Massachusetts Educator Agreement - Self-Employed Independent Contractor

Description

How to fill out Educator Agreement - Self-Employed Independent Contractor?

You can spend hours online attempting to locate the legal document template that meets the federal and state standards you require. US Legal Forms offers a vast collection of legal forms that are reviewed by professionals. You can obtain or print the Massachusetts Educator Agreement - Self-Employed Independent Contractor with my assistance.

If you already have a US Legal Forms account, you can Log In and click the Obtain button. After that, you can complete, edit, print, or sign the Massachusetts Educator Agreement - Self-Employed Independent Contractor. Every legal document template you purchase is yours permanently. To have an additional copy of any acquired form, go to the My documents tab and click the corresponding button.

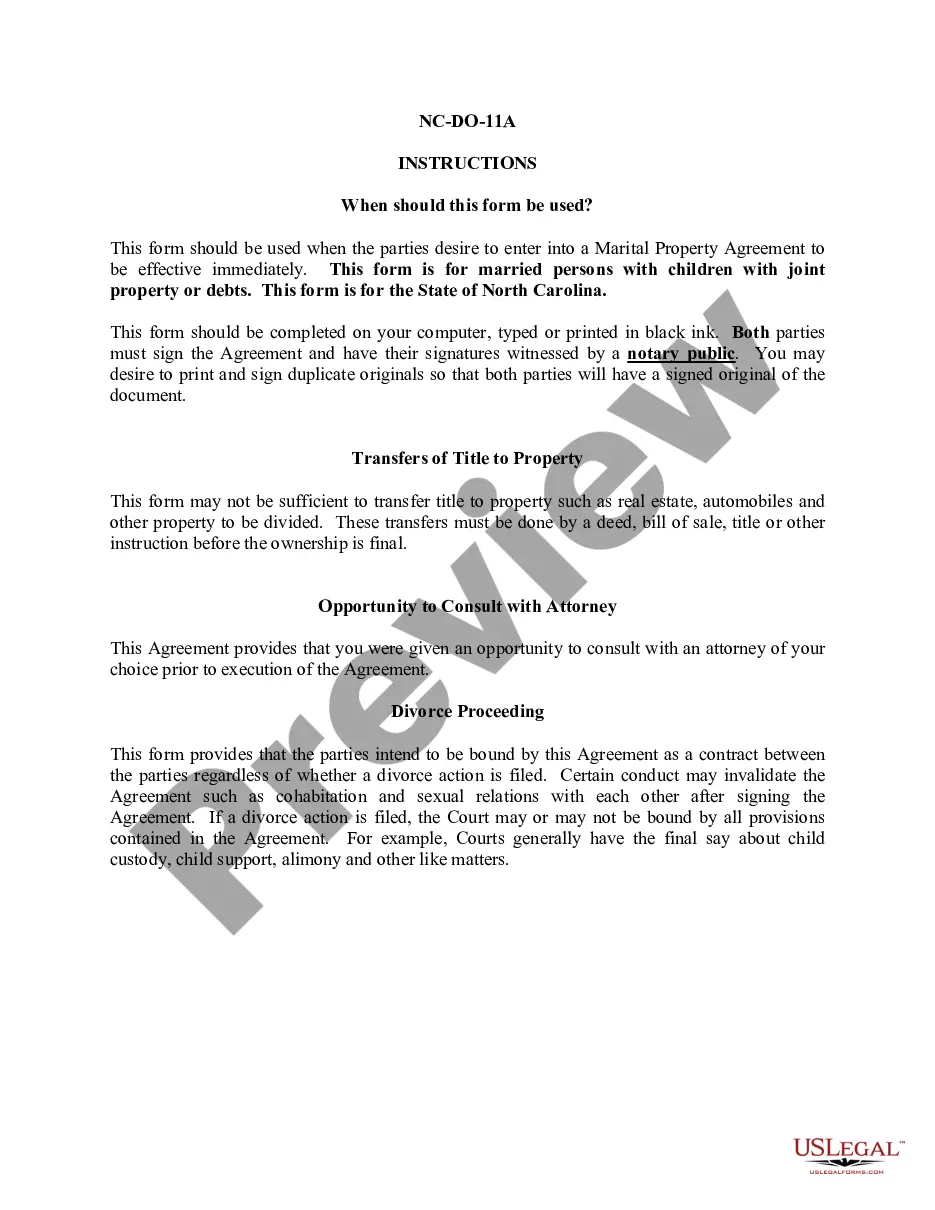

If you are using the US Legal Forms website for the first time, follow the simple instructions below: First, ensure that you have selected the correct document template for the area/city you choose. Check the form details to make certain you have picked the right form. If available, use the Review button to check the document template as well. If you wish to find another version of your form, use the Search field to find the template that suits your needs and requirements. Once you have found the template you want, click Get now to proceed. Select the pricing plan you prefer, enter your information, and register for a free account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of your document and download it to your device. Make changes to the document if necessary. You can complete, edit, sign, and print the Massachusetts Educator Agreement - Self-Employed Independent Contractor.

- Download and print a vast array of document templates using the US Legal Forms website, which offers the largest selection of legal forms.

- Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

Yes, an independent contractor qualifies as self-employed under Massachusetts law. This designation means that independent contractors operate their own businesses and are not considered employees of the organizations they work for. Thus, when you engage in agreements under the Massachusetts Educator Agreement - Self-Employed Independent Contractor, you enjoy the benefits and responsibilities that come with being self-employed. Understanding this classification is essential for tax and legal purposes.

The 3 hour rule in Massachusetts pertains to the calculation of the required work hours for certain independent contractor roles. This rule states that if an independent contractor works for at least three hours in a single day, they are entitled to receive payment for those hours worked. It is important to understand how this rule interacts with the Massachusetts Educator Agreement - Self-Employed Independent Contractor, as it may affect financial planning and contract terms. Knowing this rule helps you manage your work expectations and payments as a self-employed educator.

Filling out an independent contractor form is a simple yet important task. Start by entering the basic identifying information for both the contractor and the hiring party. Clearly state the services to be provided along with the payment terms. The Massachusetts Educator Agreement - Self-Employed Independent Contractor can facilitate the process, giving you an organized structure to follow.

