Massachusetts Self-Employed Groundskeeper Services Contract

Description

How to fill out Self-Employed Groundskeeper Services Contract?

If you need to compile, acquire, or produce valid document templates, use US Legal Forms, the largest compilation of valid forms available online.

Utilize the site's straightforward and user-friendly search to find the documents you require.

Numerous templates for commercial and individual purposes are categorized by types and states, or keywords. Use US Legal Forms to obtain the Massachusetts Self-Employed Groundskeeper Services Contract with just a few clicks.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of your legal document and download it to your device. Step 7. Fill out, edit, and print or sign the Massachusetts Self-Employed Groundskeeper Services Contract. Every legal document format you acquire is yours permanently. You have access to every form you downloaded within your account. Click on the My documents section and select a form to print or download again. Be proactive and obtain, and print the Massachusetts Self-Employed Groundskeeper Services Contract with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Massachusetts Self-Employed Groundskeeper Services Contract.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for your specific region/country.

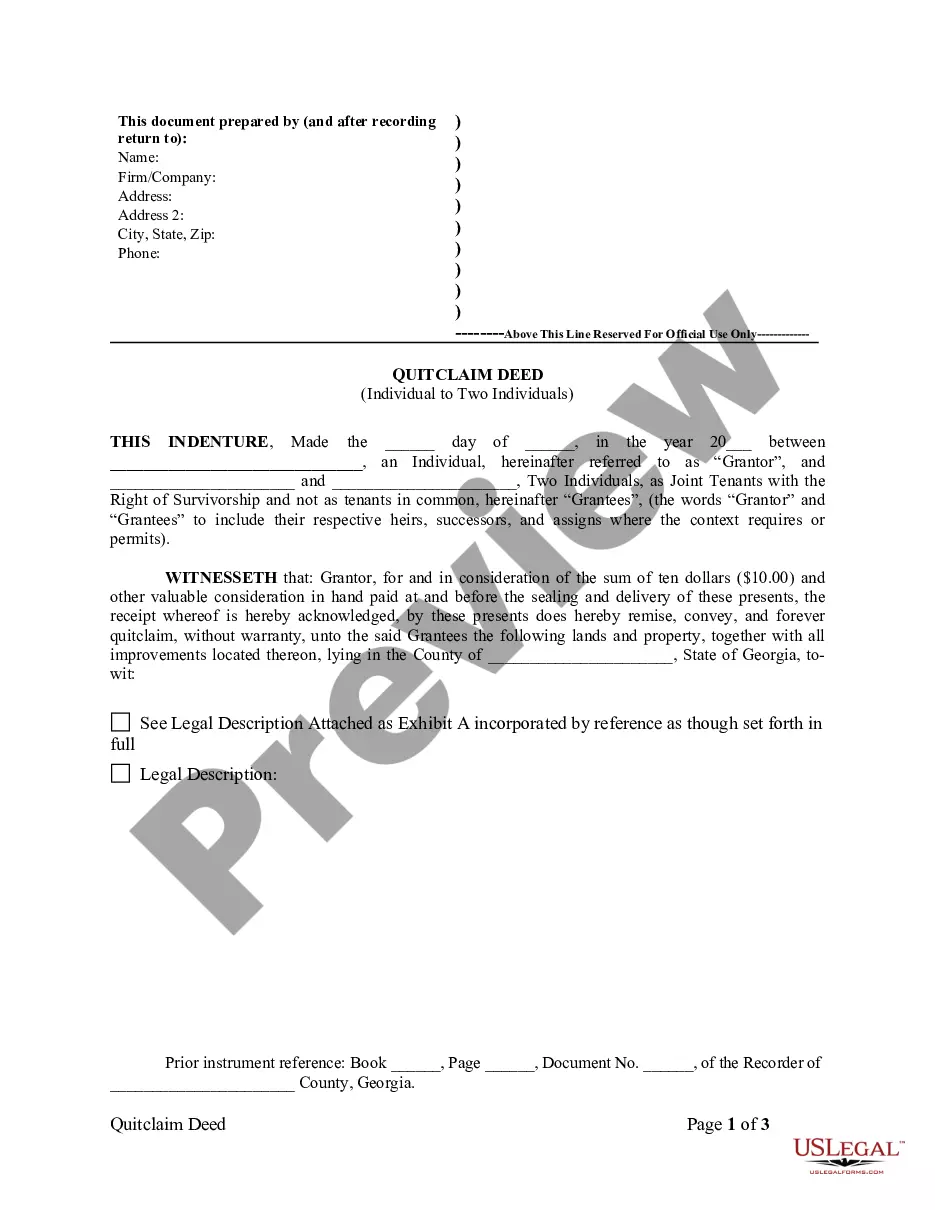

- Step 2. Use the Review option to examine the form's contents. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of your legal form template.

- Step 4. After identifying the form you need, click the Acquire now button. Choose your preferred pricing plan and enter your details to register for an account.

Form popularity

FAQ

The 1/3 rule for lawns refers to the guideline that you should never cut more than one-third of the grass height at one time. This practice promotes healthier grass growth and reduces stress on your lawn. When managing your lawn care business, a Massachusetts Self-Employed Groundskeeper Services Contract can help you communicate such important practices to your clients.

To write a contract agreement for services, begin by detailing the services you will provide and the timeline for completion. Clearly outline payment terms, including amounts and due dates. A Massachusetts Self-Employed Groundskeeper Services Contract serves as an effective tool to formalize your agreement and prevent misunderstandings.

Creating a lawn service contract starts with outlining the services offered and the expectations of both parties. Include the duration of the contract, payment methods, and cancellation policies. Using a Massachusetts Self-Employed Groundskeeper Services Contract template can simplify this process, ensuring you cover all necessary components.

