Massachusetts Clauses Relating to Venture Ownership Interests

Description

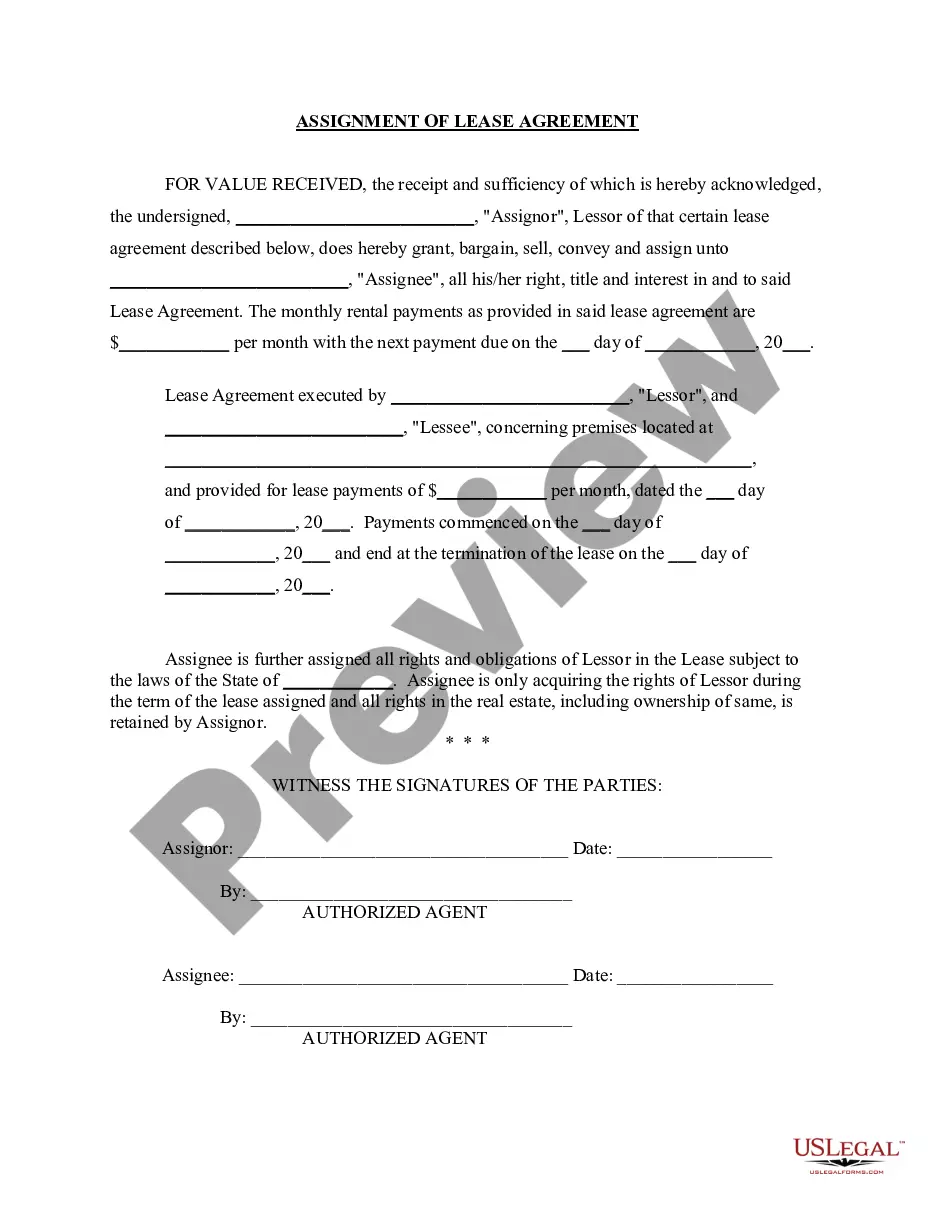

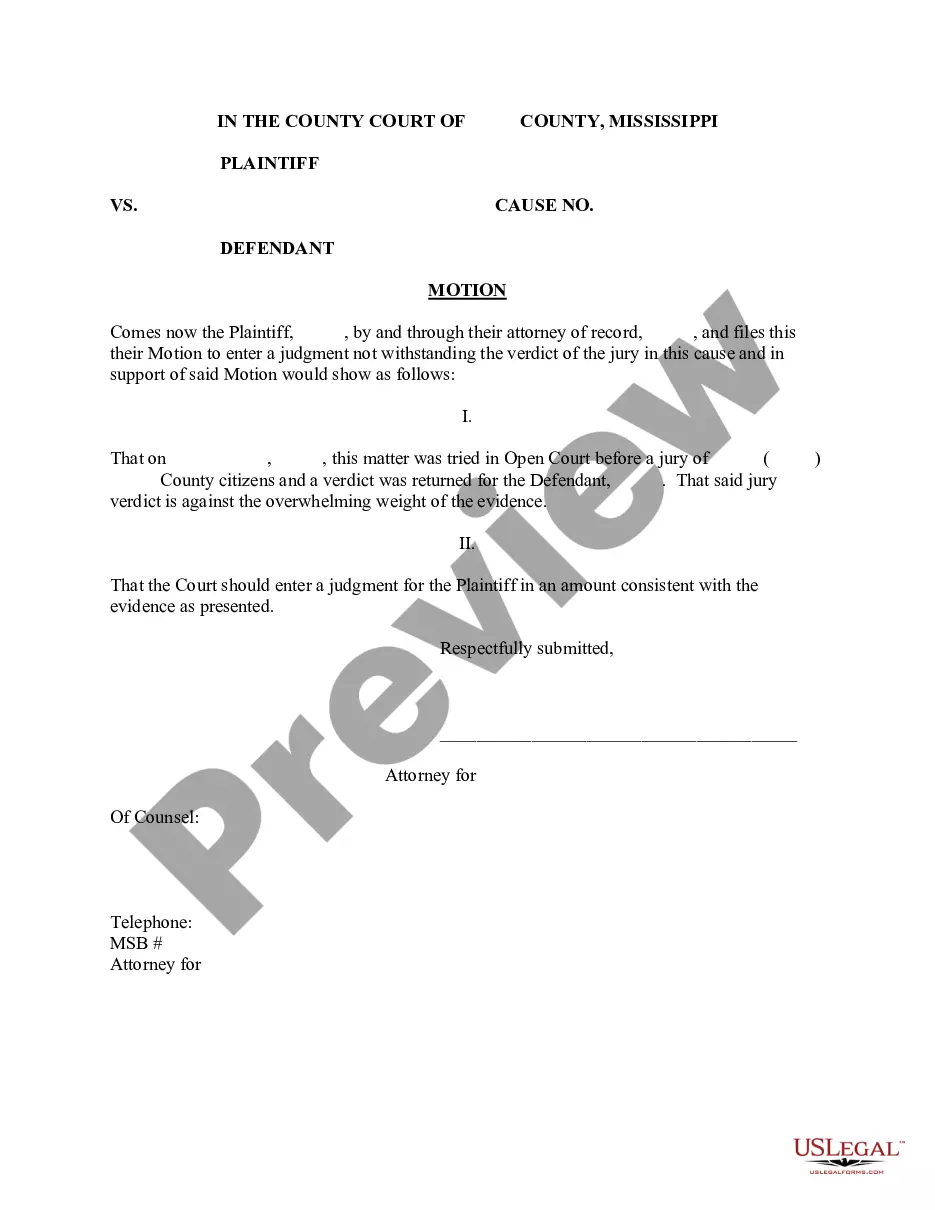

How to fill out Clauses Relating To Venture Ownership Interests?

If you wish to full, down load, or print out lawful document web templates, use US Legal Forms, the biggest variety of lawful kinds, that can be found on the Internet. Utilize the site`s simple and easy handy research to get the documents you require. Various web templates for enterprise and specific reasons are sorted by groups and claims, or key phrases. Use US Legal Forms to get the Massachusetts Clauses Relating to Venture Ownership Interests in a handful of click throughs.

When you are already a US Legal Forms buyer, log in to the profile and click the Obtain button to find the Massachusetts Clauses Relating to Venture Ownership Interests. You can also accessibility kinds you previously downloaded in the My Forms tab of your profile.

If you are using US Legal Forms initially, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for the right metropolis/country.

- Step 2. Use the Review solution to look through the form`s information. Do not forget about to read the outline.

- Step 3. When you are not happy with the develop, utilize the Research industry at the top of the display to find other models of the lawful develop web template.

- Step 4. Once you have discovered the form you require, go through the Buy now button. Choose the rates prepare you favor and include your references to register for an profile.

- Step 5. Procedure the deal. You can use your credit card or PayPal profile to finish the deal.

- Step 6. Pick the format of the lawful develop and down load it on your gadget.

- Step 7. Total, revise and print out or indicator the Massachusetts Clauses Relating to Venture Ownership Interests.

Every single lawful document web template you purchase is yours for a long time. You may have acces to each develop you downloaded with your acccount. Click on the My Forms section and decide on a develop to print out or down load once again.

Contend and down load, and print out the Massachusetts Clauses Relating to Venture Ownership Interests with US Legal Forms. There are many specialist and state-particular kinds you can utilize to your enterprise or specific requires.

