Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor

Description

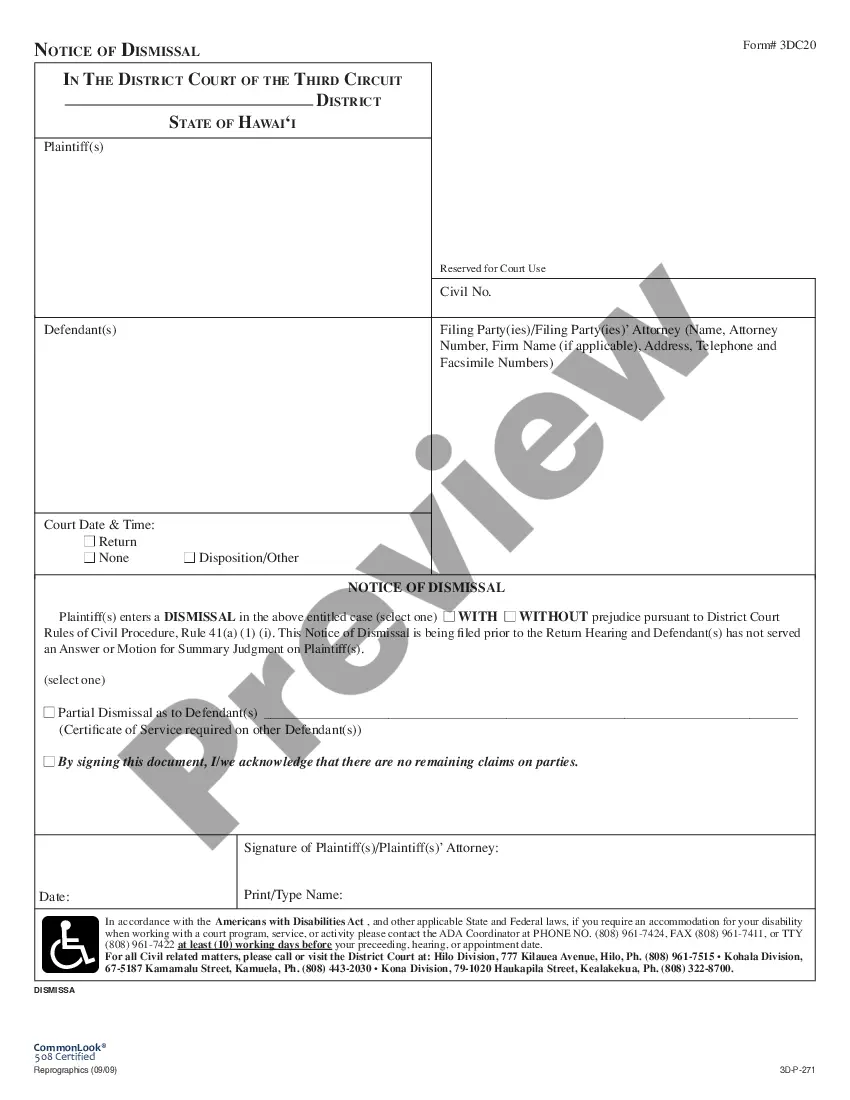

How to fill out Phlebotomist Agreement - Self-Employed Independent Contractor?

If you need to comprehensive, down load, or printing legal papers templates, use US Legal Forms, the largest assortment of legal kinds, which can be found on the web. Make use of the site`s easy and hassle-free look for to discover the files you want. Different templates for company and specific reasons are sorted by categories and states, or key phrases. Use US Legal Forms to discover the Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor in a handful of mouse clicks.

If you are currently a US Legal Forms consumer, log in for your bank account and click on the Download switch to obtain the Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor. You can also accessibility kinds you in the past acquired in the My Forms tab of your bank account.

If you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the proper metropolis/country.

- Step 2. Use the Preview option to look over the form`s content. Don`t forget to see the outline.

- Step 3. If you are unsatisfied with the kind, utilize the Look for discipline near the top of the screen to locate other variations of the legal kind template.

- Step 4. When you have located the form you want, click the Buy now switch. Choose the rates strategy you like and add your accreditations to register for an bank account.

- Step 5. Procedure the purchase. You should use your credit card or PayPal bank account to complete the purchase.

- Step 6. Select the formatting of the legal kind and down load it on your own system.

- Step 7. Full, revise and printing or signal the Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor.

Every legal papers template you purchase is the one you have permanently. You have acces to every kind you acquired with your acccount. Go through the My Forms segment and decide on a kind to printing or down load once more.

Contend and down load, and printing the Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and status-specific kinds you can use to your company or specific requirements.

Form popularity

FAQ

A freelance phlebotomist is a self-employed professional who offers phlebotomy services on a contractual basis. They typically work for various clients, including hospitals, clinics, and private individuals, without being tied to a single employer. This flexible work arrangement allows them to choose their hours and clients. A properly drafted Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor is essential to outline the terms of such freelance work and protect both parties.

Becoming a contractor phlebotomist requires a few key steps. First, obtain your phlebotomy certification and ensure you meet any state-specific requirements. After that, focus on building your client base and establishing a professional reputation. Utilizing a Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor will provide clarity on your services and legal obligations, ensuring a smooth operating process.

To become an independent contractor phlebotomist, start by obtaining the necessary certifications and licenses in your state. Next, you should build a network of potential clients, such as clinics or private practices. Finally, create a solid Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor that outlines your services and payment terms. This will protect both you and your clients throughout your working relationship.

Yes, you can be an independent phlebotomist. As a self-employed professional, you have the flexibility to set your own schedule and choose your clients. However, it is essential to understand the legal requirements and licensing needed in your state. A well-structured Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor can help clarify your rights and responsibilities in this role.

Creating an independent contractor agreement involves outlining the terms of the working relationship. You should specify the scope of work, payment details, and duration of the contract. Additionally, it is crucial to include clauses that address confidentiality and liability. For a comprehensive template, consider using US Legal Forms to ensure that your Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor meets legal standards.

To fill out an independent contractor form, begin by entering your name, contact information, and any relevant business details. Next, outline the scope of work, payment terms, and deadlines. This is crucial for the Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor, as it clarifies expectations. You can streamline this process by using US Legal Forms, which offers user-friendly templates to help you complete the form accurately.

Filling out an independent contractor agreement, especially the Massachusetts Phlebotomist Agreement - Self-Employed Independent Contractor, starts with gathering your personal information and the details of your business. Clearly state the terms of the agreement, including payment structure, duration, and specific duties. Ensure both parties sign the document to make it legally binding. Utilizing platforms like US Legal Forms can simplify this process by providing templates that guide you through each step.