Massachusetts Architect Agreement - Self-Employed Independent Contractor

Description

How to fill out Architect Agreement - Self-Employed Independent Contractor?

Have you ever been in a location where you require documents for either professional or personal tasks almost every day.

There are numerous valid document templates accessible online, but finding ones you can trust isn't easy.

US Legal Forms offers thousands of template options, including the Massachusetts Architect Agreement - Self-Employed Independent Contractor, designed to comply with federal and state regulations.

Once you find the correct form, click on Buy now.

Select the pricing plan you prefer, provide the required information to create your account, and complete your purchase using your PayPal or credit card. Choose a convenient document format and download your version. Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Massachusetts Architect Agreement - Self-Employed Independent Contractor anytime if needed. Just click the desired template to download or print the document design. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates for a variety of purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Massachusetts Architect Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

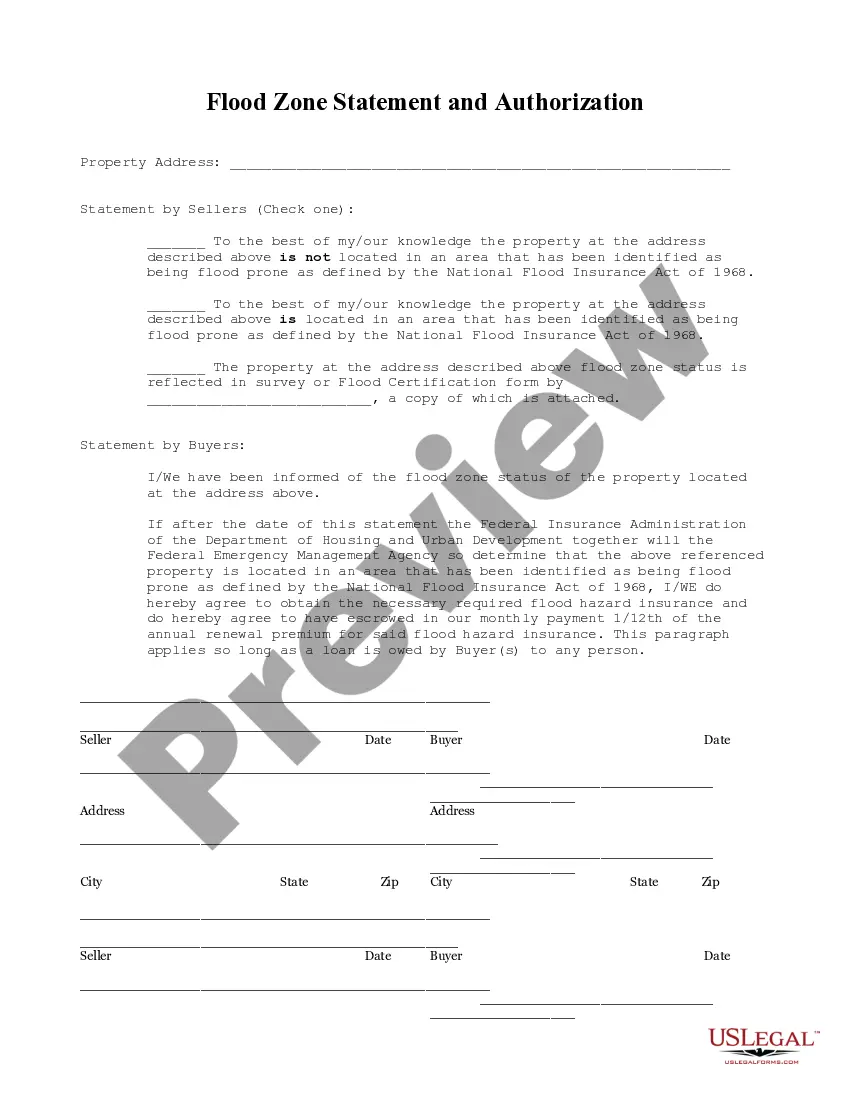

- Use the Preview button to review the form.

- Check the summary to confirm you have selected the right template.

- If the template isn’t what you’re looking for, utilize the Search field to find the form that suits your needs.

Form popularity

FAQ

To create an independent contractor agreement, start by outlining the project's scope, payment structure, and timelines. Next, ensure all relevant details about the contractor's responsibilities and rights are included. Lastly, consider using an established template, such as the Massachusetts Architect Agreement - Self-Employed Independent Contractor, to simplify the creation process and ensure compliance.

The basic independent contractor agreement consists of key components like project description, payment terms, and deadlines. It serves as a foundational contract that ensures both parties understand their roles and obligations. Crafting a clear agreement minimizes risks and establishes a professional relationship. Using a Massachusetts Architect Agreement - Self-Employed Independent Contractor template can provide a solid starting point.

An independent contractor in Massachusetts is someone who provides services to others but operates as a separate business entity. They are not considered employees and typically manage their own taxes, benefits, and work schedule. Understanding this distinction is crucial for compliance with state regulations. The Massachusetts Architect Agreement - Self-Employed Independent Contractor clarifies this relationship further.

Typically, the business requiring services drafts the independent contractor agreement. However, both parties should review the document to ensure it meets their needs and expectations. It’s wise to consult legal professionals when drafting this agreement to avoid potential disputes. A Massachusetts Architect Agreement - Self-Employed Independent Contractor template can be helpful in this process.

The independent contractor agreement in Massachusetts outlines the terms between a business and a self-employed individual. This document specifies the scope of work, payment terms, and responsibilities of each party. It's essential for clarifying expectations and protecting legal rights. Utilizing a Massachusetts Architect Agreement - Self-Employed Independent Contractor template can streamline this process.

Writing an independent contractor agreement involves several key steps. Start by clearly identifying both parties, specifying the scope of work, and detailing payment terms. It's crucial to include confidentiality clauses and termination conditions to ensure mutual understanding. Using a reliable platform like uslegalforms can simplify the process of creating a comprehensive Massachusetts Architect Agreement - Self-Employed Independent Contractor.

Yes, an architect can operate as an independent contractor. This means they work for themselves rather than being an employee of a firm. Many architects choose this path to enjoy more flexibility and control over their projects. It’s essential to have a well-defined Massachusetts Architect Agreement - Self-Employed Independent Contractor to outline the terms of your services and protect your interests.

Writing an independent contractor agreement involves a few key steps. Start by outlining the key components like the project description, deadlines, payment structure, and confidentiality clauses. Reference the Massachusetts Architect Agreement - Self-Employed Independent Contractor for specific terms that may be required. A well-written agreement protects both parties and ensures clarity throughout the contract.

Filling out an independent contractor form is straightforward. Begin by entering the contractor's personal and business information, ensuring the details align with the Massachusetts Architect Agreement - Self-Employed Independent Contractor. Specify the type of work to be completed, payment details, and deadlines. Finally, review the completed form for accuracy before submission.

To fill out a Massachusetts Architect Agreement - Self-Employed Independent Contractor, start by gathering the necessary information about both parties. Include the names, addresses, and contact details of the contractor and the client. Then, clearly outline the scope of work, payment terms, and duration of the contract. Ensure both parties review the agreement for clarity and compliance before signing.