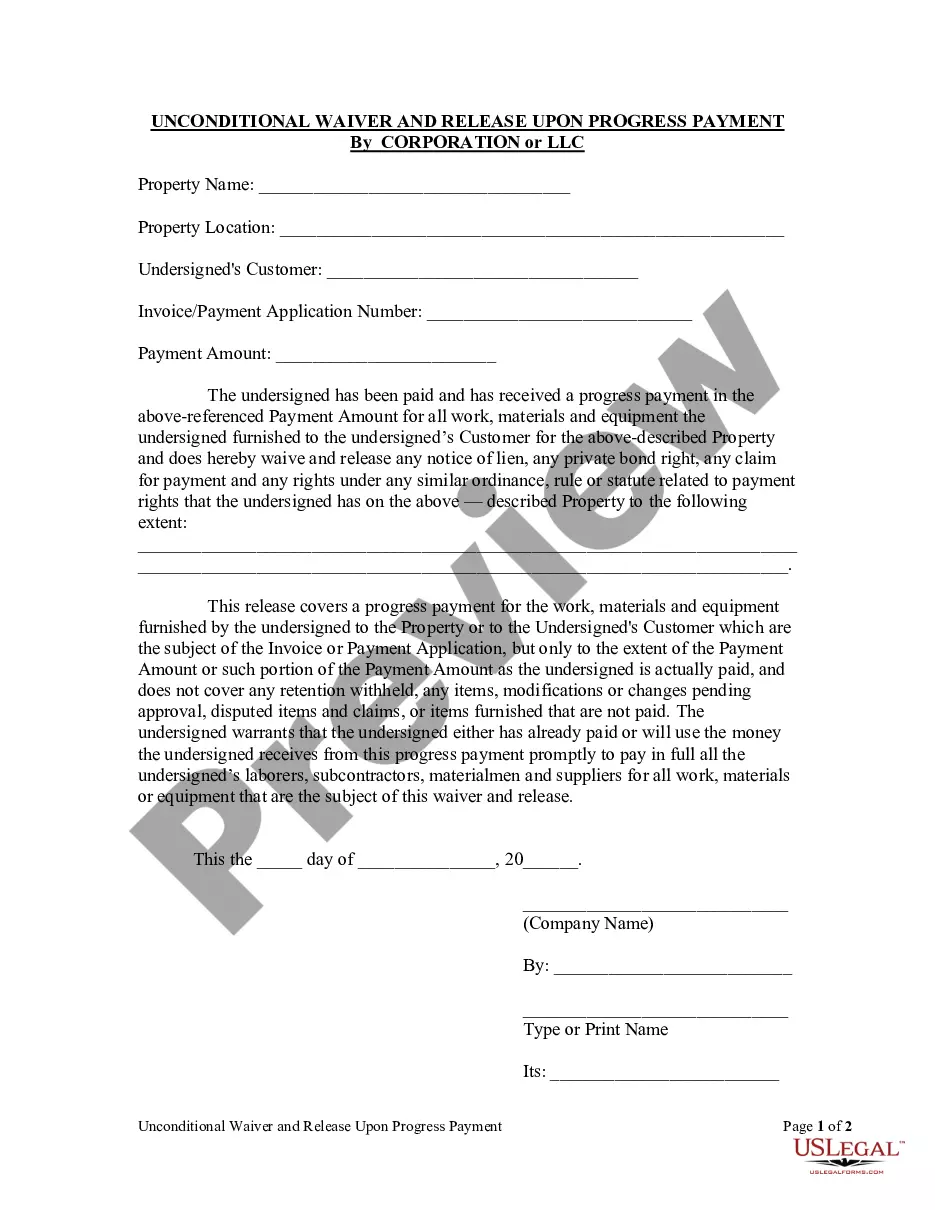

- Check the description (if available) to determine if it’s the correct template.

- Explore additional content using the Preview option.

- If the document fulfills all of your requirements, simply click Buy Now.

- To establish an account, select a pricing plan.

- Utilize a credit card or PayPal account to register.

- Save the document in your preferred format (Word or PDF).

