Massachusetts IRS EIN Application for Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

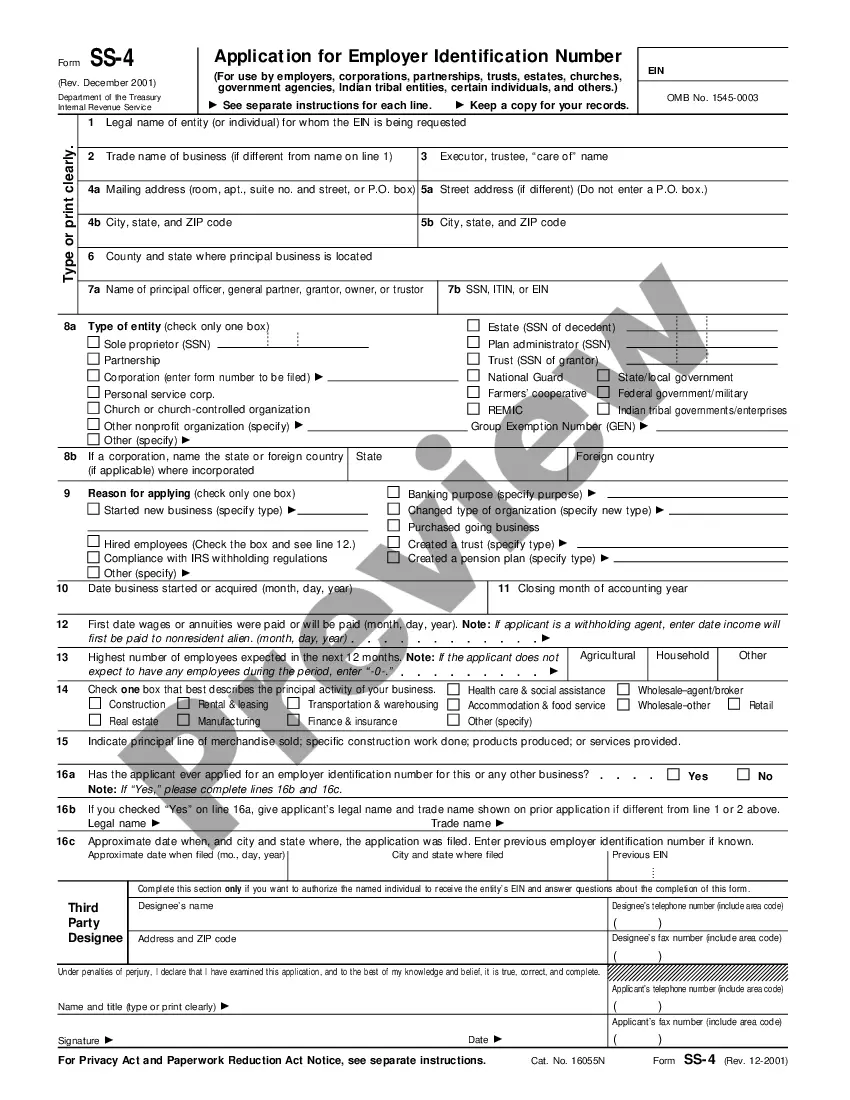

