Maryland Living Trust Property Record

Understanding this form

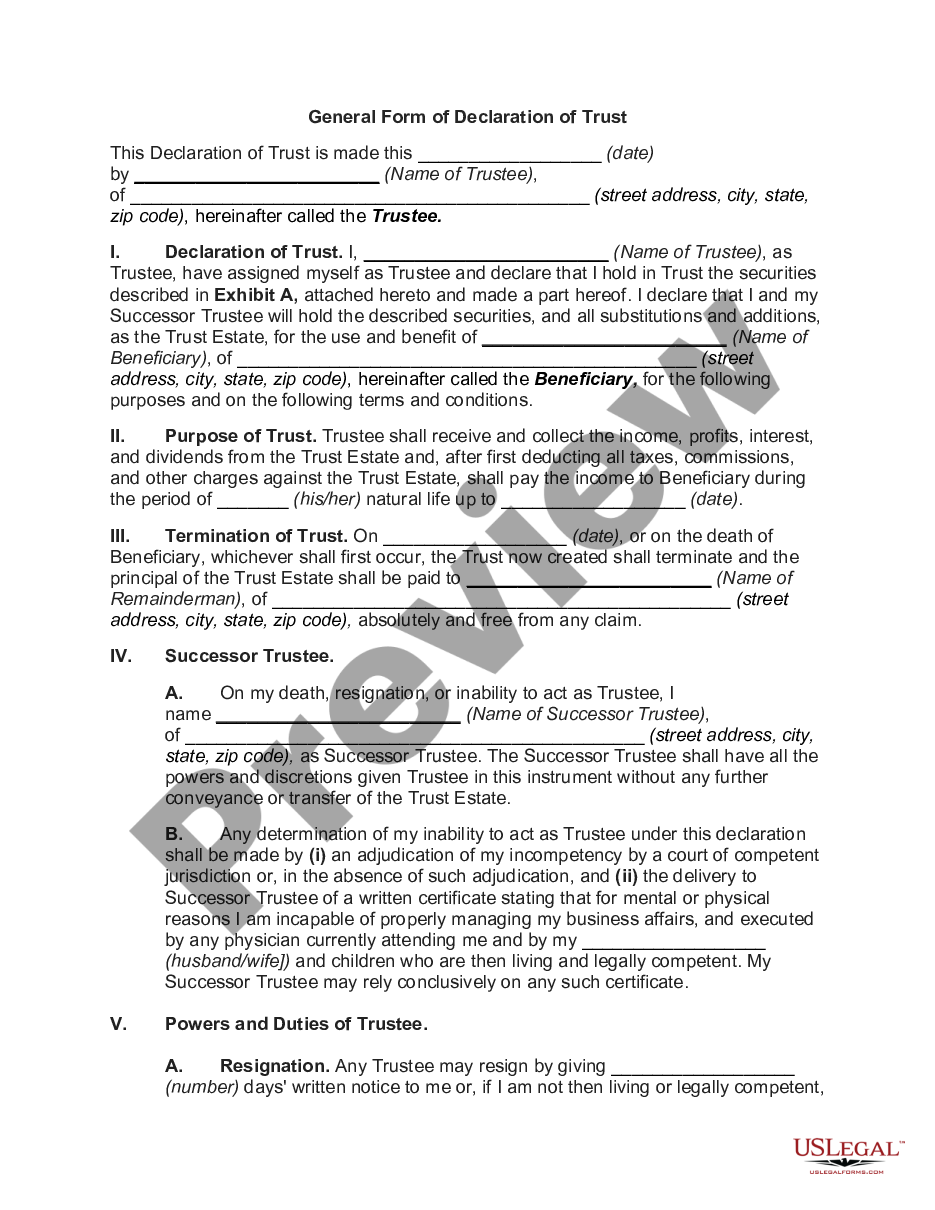

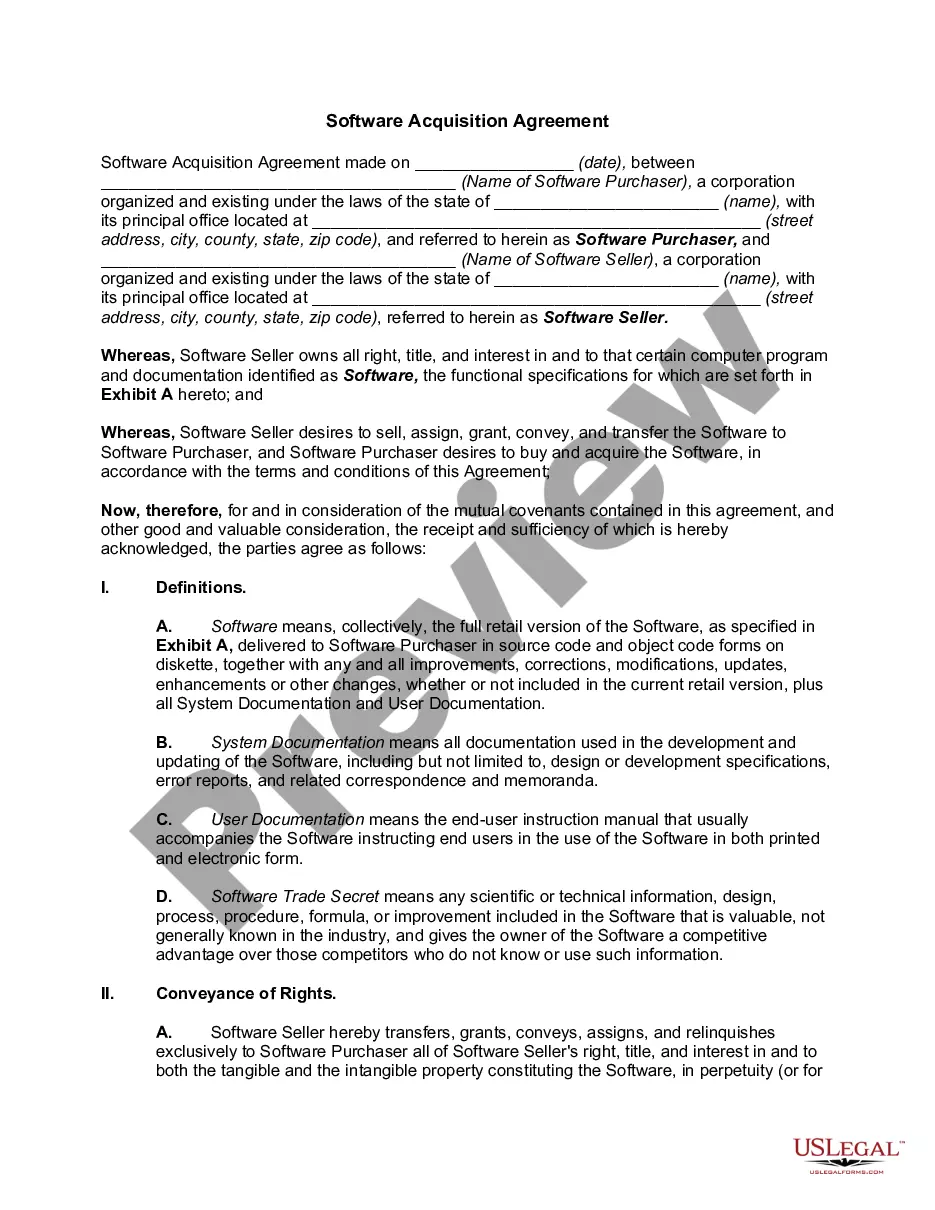

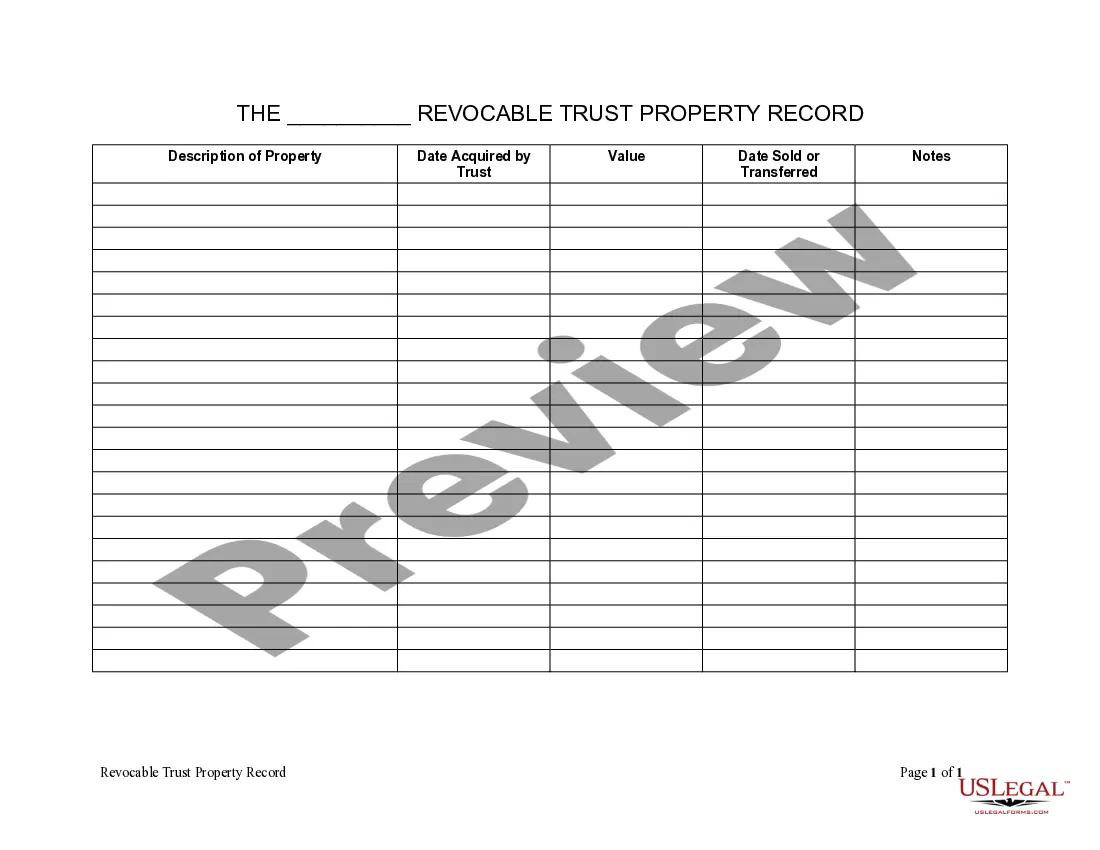

The Living Trust Property Record is a crucial legal document that helps individuals manage and track their assets within a living trust. This form ensures that all property held in the trustâwhether real estate, personal items, or intellectual propertyâis accurately recorded. Unlike other estate planning documents that may focus solely on distributing assets after death, this form is designed specifically for ongoing management during a person's lifetime.

Key components of this form

- Description of Property: Details about each asset in the trust.

- Date Acquired by Trust: When the asset was transferred into the trust.

- Value: The current worth of the asset.

- Date Sold or Transferred: The date the asset was sold or moved out of the trust.

When this form is needed

This form is best used when setting up a living trust and as a tool for ongoing asset management. If you have included various properties in your living trust, it is important to maintain a clear record to help facilitate future transactions and ensure accurate estate planning.

Who should use this form

This form is intended for:

- Individuals establishing a living trust.

- Trustees managing assets within a living trust.

