Maryland Satisfaction of Judgment

Description

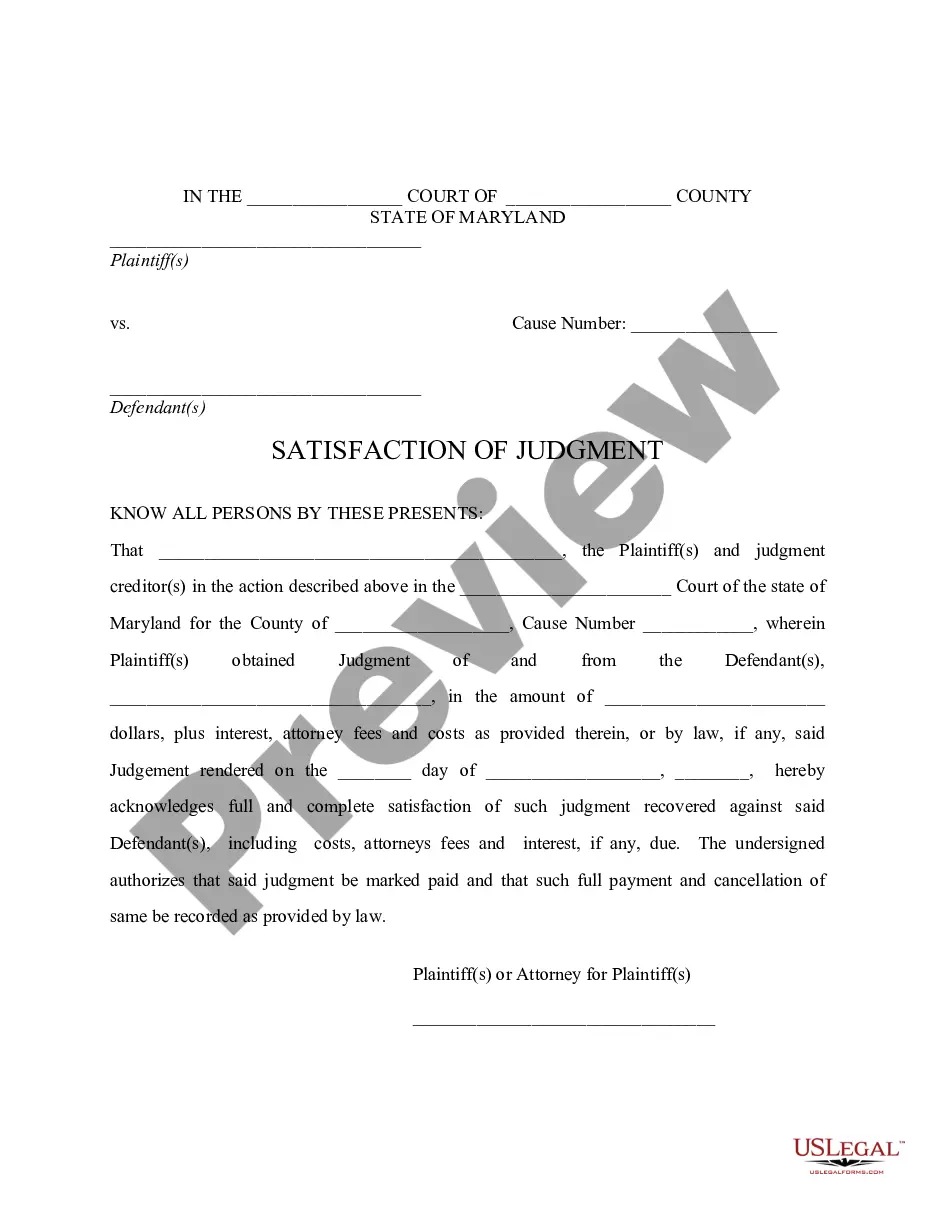

- Maryland Satisfaction of Judgment:A legal document that signifies a judgment debtor has fully paid the debt to the judgment creditor, officially clearing the debtor from legal obligations related to the judgment.

- Writ Garnishment:A court order directing a third party (garnishee) to hold assets of a debtor, typically from a bank account, to satisfy a judgment.

- Judgment Creditor:The party who wins the judgment and is owed money from the judgment debtor.

- Judgment Debtor:The party who owes money after losing a case and has a court judgment against them.

- Garnishee:An entity or person who is holding assets (often wages or bank accounts) that are due to the judgment debtor but can be seized for judgment satisfaction.

- Verify Full Payment:Ensure all debts detailed in the judgment along with any additional court costs or interests have been fully paid by the debtor.

- Obtain the Form:Acquire a 'Satisfaction of Judgment' form from the local court or online from the Maryland state judiciary's website.

- Complete the Form:Fill in all necessary details in the form, which typically includes case number, names of parties involved, and amount paid.