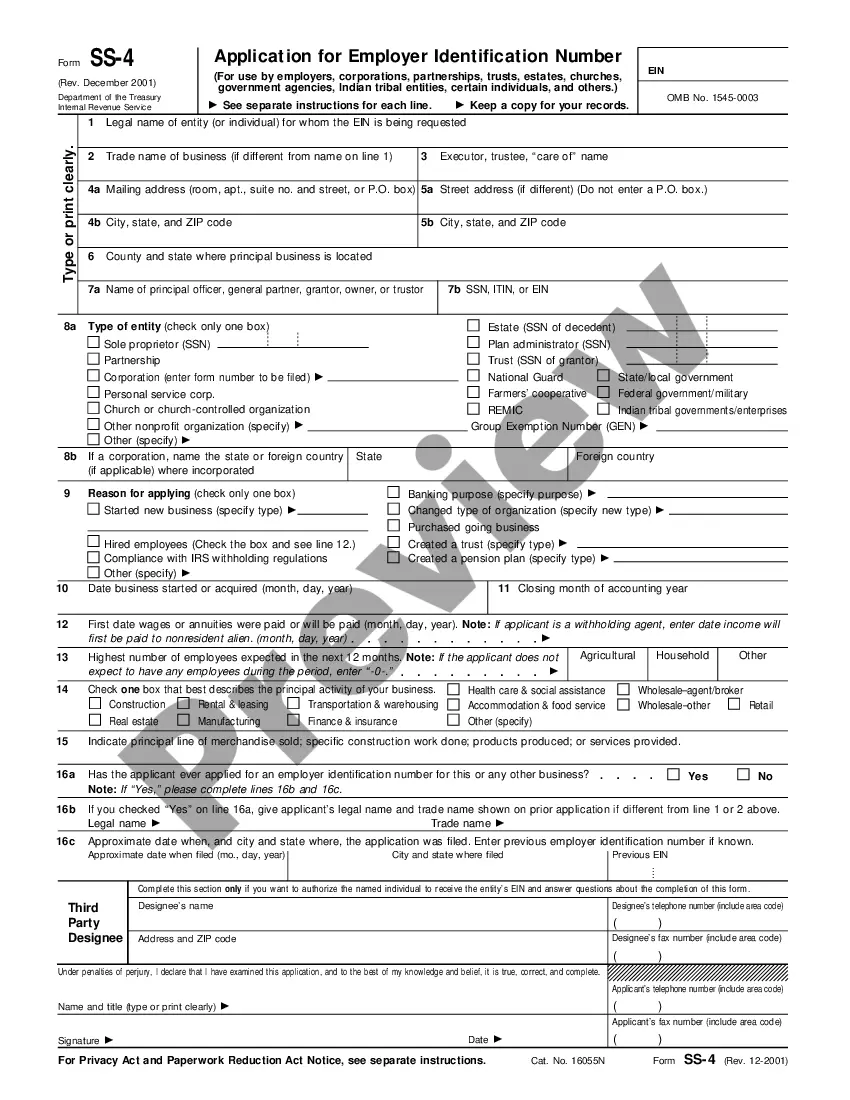

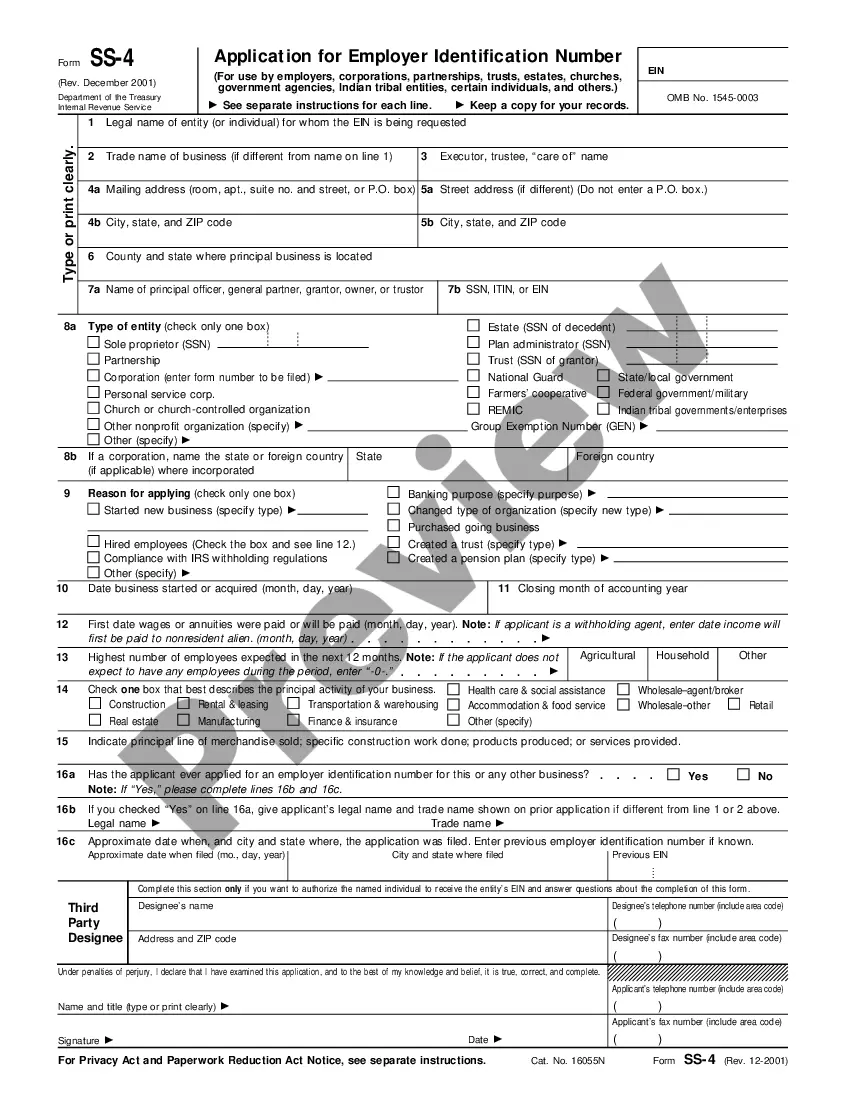

How to fill out Massachusetts IRS EIN Application For Estate?

