Uniquely packaged forms and information for Chapter 7 or 13 bankruptcies, including detailed instructions and other resources. Click and view the Free Preview for the latest revision dates and a complete overview of contents.

Maryland Bankruptcy Guide and Forms Package for Chapters 7 or 13

Description

How to fill out Maryland Bankruptcy Guide And Forms Package For Chapters 7 Or 13?

You are invited to the largest legal forms repository, US Legal Forms. Here, you can discover any template including the Maryland Bankruptcy Guide and Forms Package for Chapters 7 or 13 forms and store them (as many as you desire/need). Prepare official documents in just a few hours, instead of days or even weeks, without spending a fortune on a lawyer. Obtain your state-specific form with just a few clicks and feel confident knowing it was created by our licensed legal experts.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Bankruptcy Guide and Forms Package for Chapters 7 or 13 that you require. Since US Legal Forms is an online service, you’ll consistently have access to your saved documents, no matter which device you are using. Locate them in the My documents section.

If you don’t have an account yet, what are you waiting for? Follow our instructions below to get started.

Once you’ve finished the Maryland Bankruptcy Guide and Forms Package for Chapters 7 or 13, send it to your attorney for validation. It’s an additional step but an essential one to ensure you’re completely secured. Register with US Legal Forms now and gain access to thousands of reusable templates.

- If this is a state-specific form, verify its relevance in the state you reside in.

- Read the description (if available) to determine if it’s the appropriate template.

- View additional content using the Preview option.

- If the document aligns with your needs, click Buy Now.

- To set up an account, select a subscription plan.

- Utilize a credit card or PayPal account to enroll.

- Store the template in your preferred format (Word or PDF).

- Print the document and complete it with your or your company's information.

Form popularity

FAQ

In many cases, Chapter 7 bankruptcy is a better fit than Chapter 13 bankruptcy. For instance, Chapter 7 is quicker, many filers can keep all or most of their property, and filers don't pay creditors through a three- to five-year Chapter 13 repayment plan.

How soon can you file for Chapter 13 after Chapter 7 bankruptcy? In order to get debts discharged through Chapter 13, you must wait four years after filing a Chapter 7 bankruptcy.

A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years.

There is no threshold amount that you need to reach to file a bankruptcy. Some chapters of bankruptcy have debt limits, but there is no such thing as a debt minimum. That being said, you certainly can and should evaluate if filing a bankruptcy makes sense in your current situation.

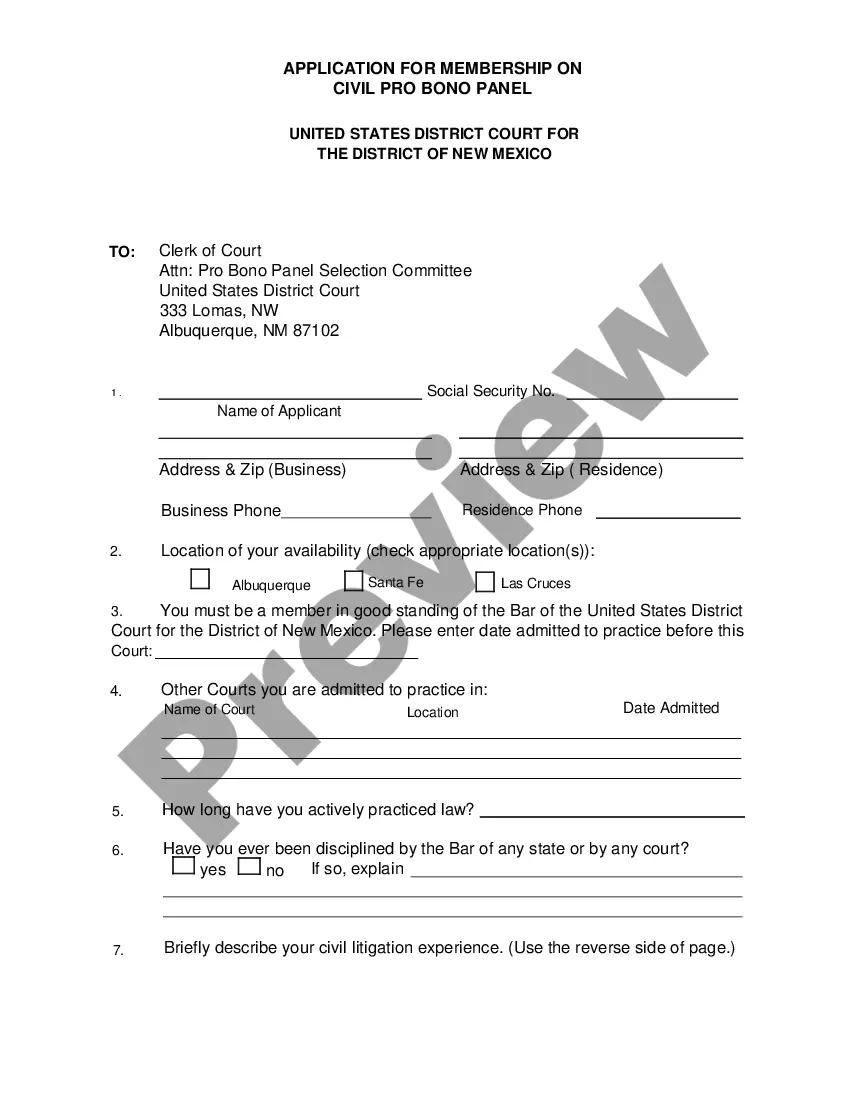

B 101 Voluntary Petition for Individuals Filing for Bankruptcy. B 101A Initial Statement About an Eviction Judgment Against You (only if you have eviction judgment against you)

Get Your Filing Fee The court filing fee for a Chapter 7 bankruptcy in Maryland is $338.

Six months of paycheck stubs. six months of bank statements. tax returns (the last two years) current investment and retirement statements. current mortgage and car loan statements. home and car valuations (printouts from online sources work)

Chapter 7 bankruptcy is designed to relieve you of unsecured debts, such as medical expenses. There is no rule that requires you to use a lawyer to file a petition. You can do the filing yourself, which is called pro se, but we recommend that you do your research first.

Advise you on whether to file a bankruptcy petition. Advise you under which chapter to file. Advise you on whether your debts can be discharged. Advise you on whether or not you will be able to keep your home, car, or other property after you file. Advise you of the tax consequences of filing.