Massachusetts Clauses Relating to Dividends, Distributions

Description

How to fill out Clauses Relating To Dividends, Distributions?

Are you currently inside a placement the place you require files for possibly company or specific purposes virtually every day? There are a lot of legal record themes available online, but discovering types you can depend on isn`t easy. US Legal Forms provides a huge number of type themes, such as the Massachusetts Clauses Relating to Dividends, Distributions, that are published to satisfy state and federal requirements.

If you are presently knowledgeable about US Legal Forms website and get a free account, basically log in. Following that, it is possible to download the Massachusetts Clauses Relating to Dividends, Distributions format.

Unless you provide an profile and want to start using US Legal Forms, adopt these measures:

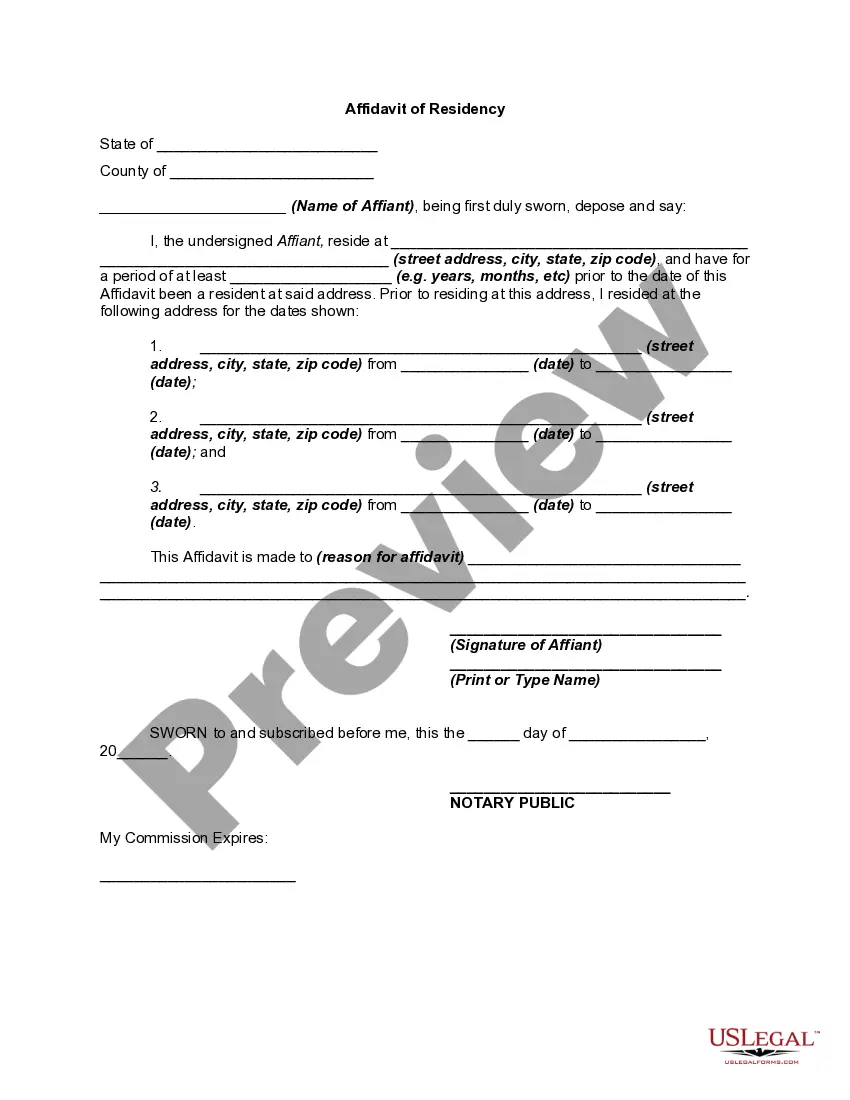

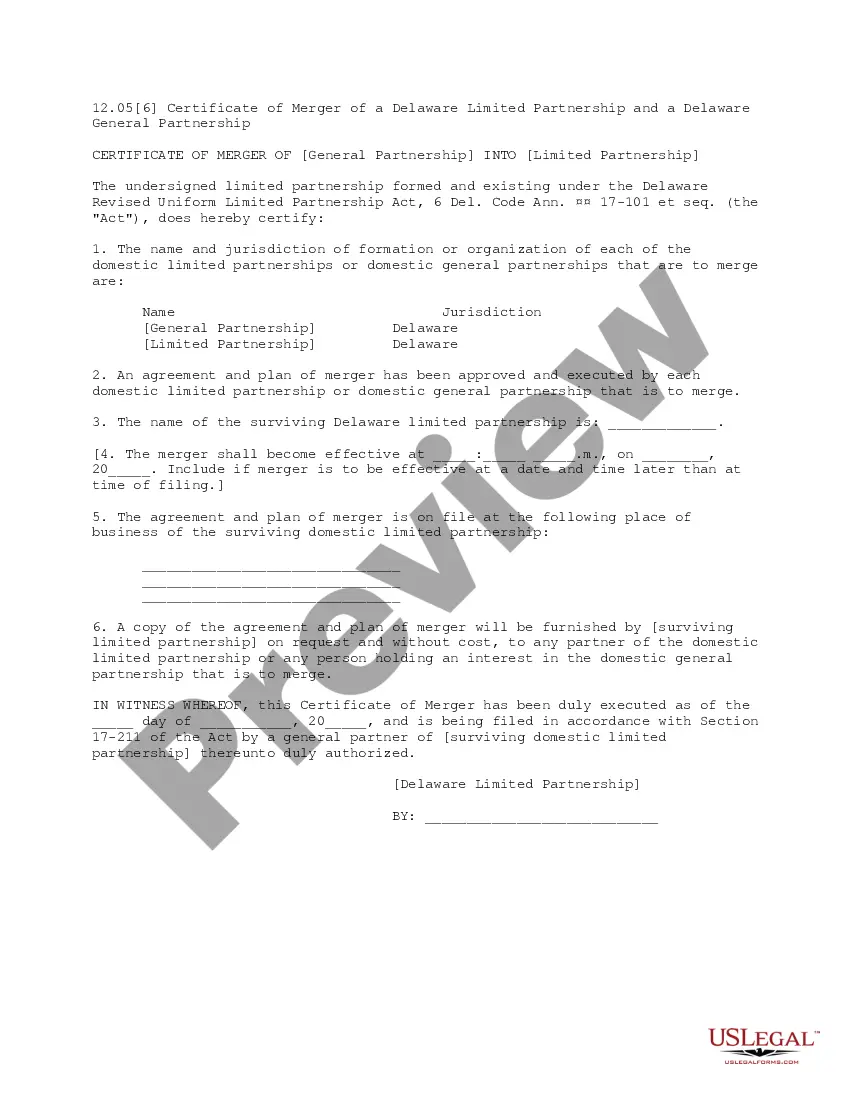

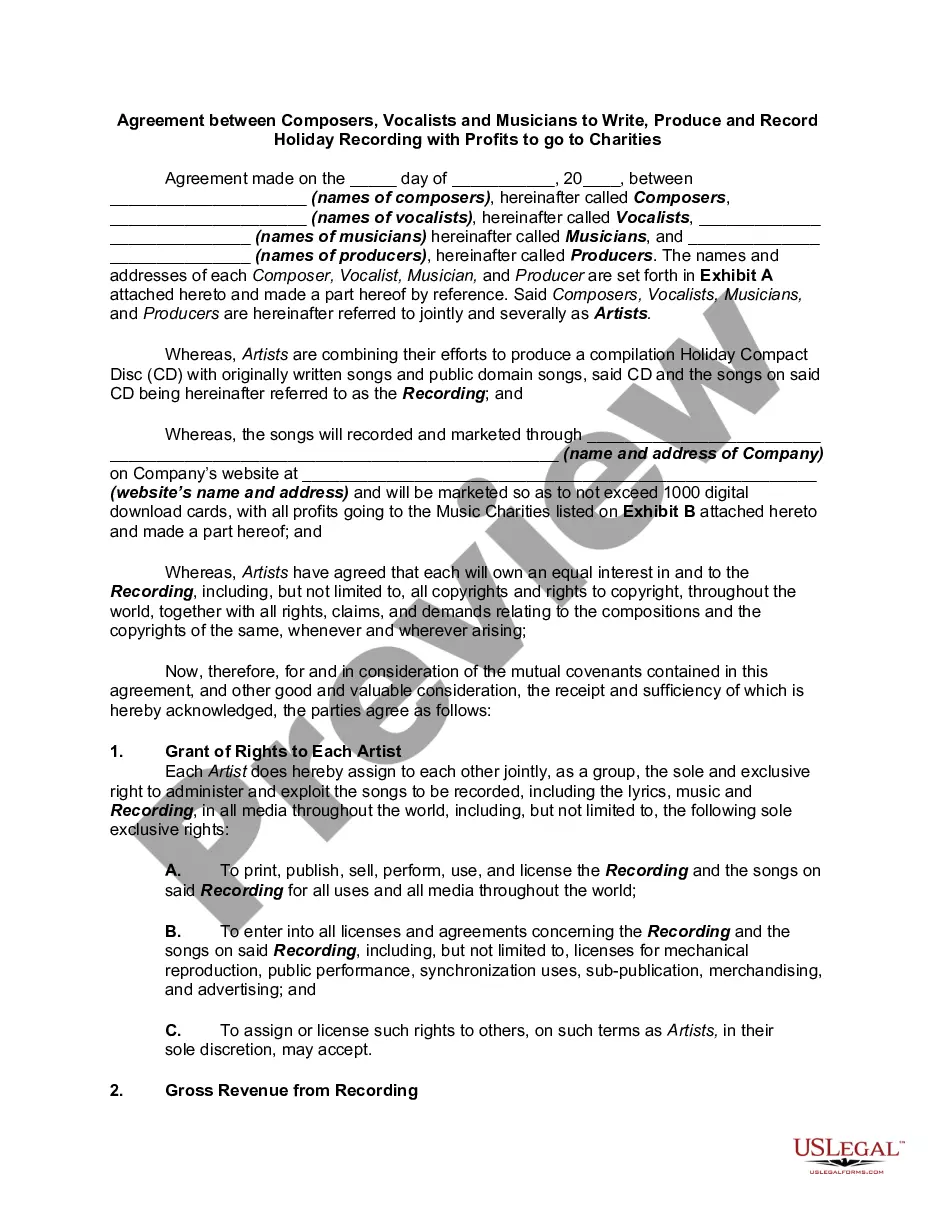

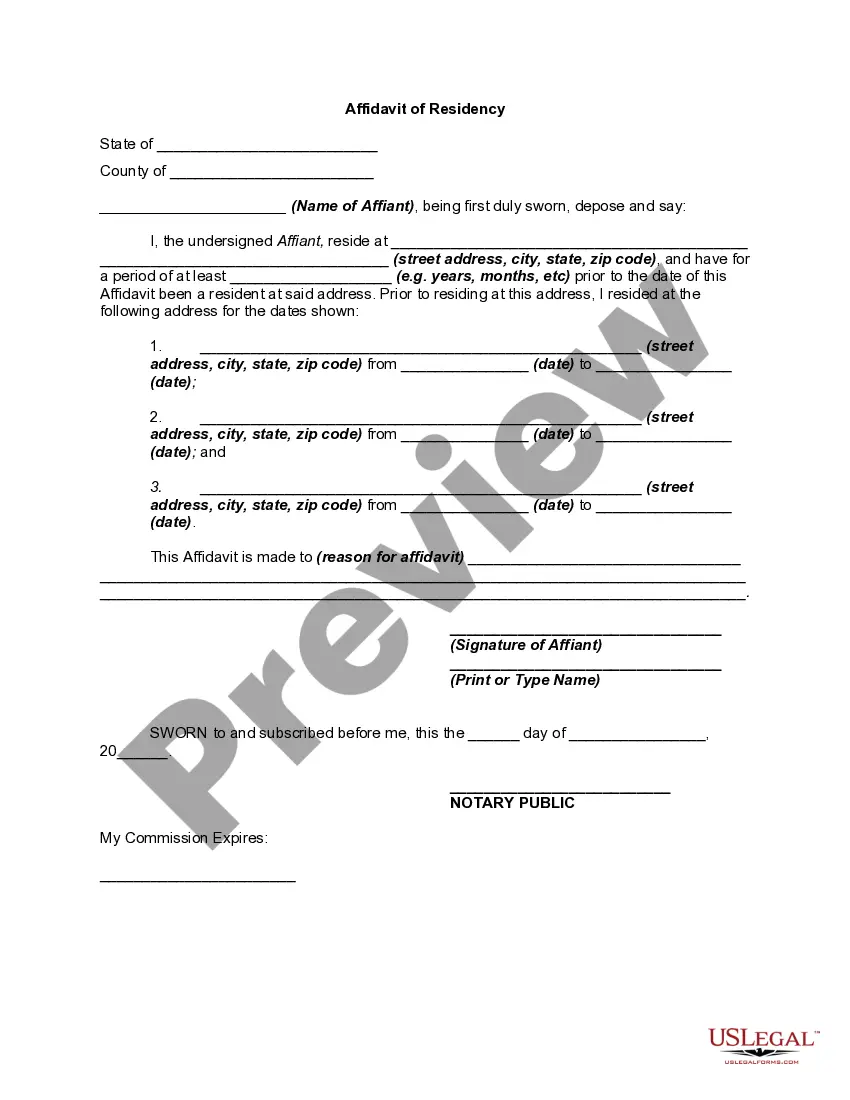

