Massachusetts Notice of Claim of Mineral Interest for Dormant Mineral Interest

Description

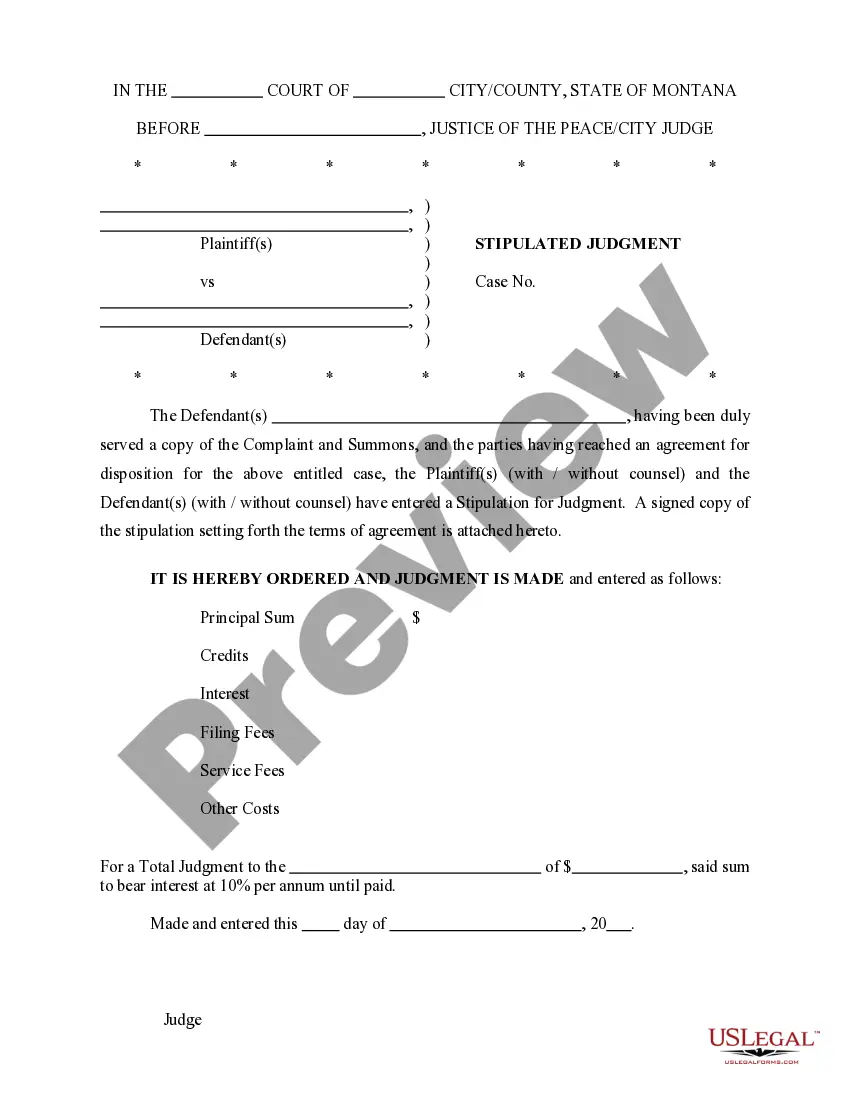

How to fill out Notice Of Claim Of Mineral Interest For Dormant Mineral Interest?

US Legal Forms - one of many greatest libraries of lawful types in America - gives a wide range of lawful record themes you may down load or produce. Making use of the web site, you will get a huge number of types for business and person uses, sorted by groups, states, or search phrases.You will find the newest models of types much like the Massachusetts Notice of Claim of Mineral Interest for Dormant Mineral Interest in seconds.

If you currently have a monthly subscription, log in and down load Massachusetts Notice of Claim of Mineral Interest for Dormant Mineral Interest from your US Legal Forms collection. The Obtain key can look on each type you perspective. You have access to all earlier delivered electronically types inside the My Forms tab of your account.

If you wish to use US Legal Forms for the first time, listed below are straightforward instructions to get you began:

- Be sure to have picked the right type to your city/county. Select the Preview key to examine the form`s articles. See the type description to actually have chosen the appropriate type.

- In case the type doesn`t suit your specifications, take advantage of the Lookup discipline on top of the screen to get the one that does.

- Should you be content with the form, affirm your option by visiting the Buy now key. Then, opt for the pricing program you want and supply your qualifications to sign up for an account.

- Procedure the transaction. Use your credit card or PayPal account to perform the transaction.

- Choose the formatting and down load the form on the gadget.

- Make modifications. Complete, revise and produce and indication the delivered electronically Massachusetts Notice of Claim of Mineral Interest for Dormant Mineral Interest.

Each and every design you added to your money lacks an expiry date and is also the one you have permanently. So, if you wish to down load or produce another duplicate, just proceed to the My Forms area and click on on the type you want.

Obtain access to the Massachusetts Notice of Claim of Mineral Interest for Dormant Mineral Interest with US Legal Forms, probably the most substantial collection of lawful record themes. Use a huge number of expert and express-certain themes that satisfy your organization or person requires and specifications.

Form popularity

FAQ

Mineral ownership, or mineral rights, are understood to be the property rights to exploit an area for the minerals, gas, or oil it harbors. The four types of mineral ownership are: Mineral Interest ? interest generated after the production of oil and gas after the sale of a deed or a lease.

If an oil company drills a well under your land without having a lease from a mineral interest owner, it is generally considered a trespass. In such circumstances, the unleased mineral interest owner would generally be entitled to his or her share of production from the well.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.

Most sellers retain ownership of any potentially profitable mineral rights, such as oil or gas.

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases.

The value of mineral rights per acre differs from state to state. Typically, the price ranges from $100 to $5,000 per acre in several states. In Texas, the average price per acre for non-producing mineral rights is usually between $0 and $250 per acre, as a general guideline.

Mineral rights can expire if the owner does not renew them or if they go unclaimed for a certain period of time. Mineral rights can also be sold, fractionalized, or transferred through gifting or inheritance.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).