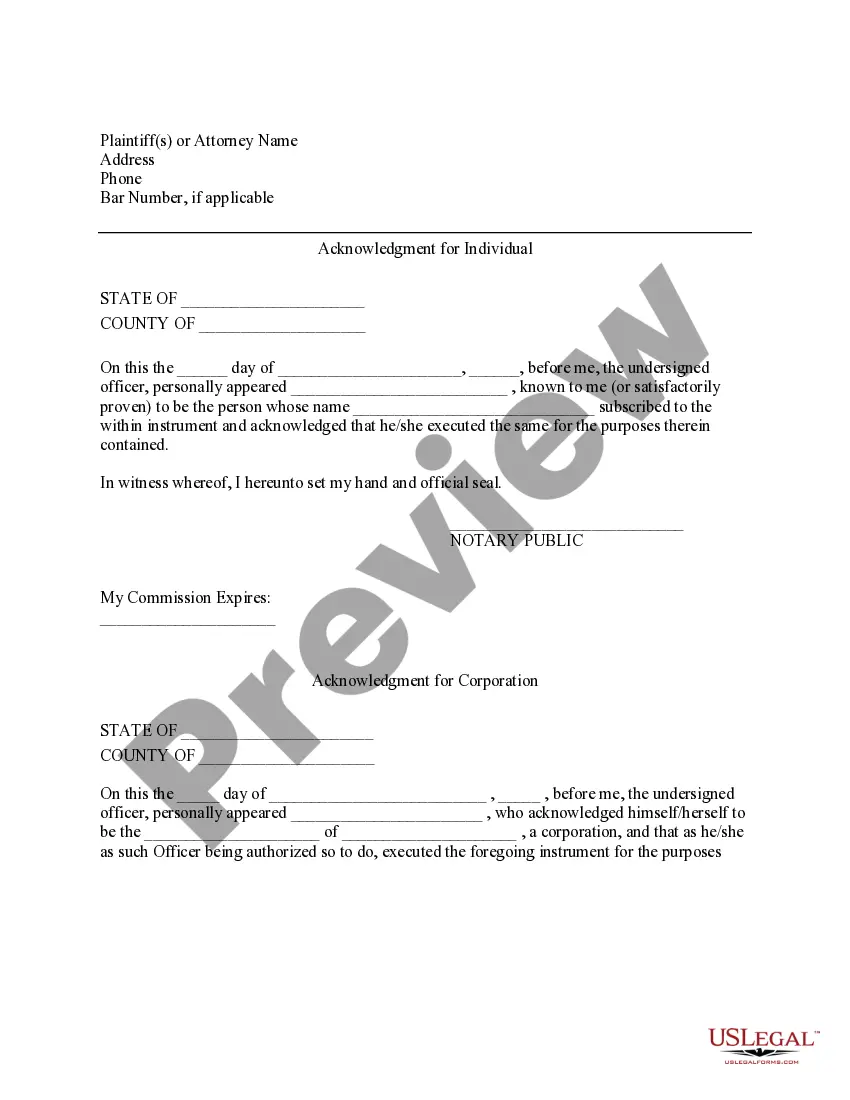

- Signature:The judgment creditor must sign the form, possibly in front of a notary public depending on county requirements.