Writing an independent contractor agreement requires clear, unambiguous language outlining the responsibilities and expectations of both parties. Begin with an introduction that specifies the roles involved, followed by sections detailing payment, duration of service, and termination terms. For a seamless arrangement, consider using templates like the Massachusetts Educator Agreement - Self-Employed Independent Contractor available on uslegalforms, ensuring you cover all essential points effectively.

To fill out a declaration of independent contractor status form, start by gathering the necessary information, including your business details and the contractor's details. Be sure to describe the nature of the work, while also identifying the relationship between you and the contractor. This form is critical in establishing the contractor status under the Massachusetts Educator Agreement - Self-Employed Independent Contractor, ensuring both parties understand their roles.

Filling out an independent contractor agreement involves a few straightforward steps. First, ensure you have the correct details, such as your name, the contractor's name, and the services they will provide. Next, clearly outline the terms of work, payment details, and other expectations. Utilizing tools like the Massachusetts Educator Agreement - Self-Employed Independent Contractor can simplify this process, making it easier to create a well-structured agreement.

An independent contractor in Massachusetts is an individual who provides services under a contractual agreement without being classified as an employee. This means they manage their own tax obligations and have more control over how they perform their work. Understanding the nuances of the Massachusetts Educator Agreement - Self-Employed Independent Contractor can help contractors navigate their responsibilities and benefits effectively.

To provide proof of employment as an independent contractor, you can present documents such as your independent contractor agreement, invoices, and any proof of payments received. These documents demonstrate your status and the nature of your work arrangement. Maintaining proper records is essential for anyone holding a Massachusetts Educator Agreement - Self-Employed Independent Contractor.

Creating an independent contractor agreement begins with identifying the key elements of your relationship with the contractor. You should include details such as the project description, payment structure, deadlines, and any necessary legal clauses. Using resources from USLegalForms can simplify this process, especially for drafting a Massachusetts Educator Agreement - Self-Employed Independent Contractor that meets state guidelines.

The basic independent contractor agreement outlines the terms and conditions of the working relationship between a client and a contractor. This document specifies the scope of work, payment terms, and the responsibilities of both parties. For those in Massachusetts, the agreement should comply with local laws, ensuring clarity for the Massachusetts Educator Agreement - Self-Employed Independent Contractor.