Form popularity

FAQ

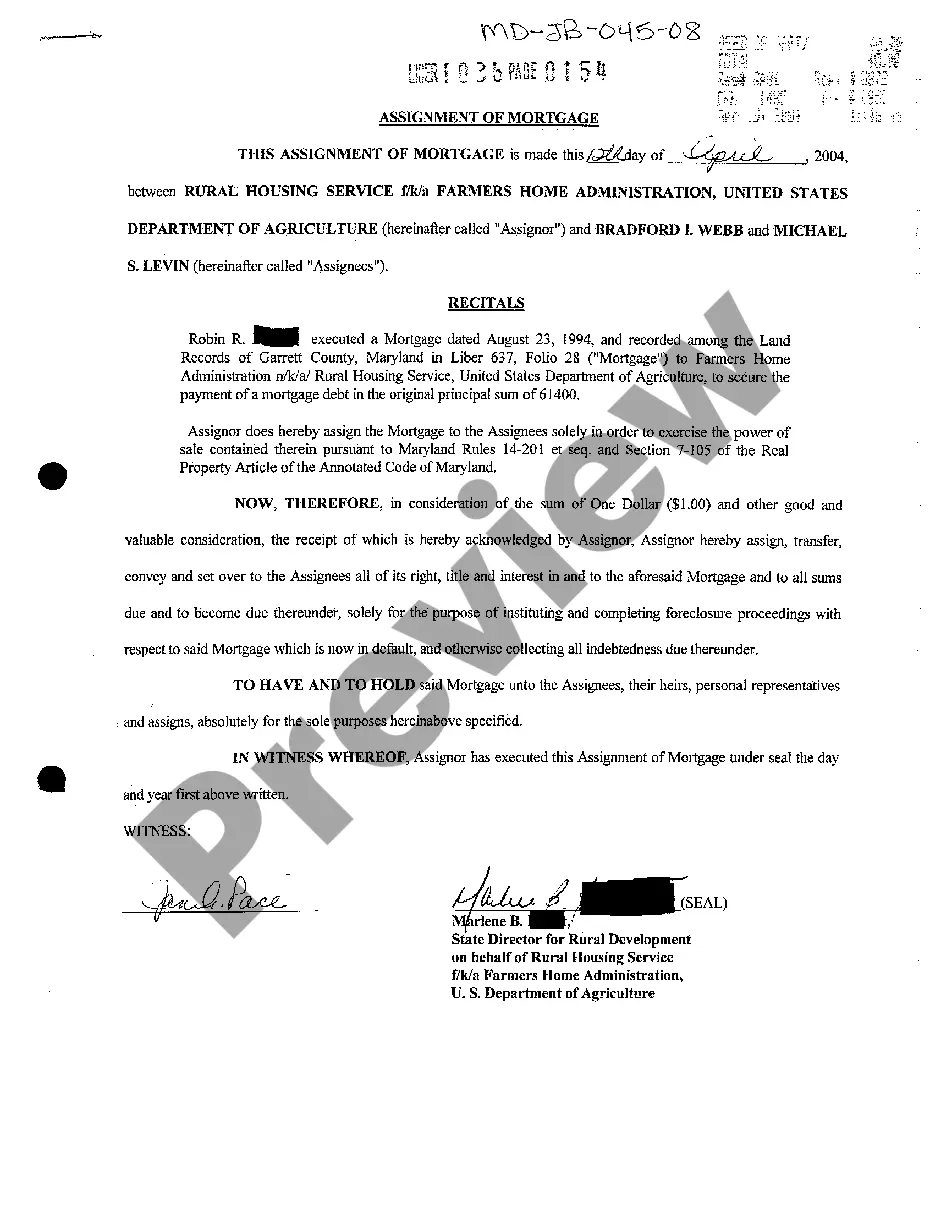

To collect a judgment in Maryland, start with a clear understanding of your rights and the debtor’s obligations. You may initiate collection through methods like bank levies or property liens after obtaining a Maryland Judgment. If these tactics do not yield results, you might need legal assistance to pursue additional routes. Accessing resources on the US Legal Forms platform can enhance your collection strategy.

To look up a judgment in Maryland, you can search the Maryland Judiciary Case Search online. This resource allows you to access information about civil judgments filed against individuals or businesses. Simply enter the necessary details, and you will see any relevant Maryland Judgments. This search tool is user-friendly and provides up-to-date information.

In Maryland, a judgment typically lasts for 12 years from the date it is obtained unless it is renewed. If you have a Maryland Judgment, you can renew it before it expires to maintain your rights to collect the debt. This renewal helps ensure that your efforts to collect do not go to waste. Staying informed about the duration of judgments is crucial for effective legal action.

In Maryland, a judgment typically lasts for 12 years from the date it is entered. This means you have a substantial period to enforce the judgment and collect your debts. If necessary, you can renew the judgment to extend its validity for another 12 years. To manage this effectively, consider leveraging the tools offered by US Legal Forms to keep track of your Maryland Judgment and ensure you take the appropriate actions on time.