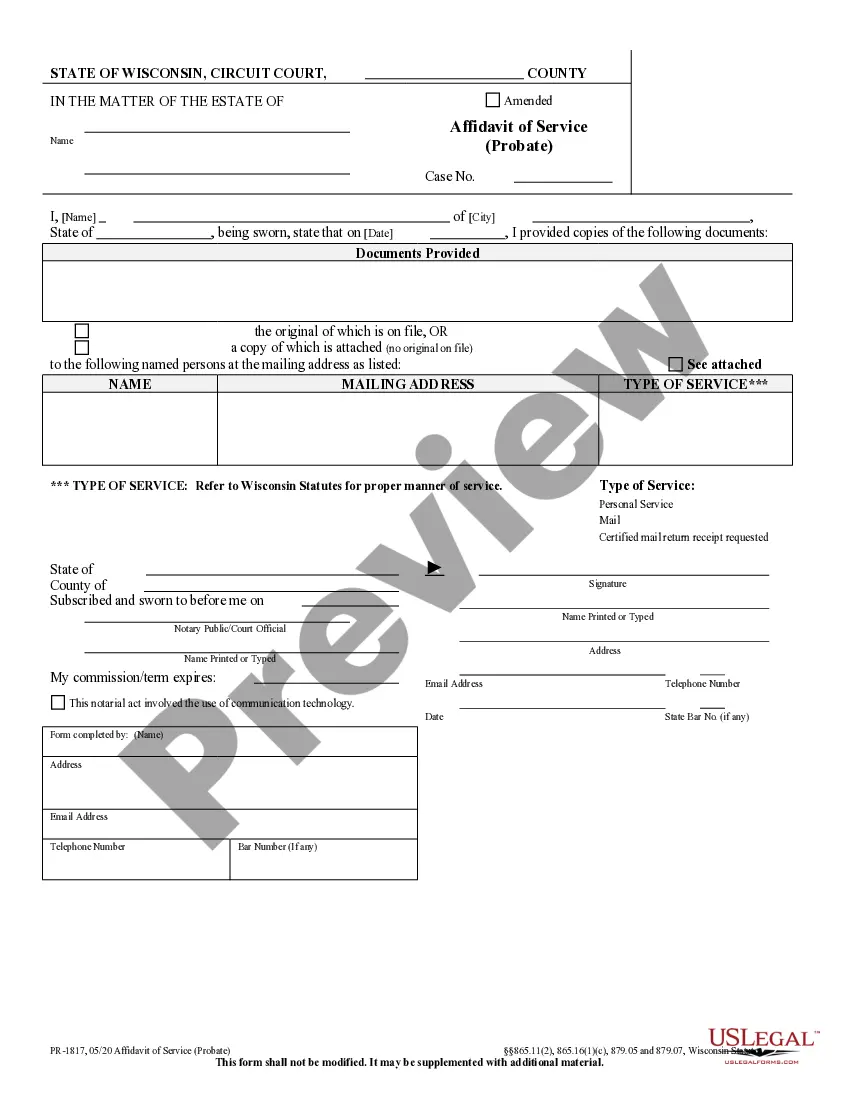

Utilize US Legal Forms to acquire a printable Massachusetts IRS EIN Application for Estate. Our legally recognized forms are formulated and consistently refreshed by experienced legal professionals.

Ours is the largest collection of forms available online and offers economical and precise samples for individuals, legal practitioners, and small to medium-sized businesses.

The templates are organized into state-specific categories, and some can be previewed before downloading.

Create your account and make a payment through PayPal or a credit card. Download the form to your device and feel free to use it multiple times. Use the search tool if you want to find another document template. US Legal Forms offers a vast array of legal and tax documents and packages for both business and personal requirements, including the Massachusetts IRS EIN Application for Estate. Over three million users have successfully utilized our service. Choose your subscription plan and receive high-quality documents in just a few clicks.

- To download samples, users need a subscription and must sign in to their account.

- Click Download next to any form you wish to obtain and find it in My documents.

- For users without a subscription, follow these steps to swiftly locate and download the Massachusetts IRS EIN Application for Estate.

- Ensure that you have the appropriate template relevant to your state.

- Examine the document by reading the description and using the Preview feature.

- Select Buy Now if it is the document you require.

Form popularity

FAQ

Are Estates required to obtain a Tax ID (EIN) Number? Yes, all estates are required to obtain a Tax ID number, also known as an employer id number or EIN if they generate more than $600 in annual gross revenue. Since an estate and the decedent are separate taxable entities, a tax ID is required to file IRS form 1041.

