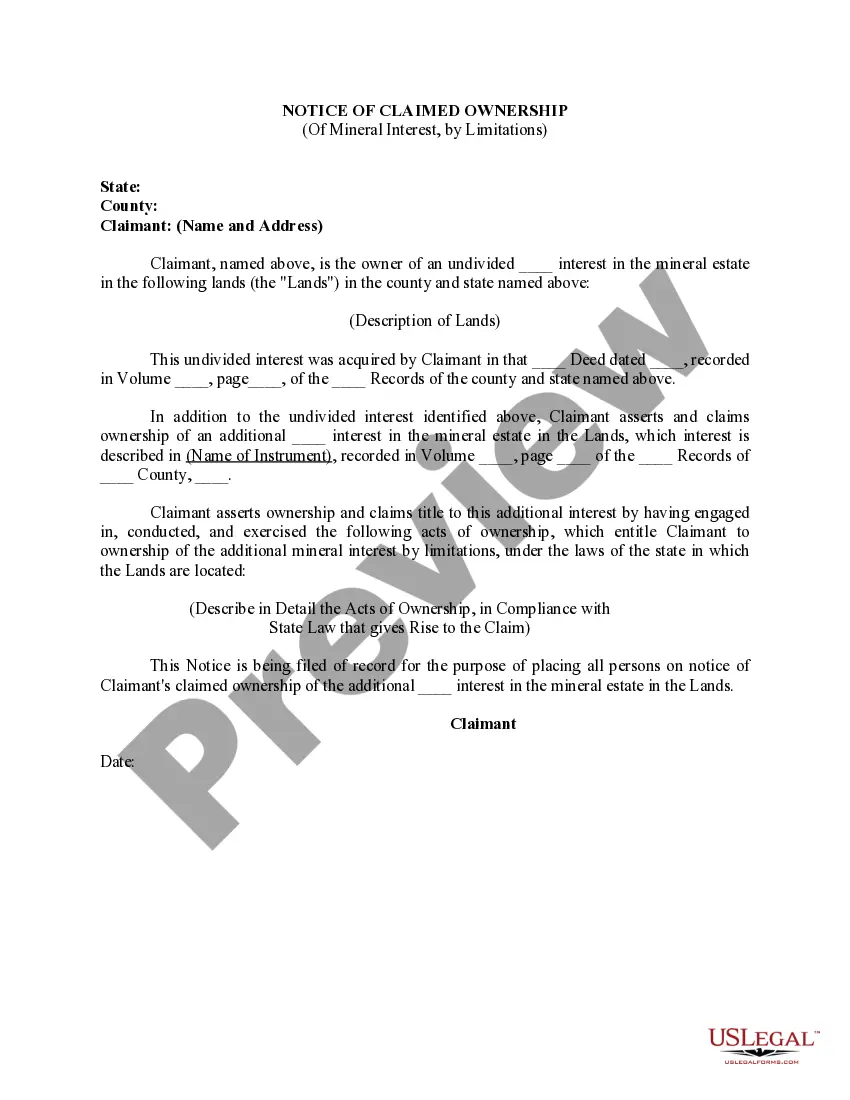

This form is used by Claimant as notice of ownership and claim of title to additional interest of the mineral estate in lands, by having engaged in, conducted, and exercised the acts of ownership, which entitle Claimant to ownership of the additional mineral interest by limitations, under the laws of the state in which the Lands are located.

Massachusetts Notice of Claimed Ownership of Mineral Interest, by Limitations

Description

How to fill out Notice Of Claimed Ownership Of Mineral Interest, By Limitations?

US Legal Forms - among the largest libraries of legitimate varieties in the States - delivers a variety of legitimate document templates you may acquire or printing. Using the web site, you can find thousands of varieties for enterprise and individual functions, categorized by groups, claims, or key phrases.You will discover the newest models of varieties much like the Massachusetts Notice of Claimed Ownership of Mineral Interest, by Limitations within minutes.

If you already have a subscription, log in and acquire Massachusetts Notice of Claimed Ownership of Mineral Interest, by Limitations in the US Legal Forms collection. The Obtain key will appear on every develop you view. You gain access to all in the past delivered electronically varieties inside the My Forms tab of your own accounts.

If you would like use US Legal Forms the first time, allow me to share basic instructions to get you started off:

- Make sure you have picked the correct develop for your personal area/area. Select the Preview key to examine the form`s content. Look at the develop outline to actually have chosen the correct develop.

- In case the develop does not fit your needs, use the Lookup discipline at the top of the display screen to discover the the one that does.

- When you are pleased with the form, validate your choice by simply clicking the Acquire now key. Then, opt for the pricing plan you favor and supply your credentials to register for an accounts.

- Procedure the financial transaction. Utilize your Visa or Mastercard or PayPal accounts to complete the financial transaction.

- Find the file format and acquire the form on your own gadget.

- Make changes. Complete, edit and printing and sign the delivered electronically Massachusetts Notice of Claimed Ownership of Mineral Interest, by Limitations.

Every format you included with your money lacks an expiry time which is your own property eternally. So, if you wish to acquire or printing yet another duplicate, just check out the My Forms portion and click on around the develop you will need.

Get access to the Massachusetts Notice of Claimed Ownership of Mineral Interest, by Limitations with US Legal Forms, the most substantial collection of legitimate document templates. Use thousands of specialist and express-certain templates that meet up with your small business or individual requires and needs.

Form popularity

FAQ

What Are Mineral Rights? Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

Hear this out loud PauseTransfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

By statute and case law, mineral properties are taxable as real property and are subject to the same laws and appraisal methodology as all real property in the state.

Mineral rights are a form of real property, and they are governed by the same principles of marital property law as other real estate. If the mineral rights were owned before marriage, they are separate property.

However, since mineral rights are a severed portion of the land rights themselves (they're separated from the land's "surface rights" and sold separately by deed, just like the land itself), they are usually considered real property.

Hear this out loud PauseThe ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.