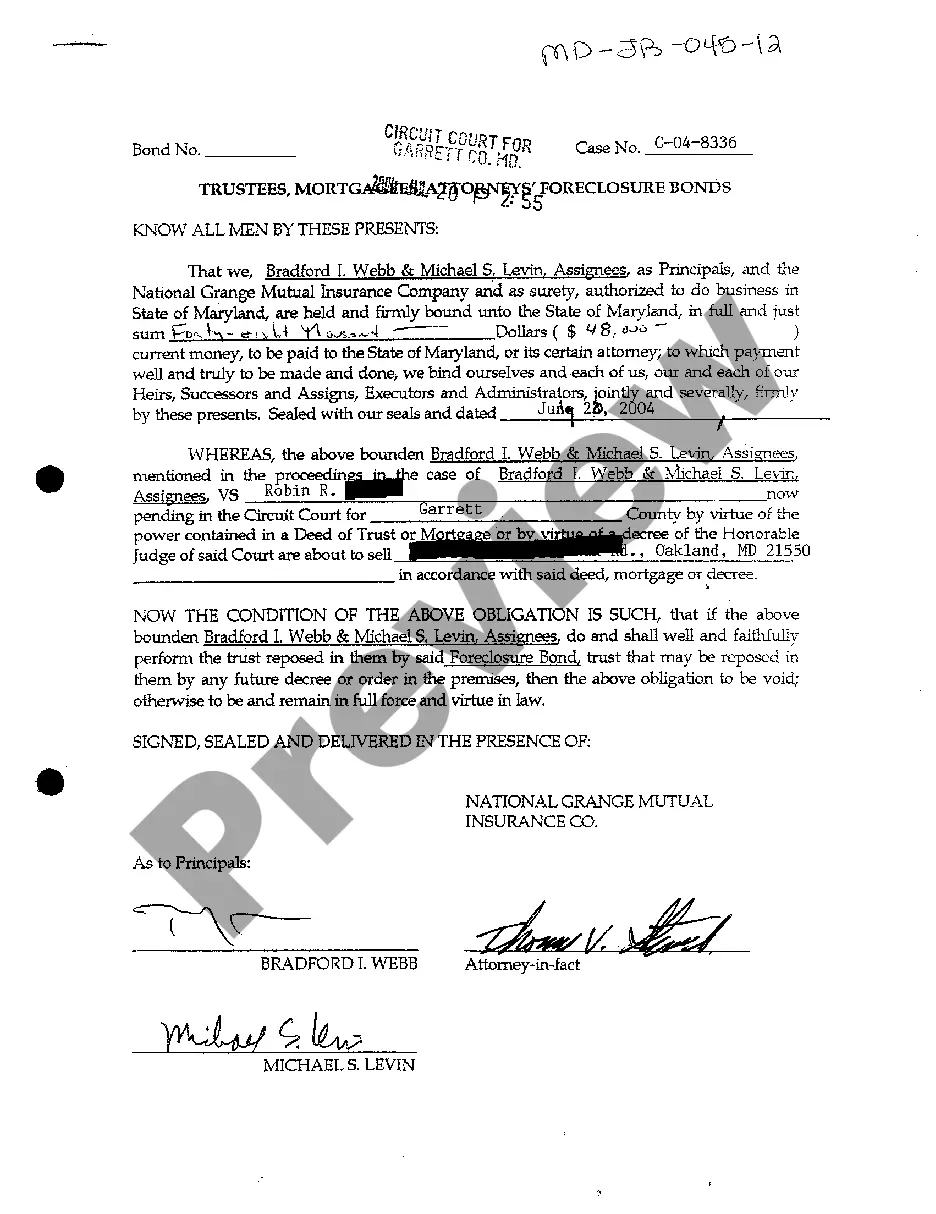

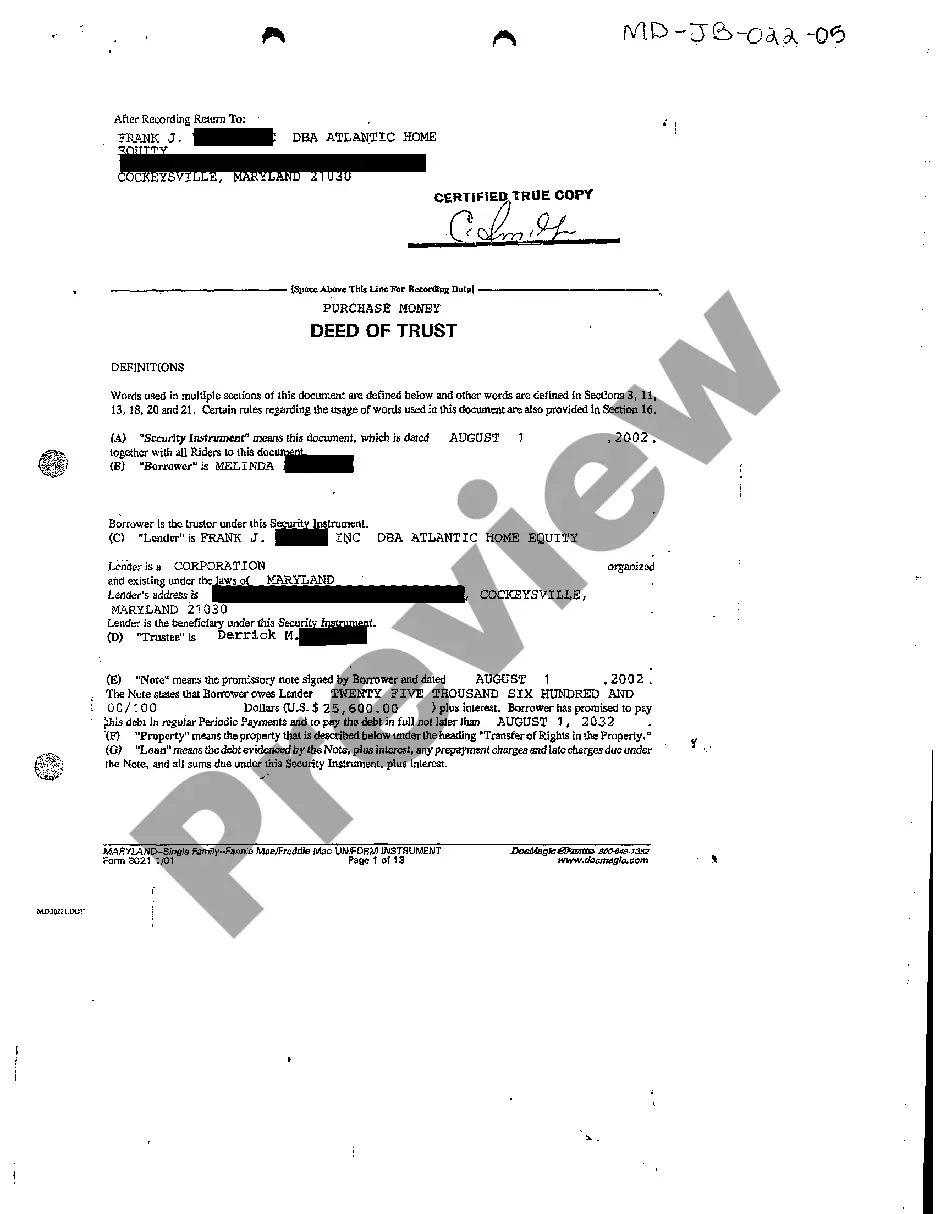

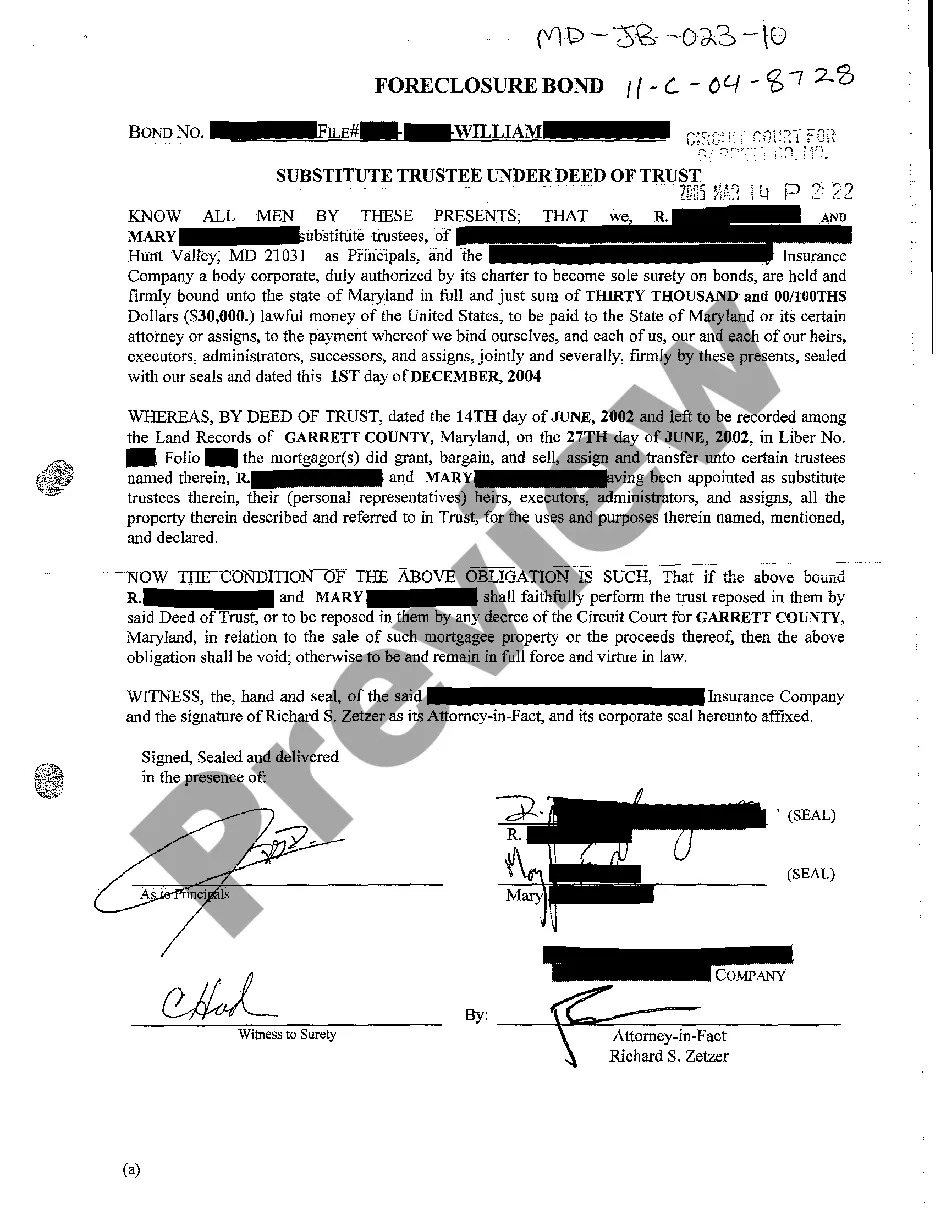

Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds

Description

How to fill out Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds?

You are invited to the largest legal document repository, US Legal Forms. Here you will discover any template including Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds templates and save them (as many of them as you desire/require). Create official documents within a few hours, instead of days or weeks, without having to spend a fortune on a legal expert.

Obtain your state-specific form in just a couple of clicks and feel assured knowing it was created by our state-certified attorneys.

If you’re already a registered user, simply Log In to your account and click Download next to the Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds you require. Since US Legal Forms is web-based, you’ll typically have access to your saved documents, regardless of the device you’re using. View them under the My documents section.

Register for US Legal Forms now and gain access to thousands of reusable templates.

- If you do not yet have an account, what are you waiting for? Follow our instructions provided below to get started.

- If this is a state-specific form, verify its validity in the state where you reside.

- Review the description (if available) to confirm it's the correct template.

