Massachusetts IRS EIN Application for Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Massachusetts IRS EIN Application For Trust?

Utilize US Legal Forms to acquire a downloadable Massachusetts IRS EIN Application for Trust.

Our court-accepted forms are created and frequently updated by professional attorneys.

Ours is the most comprehensive Forms library online and provides affordable and precise templates for clients, lawyers, and small to medium businesses.

US Legal Forms offers thousands of legal and tax templates and bundles for both business and personal requirements, including Massachusetts IRS EIN Application for Trust. More than three million users have effectively utilized our platform. Choose your subscription plan and obtain high-quality documents within just a few clicks.

- Ensure that you possess the correct form pertinent to the required state.

- Examine the form by reading the details and utilizing the Preview option.

- Select Buy Now if it’s the document you require.

- Establish your account and make payment through PayPal or by credit card.

- Download the form to your device and feel free to reuse it multiple times.

- Employ the Search field if you need to locate another document template.

Form popularity

FAQ

As long as you are living, your Revocable Living Trust does not have a separate tax identification number (TIN) or EIN and you do not need to file a separate trust tax return. The Internal Revenue Service (IRS) prefers that you use your own Social Security number.

Does my living trust need an EIN? A revocable living trust does not normally need its own TIN (Tax Identification Number) while the grantor is still alive.When the grantor dies, the living trust becomes irrevocable and the successor trustee will get an EIN from the IRS to pay the trust's taxes.

Does my living trust need an EIN? A revocable living trust does not normally need its own TIN (Tax Identification Number) while the grantor is still alive.When the grantor dies, the living trust becomes irrevocable and the successor trustee will get an EIN from the IRS to pay the trust's taxes.

You can get the tax ID number for trust by lodging an application on the IRS website or calling 800-829-4933.

The easiest way of applying for a Federal Tax ID in Massachusetts is to fill out the relevant IRS-EIN-TAX-ID form and send it via the internet or by post. You can file a simplified application form as well. It is free to apply for an Employee Identification Number through the IRS.

A trust identification number is a number that identifies a trust, like any other legal entity, for tax purposes. You need a trust identification number in order to put assets into your trust.An EIN is a number issued by the IRS which functions like a Social Security Number for the Trust.