- Beneficiaries seeking to understand the assets held in the trust.

How to complete this form

- Identify the property: For each asset, provide a detailed description.

- Record the acquisition date: Enter the date the asset was transferred to the trust.

- Specify the value: Document the estimated market value of the asset.

- Document any transfers: If the asset is sold or otherwise transferred, include the date of the transaction.

Is notarization required?

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to update the record when assets are added or sold.

- Inaccurately valuing assets, which could impact estate planning.

- Not providing a complete description of the property.

Benefits of using this form online

- Convenient access: Easily download and fill out the form at your convenience.

- Editability: Modify the document as needed to reflect life changes or additional assets.

- Reliability: Forms are drafted by licensed attorneys to ensure legal compliance.

Looking for another form?

Form popularity

FAQ

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

A living trust does not protect your assets from a lawsuit. Living trusts are revocable, meaning you remain in control of the assets and you are the legal owner until your death.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

With a revocable trust, your assets will not be protected from creditors looking to sue. That's because you maintain ownership of the trust while you're alive. Therefore if you lose a lawsuit and a judgment is awarded to the creditor, the trust may have to be closed and the money handed over.

Irrevocable trusts safeguard assets from creditors.Creditors can't claim assets in an irrevocable trust. The reason being that you don't control the assets, can't revoke the Trust, and therefore can't be considered the owner of the assets.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Trusts may be revocable or irrevocable. Each trust is different, and the creator of each trust generally determines whether the trust is revocable.Therefore, if a judgment debtor is also the creator of a revocable trust, the judgment creditor can generally garnish the money or property held by that trust.

Legally your Trust now owns all of your assets, but you manage all of the assets as the Trustee. This is the essential step that allows you to avoid Probate Court because there is nothing for the courts to control when you die or become incapacitated.

With an irrevocable trust, the assets that fund the trust become the property of the trust, and the terms of the trust direct that the trustor no longer controls the assets.Because the assets within the trust are no longer the property of the trustor, a creditor cannot come after them to satisfy debts of the trustor.