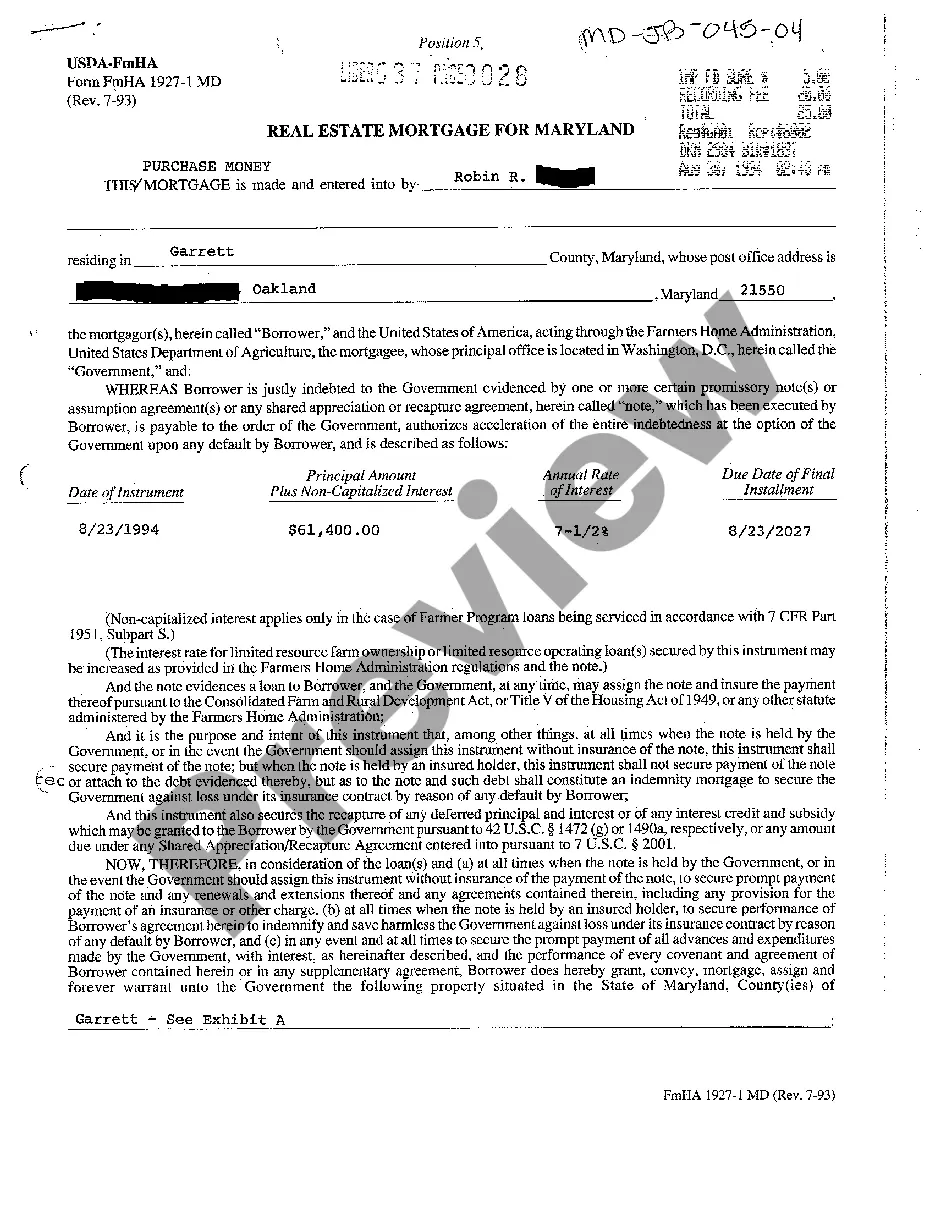

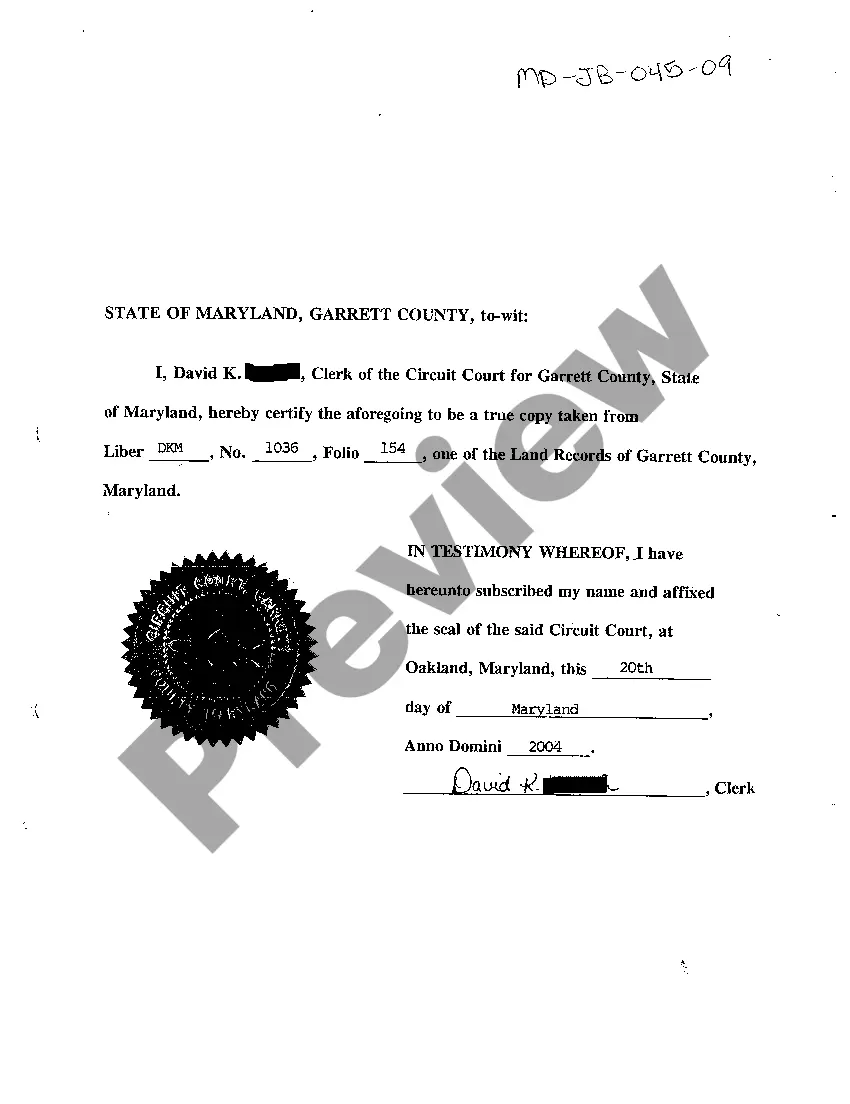

- Examine additional content with the Preview feature.

- If the document meets your needs, simply click Buy Now.

- To create your account, select a pricing plan.

- Use a credit card or PayPal account to subscribe.

- Download the document in the format you require (Word or PDF).

- Print the file and complete it with your/your company's information.

- After you've filled out the Maryland Trustees, Mortgages, Attorney's Foreclosure Bonds, send it to your attorney for confirmation. It’s an extra step but a vital one for ensuring you’re thoroughly protected.

Form popularity

FAQ

Step 1 Notice of Default. Record a Notice of Default with the county recorder. Step 2 Notice of Sale. If the borrower does not pay the balance stated in the Notice of Default within the deadline, the lender can go ahead with recording a Notice of Sale. Step 3 Auction. Step 4 Obtain Possession of Property.

While you can't redeem your home after the foreclosure sale in Maryland, you do get what is called an "equitable right of redemption" before the sale is finalized.Ratification typically takes place 30 to 45 days after the sale, though this varies from county to county.

Foreclosure Sale and Eviction If the borrower does not request mediation, the sale can occur as soon as 45 days after receipt of a Final Loss Mitigation Affidavit, or 30 days from the date the Final Loss Mitigation Affidavit was mailed to the homeowner.

Get Pre-Approved for a Mortgage. Explore Foreclosed Properties with Your Agent. Get a Thorough Inspection on the Home. Resolves Liens on the Home. Prepare for Problems and Have a Ready Solution. Related Articles. You May Also Like.