- Obtain the type you will need and make sure it is for the appropriate town/area.

- Use the Preview switch to review the shape.

- See the information to ensure that you have selected the appropriate type.

- In the event the type isn`t what you`re looking for, make use of the Look for industry to get the type that fits your needs and requirements.

- If you obtain the appropriate type, just click Buy now.

- Opt for the pricing program you desire, submit the specified details to make your money, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free paper format and download your duplicate.

Discover every one of the record themes you may have bought in the My Forms menus. You can get a extra duplicate of Massachusetts Clauses Relating to Dividends, Distributions at any time, if necessary. Just select the required type to download or print the record format.

Use US Legal Forms, by far the most substantial variety of legal types, to save lots of time and steer clear of blunders. The service provides skillfully manufactured legal record themes which can be used for a selection of purposes. Generate a free account on US Legal Forms and initiate making your lifestyle a little easier.

Form popularity

FAQ

Dividend deductions refer to the expenses such as interest and borrowing costs on loans taken to invest or management fees etc., credits or charges, that a company deducts from its dividend payments to shareholders.

A 10% TDS is payable on the dividend income amount over INR 5,000 during the fiscal year. If the PAN is not submitted, the TDS rate would be 20%. If an individual's income, which includes the dividend income is less than INR 2.5 lakh, it is not taxable.

Key Takeaways. Qualified dividends must meet special requirements issued by the IRS. The maximum tax rate for qualified dividends is 20%, with a few exceptions for real estate, art, or small business stock. Ordinary dividends are taxed at income tax rates, which as of the 2023 tax year, maxes out at 37%.

Less than 20% ownership: If the corporation owns less than 20% of the outstanding shares of the company paying the dividend, it can deduct as much as 50% of the dividend received. 20% to 80% ownership. If the corporation owns 20% to 80% of the company paying the dividend, the DRD is 65%.

For tax year 2022, Massachusetts has a 5.0% tax on both earned (salaries, wages, tips, commissions) and unearned (interest, dividends, and capital gains) income. Certain capital gains are taxed at 12%.

Current Dividend Tax Bands The dividend tax rates for 2021/22 tax year are: 7.5% (basic), 32.5% (higher) and 38.1% (additional).

However, Massachusetts law provides that interest earned on savings deposits or accounts in Massachusetts banks is included in Part B income, taxed at 5%.

In Box 71 - 1 Interest income, enter the federal interest income. In Box 88 - 15 State, enter MA. In Box 132 - State amount, enter the amount of Federal interest that is MA Bank.

Interest received by a Massachusetts resident on any tax refund from a federal, state or local government is subject to Massachusetts income taxation at the rate of 10% plus surtax.

Box 1 of the 1099-INT reports all taxable interest you receive, such as your earnings from a savings account.