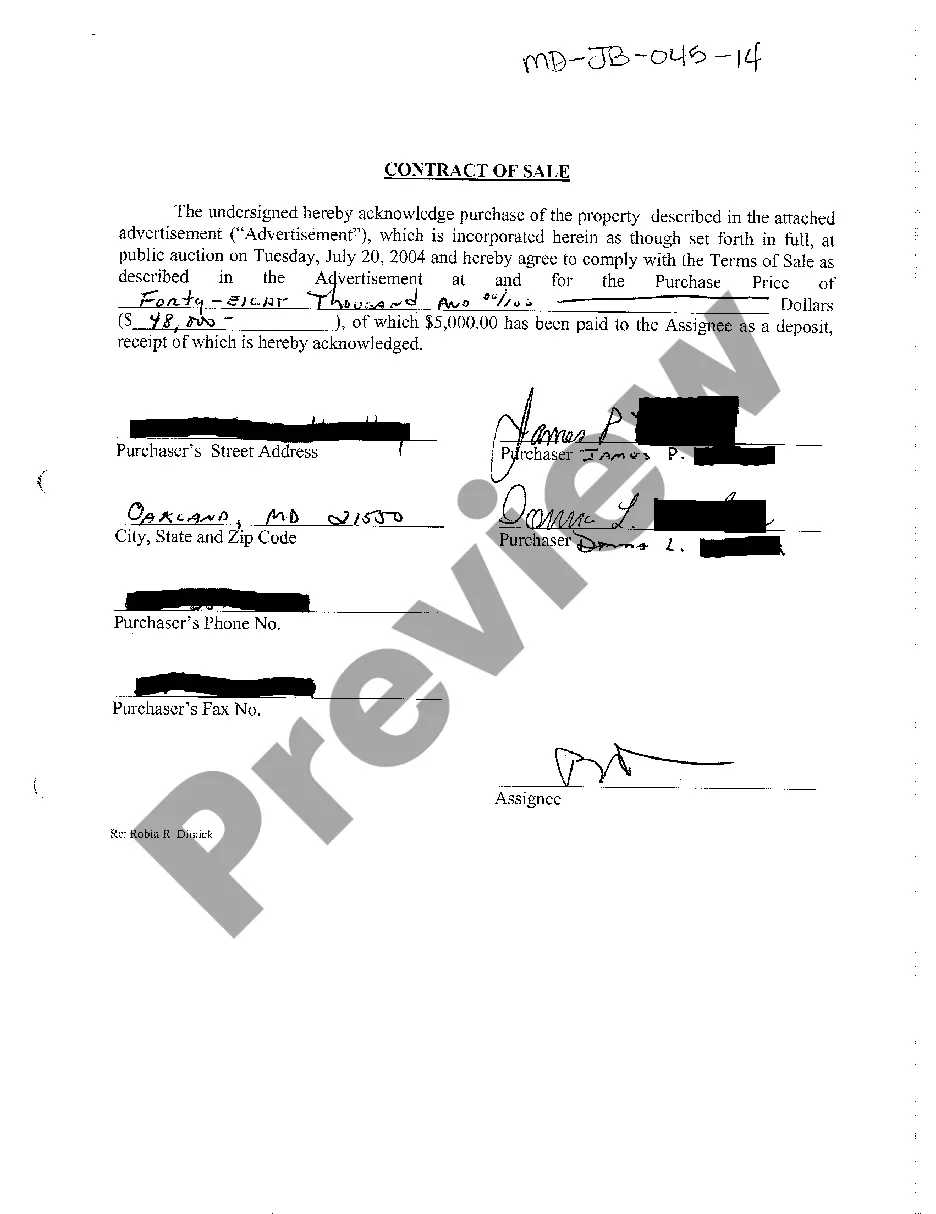

Garnishing the other person's wages; Garnishing the other person's bank account; or. Seizing the other person's personal property or real estate.

In California, a judgment lien can be attached to the debtor's real estate -- meaning a house, condo, land, or similar kind of property interest -- or to the debtor's personal property -- things like jewelry, art, antiques, and other valuables. (In some states, judgment liens can be attached to personal property only.)

In many situations, one of the best ways to collect a judgment after winning a case is to put a lien on the debtor's property. This gives you a claim to the property and, in some cases, the property will be sold at public auction in order to satisfy the debt that is owed.

A lien is a right that prohibits the debtor from transferring their interest in a property until a debt is satisfied. The lien may be attached to any property or properties located within Maryland. Once filed, a lien will remain in force for 12 years unless removed by you after receiving payment from the debtor.

In Maryland, a judgment is only valid for 12 years. If you have not been able to collect your judgment within that time, you will have to renew the judgment to continue your collection efforts.