The easiest way of applying for a Federal Tax ID in Massachusetts is to fill out the relevant IRS-EIN-TAX-ID form and send it via the internet or by post. You can file a simplified application form as well. It is free to apply for an Employee Identification Number through the IRS.

Once you have your EIN, you can register your business to get a MA Sales Tax ID at the Mass Tax Connect site (https://mtc.dor.state.ma.us/). You must bring the final MA Sales Tax ID certificate to the convention.

An estate's tax ID number is called an employer identification number, or EIN, and comes in the format 12-345678X. You can apply online for this number. You can also apply by FAX or mail; see How to Apply for an EIN. A decedent's estate figures its gross income in much the same manner as an individual.

If you have lost your EIN Verification Letter from the Department of Treasury, you can request a new one. To do so, call the IRS Business & Specialty Tax Line toll free at 1-800-829-4933 between the hours of 7am and 7pm in your local time zone.

You may apply for an EIN online if your principal business is located in the United States or U.S. Territories. The person applying online must have a valid Taxpayer Identification Number (SSN, ITIN, EIN). You are limited to one EIN per responsible party per day.

The easiest and fastest way to apply for an EIN is to visit the Internal Revenue Service (IRS) website, between the hours of 7 am 10 pm EST, Monday Friday. The online application process only takes about 5 minutes to file the EIN online and the number will be ready in seconds.

A decedent and their estate are separate taxable entities.To file this return you will need to get a tax identification number for the estate (called an employer identification number or EIN). An estate is required to file an income tax return if assets of the estate generate more than $600 in annual income.

If you can't reach your employer by the tax deadline, you can ask the IRS for help. The IRS can reach out to your employer to urge the process along, and it may have a copy of your W-2 that was filed with the IRS, even if you didn't receive one.The form also asks for your employer's EIN if you know it.