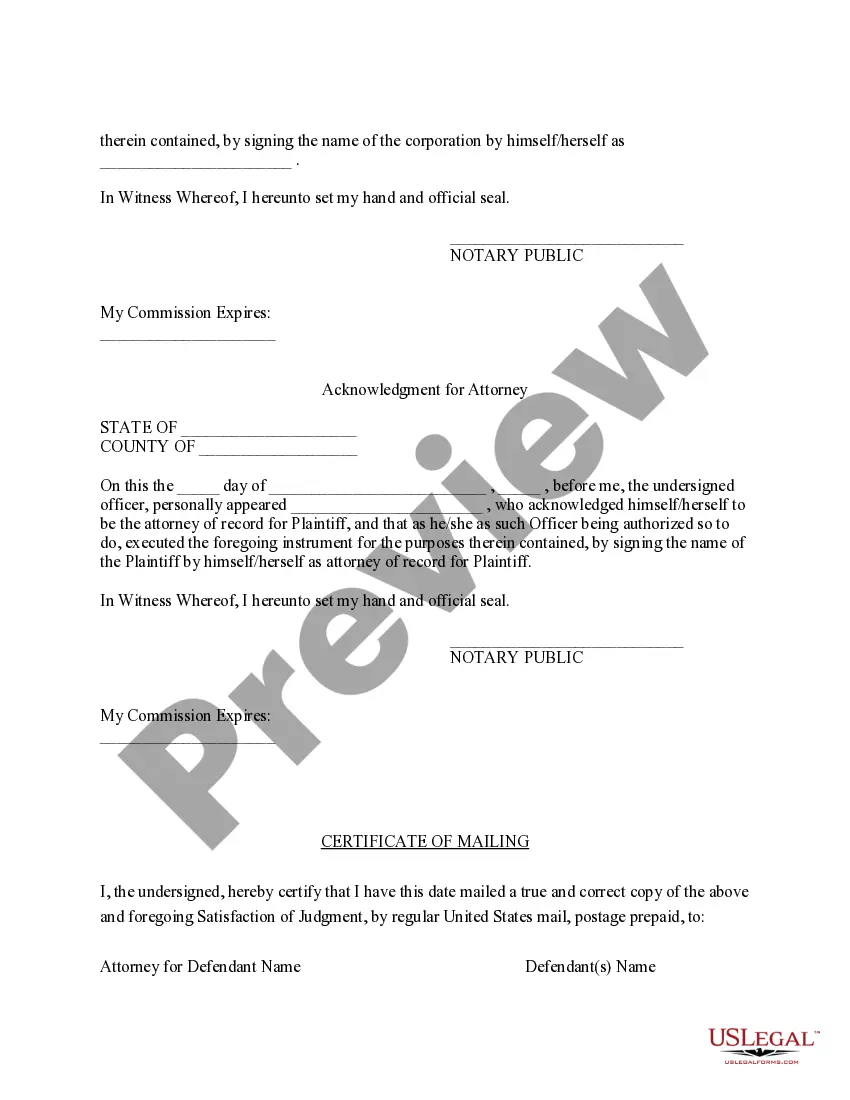

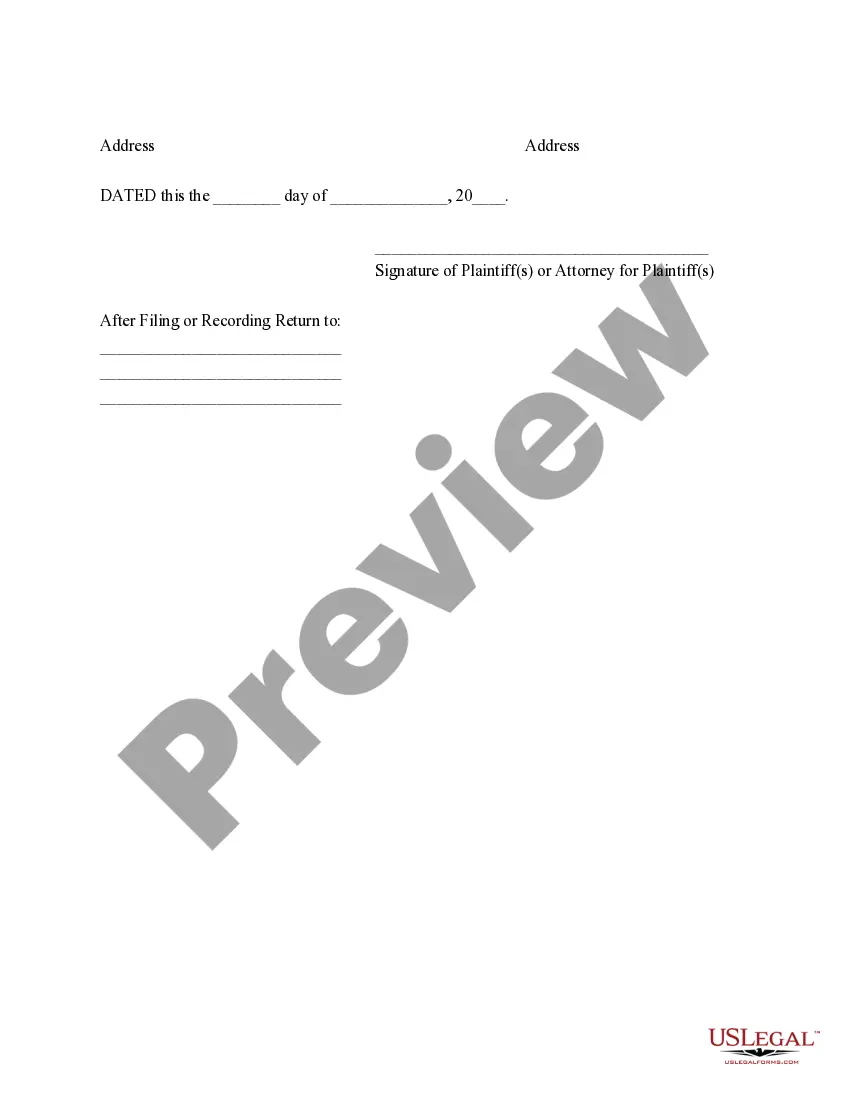

- File the Form:Submit the completed form to the same court where the judgment was originally entered. This may include filing fees depending on the specific court.