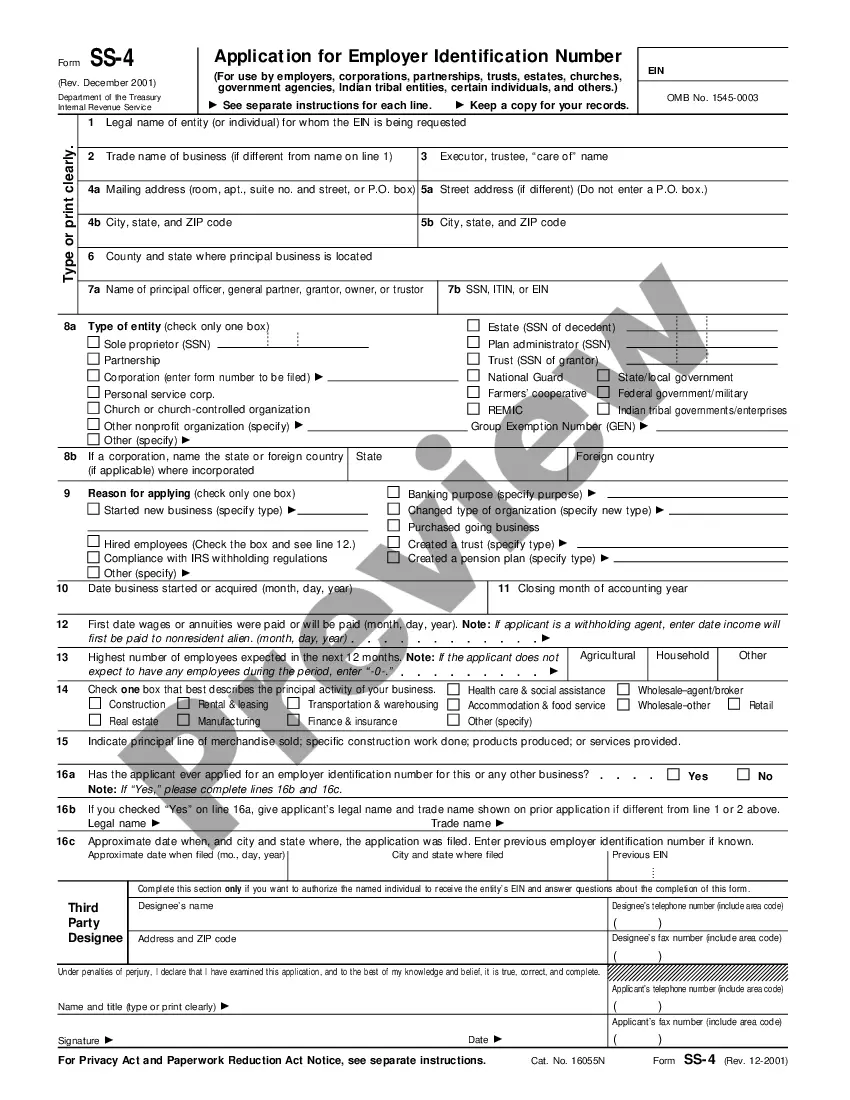

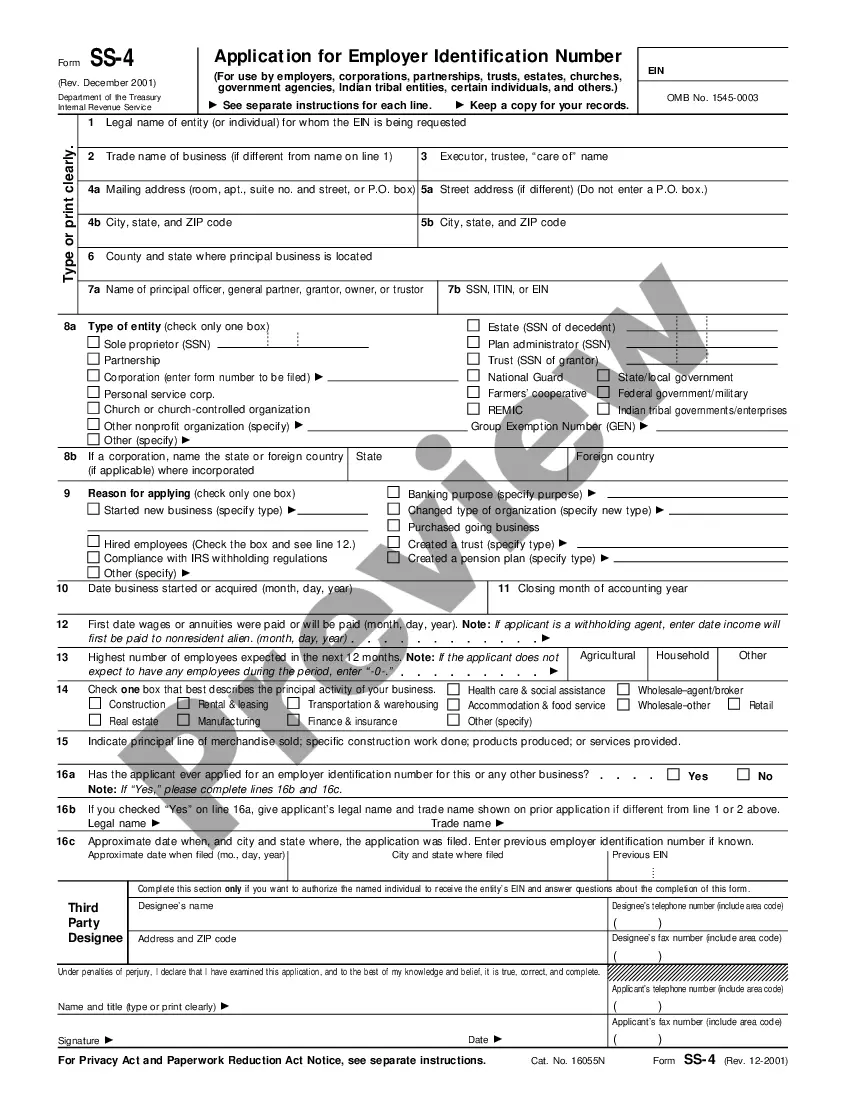

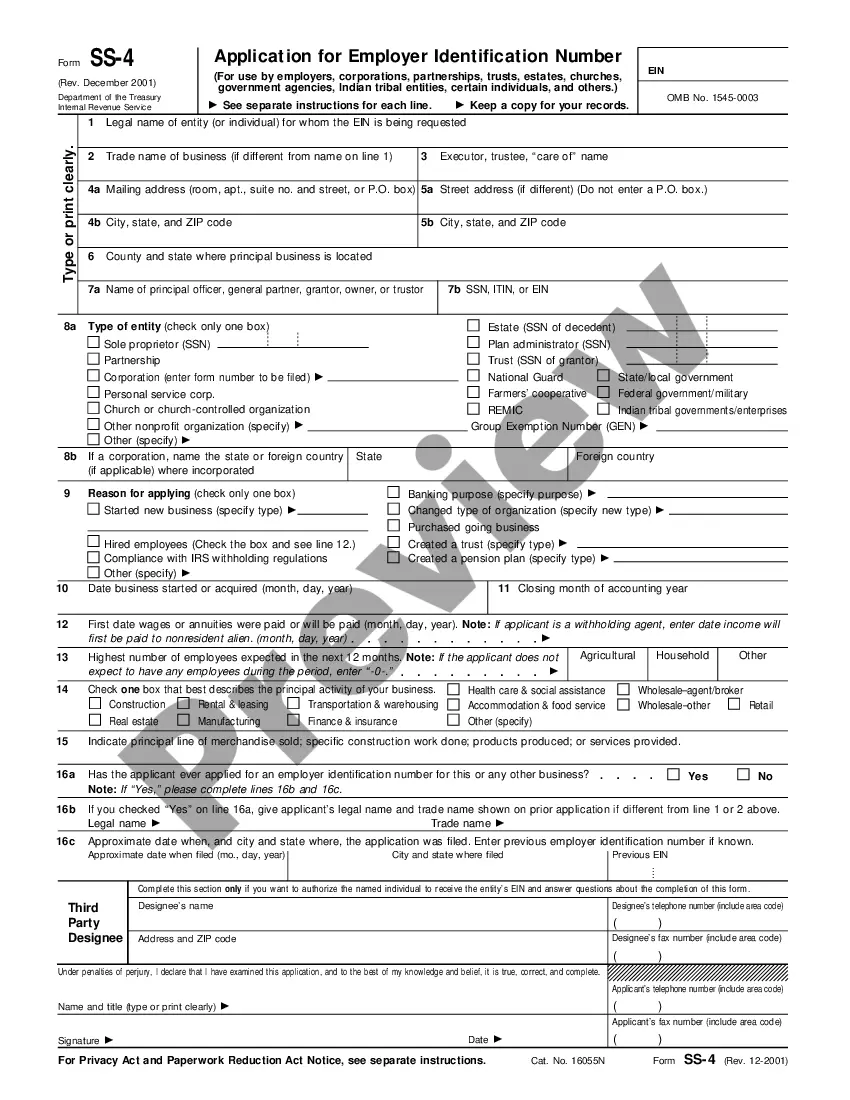

To obtain an EIN for a retirement plan trust, the plan trustee or practitioner can either apply online, or mail or fax Form SS-4, Application for Employer Identification Number to the IRS. IRS issues the EIN immediately once the information on the application is validated.

The processing timeframe for an EIN application received by mail is four weeks. Ensure that the Form SS-4 PDF contains all of the required information. If it is determined that the entity needs a new EIN, one will be assigned using the appropriate procedures for the entity type and mailed to the taxpayer.