Form popularity

FAQ

The new tax, which was approved by voters last year and went into effect in 2023, applies to Massachusetts residents with incomes over $1 million. The new tax adds an extra 4% on earnings above that threshold, making the state's income tax rate one of the highest in the U.S.

Each eligible resident received a Massachusetts tax refund via check or direct deposit, which amounted to about 14% of their state income tax liability from their 2021 tax return. The special payments came about because of a law that Massachusetts voters approved in 1986, known as Chapter 62F.

Pension and Retirement Income Income from most private pensions or annuity plans is taxable in Massachusetts but many government pensions are exempt. Withdrawals from a traditional IRA are taxable but the Massachusetts taxable amount may be different from the federal taxable amount.

As a Massachusetts resident or part-year resident, you're allowed a credit for taxes due to another jurisdiction. The credit is available only on income reported and taxed on a Massachusetts return. Note that tax due is different from taxes withheld. For this credit, use the calculated tax due, not tax withheld.

The common elements necessary to establish the existence of a joint venture are an express or implied contract, which includes the following elements: (1) a community of interest in the performance of the common purpose; (2) joint control or right of control; (3) a joint proprietary interest in the subject matter; (4) ...

A joint venture (JV) is a business arrangement in which two or more parties agree to pool their resources for the purpose of accomplishing a specific task. This task can be a new project or any other business activity.

Chapter 62F is a Massachusetts General Law that requires the Department of Revenue to issue a credit to taxpayers if total tax revenues in a given fiscal year exceed an annual cap tied to wage and salary growth in the Commonwealth.

Ing to Massachusetts' ?joint venture? theory, a defendant may be charged with a crime if he aided or abetted the person who committed the criminal act. (3) by agreement is willing and available to help the other if necessary. Commonwealth v. Cohen, 412 Mass.