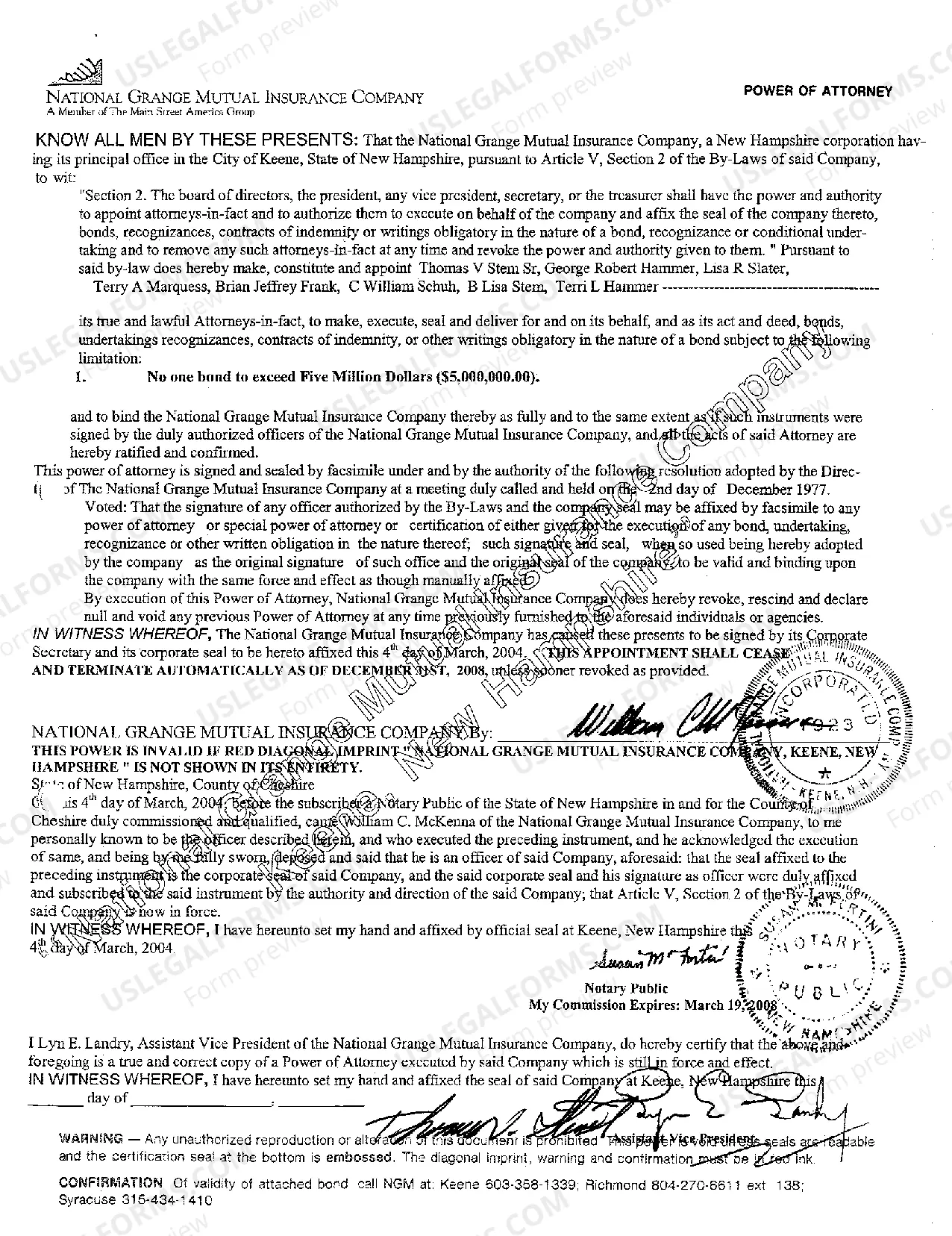

Maryland Trustee in Foreclosure Bonds are required by the various county courts. They are required by persons appointed as Trustee to foreclose on real estate. The required bond amount is set by the court. This is a one-time charge and there will not be any renewal premiums due.

Negotiate With Your Lender. If you found yourself in a situation where you are behind on mortgage payments, and believe that your lender can try to foreclose on your house, try negotiating a new payment plan. Reinstate Your Loan. Forbearance Plan. Sell Your Property.

Most people do not realize that they can stop foreclosure even if they stopped paying their mortgage. Absolutely! Many recent cases have been filed improperly and an experienced attorney can assist with the identification and filing of substantive and procedural defenses with the court and vigorously defend your case.

In a nonjudicial foreclosure, the third party who normally handles the foreclosure process is called a "trustee." In theory, a foreclosure trustee is a neutral party, but the lender or loan servicer usually chooses the trustee, who is often affiliated with the lender or the lender's attorney.

A right of redemption bond protects a party that purchases a property through a foreclosure sale or auction in the event that the original owner exercises the right to redeem the property by paying off their debt after the sale.