Writing a contract for lawn service involves specifying the services you will perform, such as mowing, fertilizing, or landscaping. Ensure to include payment details, service frequency, and any warranties or guarantees. A well-crafted Massachusetts Self-Employed Groundskeeper Services Contract can provide a solid foundation, protecting both you and your client.

To write a simple service agreement, start by clearly defining the services to be provided. Include details such as payment terms, duration of the contract, and any specific responsibilities. Utilizing a Massachusetts Self-Employed Groundskeeper Services Contract can streamline the process, allowing you to focus on delivering quality services while ensuring all legal bases are covered.

An independent contractor agreement in Massachusetts outlines the terms between a business and a self-employed individual. This contract defines the scope of work, payment terms, and both parties' responsibilities. By using a Massachusetts Self-Employed Groundskeeper Services Contract, you can clarify expectations and protect your interests, ensuring a smooth working relationship.

Lawn care contracts work by setting expectations and responsibilities for both the service provider and the client. They typically outline the services to be rendered, payment schedules, and the duration of the contract. By having a clear agreement, both parties understand their obligations, which minimizes disputes. Utilizing a well-crafted Massachusetts Self-Employed Groundskeeper Services Contract can enhance your professional image and promote smooth business transactions.

To write a lawn care contract, start by clearly defining the services you will provide. Include details such as the scope of work, payment terms, and duration of the agreement. Make sure to specify any additional costs for extra services, and outline the responsibilities of both parties. Using a template, such as the one available from uslegalforms, can simplify the process and ensure you cover essential aspects in your Massachusetts Self-Employed Groundskeeper Services Contract.

To obtain lawn maintenance contracts, consider leveraging online platforms, local advertisements, and word-of-mouth referrals. Building a strong portfolio showcasing your previous work can also attract potential clients. Finally, incorporating a well-drafted Massachusetts Self-Employed Groundskeeper Services Contract in your proposals demonstrates professionalism and can help you win contracts more effectively.

Landscaping contracts serve as legally binding agreements between you and your client. They outline the services you will provide, payment details, and any specific terms, ensuring clarity for both parties. By using a Massachusetts Self-Employed Groundskeeper Services Contract, you establish a clear understanding of expectations, which can lead to smoother projects and happier clients.