- Notify the Debtor:Provide a copy of the filed satisfaction form to the judgment debtor as confirmation of debt clearance.

- Delay in Filing:Delay in filing the satisfaction can lead to unnecessary continuation of credit impairment for the debtor.

- Inaccurate Information:Errors in filing the document may result in its rejection and need for re-submission, delaying the process.

- Legal Consequences:Failure to file can result in the judgment creditor facing legal penalties or sanctions.

- Filing a 'Maryland Satisfaction of Judgment' is essential for clearing a debtor's record once a debt is fully paid.

- The process involves a series of steps including obtaining and completing a form, and filing it with the respective court.

- Timeliness and accuracy in the filing process are crucial to avoid possible legal and credit issues for both creditor and debtor.

How to fill out Maryland Satisfaction Of Judgment?

Greetings to the finest legal documents repository, US Legal Forms.

Here, you can obtain any template, such as Maryland Satisfaction of Judgment forms, and download them (as many as you desire or require). Prepare formal documents in just a few hours, rather than days or even weeks, without spending a fortune on a lawyer.

Acquire your state-specific document in just a few clicks and feel confident knowing that it was created by our licensed attorneys.

To create your account, select a pricing option. Use a credit card or PayPal account to sign up. Download the document in your preferred format (Word or PDF). Print the document and fill it out with your or your business’s information. Once you’ve completed the Maryland Satisfaction of Judgment, present it to your attorney for validation. Though it’s an extra step, it’s crucial for ensuring you’re fully protected. Register for US Legal Forms today and access thousands of reusable templates.

- If you’re already a registered user, simply Log In to your account and click Download next to the Maryland Satisfaction of Judgment you need.

- Since US Legal Forms is online, you will always have access to your saved documents, no matter what device you’re using.

- Locate them within the My documents section.

- If you don’t have an account yet, what are you waiting for.

- Follow our instructions below to get started.

- If this is a region-specific template, verify its validity in the state you reside in.

- Review the description (if available) to confirm if it’s the correct sample.

- View more details using the Preview feature.

- If the document meets all your needs, simply click Buy Now.

Form popularity

FAQ

When a judgment is satisfied, it means that the debtor has fulfilled the obligations set forth by the court, typically through payment. This status indicates that the creditor can no longer pursue collection efforts. Understanding the implications of a satisfied judgment is important for your financial record. You can easily file your satisfaction of judgment with support from platforms like US Legal Forms, ensuring all legal requirements are met.

Rule 2-621 in Maryland pertains to the procedures required for filing and satisfying judgments. This rule ensures that judgments are promptly recorded, providing clarity and organization in the legal process. Familiarizing yourself with this rule can help creditors navigate the complexities of a Maryland Satisfaction of Judgment more effectively, ensuring compliance and legality in collection efforts.

In Maryland, the interest rate on a judgment is set at 10% per annum unless specified otherwise in the judgment itself. This interest accrues from the date of the judgment until the judgment is satisfied. It's essential to factor in this interest when calculating the total amount owed. Being informed about Maryland Satisfaction of Judgment will ensure you understand how this interest affects your collection efforts.

To collect on a judgment in Maryland, you must first ensure that the judgment is properly recorded. You can then undertake various actions such as wage garnishment or bank account levies to recover the amount owed. Utilizing tools offered by platforms like USLegalForms can make this process more straightforward, providing you with the necessary forms and guidelines. Ultimately, understanding the Maryland Satisfaction of Judgment process helps you navigate your collection options efficiently.

In Maryland, the legal rate of interest on a judgment is set by law, typically at 10 percent per year. This rate applies to most judgments, impacting the total amount you may owe following a judgment. Understanding this interest rate is essential for anyone involved in a Maryland Satisfaction of Judgment, as it can significantly affect your financial obligations. For clarity and assistance, consider using US Legal Forms to help manage your judgment effectively.

The final judgment rule in Maryland states that a party can only appeal a final order, or judgment, that resolves all issues in a case. This rule ensures that appeals are based on complete information. Understanding this legal principle is essential for anyone engaged in disputes linked to the Maryland Satisfaction of Judgment.

Confessed judgment refers to an arrangement where a debtor agrees to the entry of a judgment against them without the need for a trial. This type of judgment can speed up the enforcement process for creditors. It's important to comprehend the implications of confessed judgment, especially when dealing with the Maryland Satisfaction of Judgment.

Collecting on a judgment in Maryland involves several steps. You may start by garnishing wages or bank accounts, or placing liens on the debtor's property. It is important to follow the state's legal procedures to enforce your Maryland Satisfaction of Judgment effectively.

To file a judgment lien in Maryland, you must first obtain a copy of your judgment from the court. Then, you can complete the necessary forms to record the lien with the appropriate county land records office. This action creates a lien on the debtor's real property, offering you security for your Maryland Satisfaction of Judgment.